This version of the form is not currently in use and is provided for reference only. Download this version of

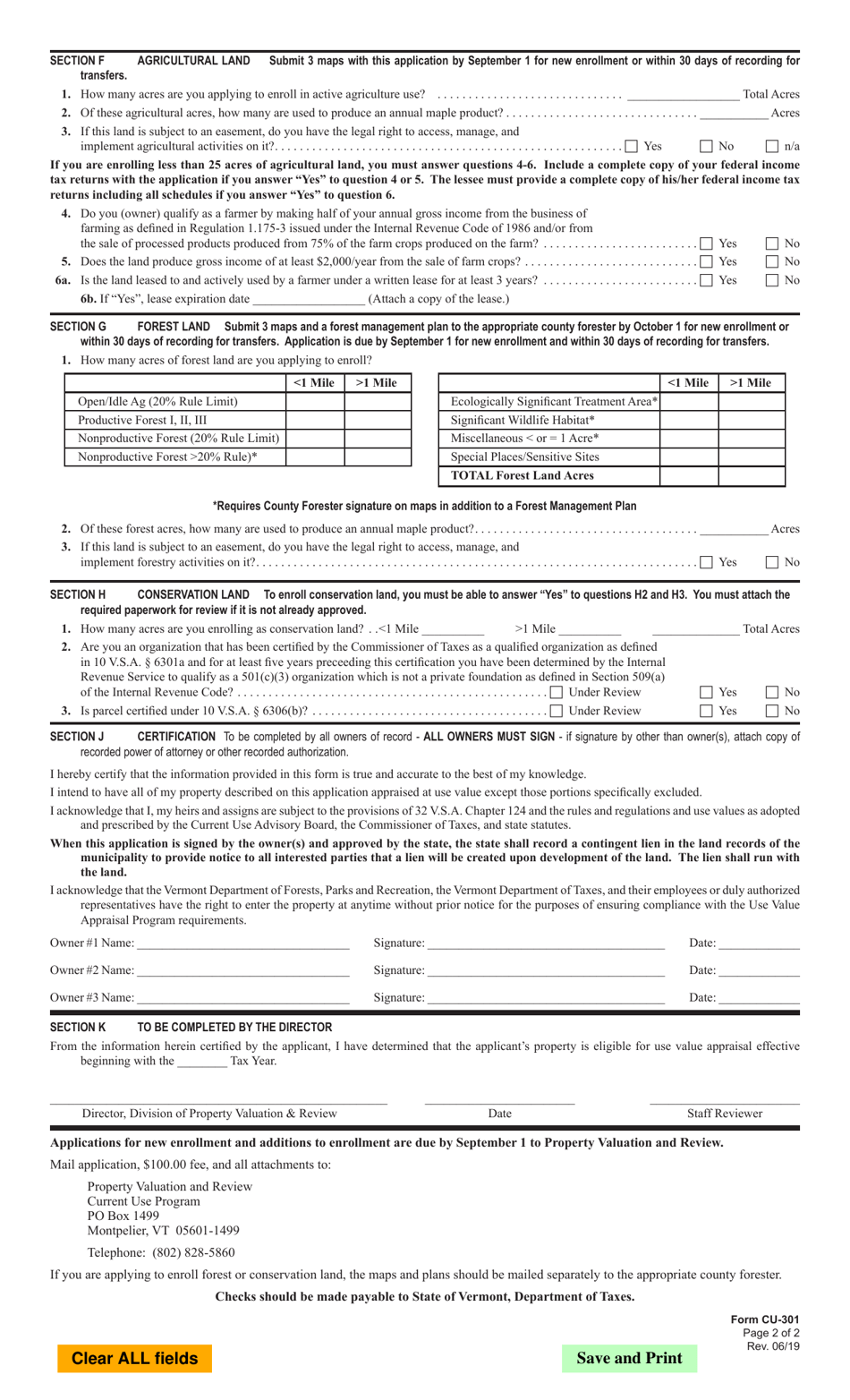

Form CU-301

for the current year.

