This version of the form is not currently in use and is provided for reference only. Download this version of

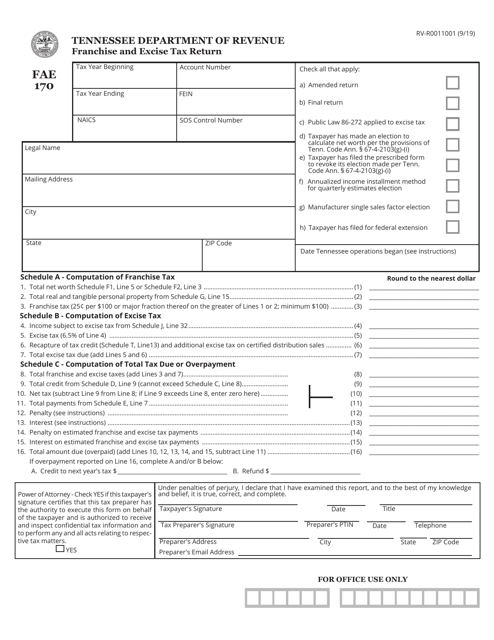

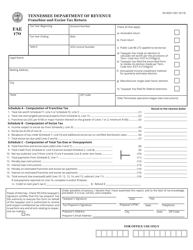

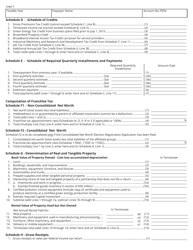

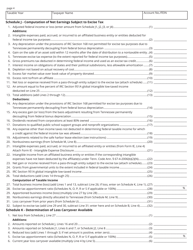

Form FAE170 (RV-R0011001)

for the current year.

