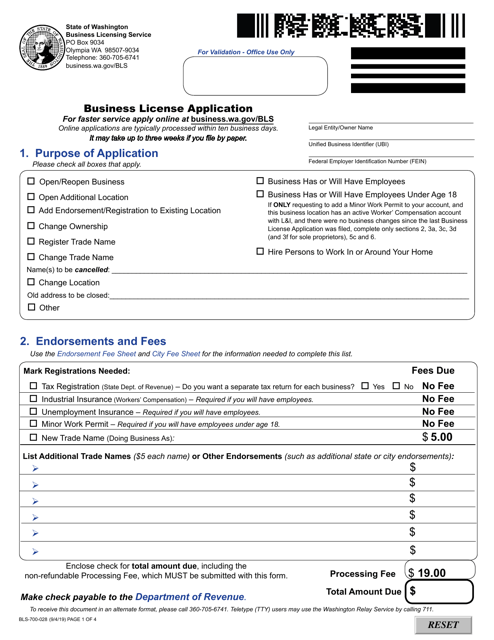

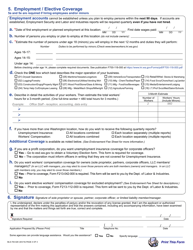

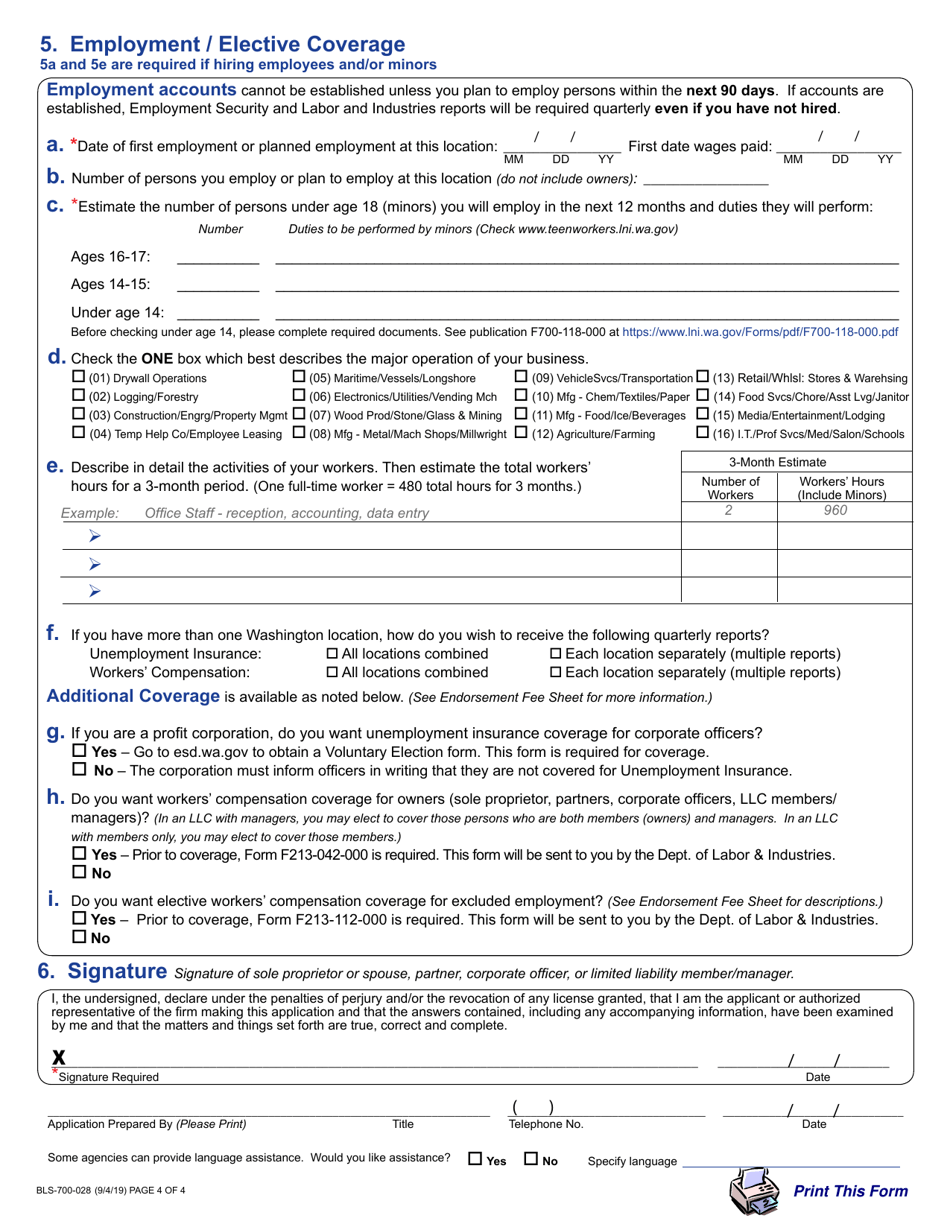

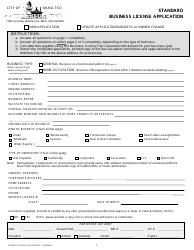

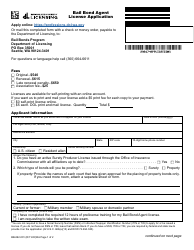

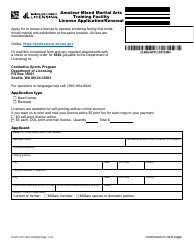

Form BLS-700-028 Business License Application - Washington

What Is Form BLS-700-028?

This is a legal form that was released by the Washington State Business Licensing Service - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BLS-700-028?

A: Form BLS-700-028 is a Business License Application for the state of Washington.

Q: What is the purpose of Form BLS-700-028?

A: The purpose of Form BLS-700-028 is to apply for a business license in the state of Washington.

