This version of the form is not currently in use and is provided for reference only. Download this version of

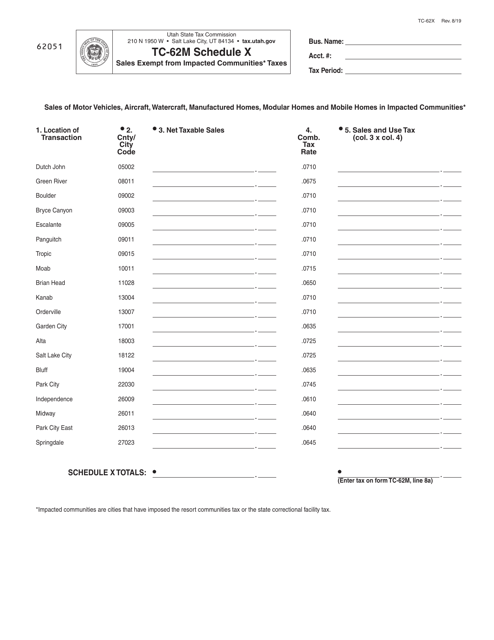

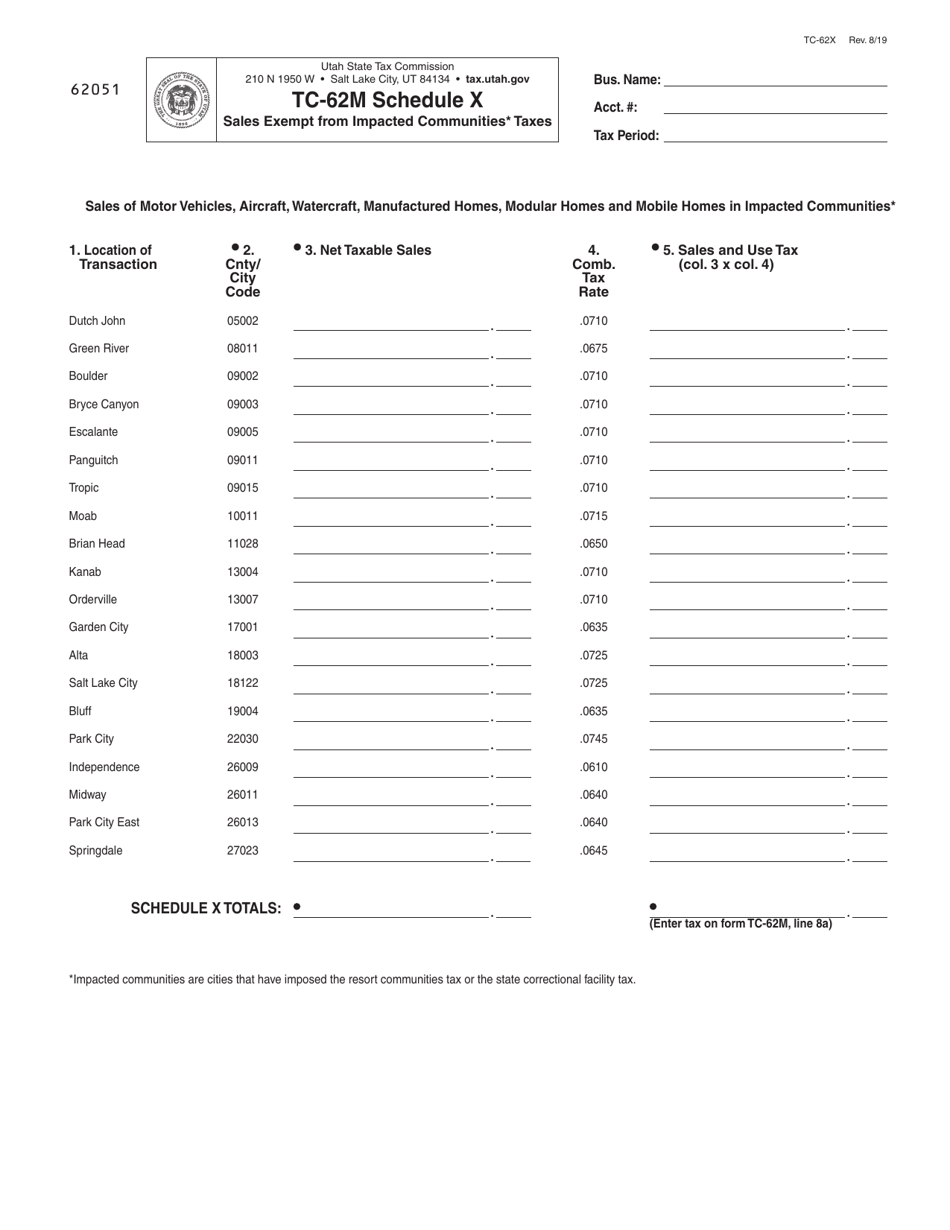

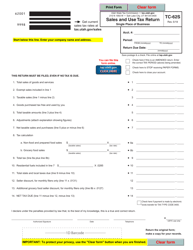

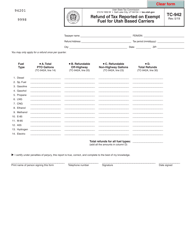

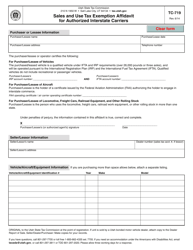

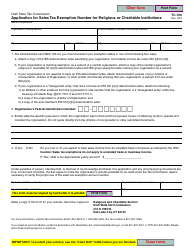

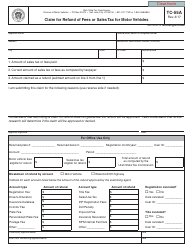

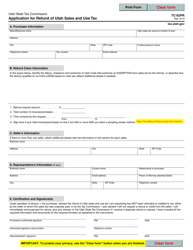

Form TC-62M Schedule X

for the current year.

Form TC-62M Schedule X Sales Exempt From Impacted Communities Taxes - Utah

What Is Form TC-62M Schedule X?

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-62M, Sales and Use Tax Return for Multiple Places of Business. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is TC-62M Schedule X?

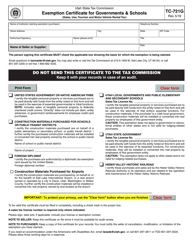

A: TC-62M Schedule X is a form used in Utah for reporting sales exempt from impacted communities taxes.

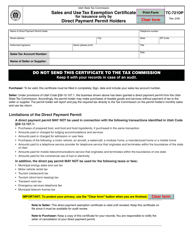

Q: What are impacted communities taxes?

A: Impacted communities taxes are taxes imposed by certain jurisdictions in Utah.

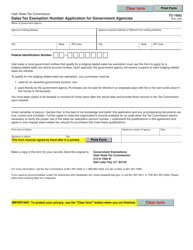

Q: Who is required to file TC-62M Schedule X?

A: Individuals or businesses that have made sales exempt from impacted communities taxes in Utah are required to file TC-62M Schedule X.

Q: What sales are exempt from impacted communities taxes?

A: Sales that are exempt from impacted communities taxes include those made to the United States, the state of Utah, and certain tax-exempt entities.

Q: Do I need to pay impacted communities taxes?

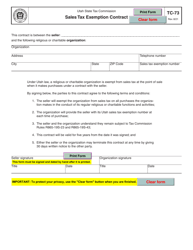

A: Whether or not you need to pay impacted communities taxes depends on the specific jurisdiction in Utah where the sale takes place. You should consult with the Utah State Tax Commission or a tax professional for more information.

