This version of the form is not currently in use and is provided for reference only. Download this version of

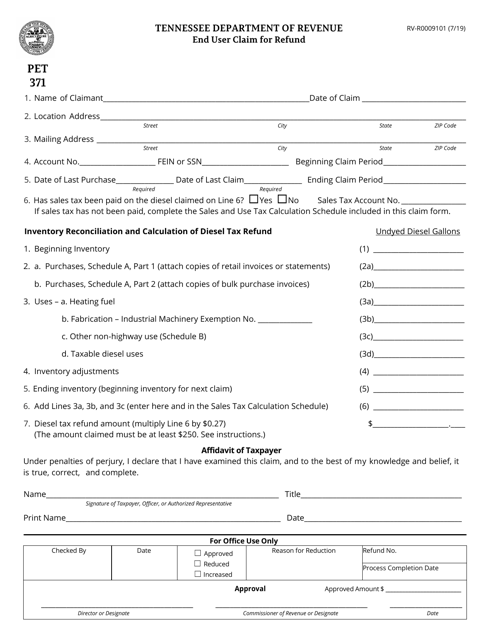

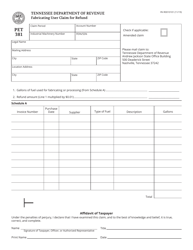

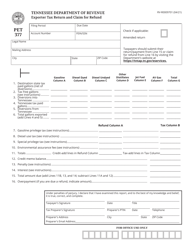

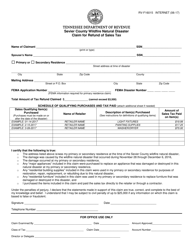

Form PET371 (RV-R0009101)

for the current year.

