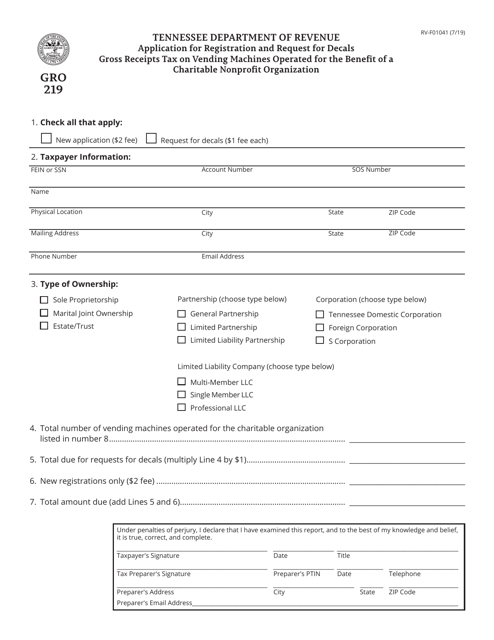

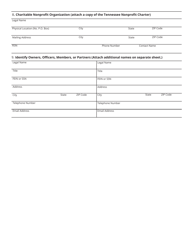

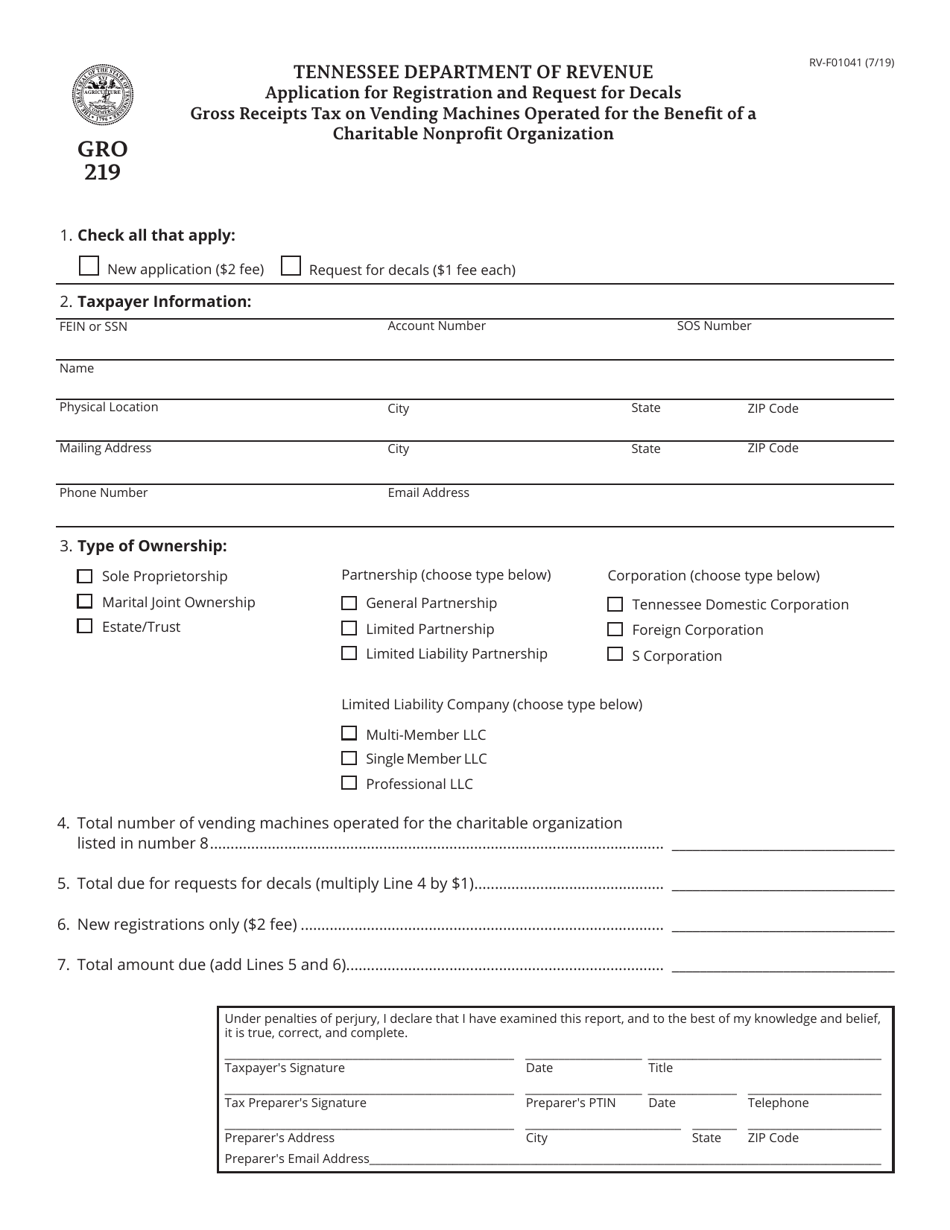

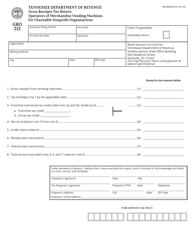

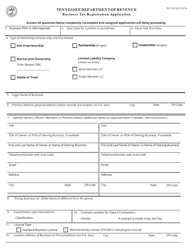

Form GRO219 (RV-F01041) Application for Registration and Request for Decals Gross Receipts Tax on Vending Machines Operated for the Benefit of a Charitable Nonprofit Organization - Tennessee

What Is Form GRO219 (RV-F01041)?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GRO219?

