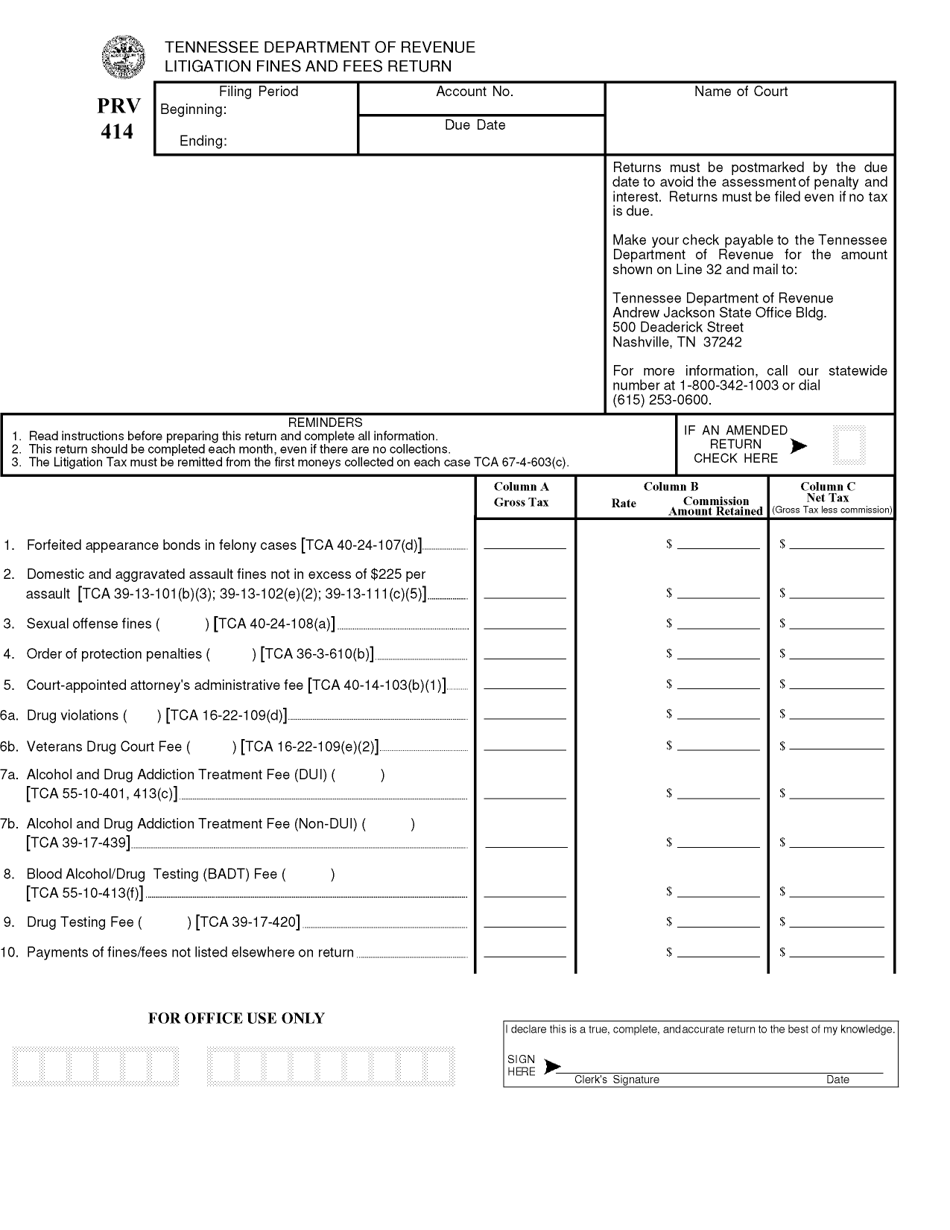

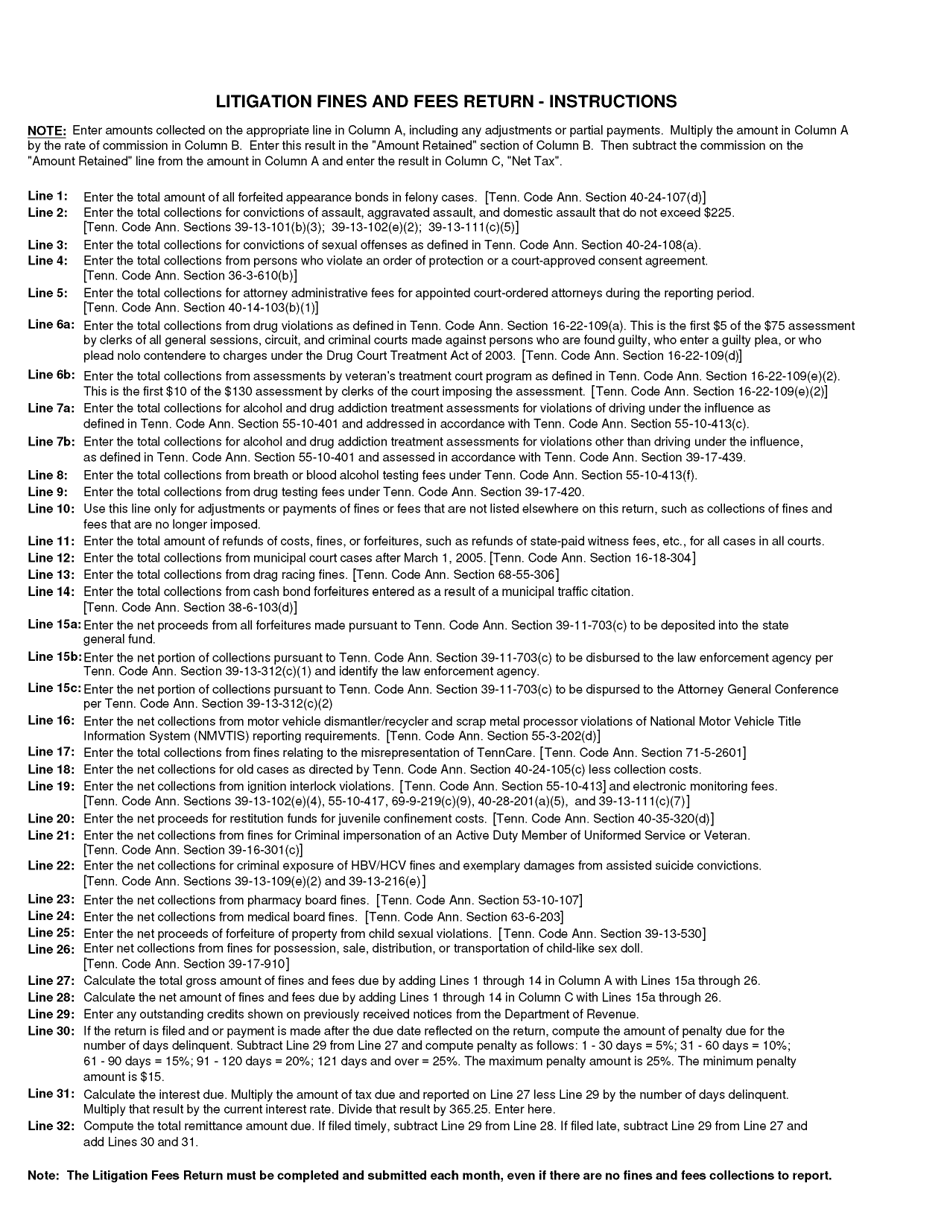

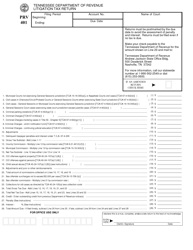

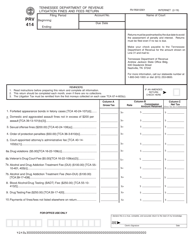

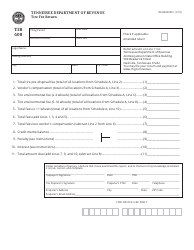

Form PRV414 Litigation Fines and Fees Return - Tennessee

What Is Form PRV414?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PRV414 Litigation Fines and Fees Return?

A: PRV414 Litigation Fines and Fees Return is a form used in Tennessee to report and pay any fines and fees associated with litigation.

Q: When do I need to file PRV414 Litigation Fines and Fees Return?

A: PRV414 Litigation Fines and Fees Return must be filed and paid annually by the due date specified by the Tennessee Department of Revenue.

Q: Who needs to file PRV414 Litigation Fines and Fees Return?

