This version of the form is not currently in use and is provided for reference only. Download this version of

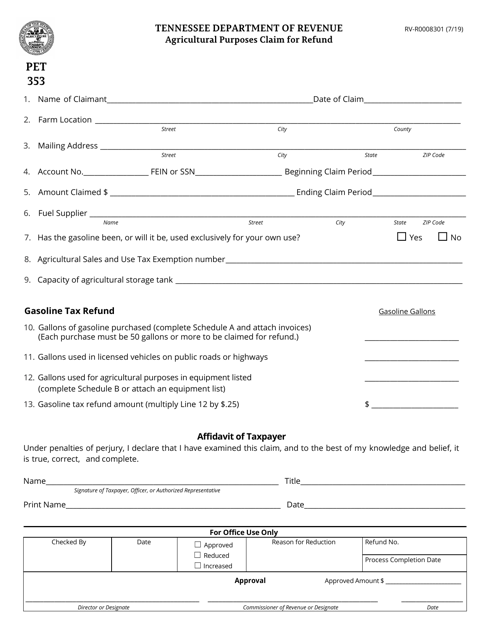

Form PET353 (RV-R0008301)

for the current year.

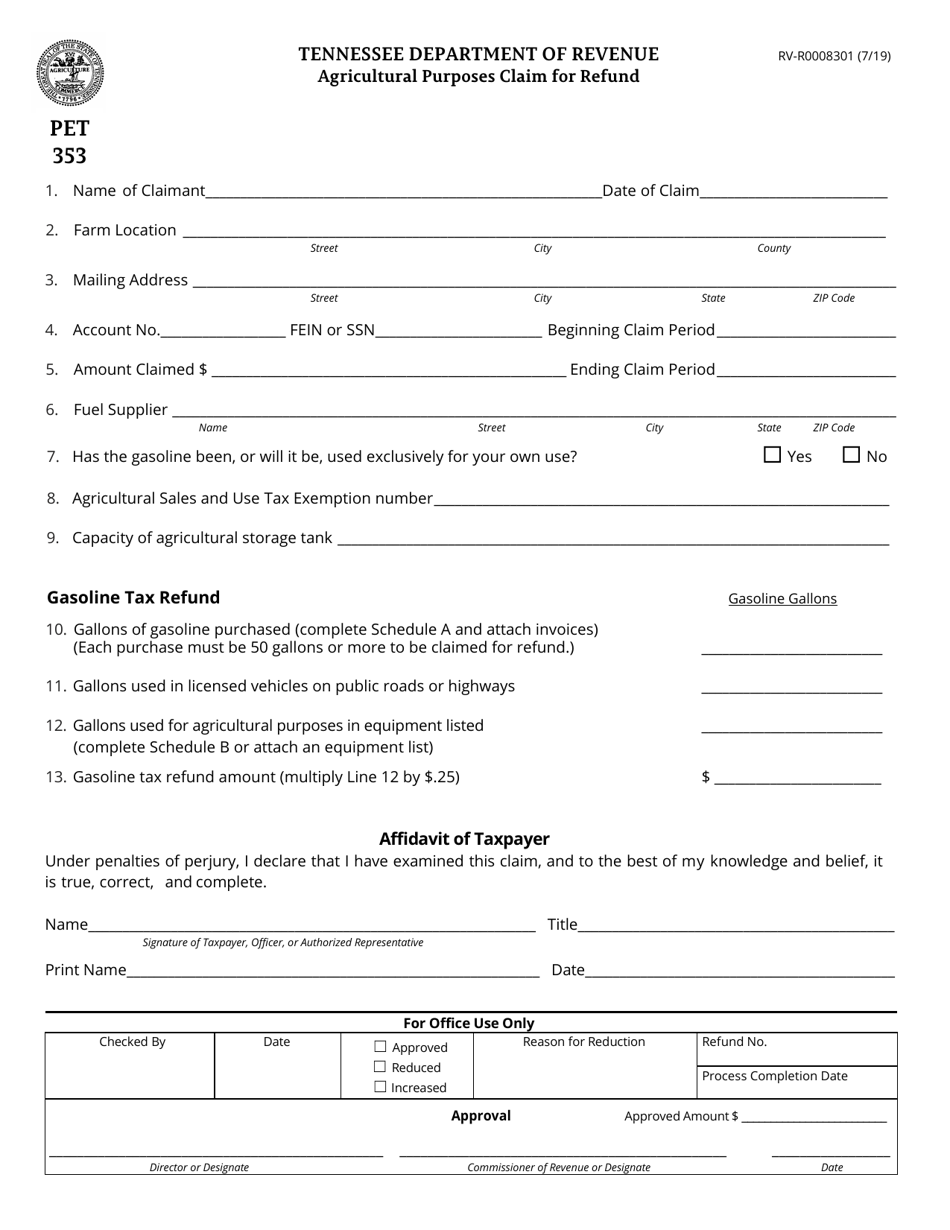

Form PET353 (RV-R0008301) Agricultural Purposes Claim for Refund - Tennessee

What Is Form PET353 (RV-R0008301)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET353?

