This version of the form is not currently in use and is provided for reference only. Download this version of

Form PET377 (RV-R0009701)

for the current year.

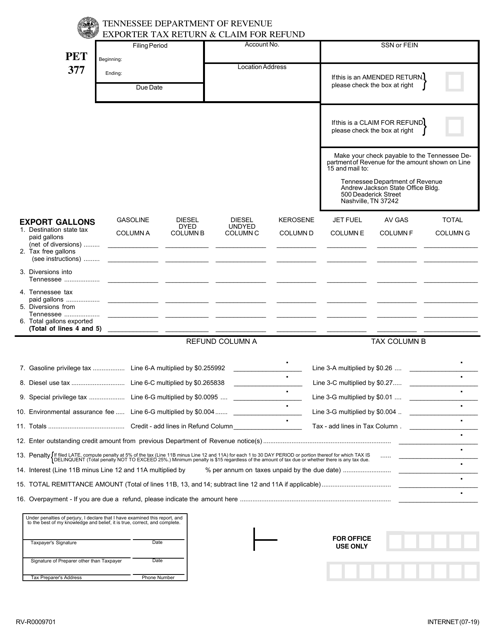

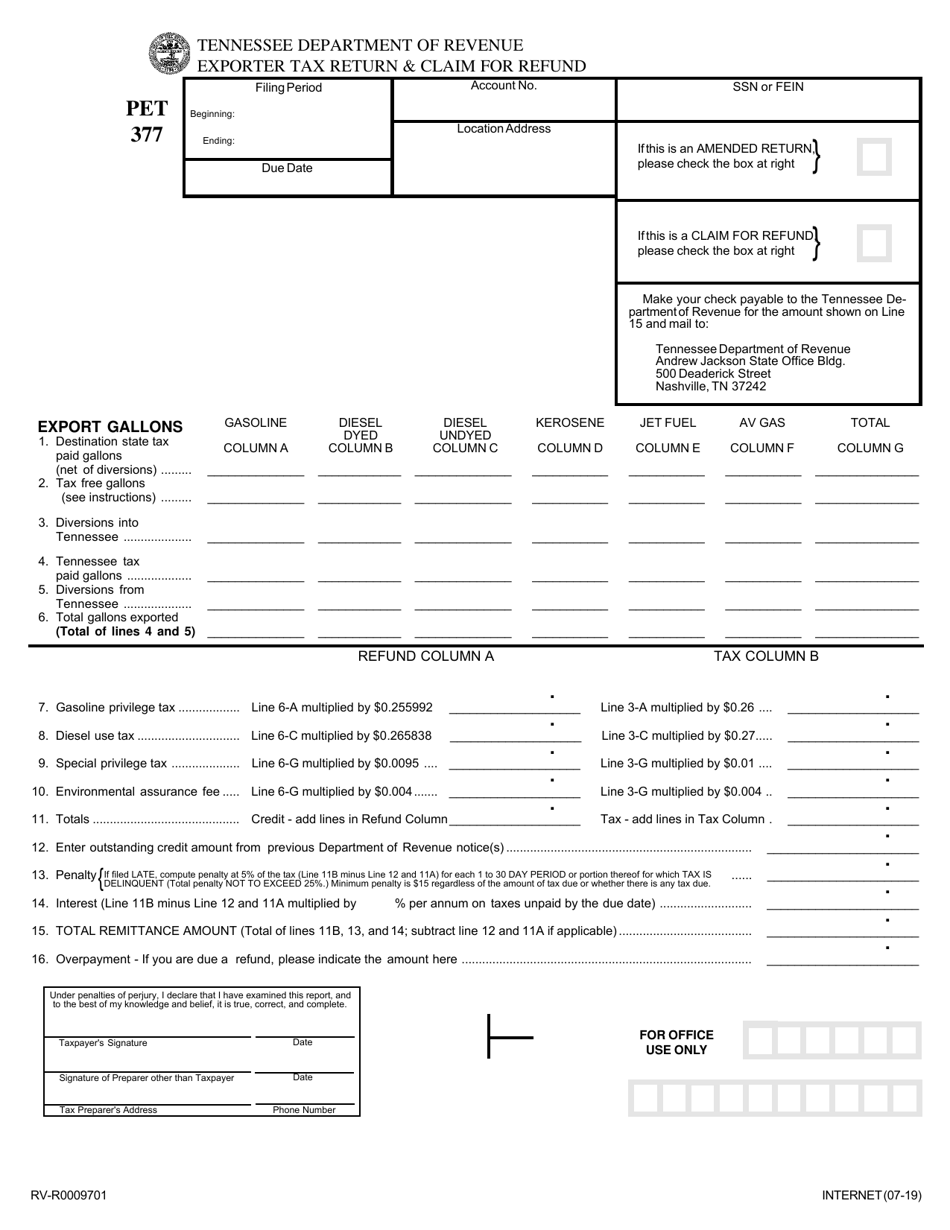

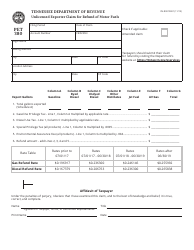

Form PET377 (RV-R0009701) Exporter Tax Return & Claim for Refund - Tennessee

What Is Form PET377 (RV-R0009701)?

