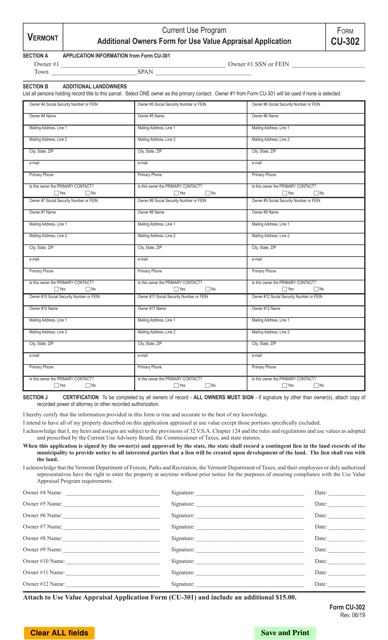

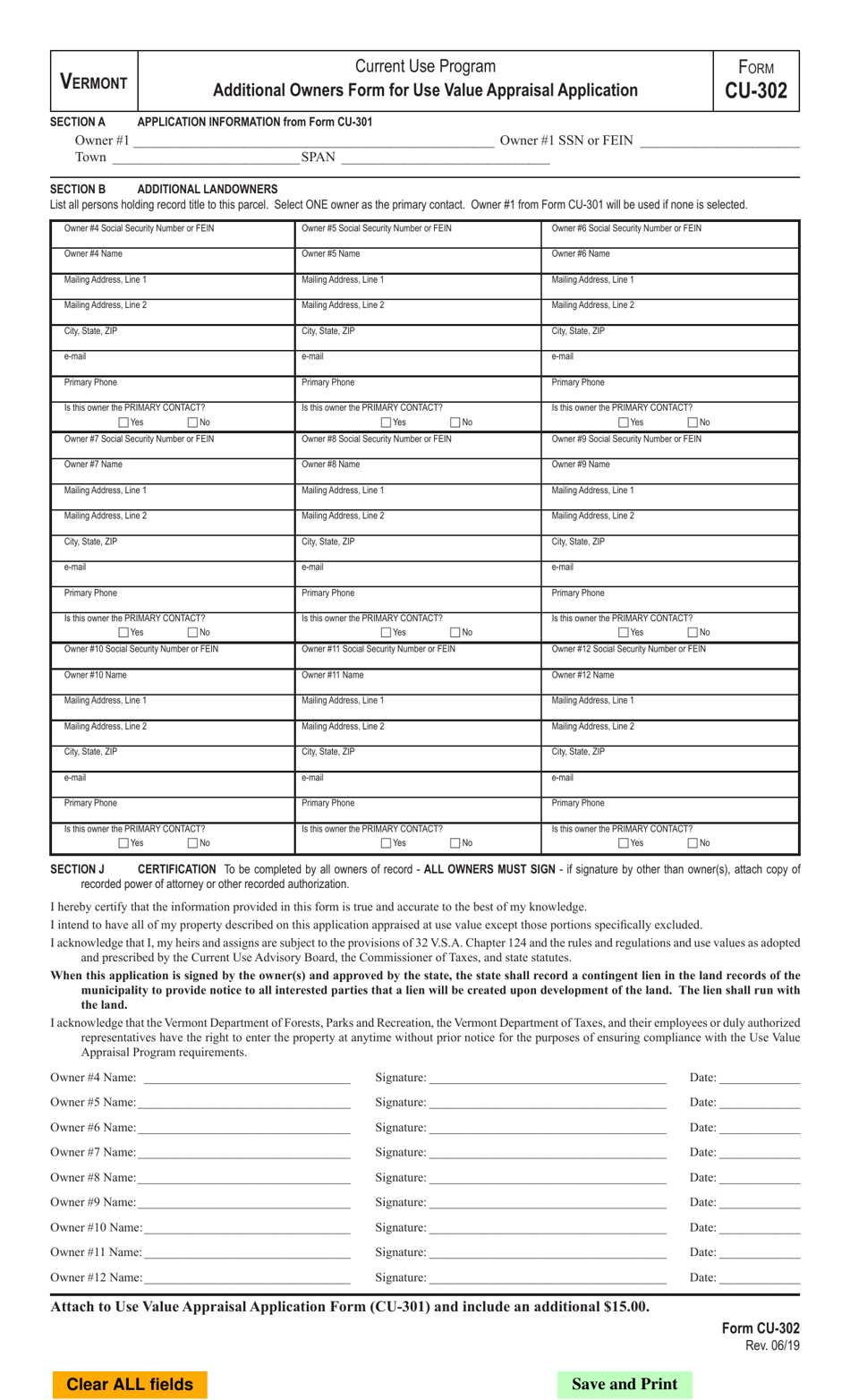

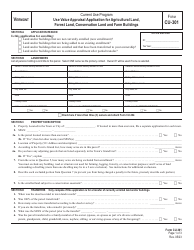

Form CU-302 Additional Owners Form for Use Value Appraisal Application - Vermont

What Is Form CU-302?