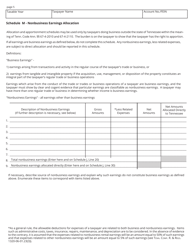

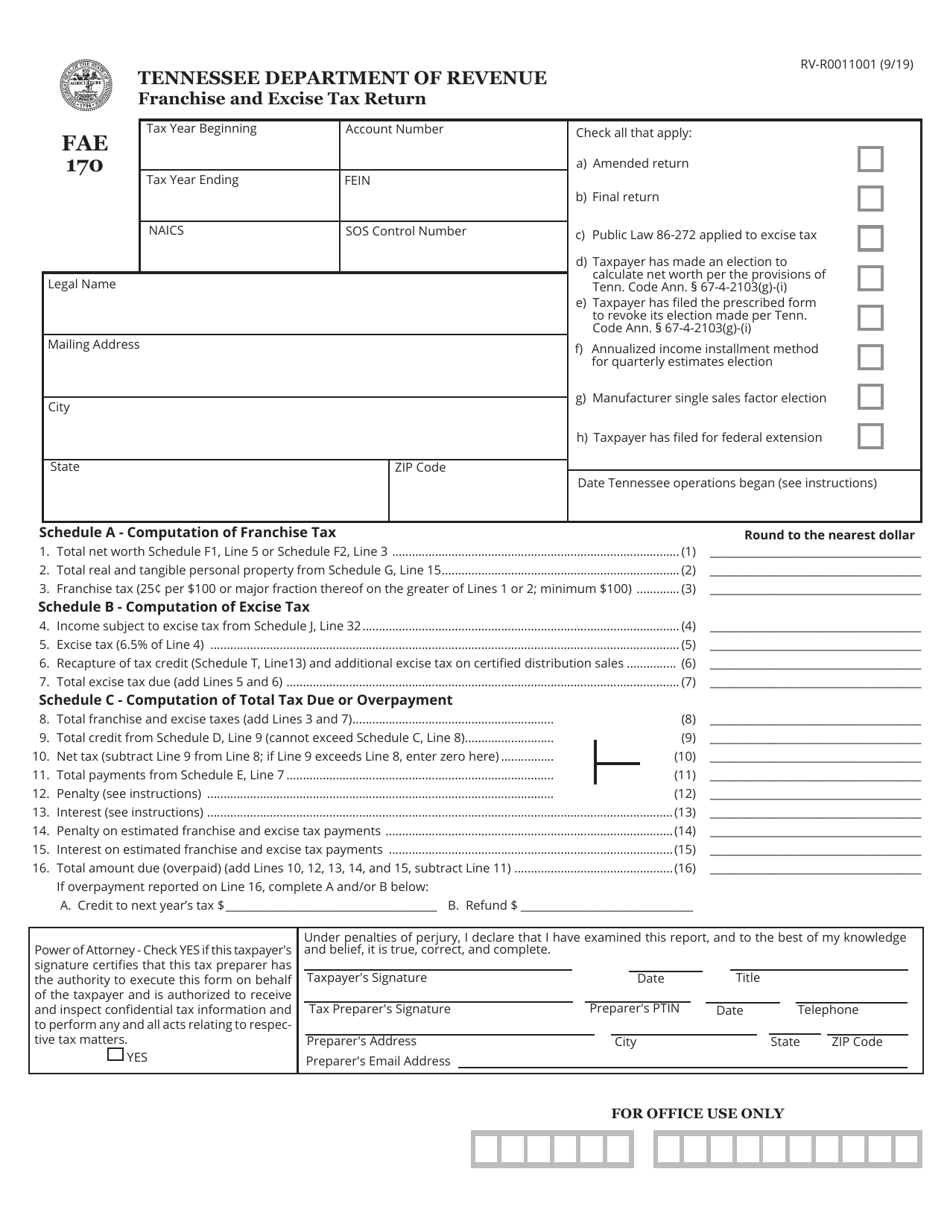

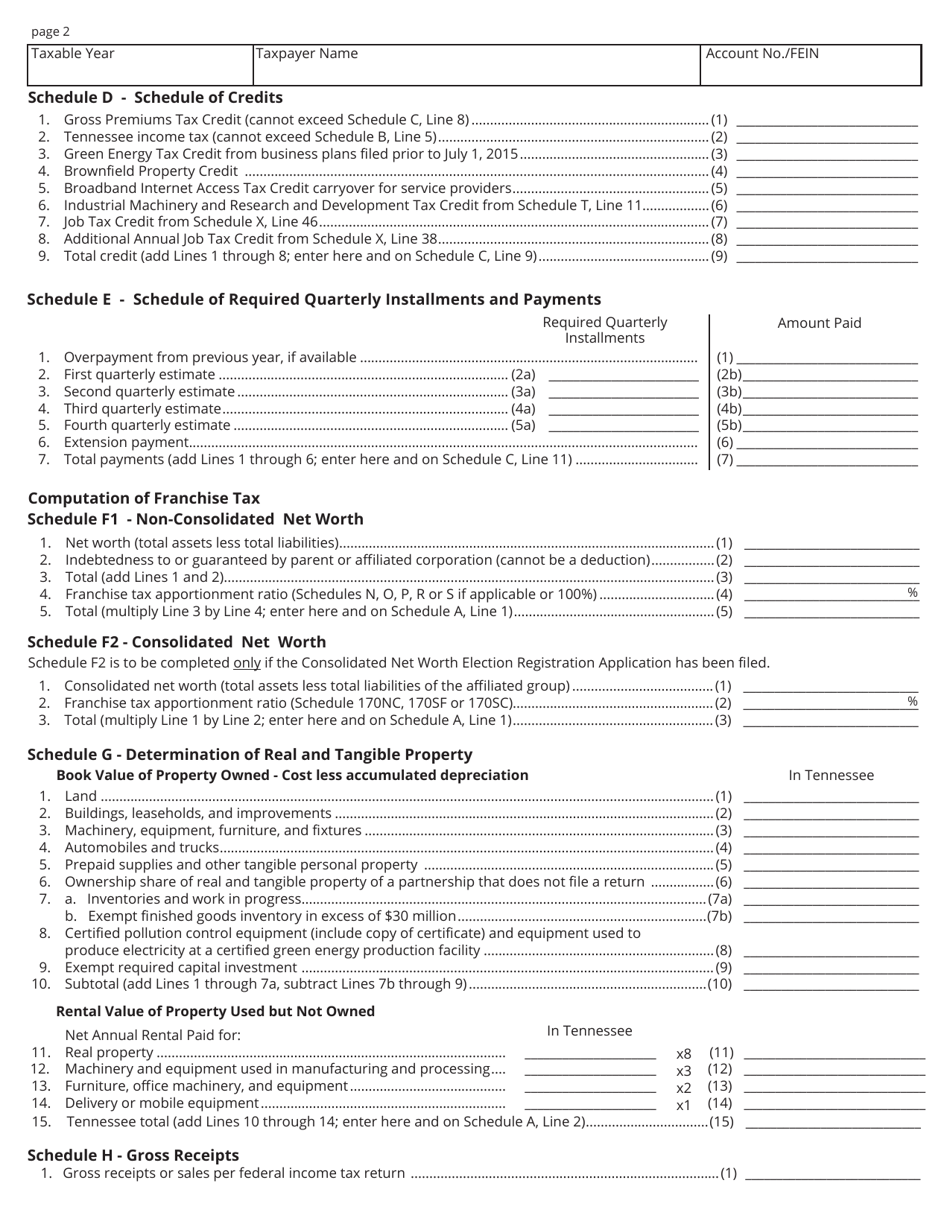

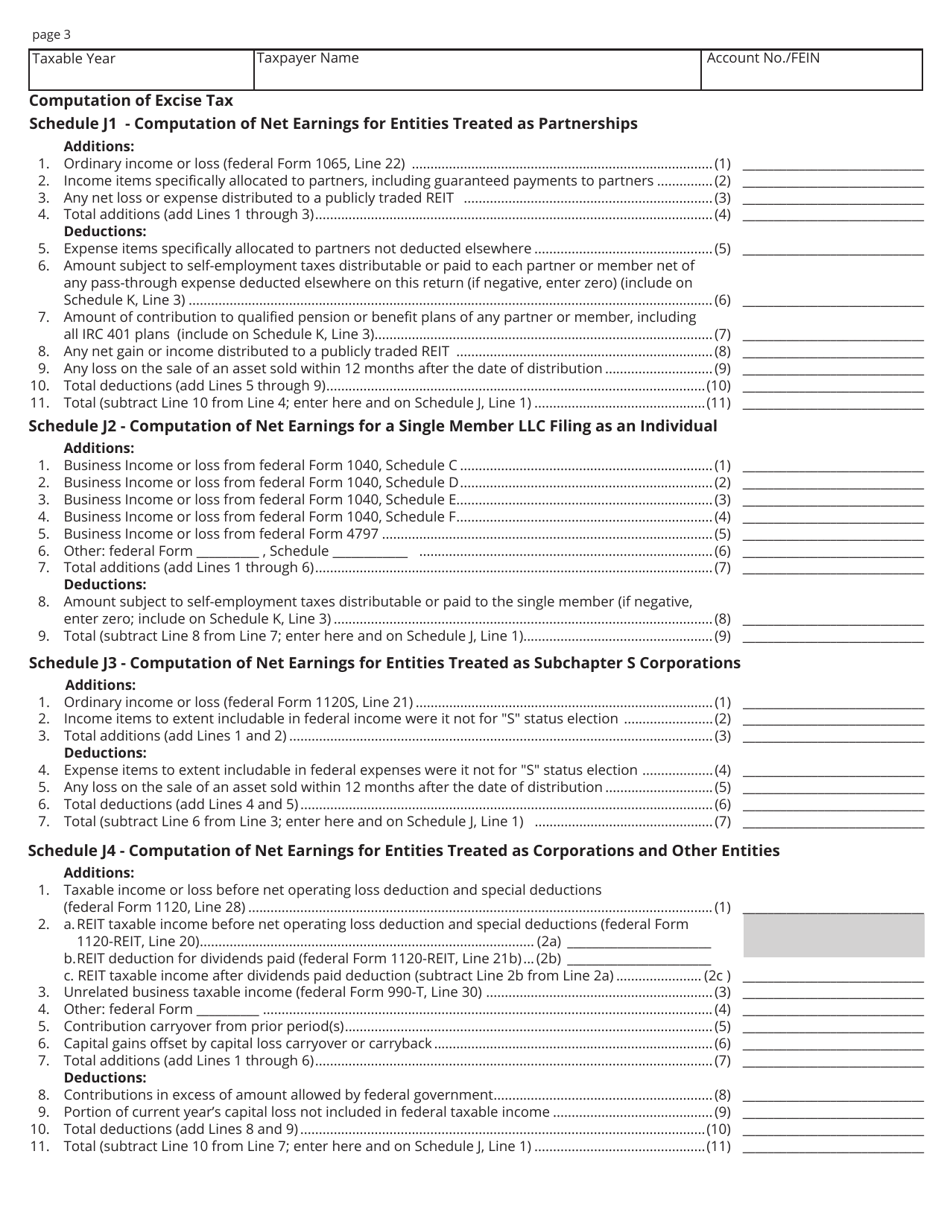

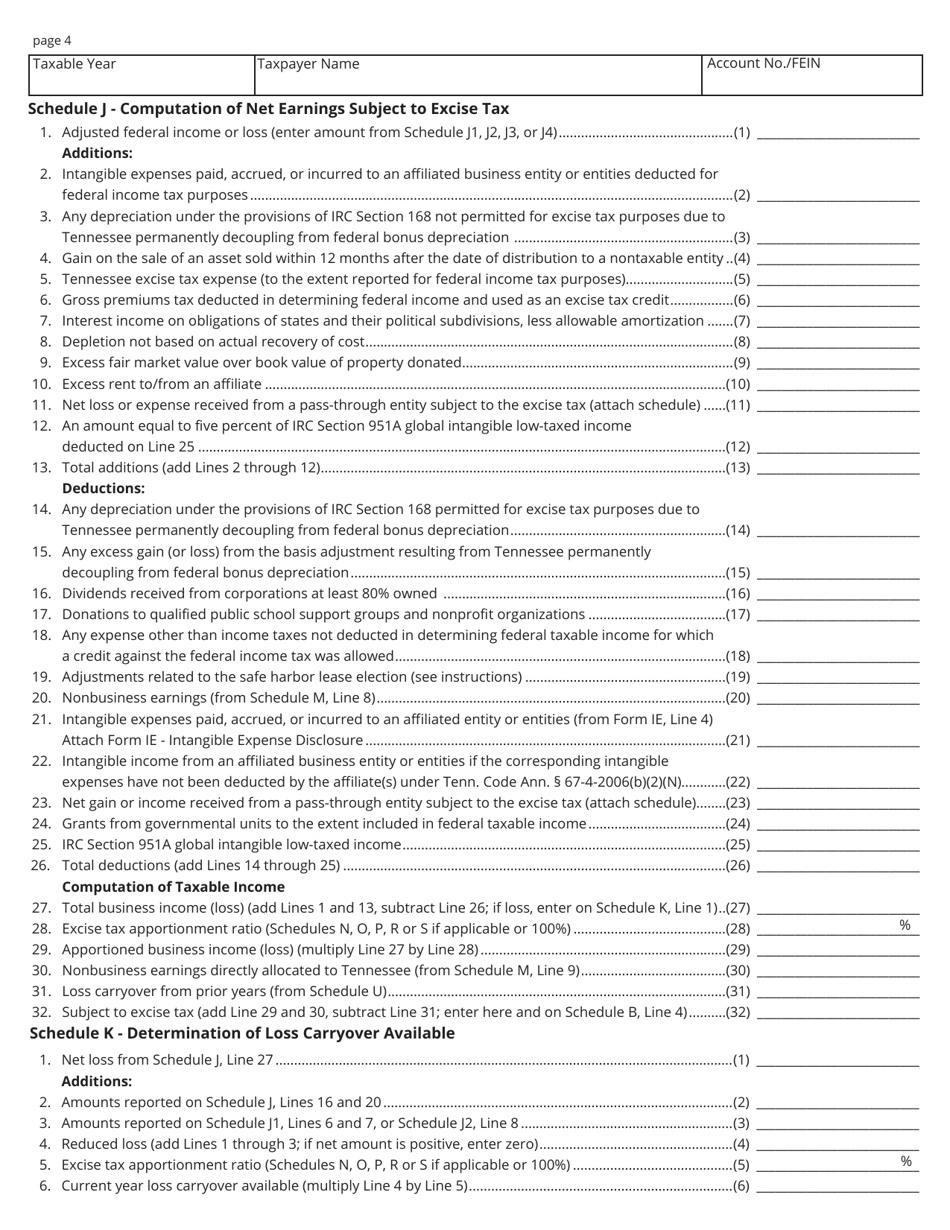

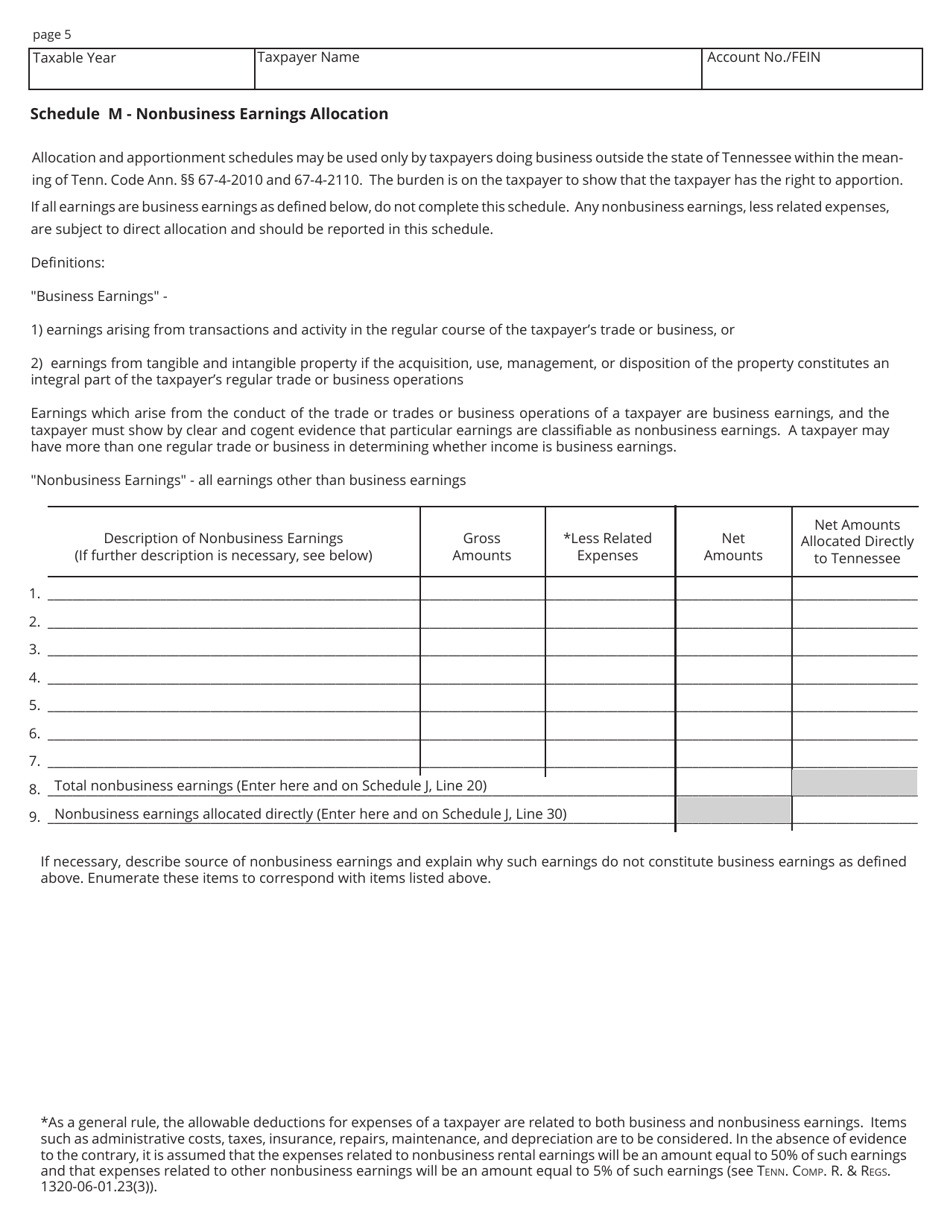

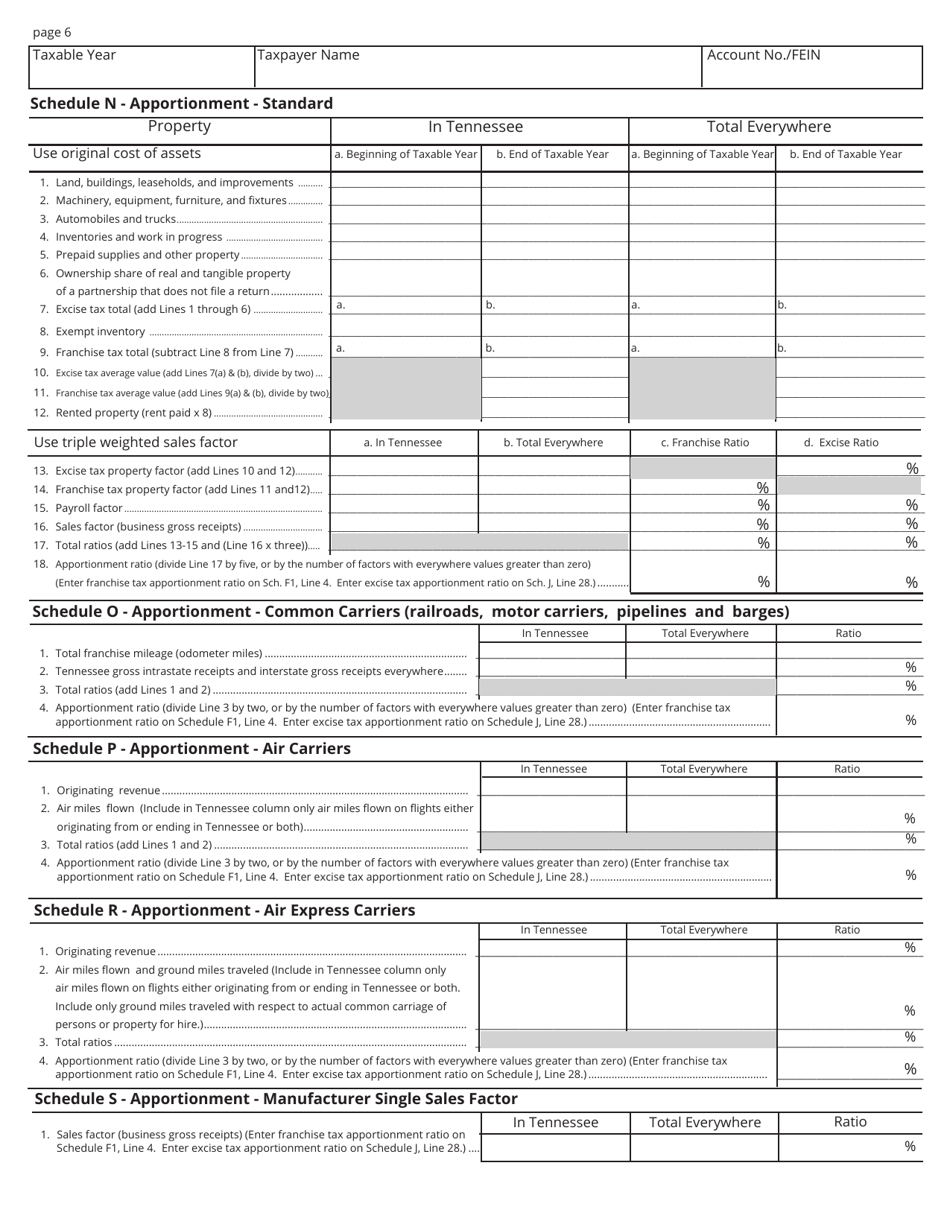

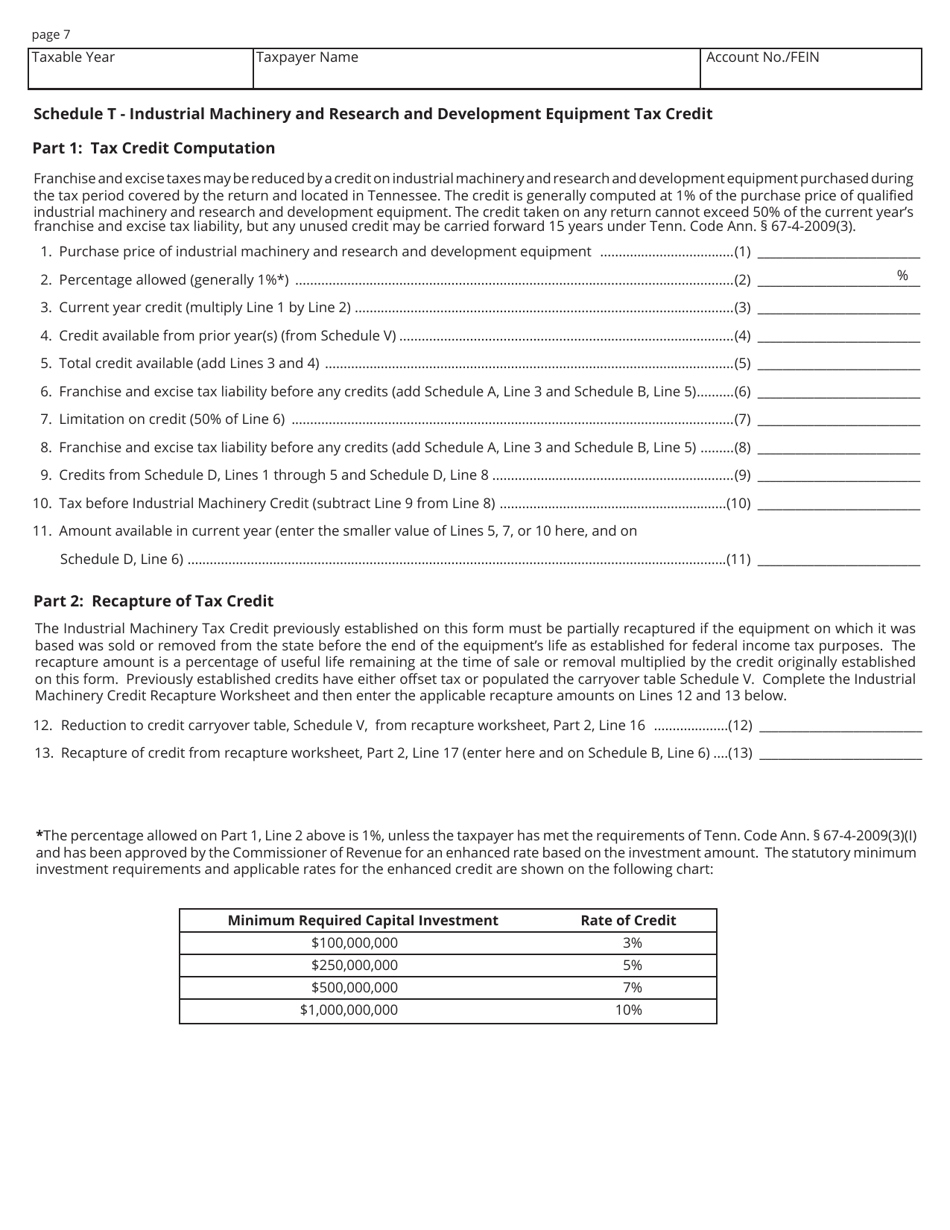

