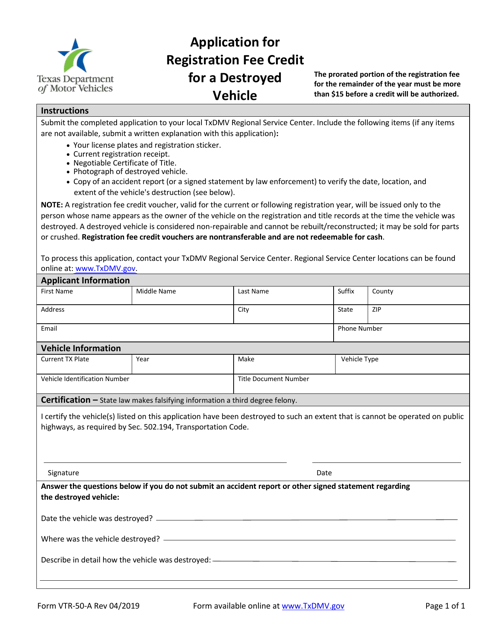

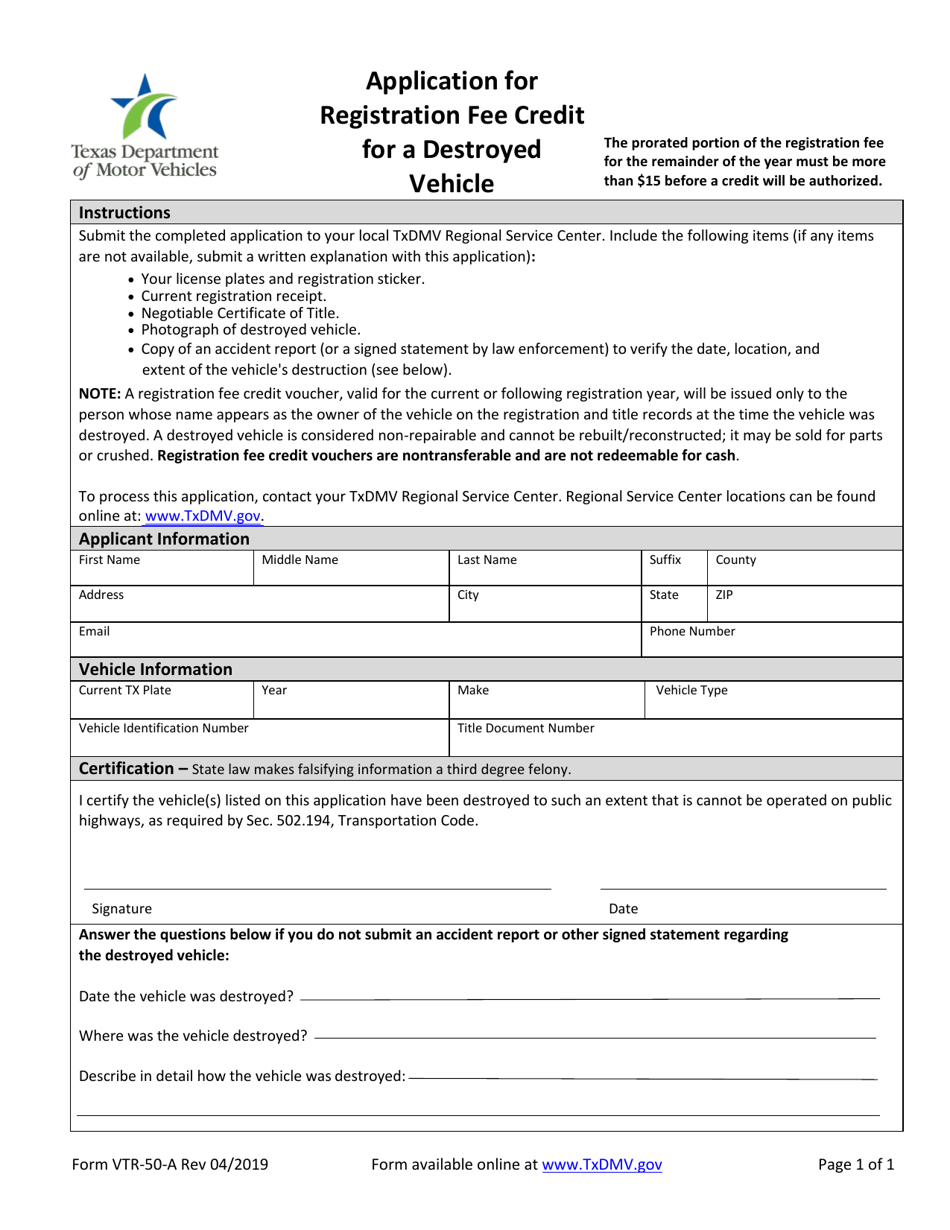

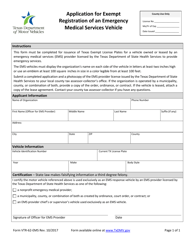

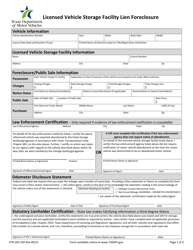

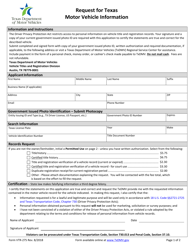

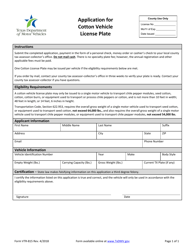

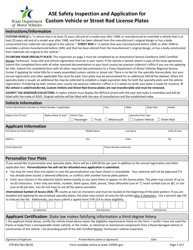

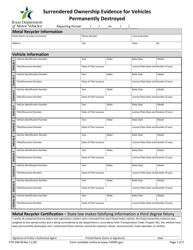

Form VTR-50-A Application for Registration Fee Credit for a Destroyed Vehicle - Texas

What Is Form VTR-50-A?

This is a legal form that was released by the Texas Department of Motor Vehicles - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VTR-50-A?

A: Form VTR-50-A is the Application for Registration Fee Credit for a Destroyed Vehicle in Texas.

Q: What is the purpose of Form VTR-50-A?

A: The purpose of Form VTR-50-A is to apply for a credit of the registration fee paid for a vehicle that has been destroyed.

Q: Who can use Form VTR-50-A?

A: Individuals who have paid the registration fee for a vehicle that was destroyed can use Form VTR-50-A.

Q: What information is required on Form VTR-50-A?

A: Form VTR-50-A requires information about the destroyed vehicle, the reason for destruction, and the applicant's contact information.

Q: Are there any fees associated with Form VTR-50-A?

A: There are no fees associated with filing Form VTR-50-A.

Q: How long does it take to process Form VTR-50-A?

A: Processing times for Form VTR-50-A may vary, but it typically takes a few weeks to receive the registration fee credit.

Q: Can I apply for a registration fee credit for a stolen vehicle?

A: No, Form VTR-50-A is specifically for vehicles that have been destroyed, not stolen.

Q: What should I do with the license plates from the destroyed vehicle?

A: The license plates from the destroyed vehicle should be returned to the Texas Department of Motor Vehicles or your local county tax office.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Texas Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VTR-50-A by clicking the link below or browse more documents and templates provided by the Texas Department of Motor Vehicles.