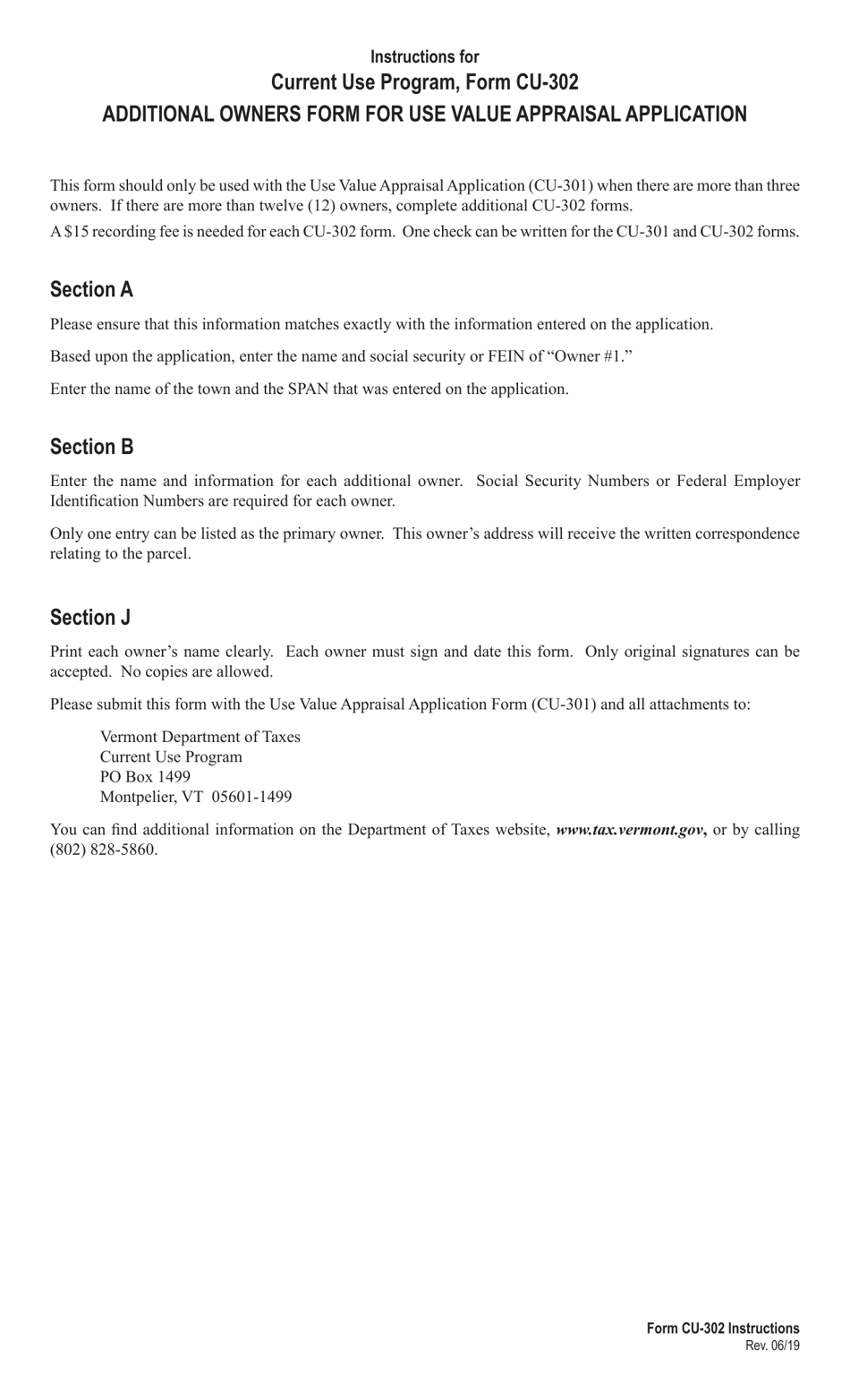

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form CU-302?

A: The Form CU-302 is the Additional Owners Form for Use Value Appraisal Application in Vermont.

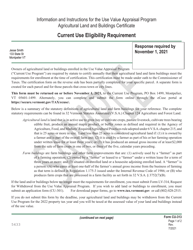

Q: What is the Use Value Appraisal Application?

A: The Use Value Appraisal Application is a program in Vermont that provides property tax relief to landowners who keep their land in agricultural or forest use.

Q: What is the purpose of Form CU-302?

A: The purpose of Form CU-302 is to collect information about additional owners of a property that is applying for use value appraisal.

Q: Who needs to fill out Form CU-302?

A: Additional owners of a property applying for use value appraisal in Vermont need to fill out Form CU-302.

Q: Is Form CU-302 specific to Vermont?

A: Yes, Form CU-302 is specific to Vermont and its Use Value Appraisal Application program.

Q: Are there any fees associated with submitting Form CU-302?

A: No, there are no fees associated with submitting Form CU-302.

Q: Are there any deadlines for submitting Form CU-302?

A: The deadlines for submitting Form CU-302 may vary, so it's best to check the instructions or contact the Vermont Department of Taxes for specific deadlines.

Q: What happens after submitting Form CU-302?

A: After submitting Form CU-302, the additional owners information will be processed and reviewed as part of the Use Value Appraisal Application.

Q: Can I make changes to Form CU-302 after submission?

A: If you need to make changes to Form CU-302 after submission, you should contact the Vermont Department of Taxes for guidance.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CU-302 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.