This version of the form is not currently in use and is provided for reference only. Download this version of

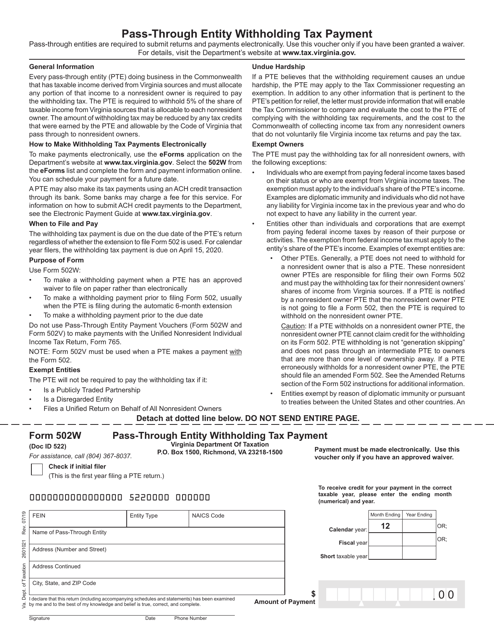

Form 502W

for the current year.

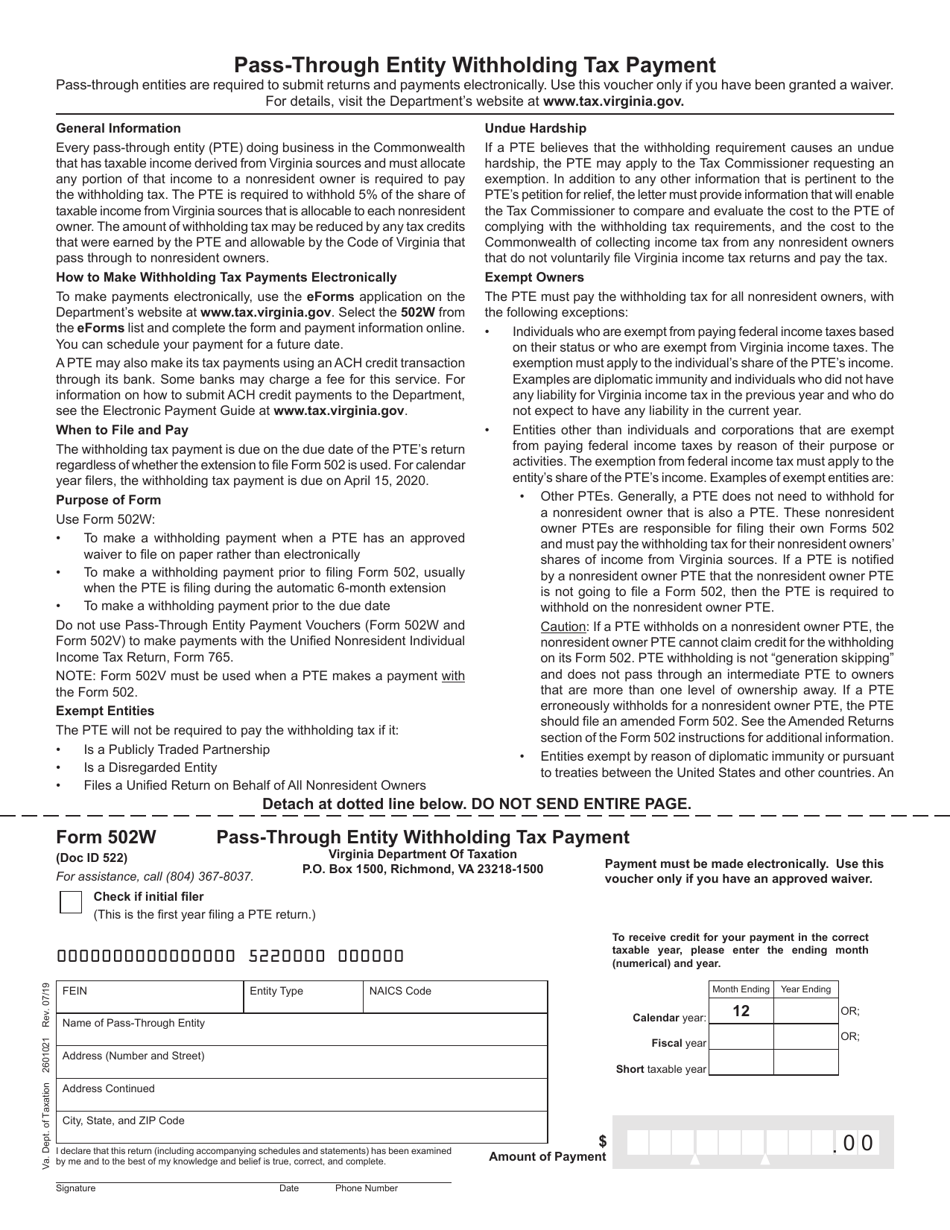

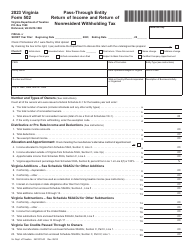

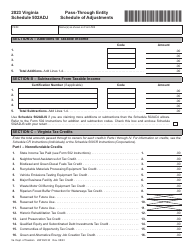

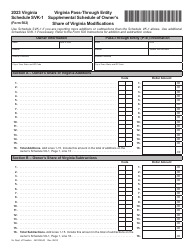

Form 502W Pass-Through Entity Withholding Tax Payment Voucher - Virginia

What Is Form 502W?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502W?

