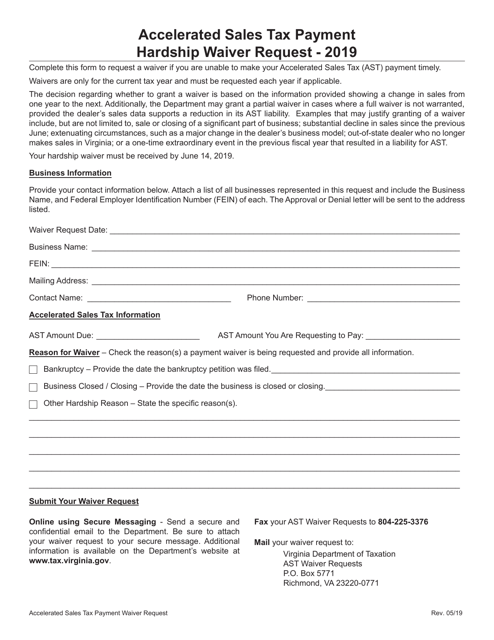

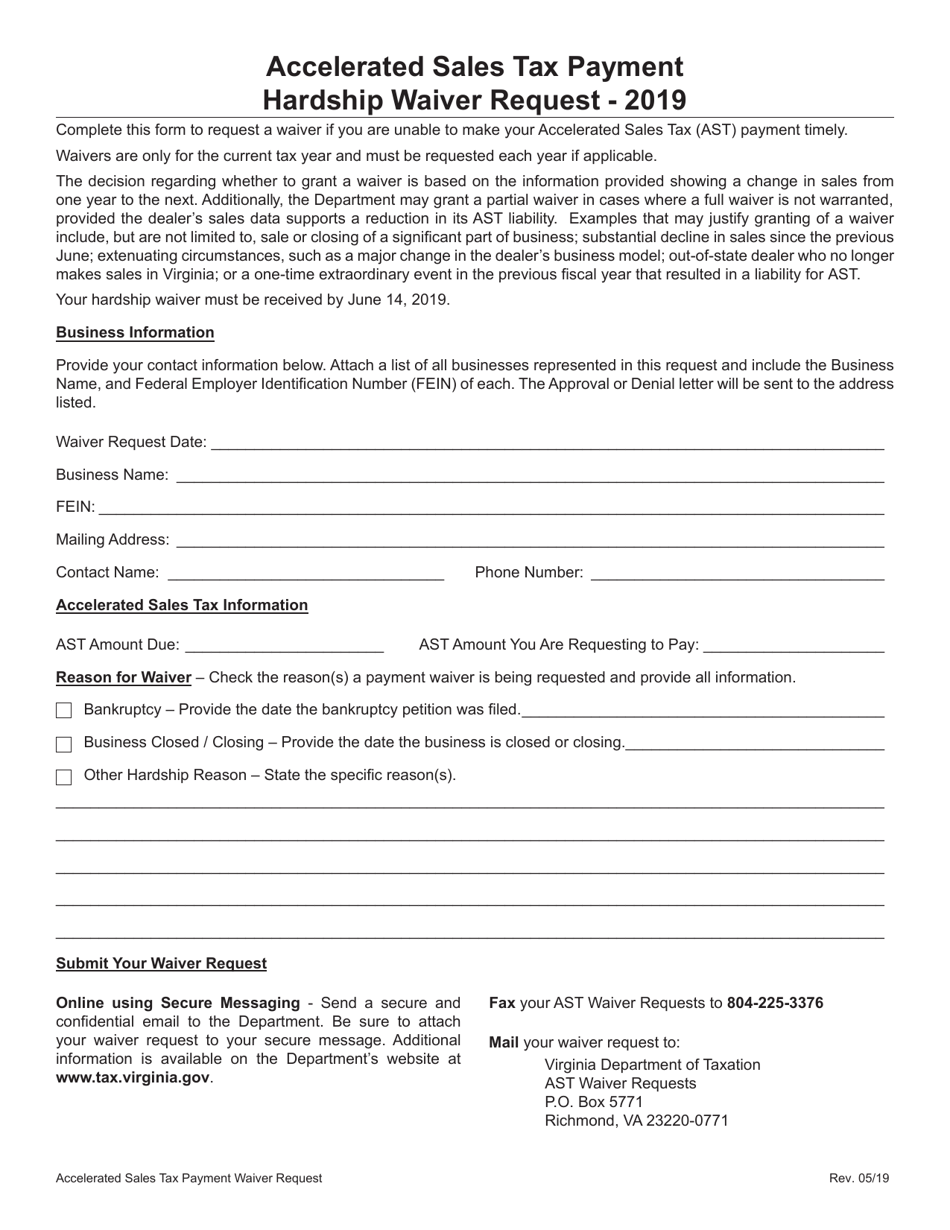

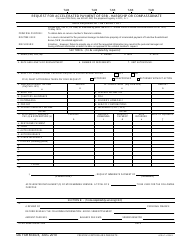

Accelerated Sales Payment Hardship Waiver Request - Virginia

Accelerated Sales Payment Hardship Waiver Request is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is an Accelerated Sales Payment Hardship Waiver Request?

A: An Accelerated Sales Payment Hardship Waiver Request is a request made in Virginia to waive the requirement for the accelerated payment of sales tax due to financial hardship.

Q: Who can submit an Accelerated Sales Payment Hardship Waiver Request in Virginia?

A: Any taxpayer in Virginia who is facing financial hardship and is unable to make the accelerated payment of sales tax can submit an Accelerated Sales Payment Hardship Waiver Request.

Q: What is the purpose of the waiver request?

A: The purpose of the waiver request is to seek relief from the requirement to make the accelerated payment of sales tax due to financial hardship.

Q: How can I submit an Accelerated Sales Payment Hardship Waiver Request in Virginia?

A: You can submit the request by filling out the necessary form and submitting it to the appropriate tax authority in Virginia.

Q: What information is required in the waiver request?

A: The waiver request typically requires information such as the taxpayer's financial situation, reasons for hardship, and supporting documentation.

Q: Is there a deadline to submit the waiver request?

A: Yes, there is usually a deadline for submitting the waiver request. It is important to check with the tax authority in Virginia for the specific deadline.

Q: Is approval of the waiver request guaranteed?

A: Approval of the waiver request is not guaranteed. It will depend on the individual circumstances and the discretion of the tax authority in Virginia.

Q: What happens if the waiver request is approved?

A: If the waiver request is approved, the taxpayer may be granted relief from the requirement to make the accelerated payment of sales tax.

Q: What happens if the waiver request is denied?

A: If the waiver request is denied, the taxpayer will be required to make the accelerated payment of sales tax as originally scheduled.

Form Details:

- Released on May 1, 2019;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.