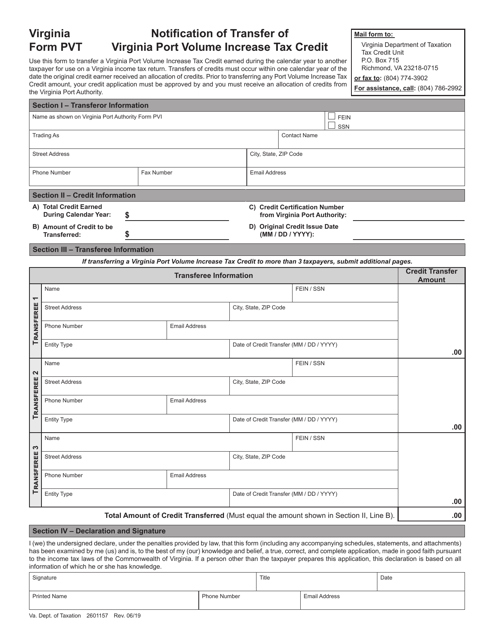

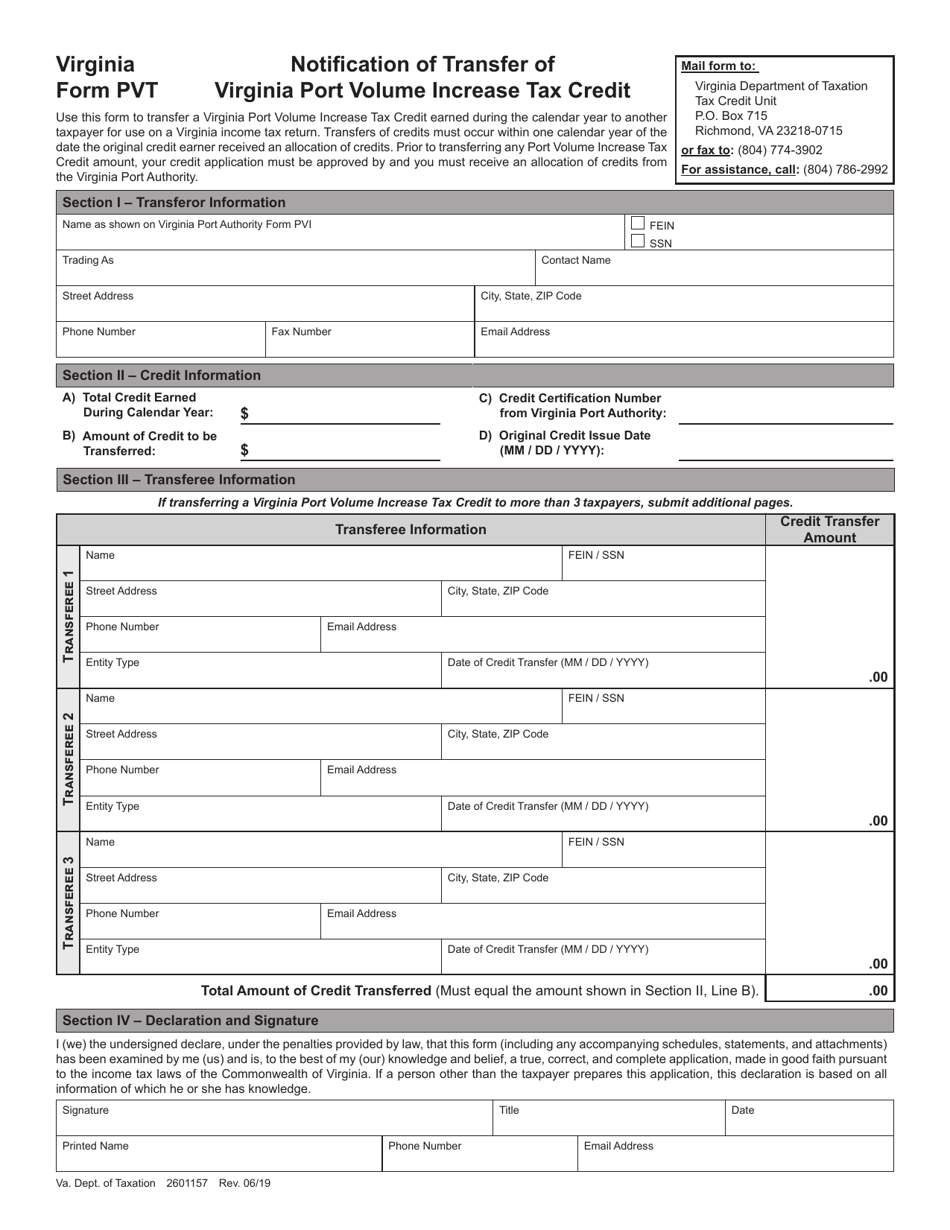

Form PVT Notification of Transfer of Virginia Port Volume Increase Tax Credit - Virginia

What Is Form PVT?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PVT Notification of Transfer of Virginia Port Volume Increase Tax Credit form?

A: The PVT Notification of Transfer of Virginia Port Volume Increase Tax Credit form is a document used to report the transfer of tax credits related to port volume increase in Virginia.

Q: What is the purpose of the form?

A: The purpose of the form is to notify the Virginia Port Authority about the transfer of tax credits related to port volume increase.

Q: Who needs to file this form?

A: Any individual or entity transferring Virginia Port Volume Increase tax credits needs to file this form.

Q: When does the form need to be filed?

A: The form needs to be filed within 30 days of the transfer of the tax credits.

Q: Is there a fee for filing this form?

A: There is no fee for filing this form.

Q: What information is required on the form?

A: The form requires information about the transferor and transferee, details of the tax credits being transferred, and an explanation of the transfer.

Q: Is any documentation required to be attached with the form?

A: Yes, you need to attach a copy of the transfer agreement or other relevant documentation that supports the transfer of tax credits.

Q: What happens after the form is filed?

A: Once the form is filed, the Virginia Port Authority will review the information and process the transfer of tax credits accordingly.

Q: Are there any penalties for not filing this form?

A: Failure to file this form may result in penalties or denial of the transfer of tax credits.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PVT by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.