This version of the form is not currently in use and is provided for reference only. Download this version of

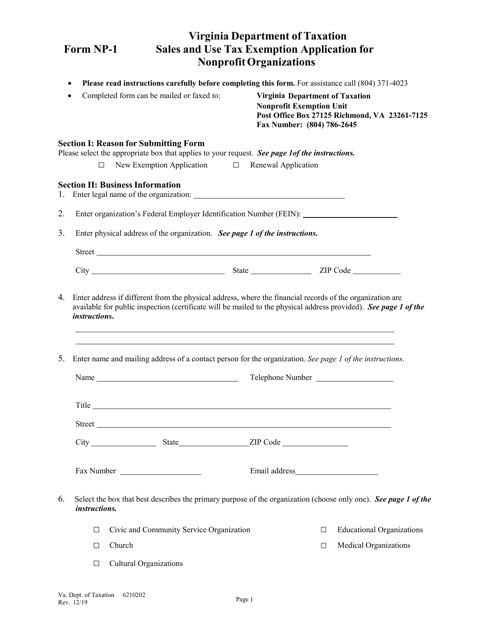

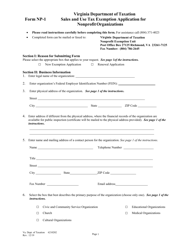

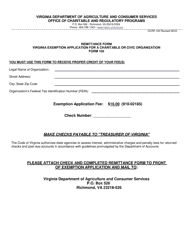

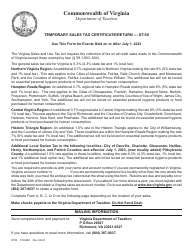

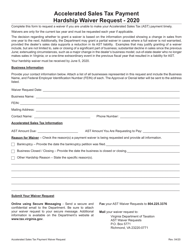

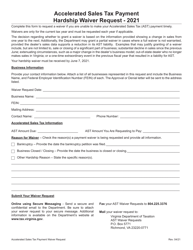

Form NP-1

for the current year.

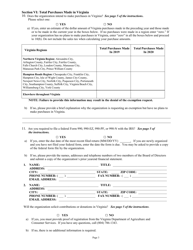

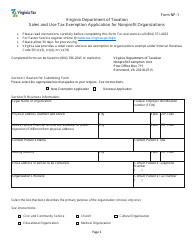

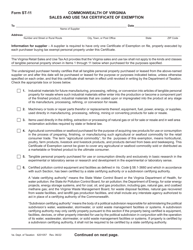

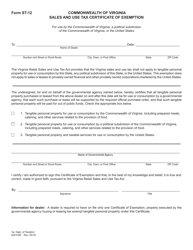

Form NP-1 Sales and Use Tax Exemption Application for Nonprofit Organizations - Virginia

What Is Form NP-1?

