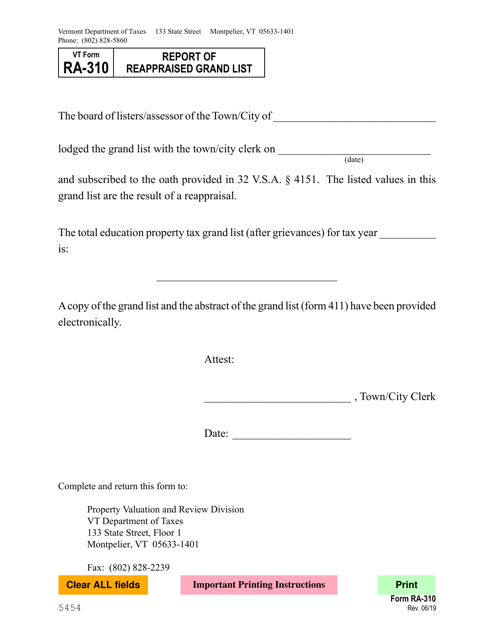

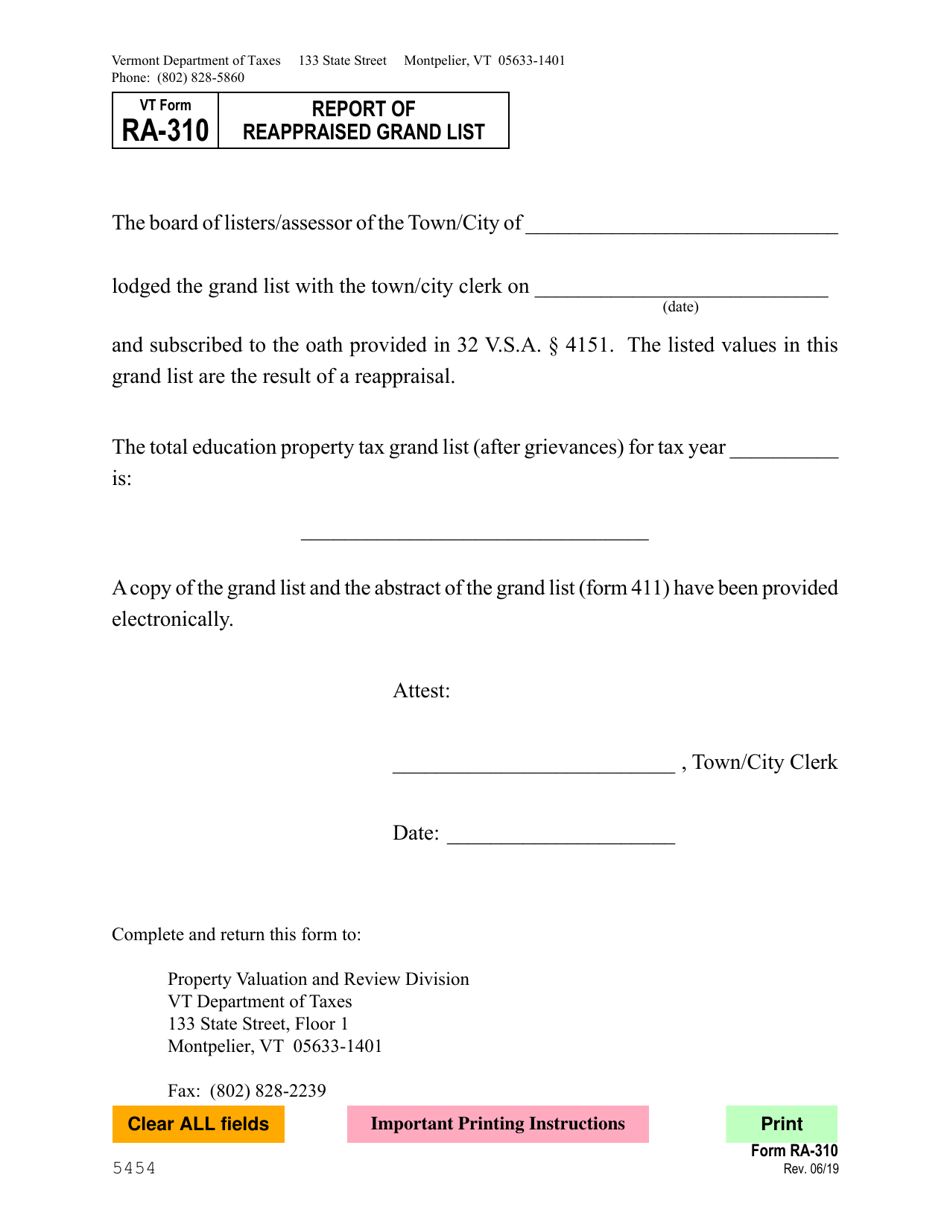

VT Form RA-310 Report of Reappraised Grand List - Vermont

What Is VT Form RA-310?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form RA-310?

A: VT Form RA-310 is the Report of Reappraised Grand List in Vermont.

Q: What is the purpose of VT Form RA-310?

A: The purpose of VT Form RA-310 is to report the reappraised grand list in Vermont.

Q: Who needs to file VT Form RA-310?

A: VT Form RA-310 needs to be filed by the applicable authorities in Vermont responsible for appraising and maintaining the grand list.

Q: When is VT Form RA-310 due?

A: The due date for filing VT Form RA-310 varies, and it is typically specified by the Vermont Department of Taxes.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form RA-310 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.