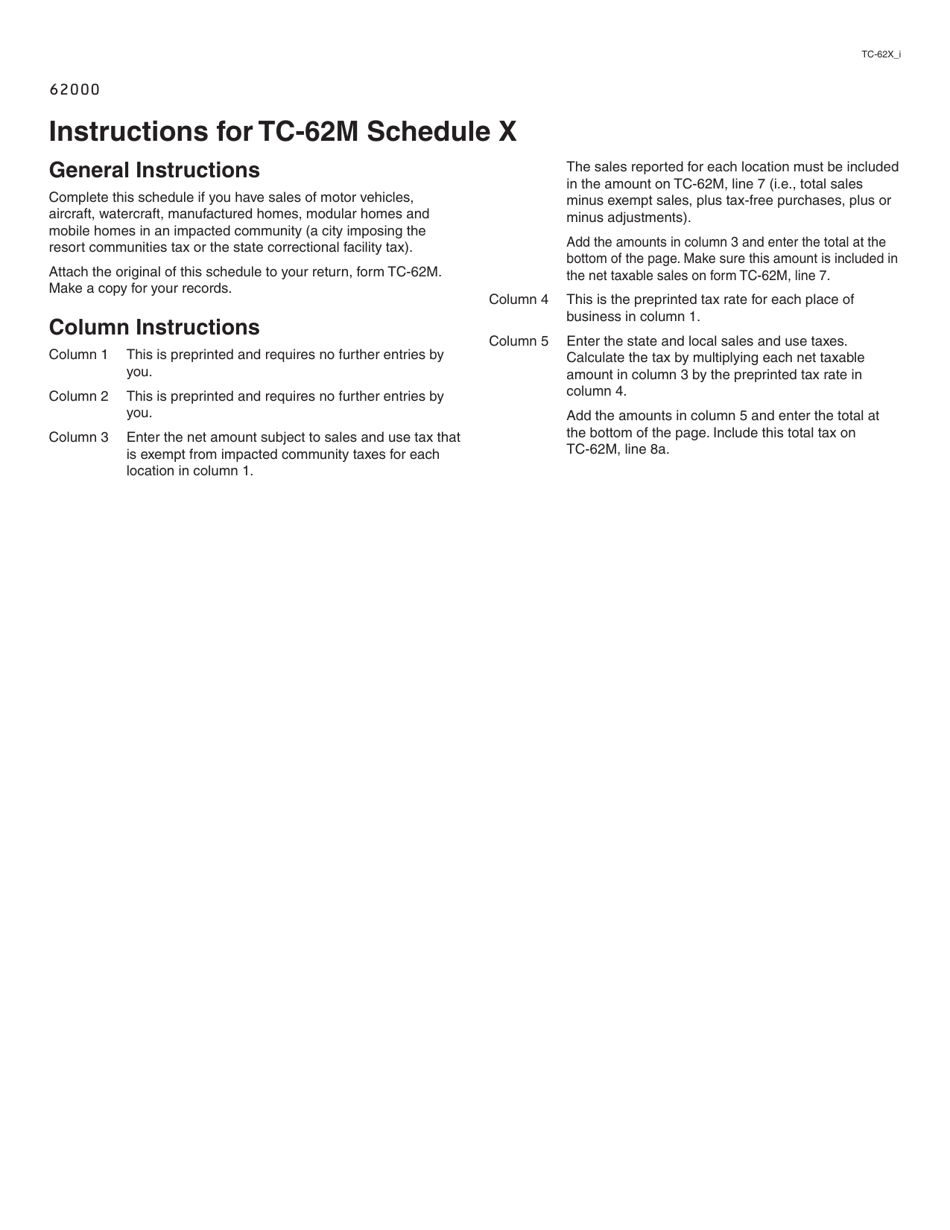

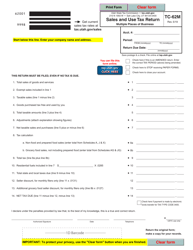

Q: How do I complete TC-62M Schedule X?

A: To complete TC-62M Schedule X, you will need to provide information about the exempt sales, including the amount of sales exempt from impacted communities taxes and the jurisdiction in which the sales were made.

Q: When is the deadline for filing TC-62M Schedule X?

A: The deadline for filing TC-62M Schedule X is the same as the deadline for filing the related sales tax return in Utah. You should check with the Utah State Tax Commission or a tax professional for the specific deadline.

Q: What are the consequences of not filing TC-62M Schedule X?

A: Failure to file TC-62M Schedule X or reporting inaccurate information may result in penalties and interest.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TC-62M Schedule X by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.