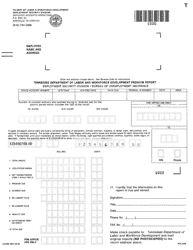

This version of the form is not currently in use and is provided for reference only. Download this version of

Form LB-0441

for the current year.

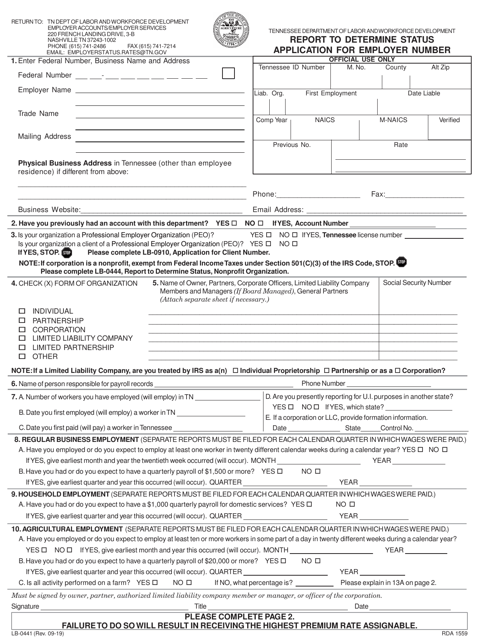

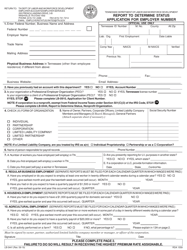

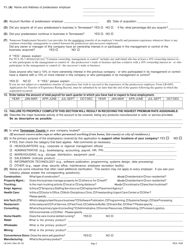

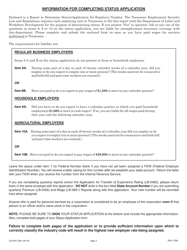

