This version of the form is not currently in use and is provided for reference only. Download this version of

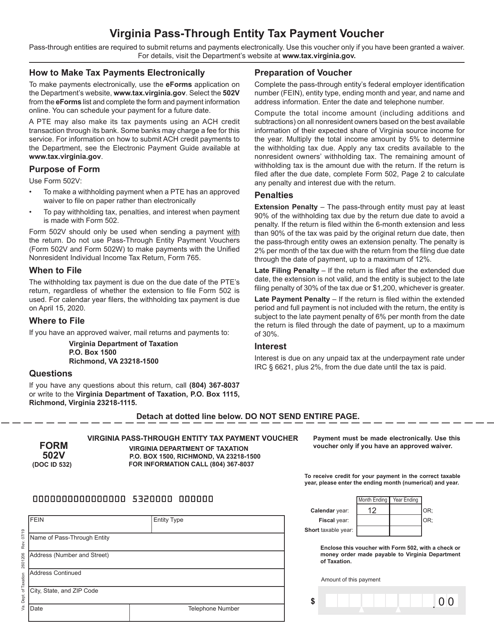

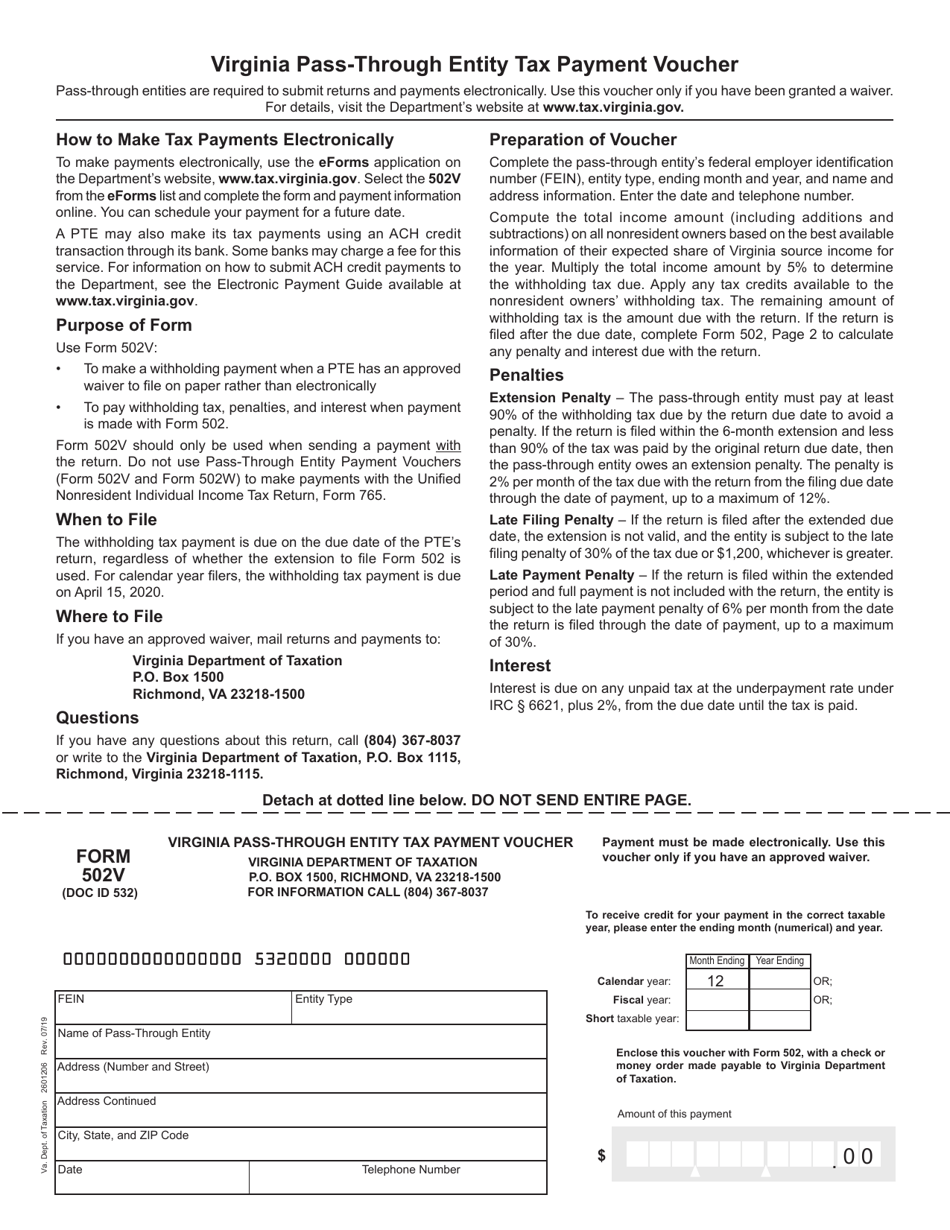

Form 502V

for the current year.

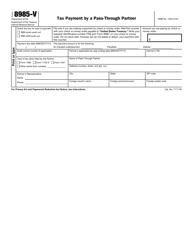

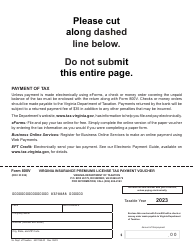

Form 502V Virginia Pass-Through Entity Tax Payment Voucher - Virginia

What Is Form 502V?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 502V?

A: Form 502V is the Virginia Pass-Through Entity Tax Payment Voucher.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity (such as a partnership or limited liability company) that doesn't pay taxes directly, but instead passes through its income, deductions, and credits to its owners or members.

Q: Who needs to use Form 502V?

A: Pass-through entities in Virginia who need to make tax payments.

Q: What is the purpose of Form 502V?

A: Form 502V is used to make tax payments for pass-through entities in Virginia.

Q: Do I need to file Form 502V if I don't owe any taxes?

A: If you don't owe any taxes, you don't need to file Form 502V.

Q: When is Form 502V due?

A: Form 502V is due on or before the 15th day of the fourth month following the close of the tax year.

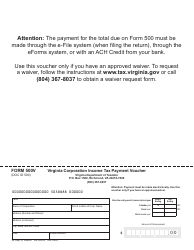

Q: How do I pay the tax owed on Form 502V?

A: You can pay the tax owed on Form 502V by mailing a check or money order with the voucher or by making an electronic payment.

Q: Is there a penalty for late payment of taxes?

A: Yes, there may be a penalty for late payment of taxes. It's important to pay on time to avoid penalties and interest.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502V by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.