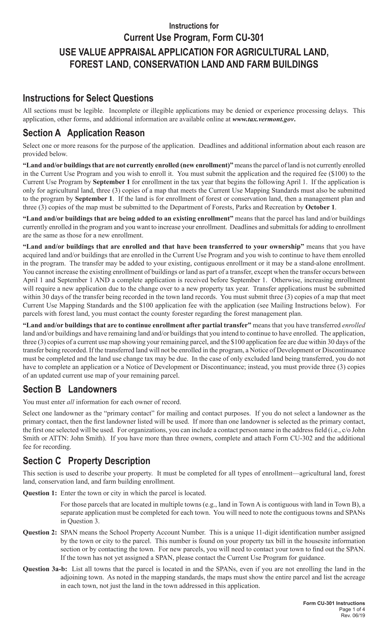

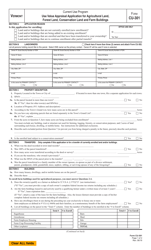

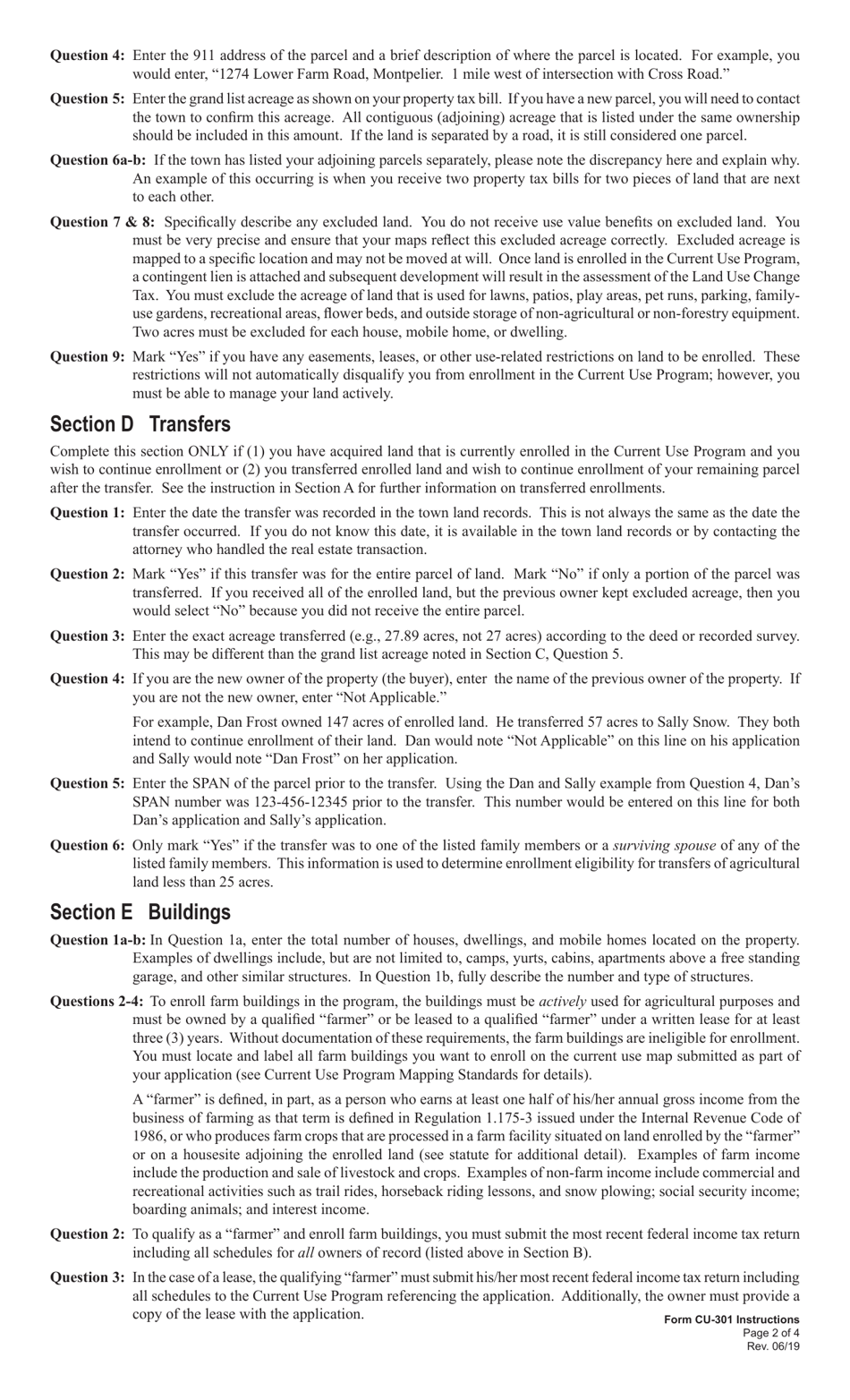

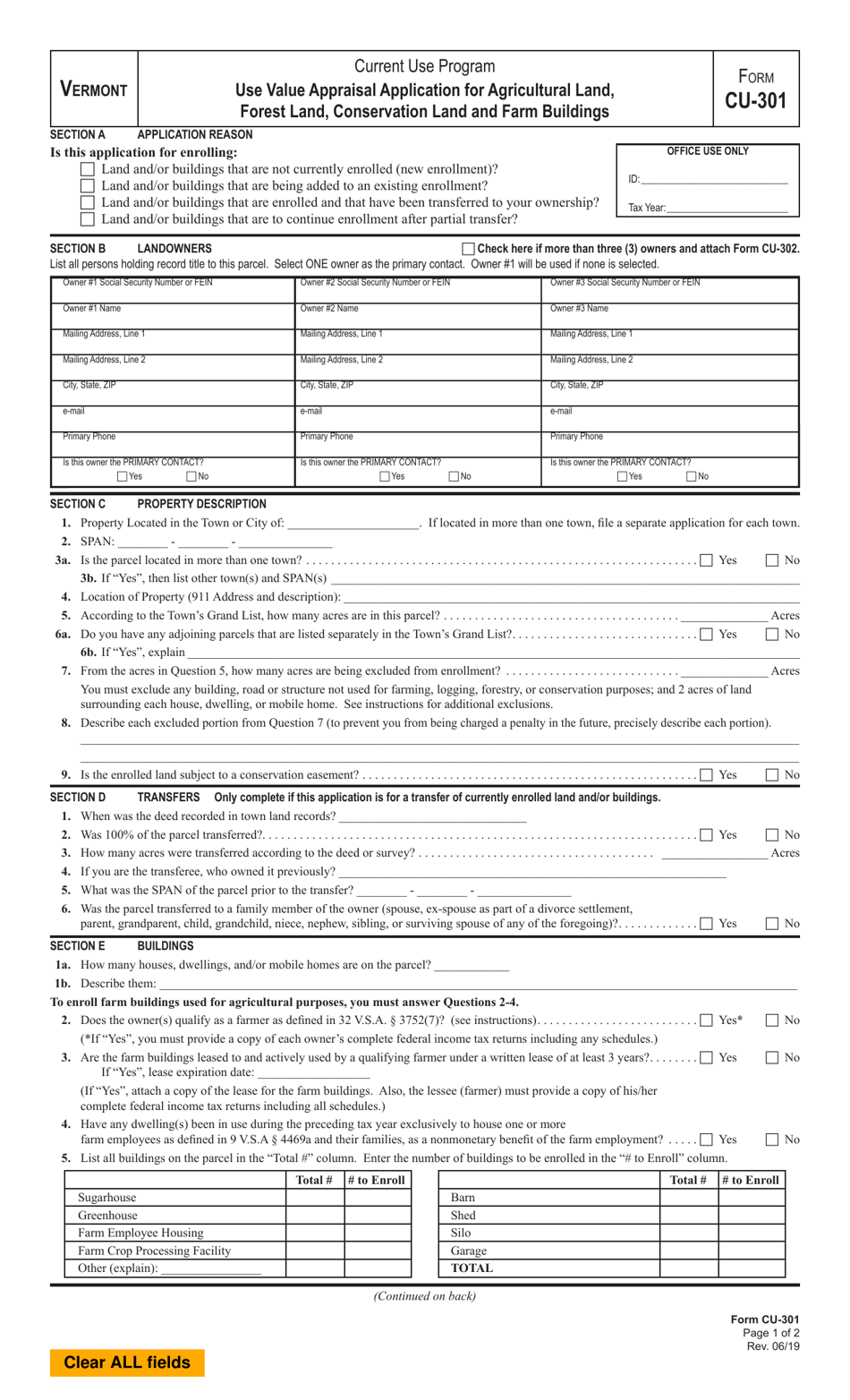

Form CU-301 Current Use Program Use Value Appraisal Application for Agricultural Land, Forest Land, Conservation Land and Farm - Vermont

What Is Form CU-301?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CU-301?

A: The Form CU-301 is an application for the Current Use Program Use Value Appraisal for agricultural land, forest land, conservation land, and farm in Vermont.

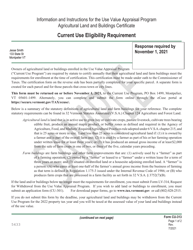

Q: What is the Current Use Program?

A: The Current Use Program is a program in Vermont that provides property tax relief to landowners who agree to keep their land in agricultural, forest, or conservation use.

Q: What is Use Value Appraisal?

A: Use Value Appraisal is the process of assessing the value of land based on its current use, rather than its market value.

Q: Who can apply for the Current Use Program?

A: Landowners in Vermont who meet certain eligibility criteria can apply for the Current Use Program.

Q: What types of land are eligible for the Current Use Program?

A: Agricultural land, forest land, conservation land, and farm are eligible for the Current Use Program.

Q: Why would someone apply for the Current Use Program?

A: Landowners apply for the Current Use Program to receive property tax relief and preserve their land for agricultural, forest, or conservation use.

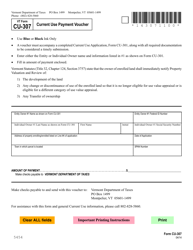

Q: Are there any deadlines for submitting Form CU-301?

A: Yes, the application must be filed with the Vermont Department of Taxes by September 1st of the year preceding the tax year for which the landowner seeks enrollment.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CU-301 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.