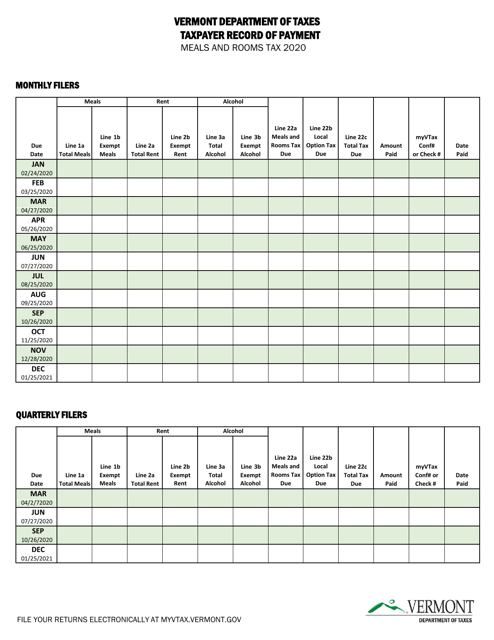

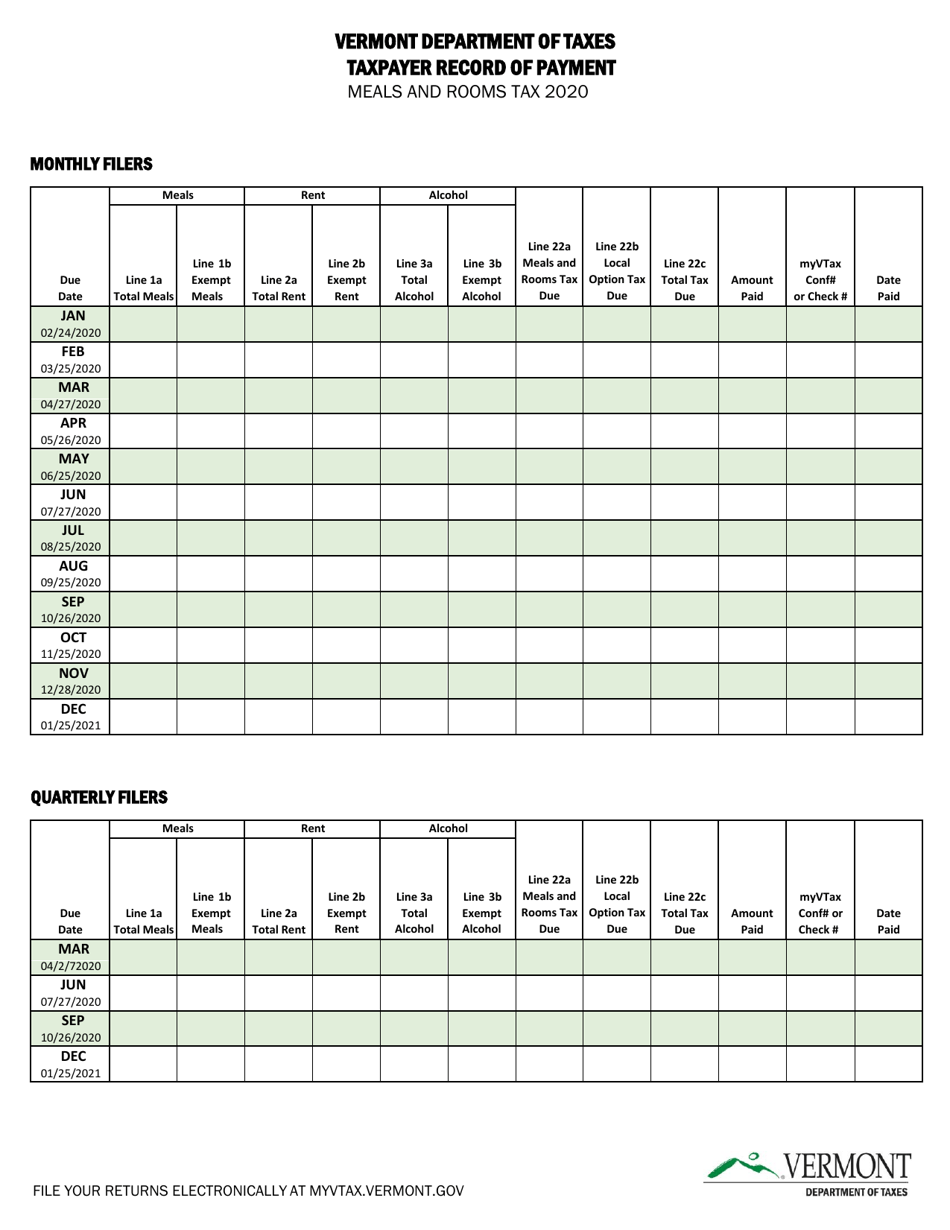

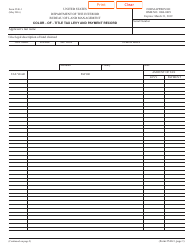

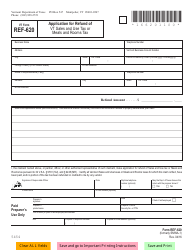

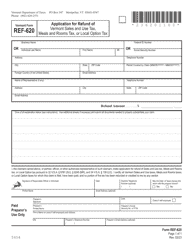

Meals and Rooms Tax Record of Payment - Vermont

Meals and Rooms Tax Record of Payment is a legal document that was released by the Vermont Department of Taxes - a government authority operating within Vermont.

FAQ

Q: What is the Meals and Rooms Tax?

A: The Meals and Rooms Tax is a tax on meals and lodging in the state of Vermont.

Q: Who is required to pay the Meals and Rooms Tax?

A: Individuals or businesses that provide meals or lodging in Vermont are required to pay the Meals and Rooms Tax.

Q: How is the Meals and Rooms Tax calculated?

A: The Meals and Rooms Tax is calculated as a percentage of the sales or rental amount, depending on the type of transaction.

Q: What happens if I don't pay the Meals and Rooms Tax?

A: Failure to pay the Meals and Rooms Tax could result in penalties and interest being assessed on the unpaid amount.

Q: Can I deduct the Meals and Rooms Tax on my federal income tax return?

A: No, the Meals and Rooms Tax paid to the state of Vermont is not deductible on your federal income tax return.

Form Details:

- The latest edition currently provided by the Vermont Department of Taxes;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.