This version of the form is not currently in use and is provided for reference only. Download this version of

Form PTE

for the current year.

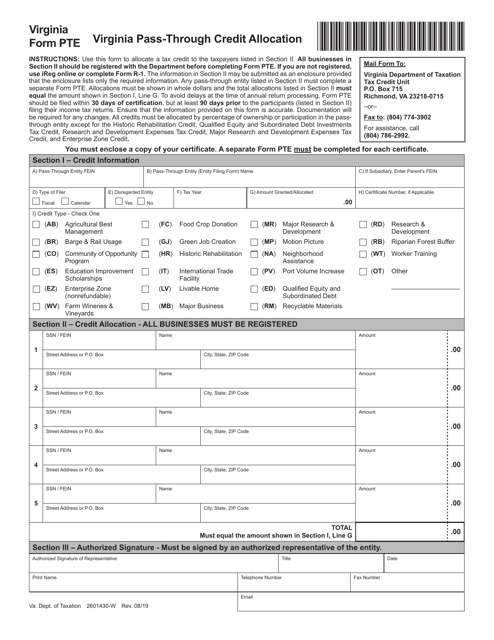

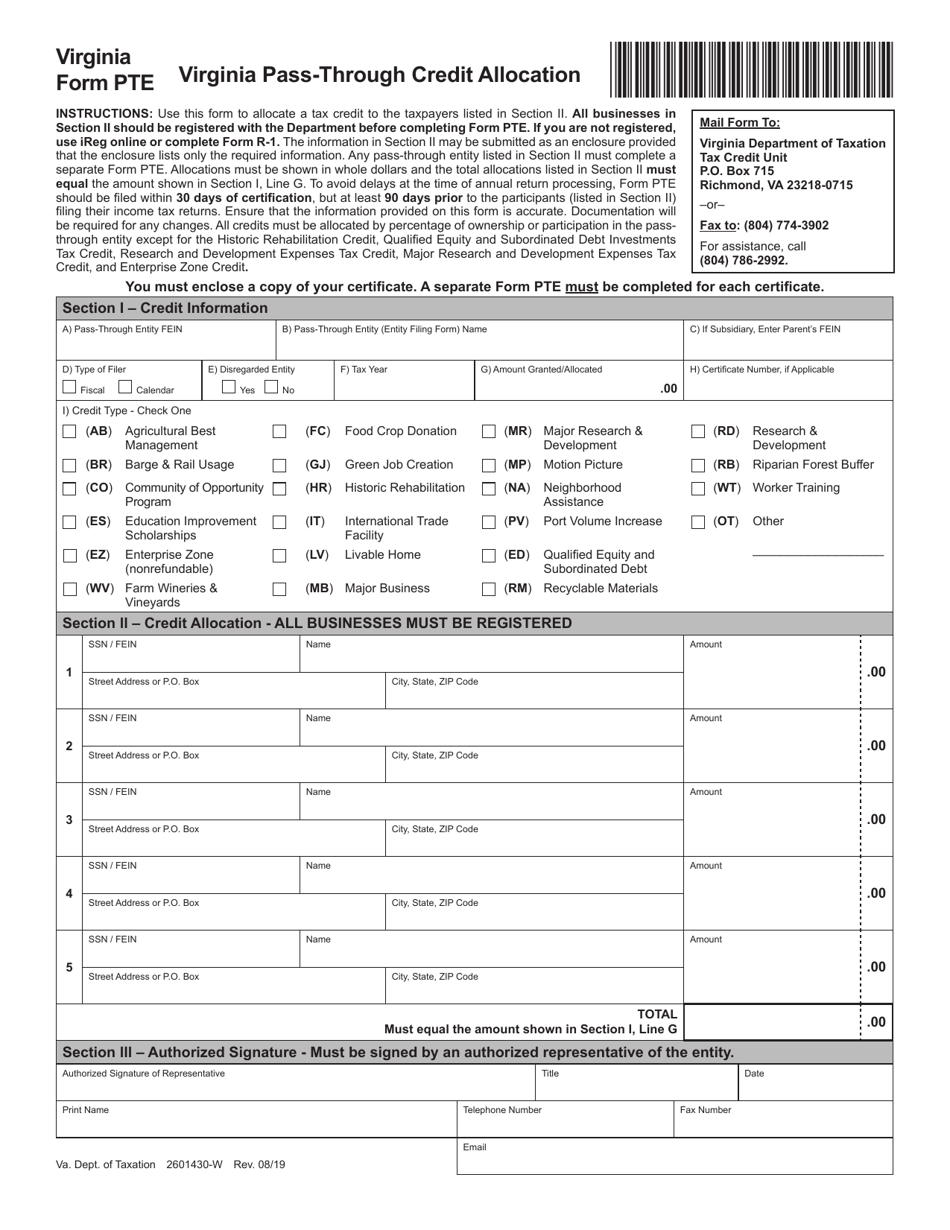

Form PTE Virginia Pass-Through Credit Allocation - Virginia

What Is Form PTE?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PTE Virginia Pass-Through Credit Allocation?

A: The Form PTE Virginia Pass-Through Credit Allocation is a form used by Virginia taxpayers who have income from a pass-through entity and want to allocate certain credits to their individual income tax returns.

Q: Who should file the Form PTE Virginia Pass-Through Credit Allocation?

A: Any Virginia taxpayer who has income from a pass-through entity and wants to allocate certain credits to their individual income tax return should file the Form PTE Virginia Pass-Through Credit Allocation.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity that does not pay income taxes itself, but instead passes its income, deductions, and credits through to its owners or members, who report them on their individual income tax returns.

Q: What credits can be allocated using the Form PTE Virginia Pass-Through Credit Allocation?

A: The Form PTE Virginia Pass-Through Credit Allocation can be used to allocate various credits, such as the Virginia research and development expenses tax credit, the Virginia coalfield employment enhancement tax credit, and the Virginia neighborhood assistance tax credit, among others.

Q: When is the deadline for filing the Form PTE Virginia Pass-Through Credit Allocation?

A: The deadline for filing the Form PTE Virginia Pass-Through Credit Allocation is the same as the deadline for filing your Virginia individual income tax return, which is typically May 1st.

Q: Can I amend my Form PTE Virginia Pass-Through Credit Allocation?

A: Yes, you can amend your Form PTE Virginia Pass-Through Credit Allocation if you discover errors or need to make changes. You should use the amended form and follow the instructions for filing an amended return.

Q: Are there any penalties for not filing the Form PTE Virginia Pass-Through Credit Allocation?

A: Yes, if you fail to file the Form PTE Virginia Pass-Through Credit Allocation when required, you may be subject to penalties and interest on any underpayment of taxes.

Q: Is there a fee for filing the Form PTE Virginia Pass-Through Credit Allocation?

A: No, there is no fee for filing the Form PTE Virginia Pass-Through Credit Allocation.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTE by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.