A: Any individual or business entity that has incurred fines and fees related to litigation in Tennessee must file PRV414 Litigation Fines and Fees Return.

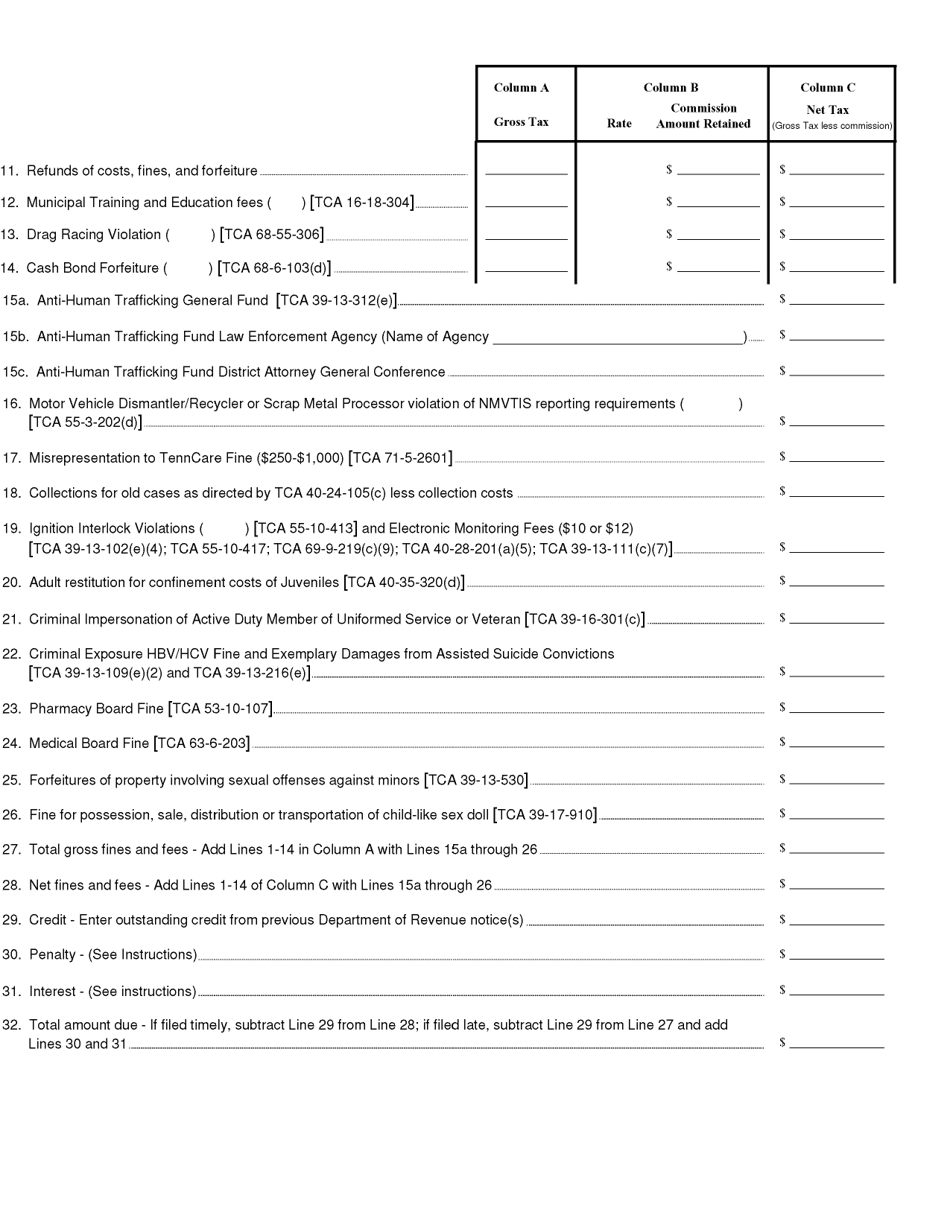

Q: What fines and fees should be reported on PRV414 Litigation Fines and Fees Return?

A: You should report any fines and fees that were imposed as a result of litigation in Tennessee, including court costs, penalties, and other related expenses.

Q: What happens if I fail to file PRV414 Litigation Fines and Fees Return?

A: If you fail to file PRV414 Litigation Fines and Fees Return or pay the required fines and fees on time, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PRV414 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.