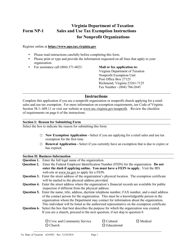

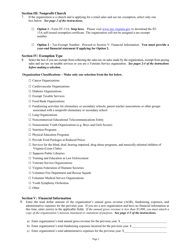

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

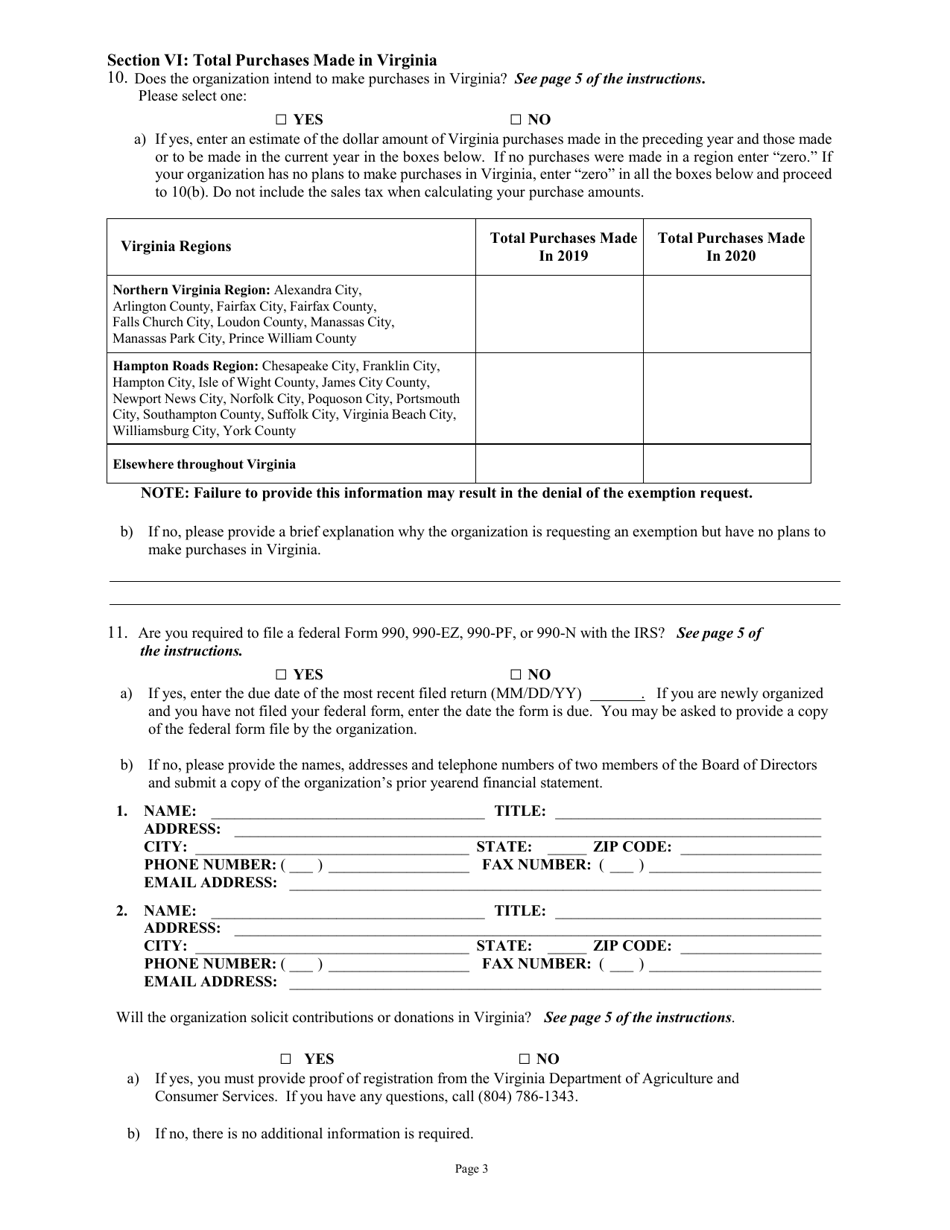

Q: What is NP-1 Sales and Use Tax Exemption Application?

A: NP-1 Sales and Use Tax Exemption Application is a form for nonprofit organizations in Virginia to apply for sales and use tax exemption.

Q: Who is eligible to use the NP-1 form?

A: Nonprofit organizations in Virginia that meet certain requirements are eligible to use the NP-1 form.

Q: What is the purpose of the NP-1 form?

A: The purpose of the NP-1 form is to allow qualifying nonprofit organizations to apply for exemption from sales and use tax in Virginia.

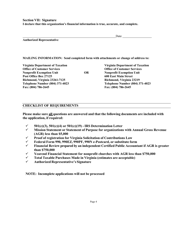

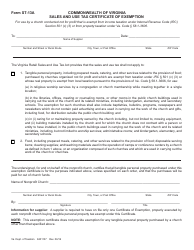

Q: What are the requirements to qualify for sales and use tax exemption?

A: To qualify for sales and use tax exemption, nonprofit organizations must meet certain criteria, such as being organized and operated exclusively for religious, charitable, scientific, or educational purposes.