A: Form 502W is the Pass-Through Entity Withholding Tax Payment Voucher for Virginia.

Q: Who needs to use Form 502W?

A: Pass-through entities in Virginia that have withholding tax obligations need to use Form 502W.

Q: What is the purpose of Form 502W?

A: Form 502W is used to make withholding tax payments for pass-through entities in Virginia.

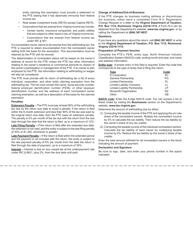

Q: When is Form 502W due?

A: Form 502W is due on or before the 15th day of the 4th month following the close of the taxable year.

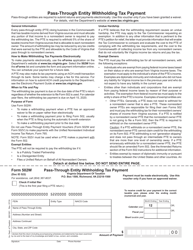

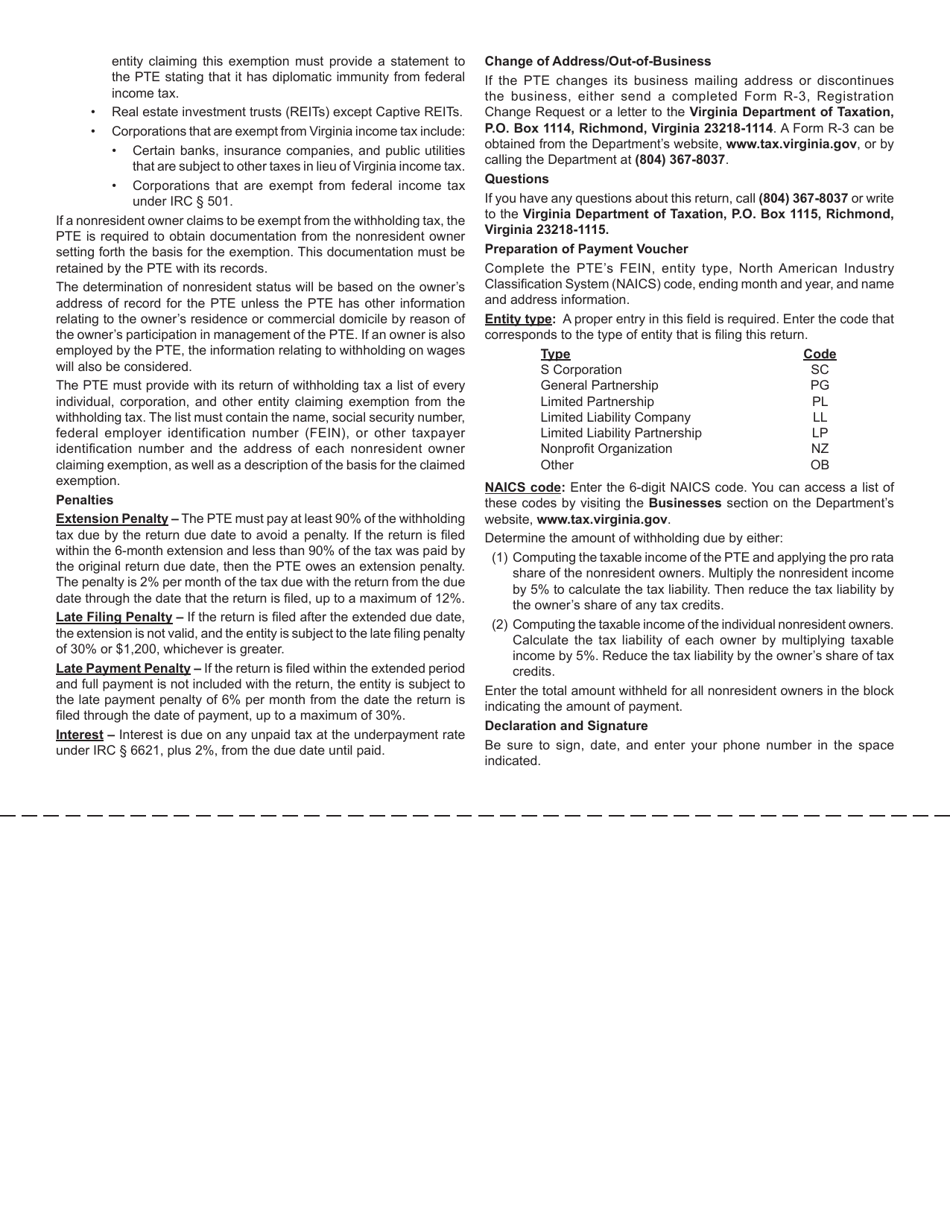

Q: How do I fill out Form 502W?

A: You will need to provide your entity information, calculate the amount of withholding tax due, and include payment information.

Q: What happens if I don't file Form 502W?

A: Failure to file Form 502W or pay the withholding tax by the due date may result in penalties and interest.

Q: Can I amend Form 502W if I made a mistake?

A: Yes, you can file an amended Form 502W if you made a mistake on your original submission.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502W by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.