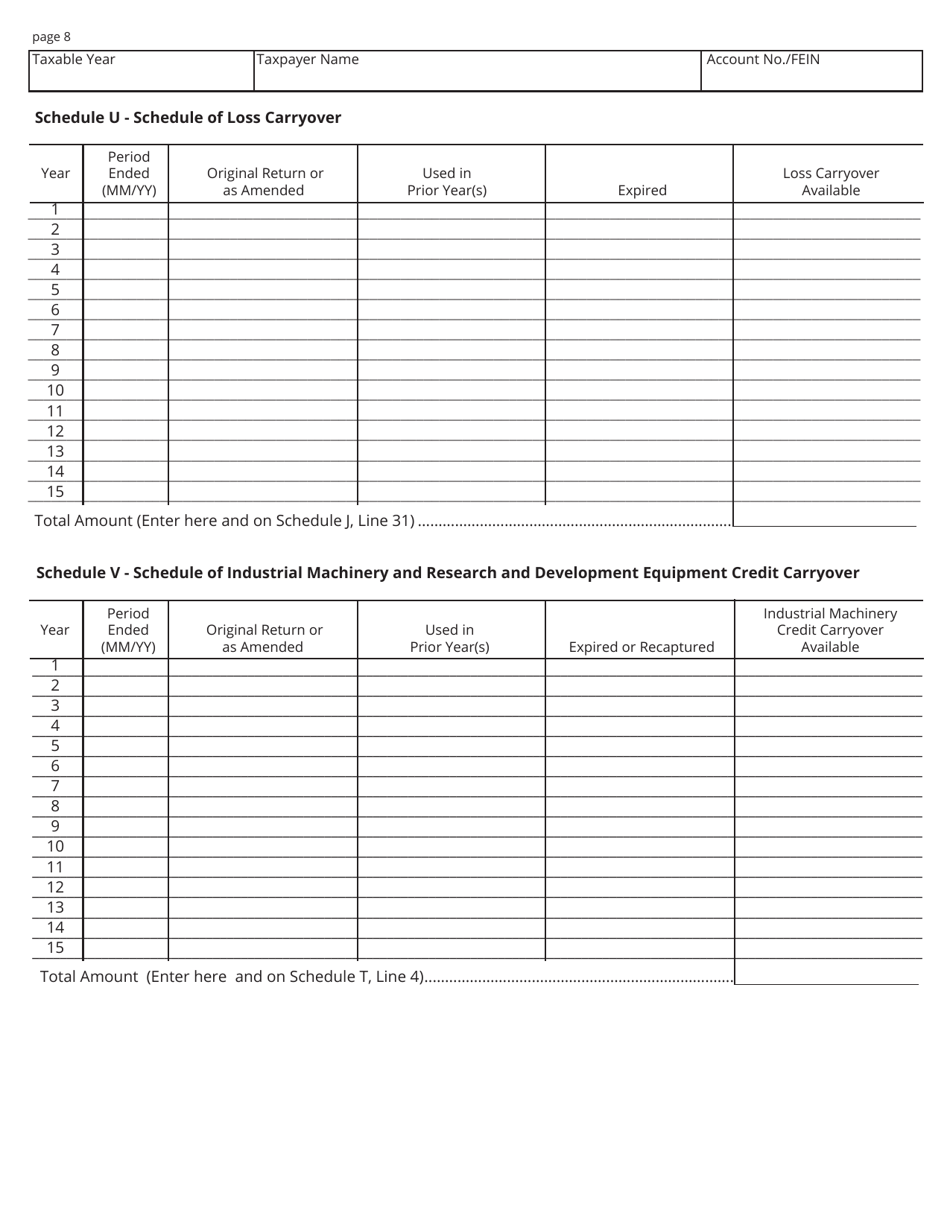

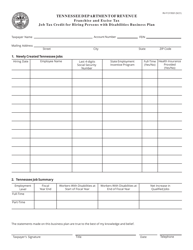

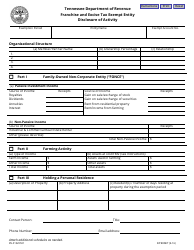

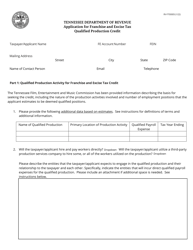

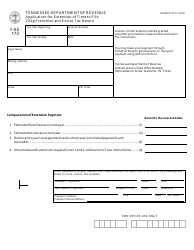

Form FAE170 (RV-R0011001) Franchise and Excise Tax Return - Tennessee