A: Form PET353 is a specific form used for claiming a refund for agricultural purposes in Tennessee.

Q: Who can use Form PET353?

A: Form PET353 can be used by individuals or businesses engaged in agricultural activities in Tennessee.

Q: What is the purpose of Form PET353?

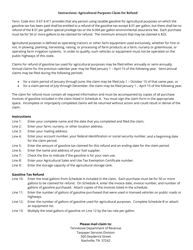

A: The purpose of Form PET353 is to claim a refund on gasoline or diesel fuel used for qualified agricultural purposes.

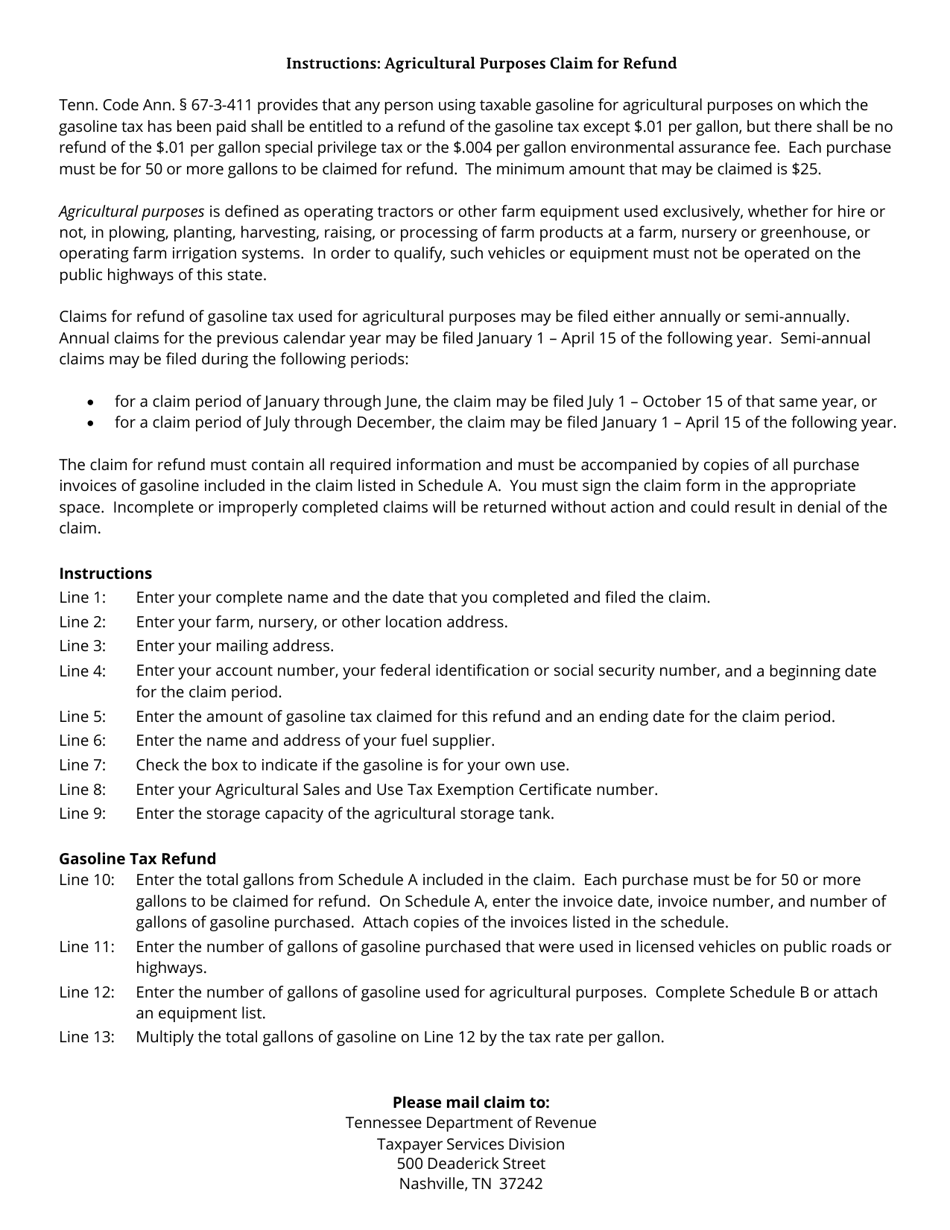

Q: What qualifies as agricultural purposes?

