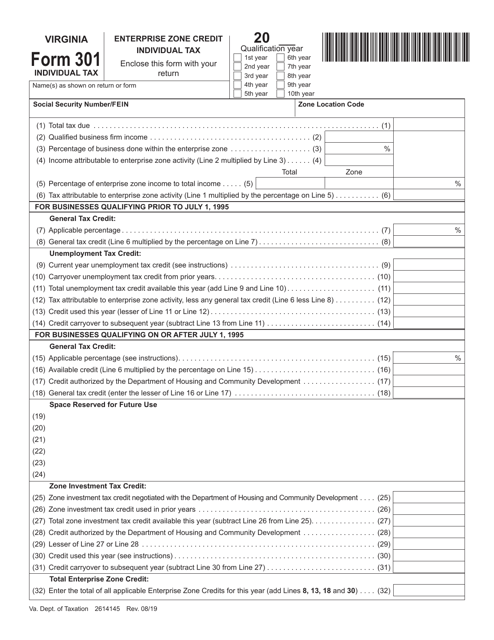

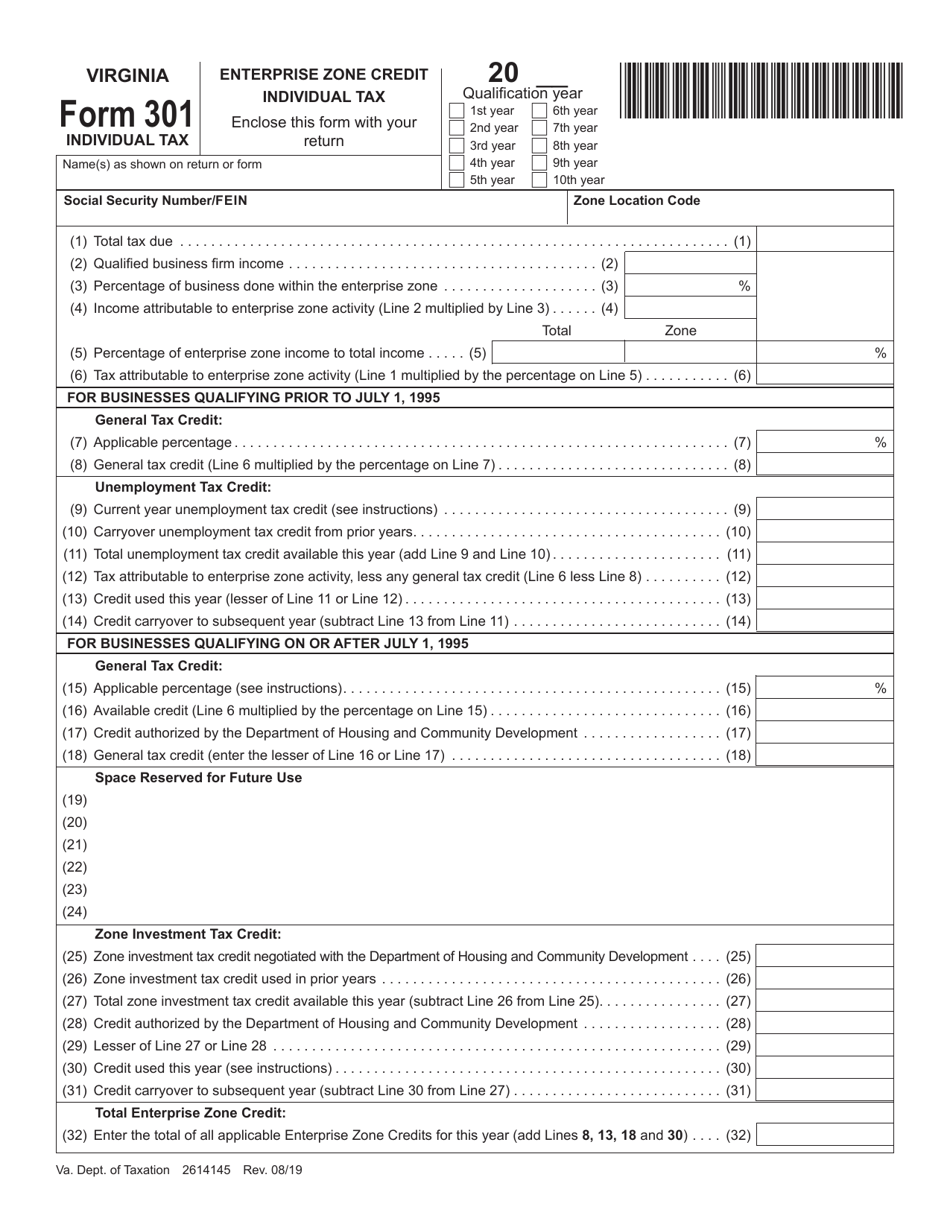

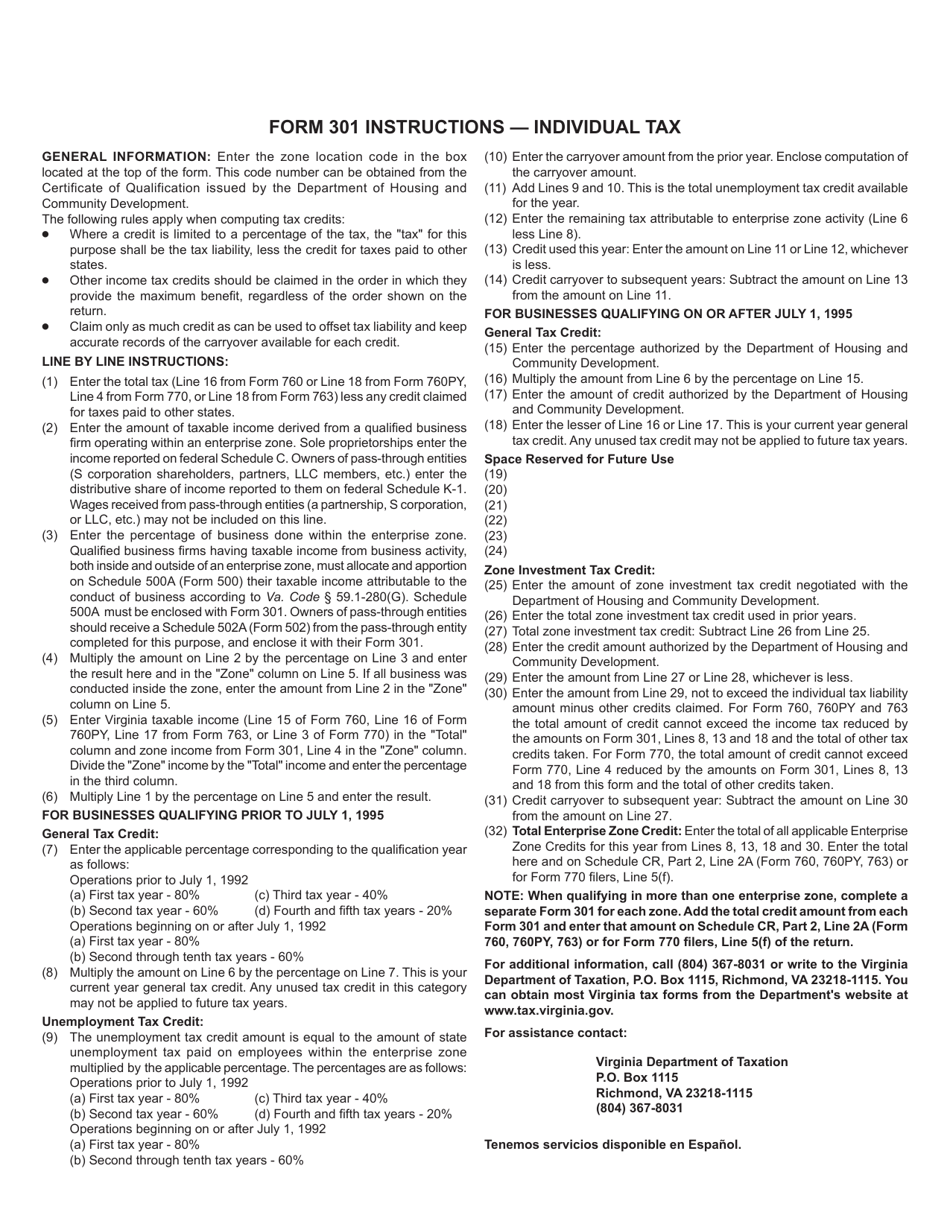

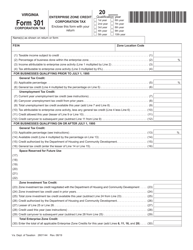

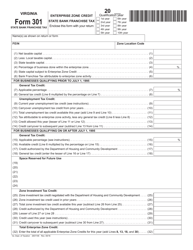

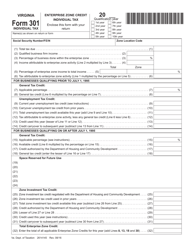

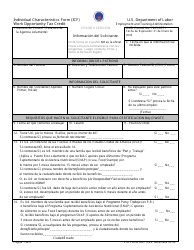

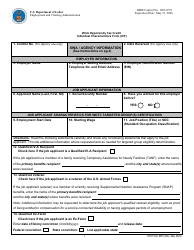

Form 301 INDIVIDUAL Enterprise Zone Credit - Individual Tax - Virginia

What Is Form 301 INDIVIDUAL?

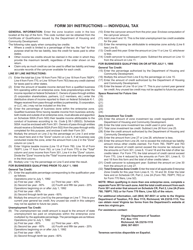

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 301?

A: Form 301 is a tax form used in Virginia for claiming the Individual Enterprise Zone Credit.

Q: What is the Individual Enterprise Zone Credit?

A: The Individual Enterprise Zone Credit is a tax credit available to individuals who invest in businesses located in designated enterprise zones in Virginia.

Q: How do I qualify for the Individual Enterprise Zone Credit?

A: To qualify for the Individual Enterprise Zone Credit, you must make a qualified investment in a qualified business located in a designated enterprise zone in Virginia.

Q: What is a qualified investment?

A: A qualified investment is an investment made in a qualified business that meets certain criteria set by the Virginia Department of Housing and Community Development.

Q: What is a designated enterprise zone?

A: A designated enterprise zone is a specific geographic area in Virginia that has been designated as economically distressed and eligible for special tax incentives.

Q: How much is the Individual Enterprise Zone Credit?

A: The amount of the credit depends on the amount of your qualified investment and may vary from year to year.

Q: How do I claim the Individual Enterprise Zone Credit?

A: You can claim the Individual Enterprise Zone Credit by completing and filing Form 301 with your Virginia income tax return.

Q: Are there any limitations on the Individual Enterprise Zone Credit?

A: Yes, there are certain limitations on the credit, such as the maximum amount of credit that can be claimed in a single year and the carryforward provisions.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 301 INDIVIDUAL by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.