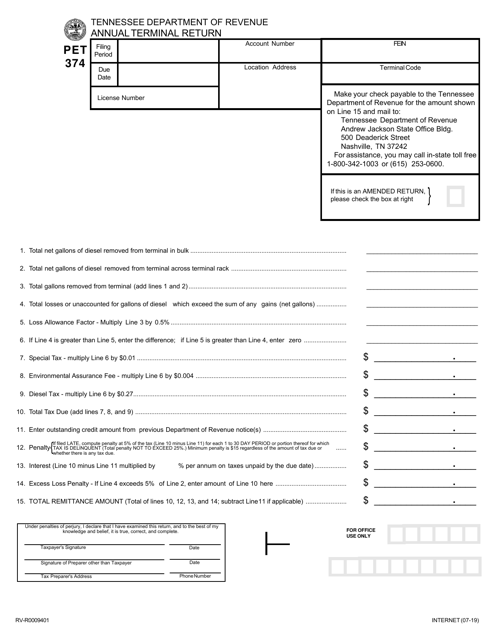

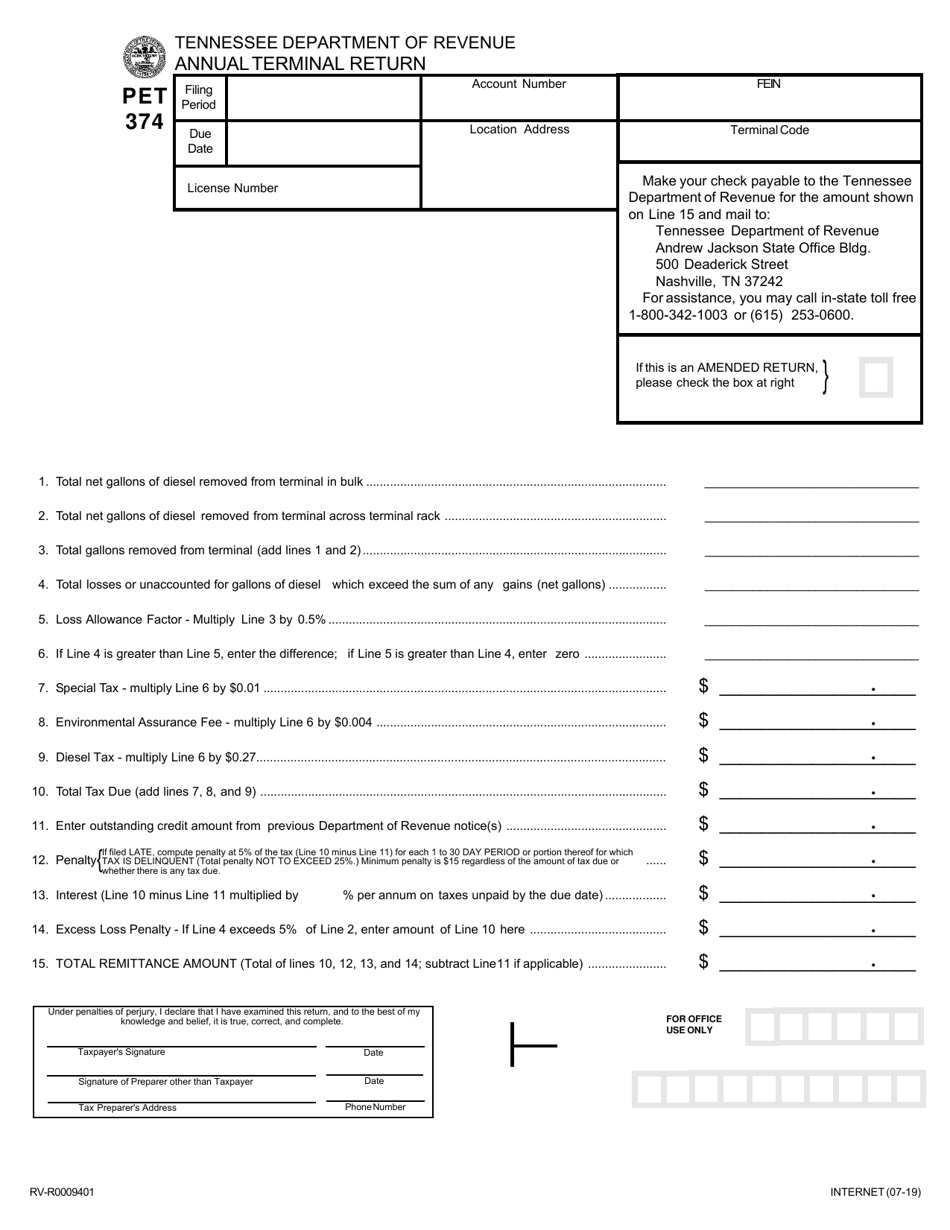

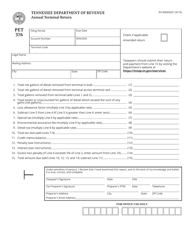

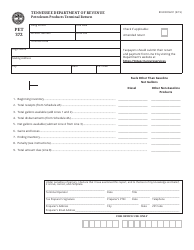

Form PET374 (RV-R0009401) Annual Terminal Return - Tennessee

What Is Form PET374 (RV-R0009401)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET374?

A: Form PET374 is an Annual Terminal Return.

Q: What is the purpose of Form PET374?

A: The purpose of Form PET374 is to report terminal operator fuel sales and motor fuel-use tax liability in Tennessee.

Q: Who needs to file Form PET374?

A: Terminal operators who sell fuel or use motor fuel in Tennessee need to file Form PET374.

Q: What information is required on Form PET374?

A: Form PET374 requires information such as fuel sales, tax liability, and other relevant details.

Q: How frequently should Form PET374 be filed?

A: Form PET374 should be filed annually.

Q: Is there a deadline for filing Form PET374?

A: Yes, there is a deadline for filing Form PET374. The specific deadline can be obtained from the Tennessee Department of Revenue.

Q: Who should I contact for more information about Form PET374?

A: For more information about Form PET374, you can contact the Tennessee Department of Revenue.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET374 (RV-R0009401) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.