What Is Form FAE170 (RV-R0011001)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FAE170?

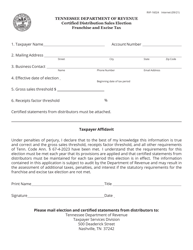

A: Form FAE170 is the Franchise and Excise Tax Return used for reporting franchise and excise taxes in Tennessee.

Q: Who needs to file Form FAE170?

A: Any corporation doing business in Tennessee that meets the requirements for filing franchise and excise taxes needs to file Form FAE170.

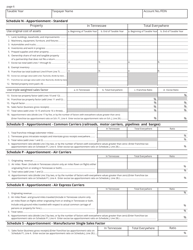

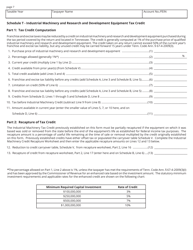

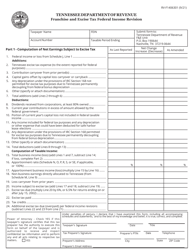

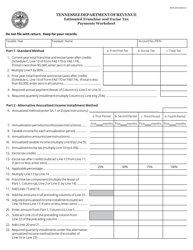

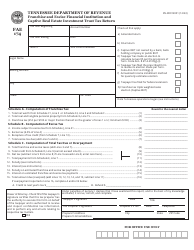

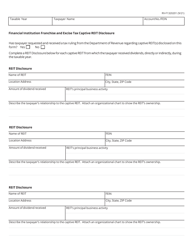

Q: What information is required on Form FAE170?

A: Form FAE170 requires information about the corporation's income, deductions, assets, and other relevant financial details.

Q: How often do I need to file Form FAE170?

A: Form FAE170 must be filed annually by the due date, which is usually the 15th day of the 4th month after the close of the corporation's taxable year.

Q: Are there any penalties for late filing of Form FAE170?

A: Yes, there are penalties for late filing, and interest may be charged on any unpaid tax.

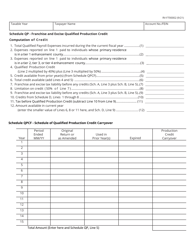

Q: Are there any exemptions or deductions available on Form FAE170?

A: Yes, there are certain exemptions, deductions, and credits available on Form FAE170. The instructions provided with the form will provide more details.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FAE170 (RV-R0011001) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.