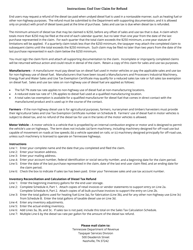

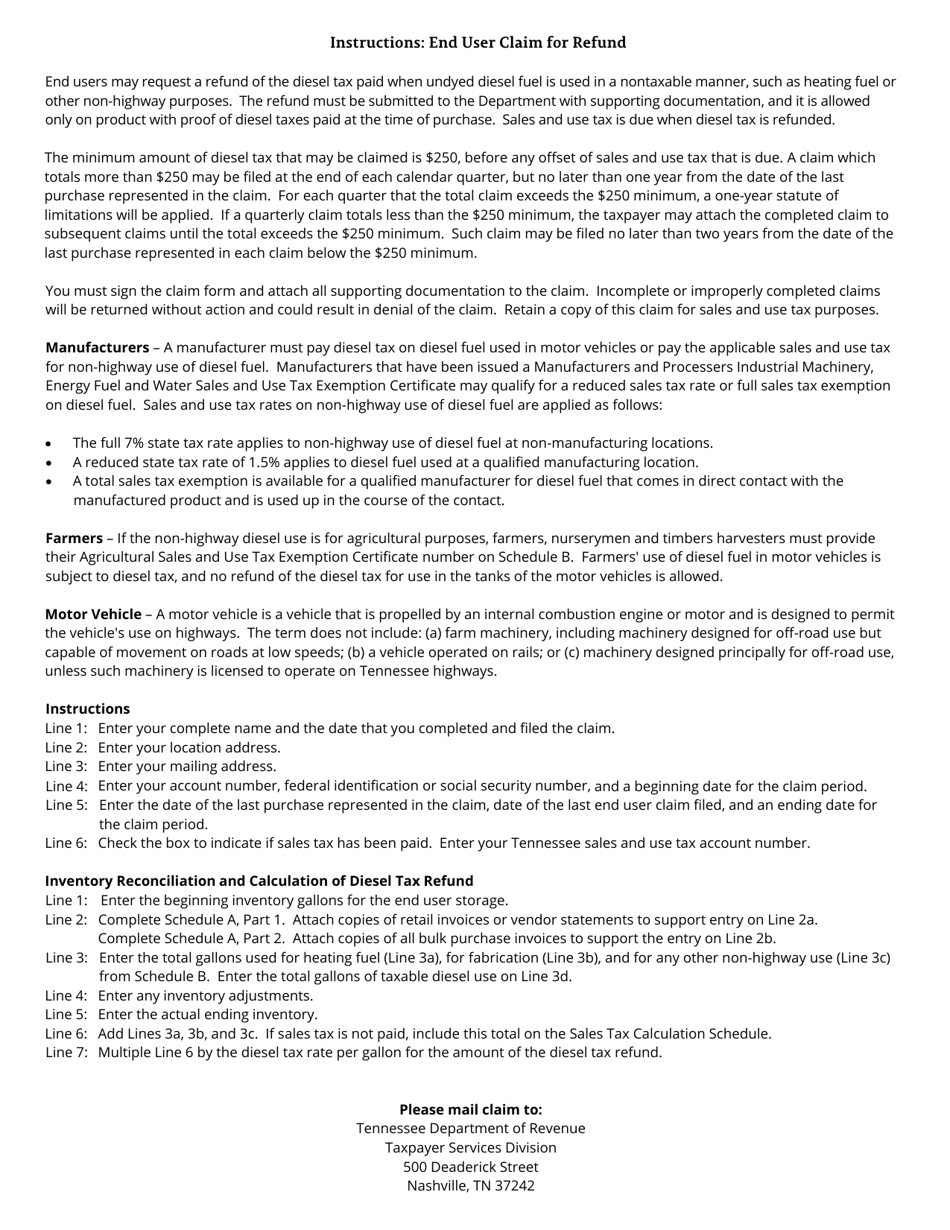

Form PET371 (RV-R0009101) End User Claim for Refund - Tennessee

What Is Form PET371 (RV-R0009101)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET371?

A: Form PET371 is the End User Claim for Refund specifically for Tennessee.

Q: What is the purpose of Form PET371?

A: The purpose of Form PET371 is to claim a refund of Tennessee sales tax paid on certain items.

Q: Who can use Form PET371?

A: Form PET371 can be used by end users who have paid Tennessee sales tax on qualifying items.

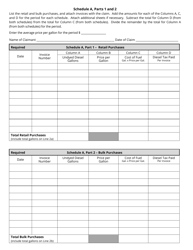

Q: What items are eligible for a refund using Form PET371?

A: Qualifying items for refund using Form PET371 include energy-efficient appliances, energy-saving products, and certain motor fuel.