A: Agricultural purposes include activities such as farming, livestock production, and horticulture.

Q: Are there any deadlines for filing Form PET353?

A: Yes, Form PET353 must be filed within three years of the date of purchase of the fuel.

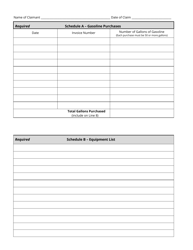

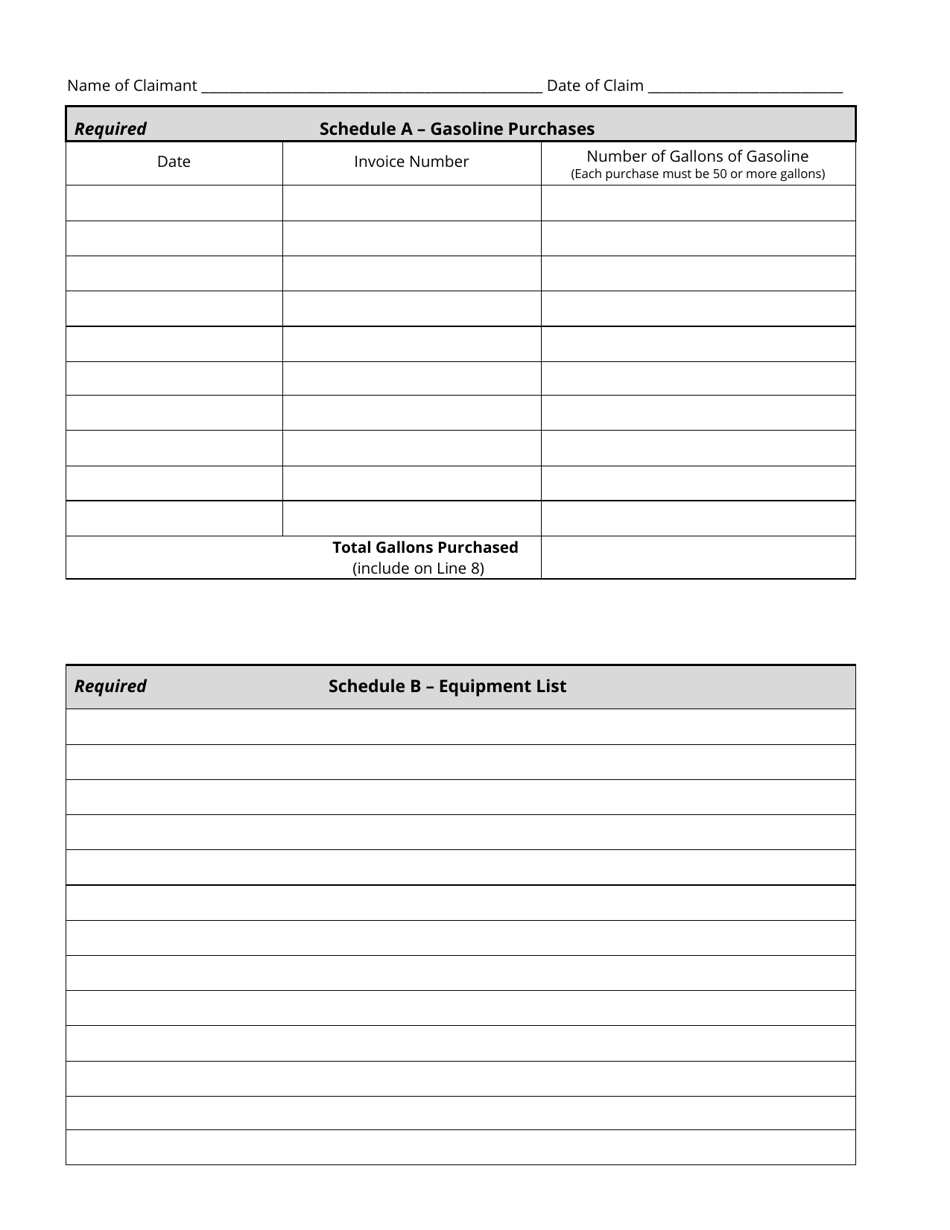

Q: What supporting documentation is required with Form PET353?

A: You will need to provide proof of fuel purchases, such as receipts or invoices, along with your claim.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET353 (RV-R0008301) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.