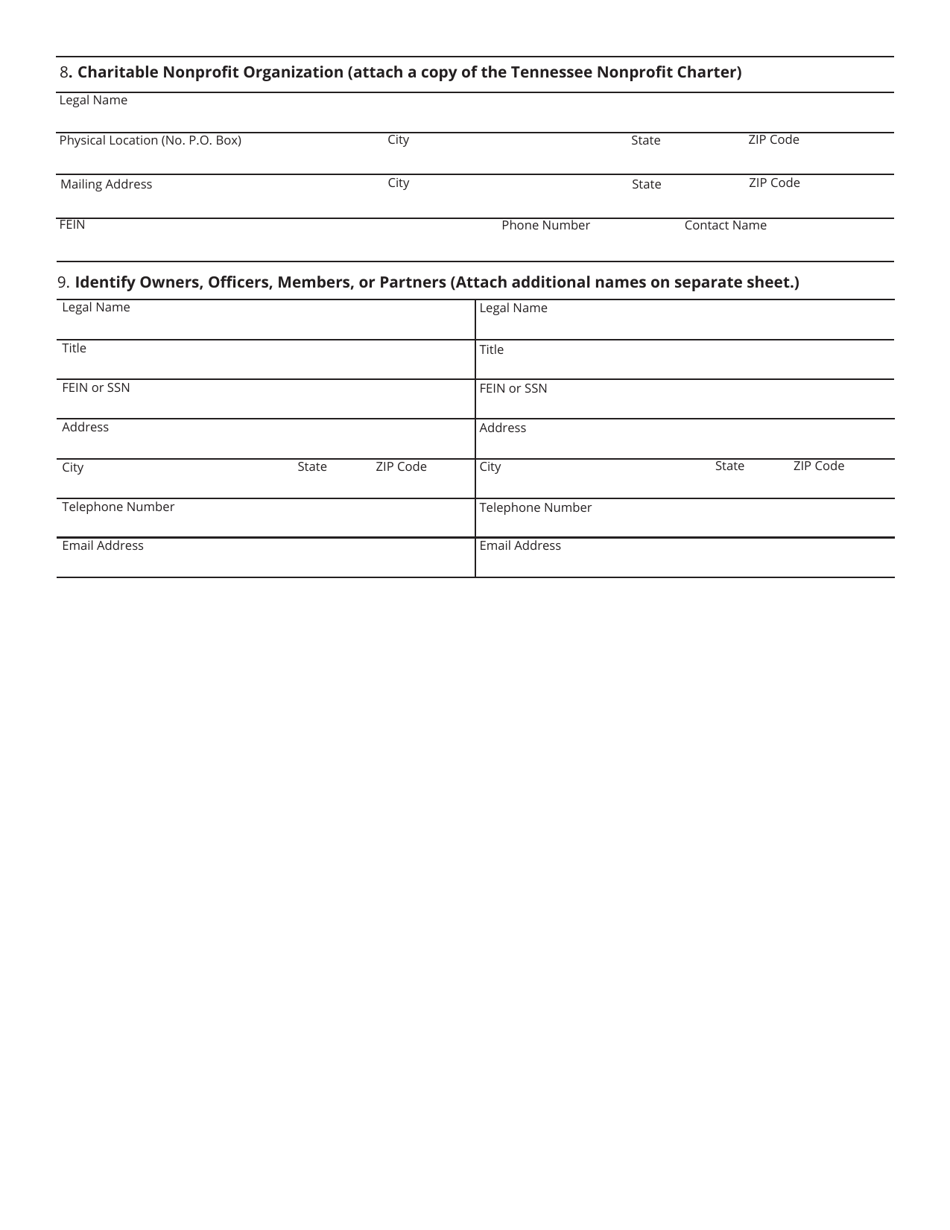

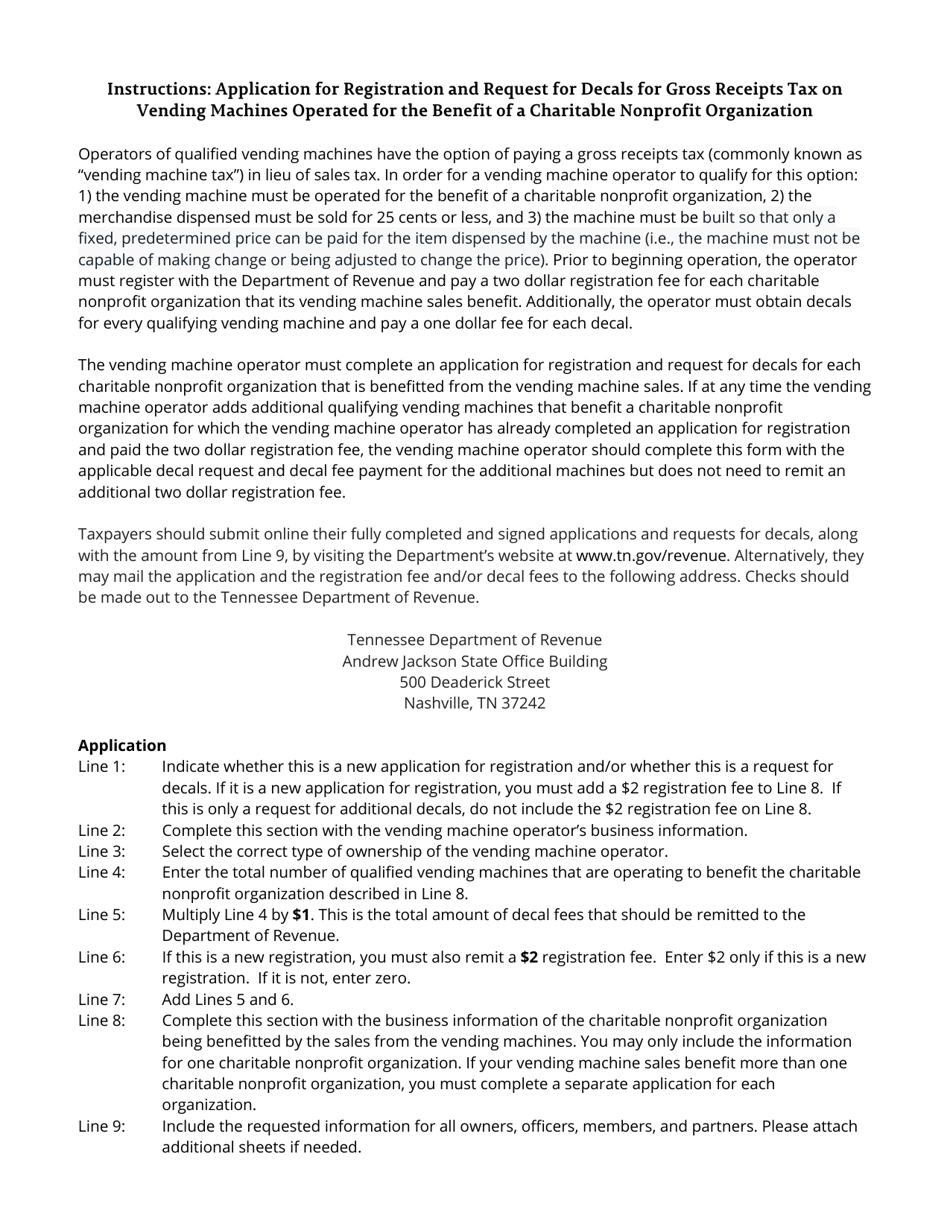

A: Form GRO219 is an application for registration and request for decals for vending machines operated for the benefit of a charitable nonprofit organization in Tennessee.

Q: What is the purpose of Form GRO219?

A: The purpose of Form GRO219 is to register and request decals for vending machines that are operated to benefit a charitable nonprofit organization in Tennessee and are subject to gross receipts tax.

Q: What is the gross receipts tax on vending machines operated for the benefit of a charitable nonprofit organization in Tennessee?

A: The gross receipts tax is a tax levied on the gross receipts generated by vending machines operated for the benefit of a charitable nonprofit organization in Tennessee.

Q: Who needs to file Form GRO219?

A: Any individual or organization operating vending machines for the benefit of a charitable nonprofit organization in Tennessee needs to file Form GRO219 and register for the gross receipts tax on these machines.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GRO219 (RV-F01041) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.