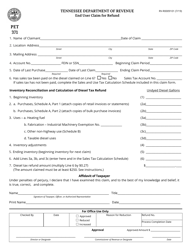

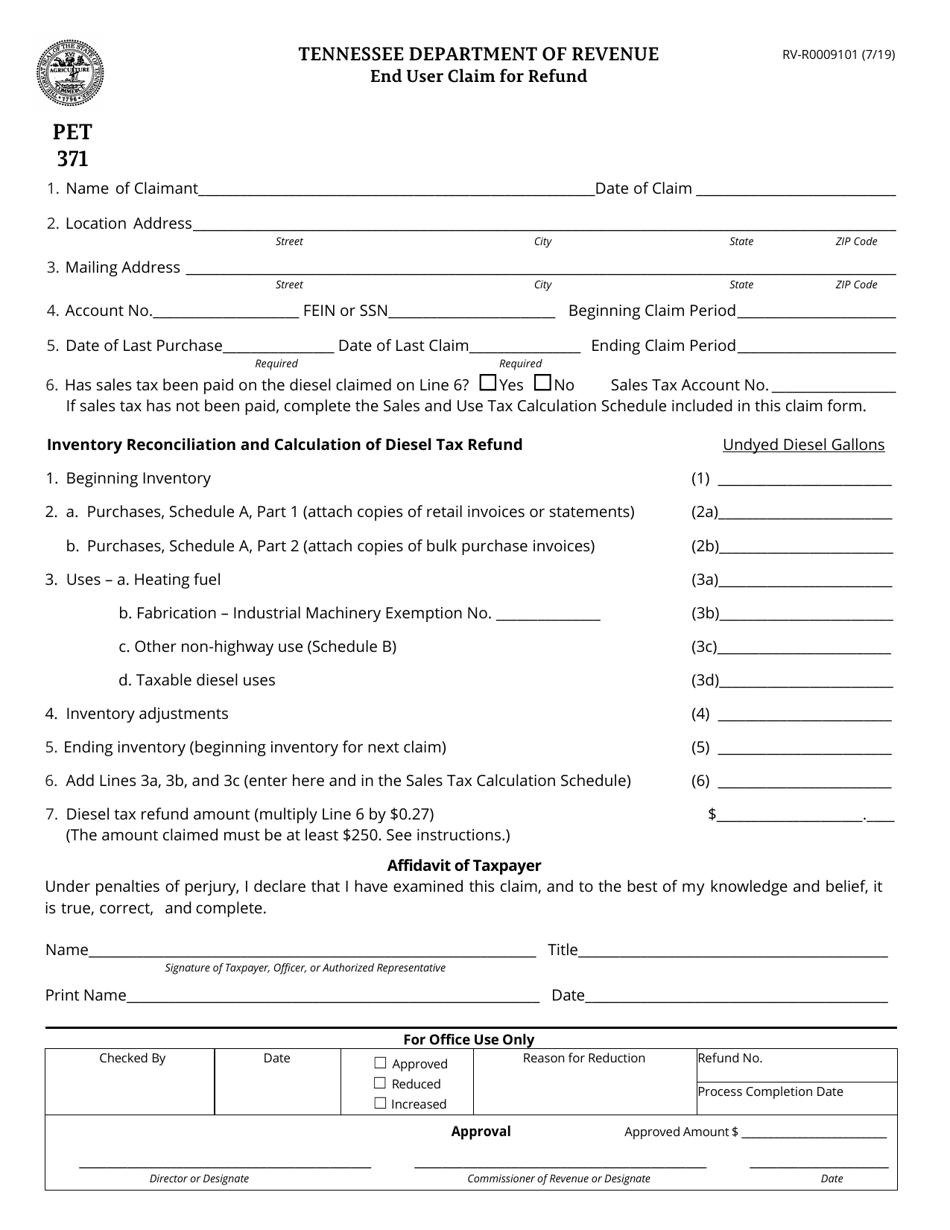

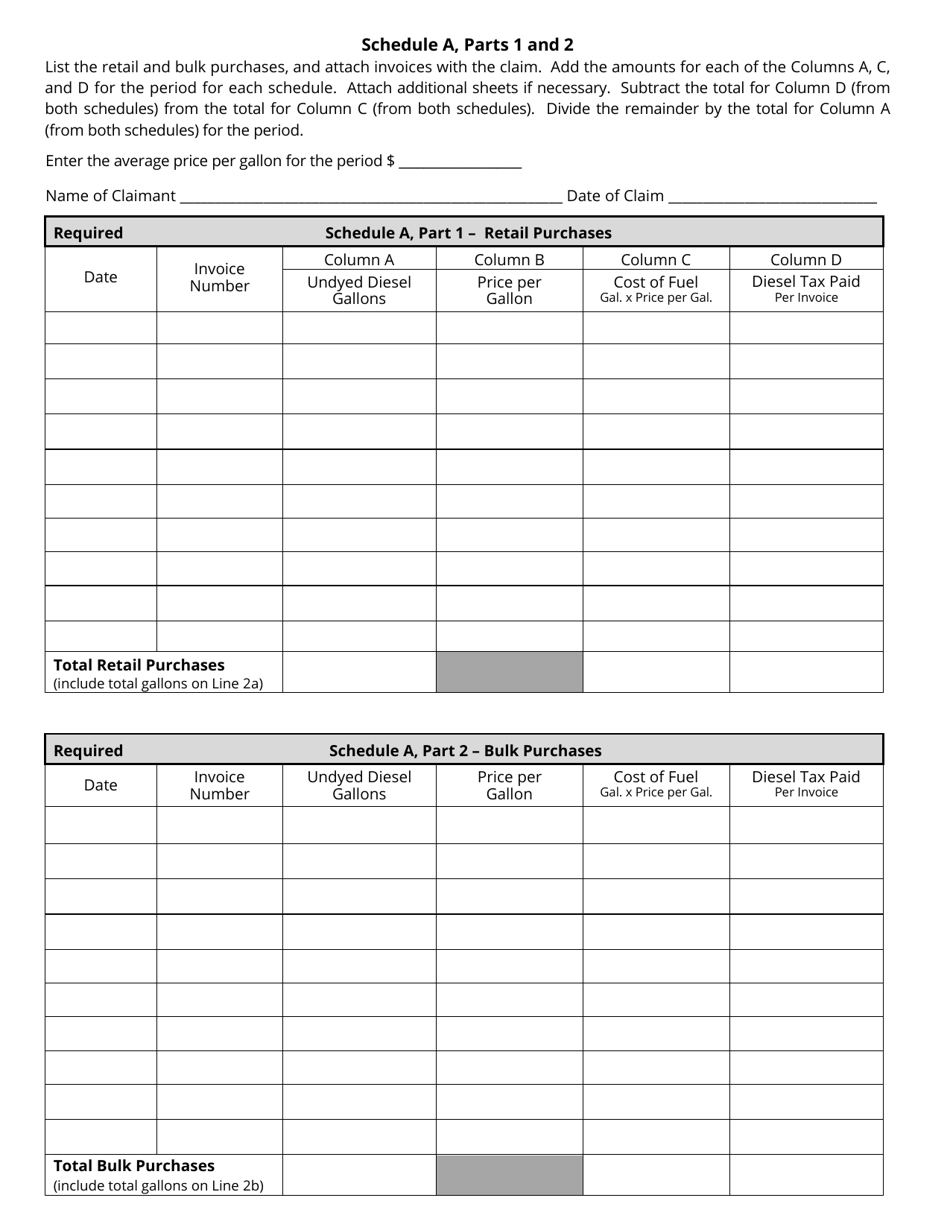

Q: What documentation is required to submit Form PET371?

A: You will need to provide proof of purchase and documentation supporting your claim, such as receipts or invoices.

Q: Is there a deadline to submit Form PET371?

A: Yes, Form PET371 must be submitted within one year from the date of purchase of the qualifying items.

Q: When can I expect to receive my refund?

A: Refunds for Form PET371 are typically processed within 60 days of submission, but processing times may vary.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET371 (RV-R0009101) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.