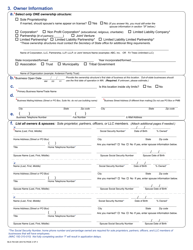

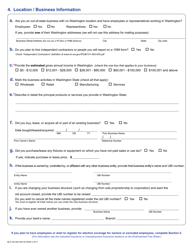

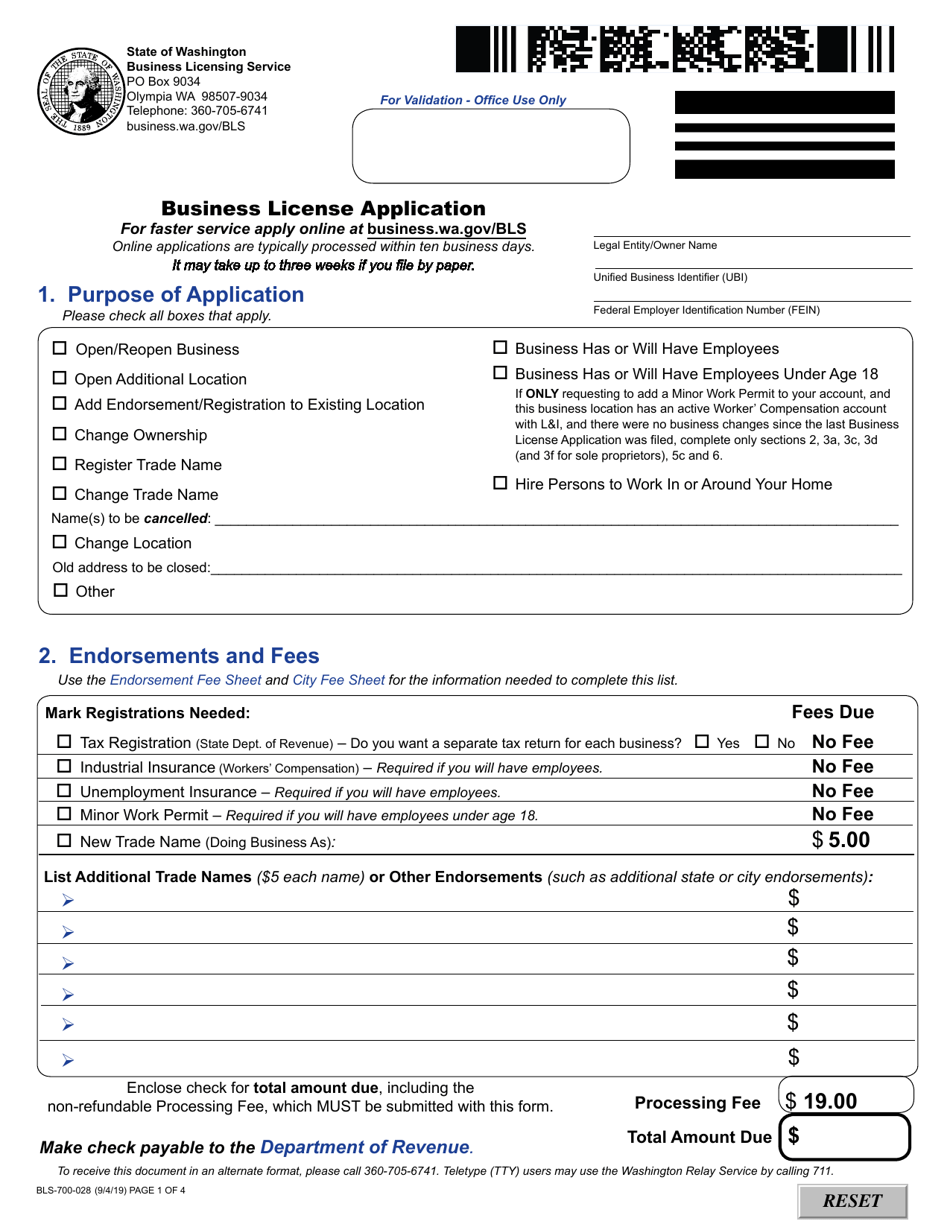

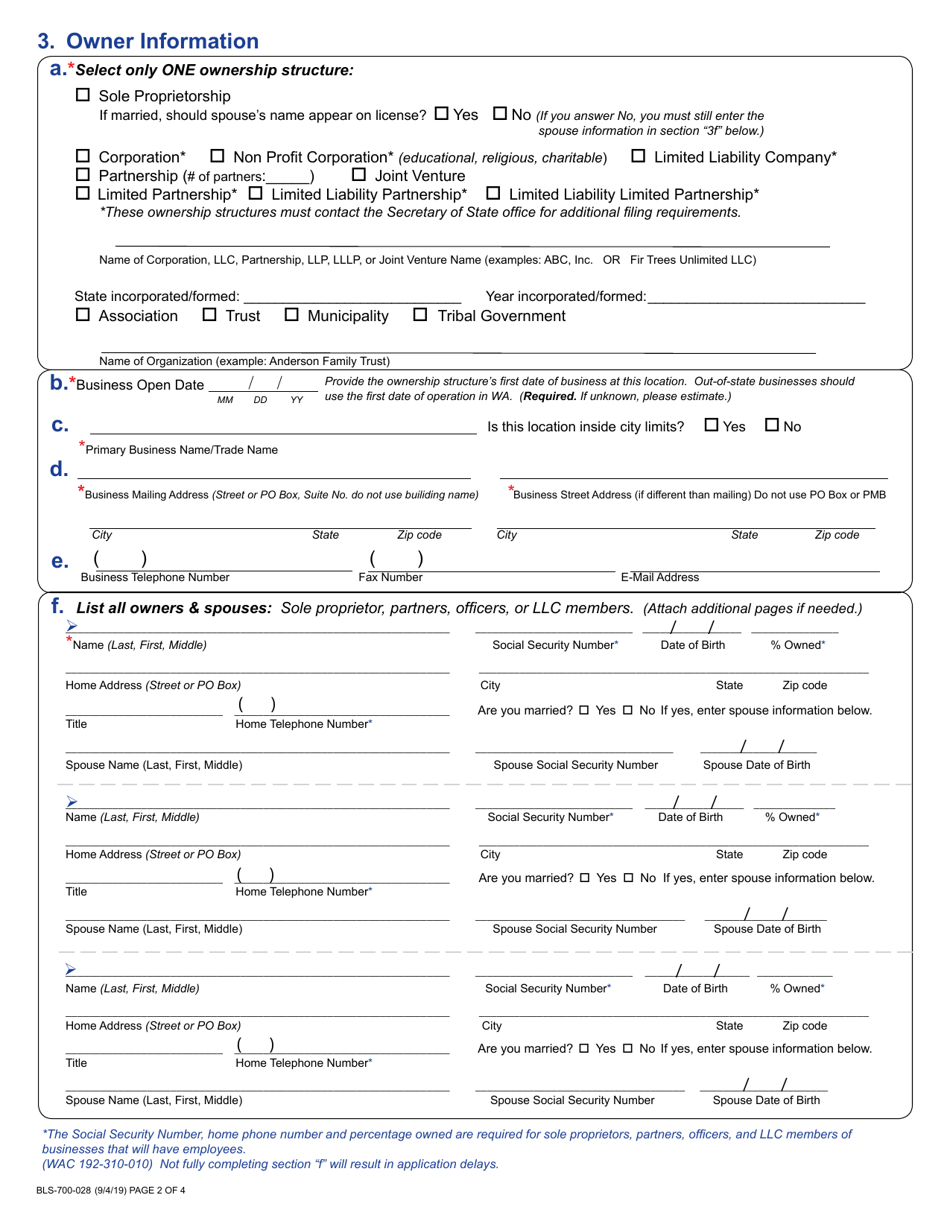

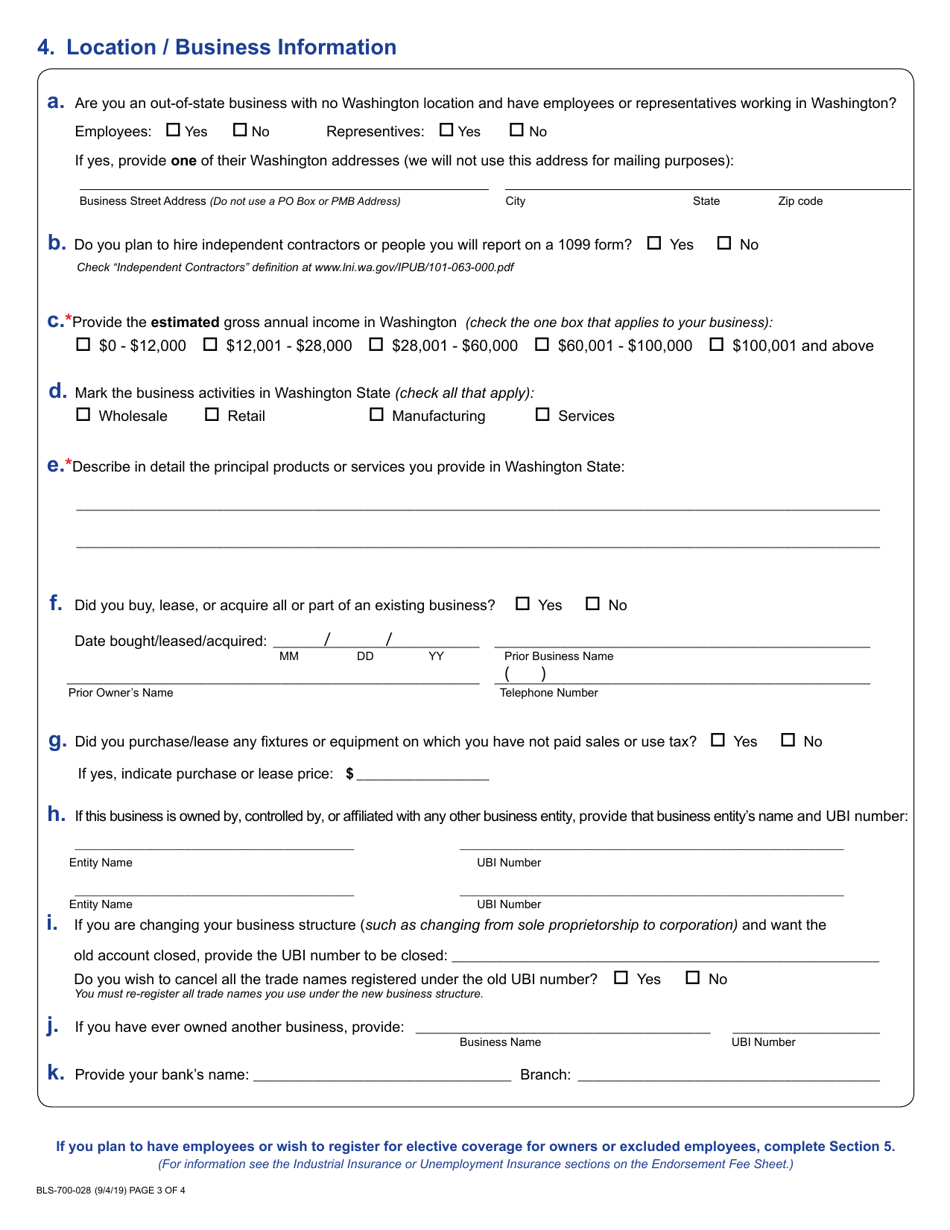

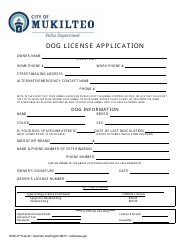

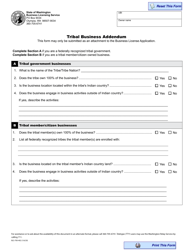

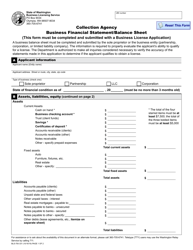

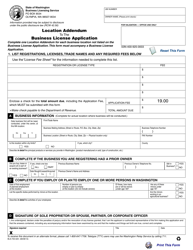

Q: What information is required on Form BLS-700-028?

A: Form BLS-700-028 requires information such as the name and address of the business, type of business entity, estimated annual gross business income, and other related details.

Q: Are there any fees associated with Form BLS-700-028?

A: Yes, there are fees associated with Form BLS-700-028. The amount of the fees depends on the type of business and other factors.

Q: How long does it take to process Form BLS-700-028?

A: The processing time for Form BLS-700-028 may vary, but typically it takes a few weeks to process the application.

Q: What happens after submitting Form BLS-700-028?

A: After submitting Form BLS-700-028, your application will be reviewed by the Washington State Department of Revenue, and if approved, you will receive your business license.

Q: Do I need a business license in Washington?

A: Yes, most businesses in Washington are required to have a business license.

Q: Are there any exemptions to the business license requirement in Washington?

A: Yes, some businesses may be exempt from the business license requirement in Washington. It is best to check with the Washington State Department of Revenue for specific exemptions.

Form Details:

- Released on September 4, 2019;

- The latest edition provided by the Washington State Business Licensing Service;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BLS-700-028 by clicking the link below or browse more documents and templates provided by the Washington State Business Licensing Service.