Q: Are all nonprofit organizations eligible for sales and use tax exemption?

A: No, only nonprofit organizations that meet the specific criteria outlined by the Virginia Department of Taxation are eligible for sales and use tax exemption.

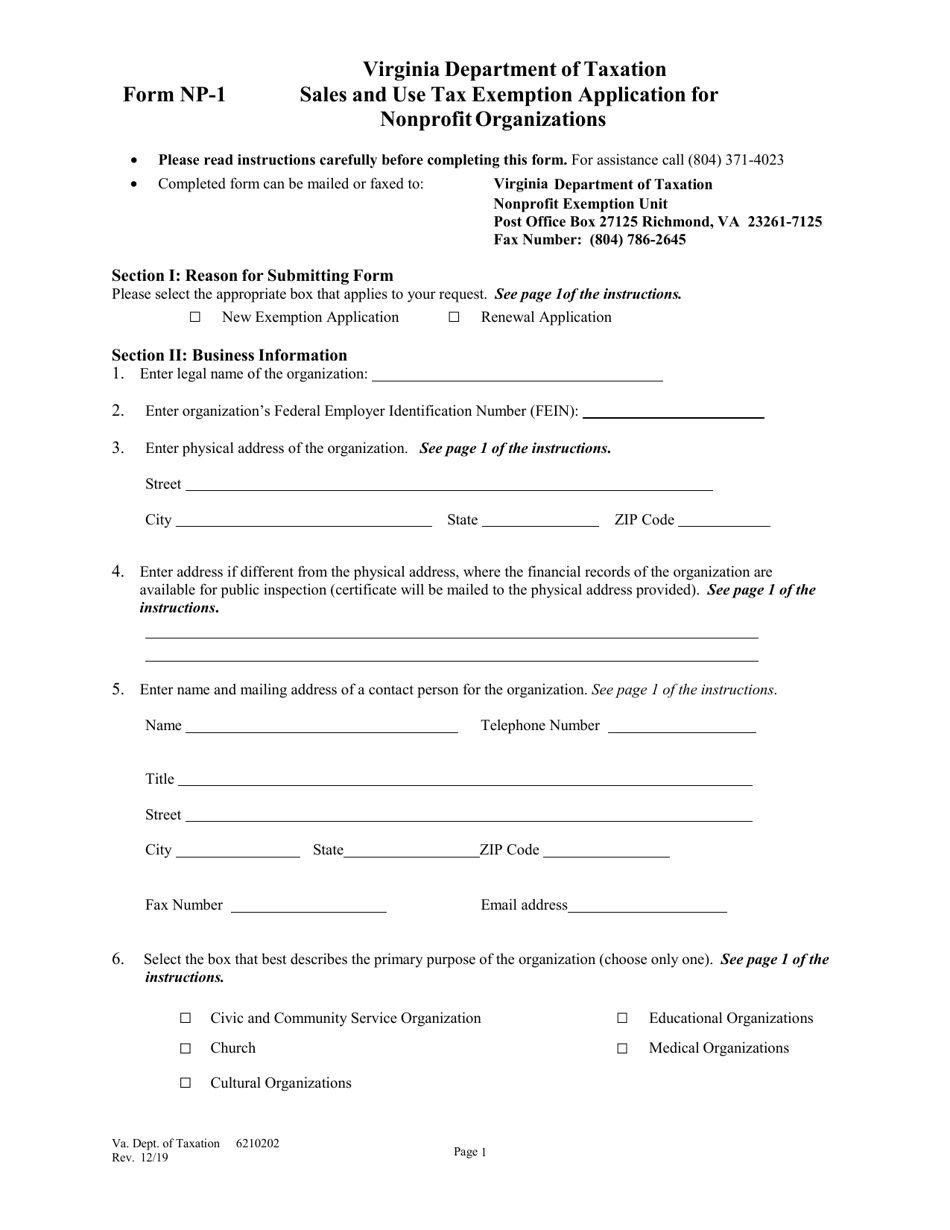

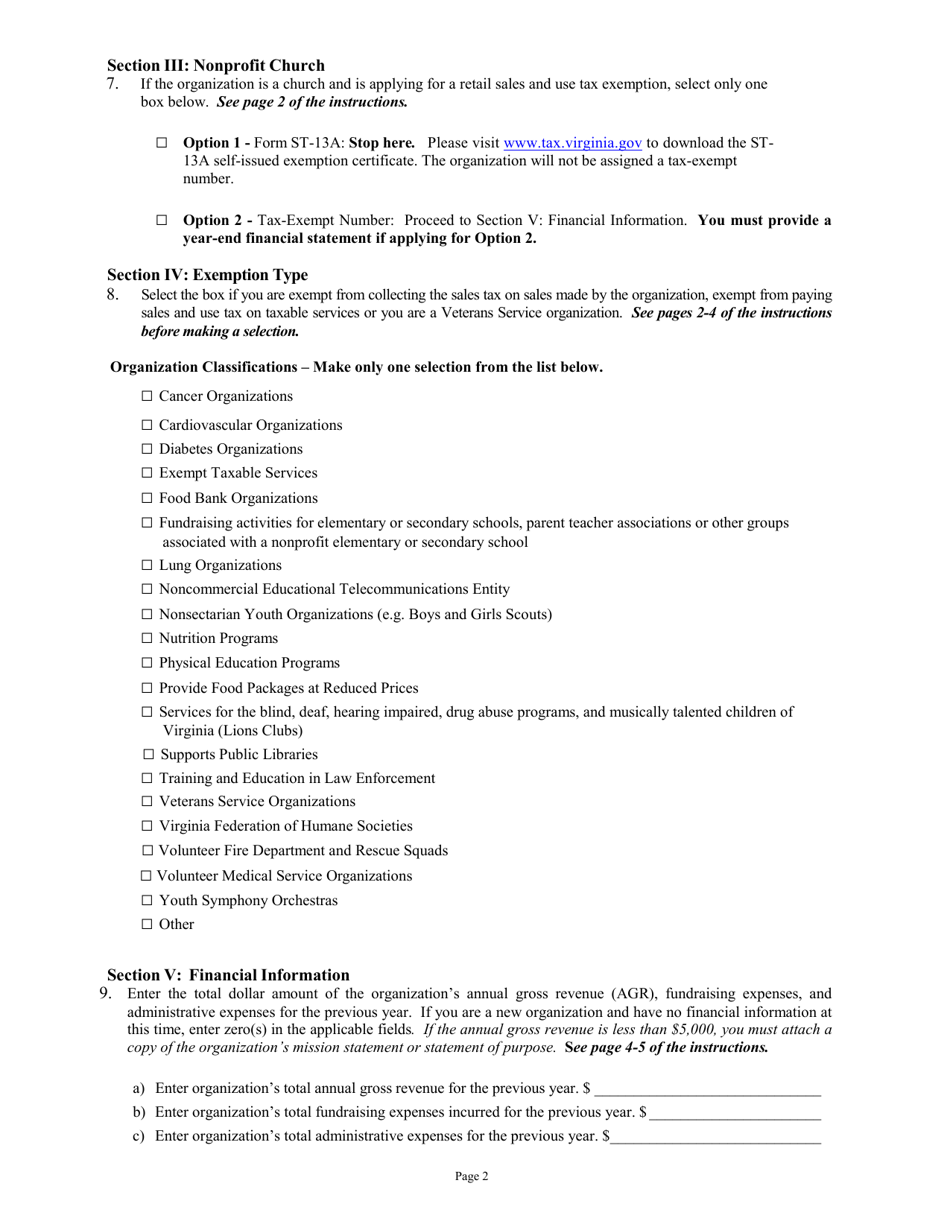

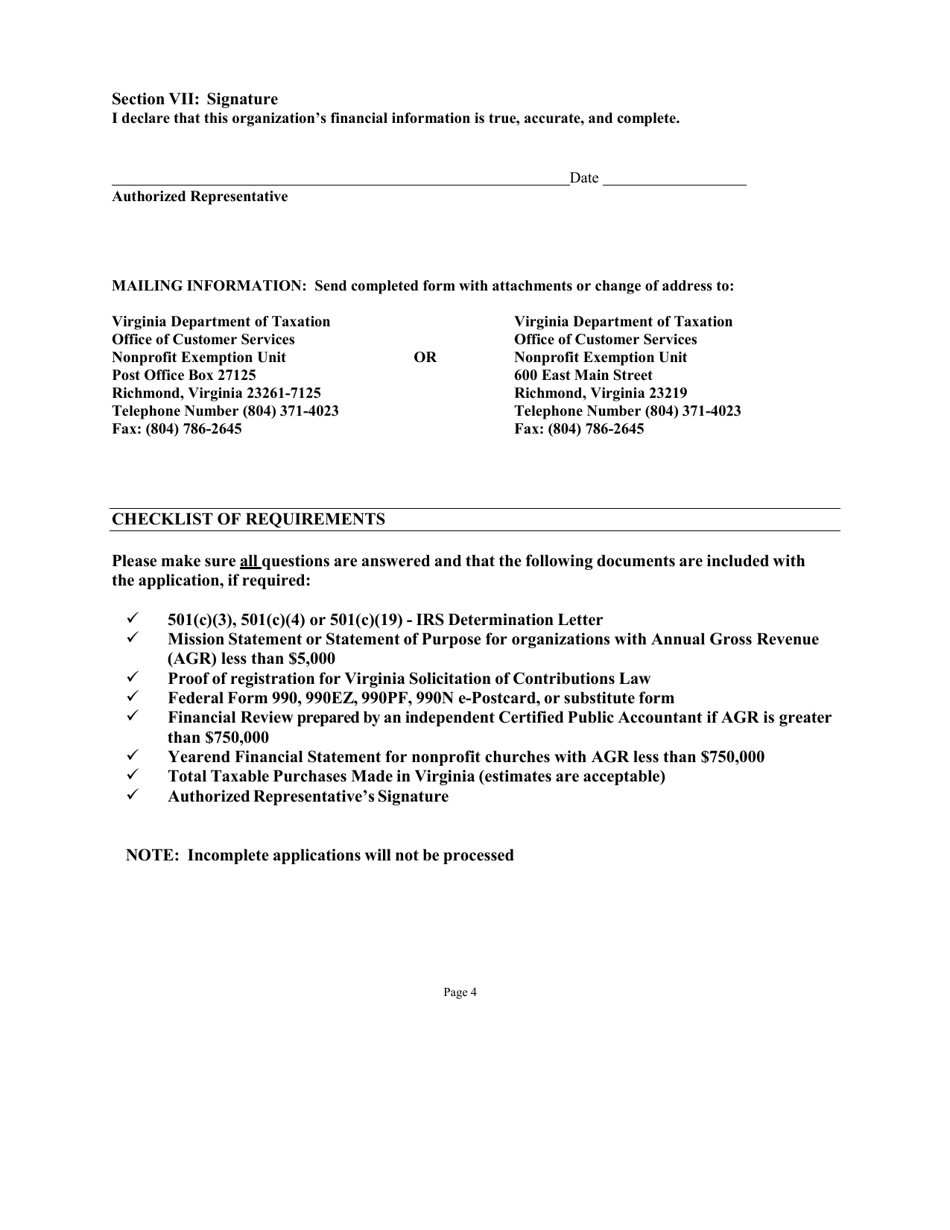

Q: What should I do after completing the NP-1 form?

A: After completing the NP-1 form, you should submit it to the Virginia Department of Taxation along with any required documentation.

Q: How long does it take to process the NP-1 form?

A: The processing time for the NP-1 form varies, but you should allow several weeks for the Virginia Department of Taxation to review and approve your application.

Q: Are there any fees associated with the NP-1 form?

A: There may be filing fees associated with the NP-1 form, so it is important to check the current fee schedule provided by the Virginia Department of Taxation.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NP-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.