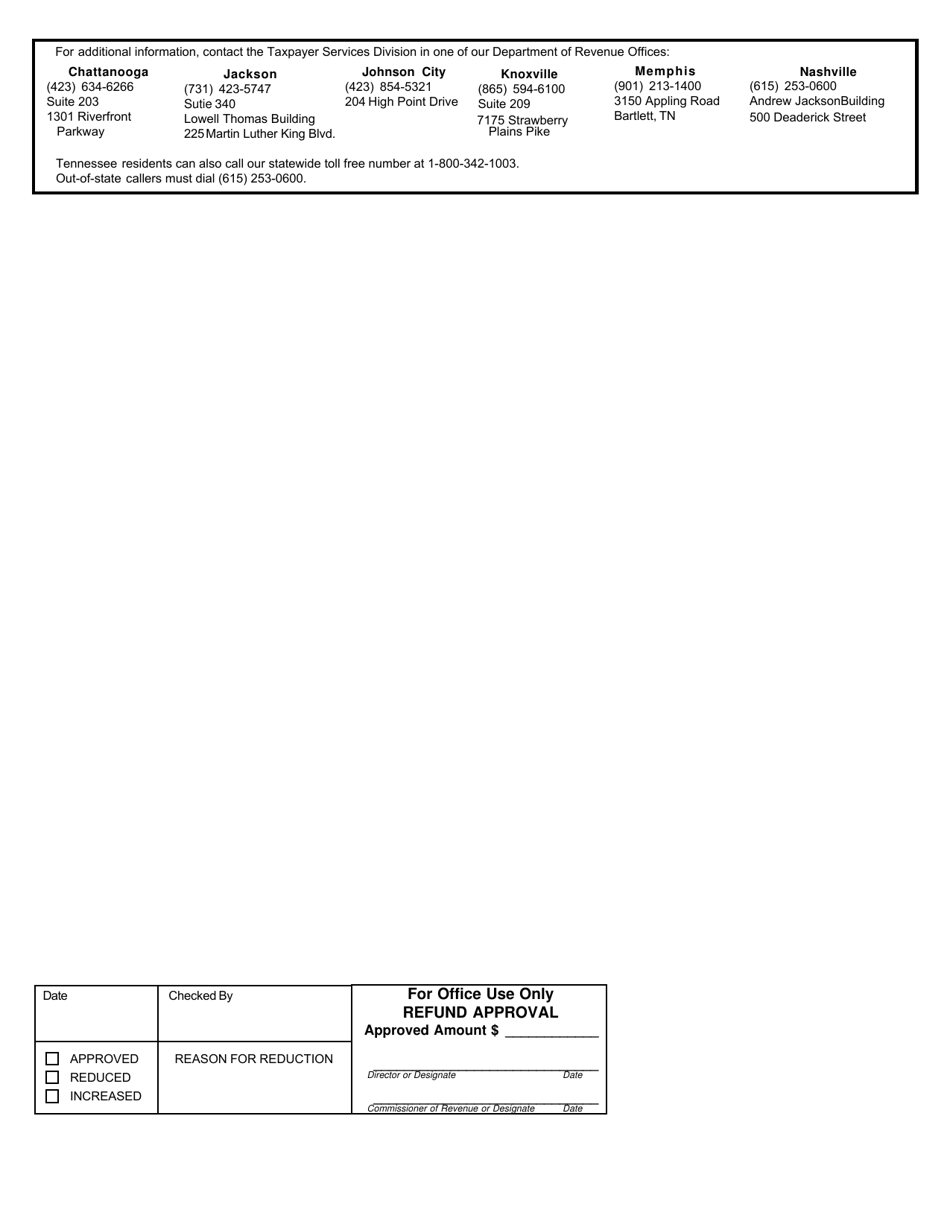

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PET377 (RV-R0009701)?

A: Form PET377 (RV-R0009701) is the Exporter Tax Return & Claim for Refund specifically for Tennessee.

Q: Who can use Form PET377 (RV-R0009701)?

A: Form PET377 (RV-R0009701) is used by exporters in Tennessee to report their tax liability and claim a refund.

Q: What is the purpose of Form PET377 (RV-R0009701)?

A: The purpose of Form PET377 (RV-R0009701) is to accurately report the tax liability of exporters in Tennessee and claim any eligible refund.

Q: When is Form PET377 (RV-R0009701) due?

A: The due date for Form PET377 (RV-R0009701) varies and is determined by the Department of Revenue. Please refer to the instructions or contact the department for the specific due date.

Q: Are there any penalties for late filing of Form PET377 (RV-R0009701)?

A: There may be penalties for late filing of Form PET377 (RV-R0009701), including interest charges and penalties on any unpaid tax liability. It's important to file the form on time to avoid these penalties.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PET377 (RV-R0009701) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.