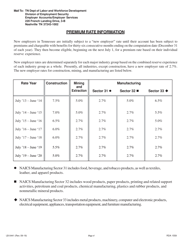

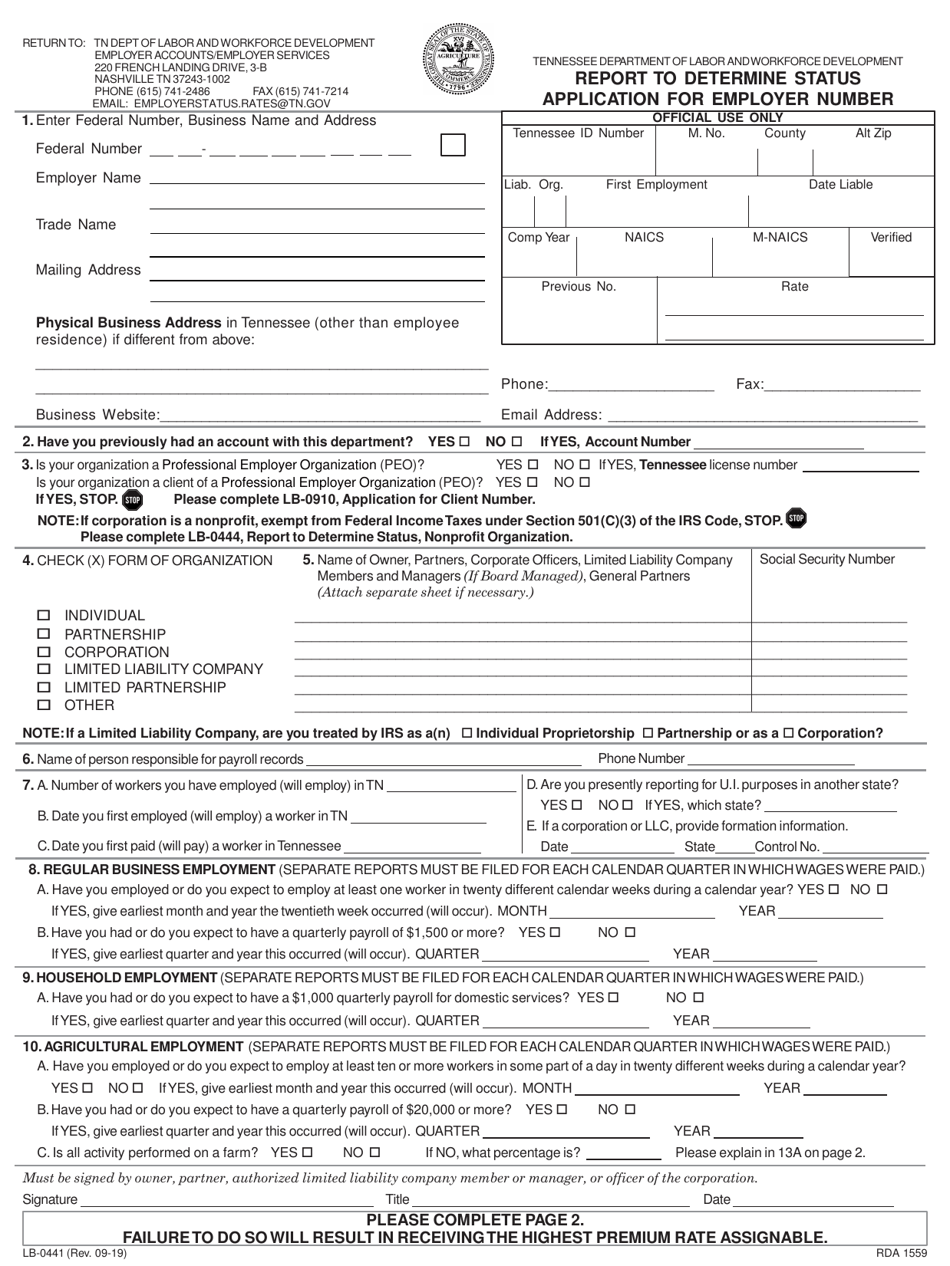

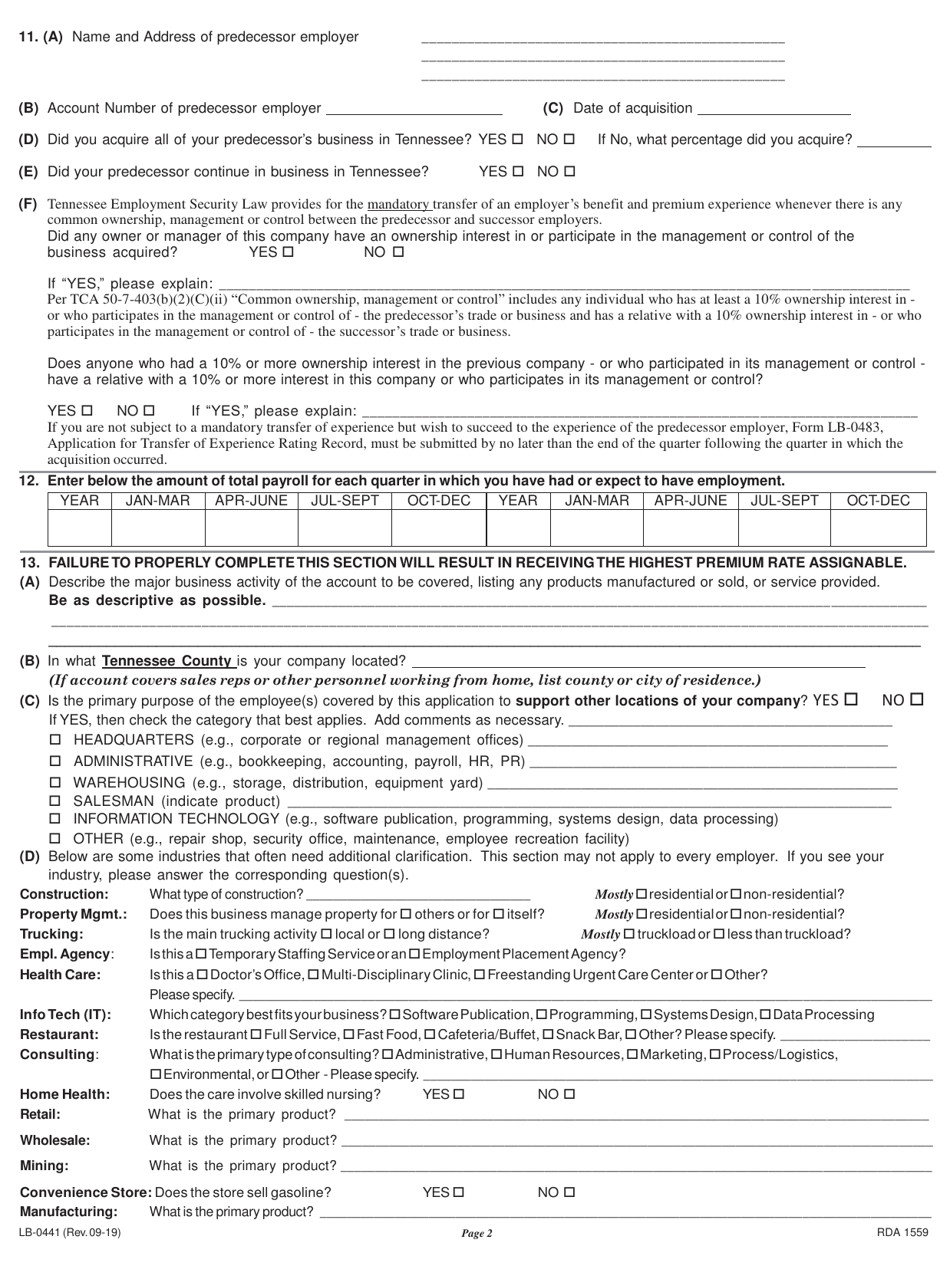

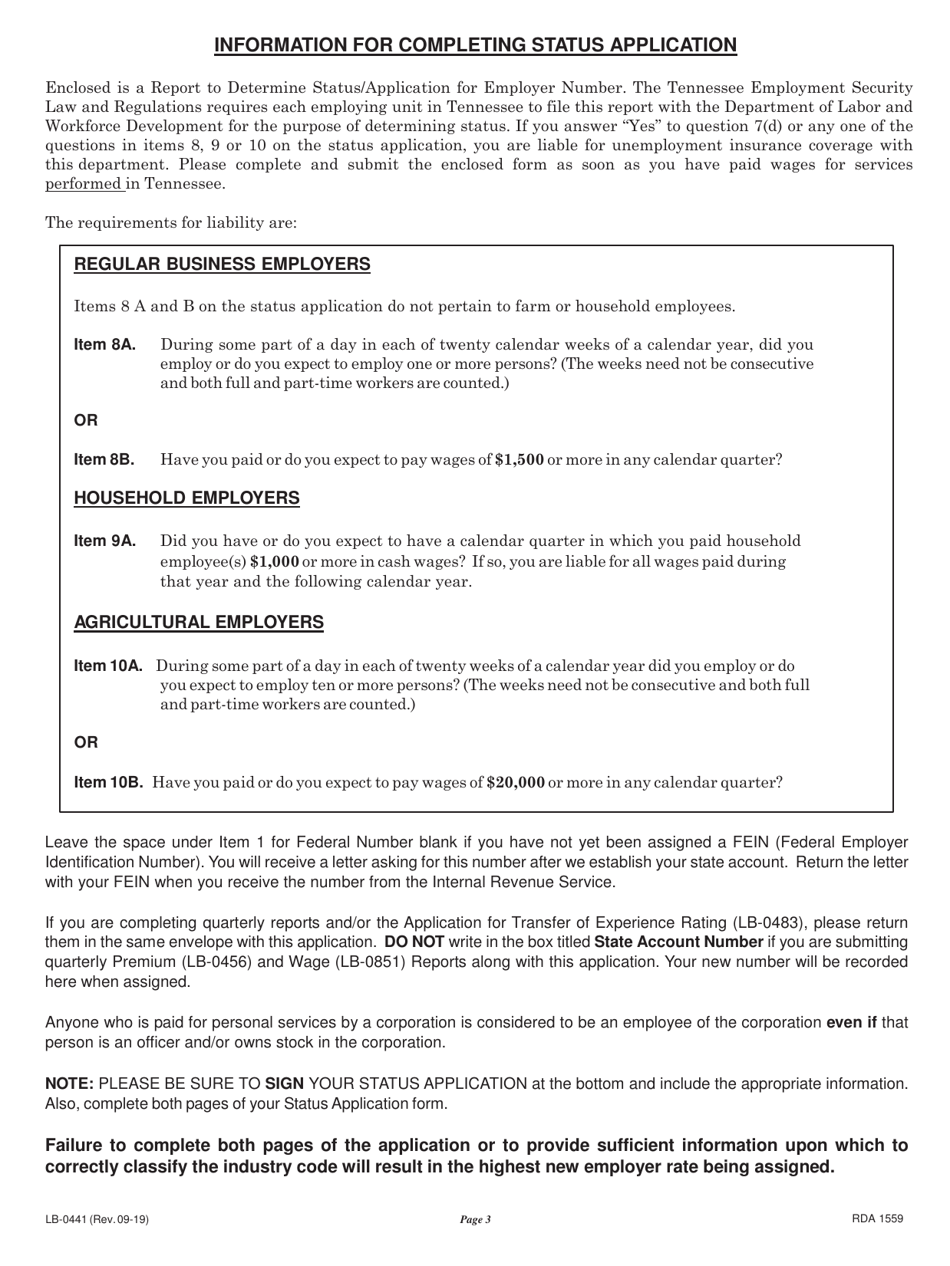

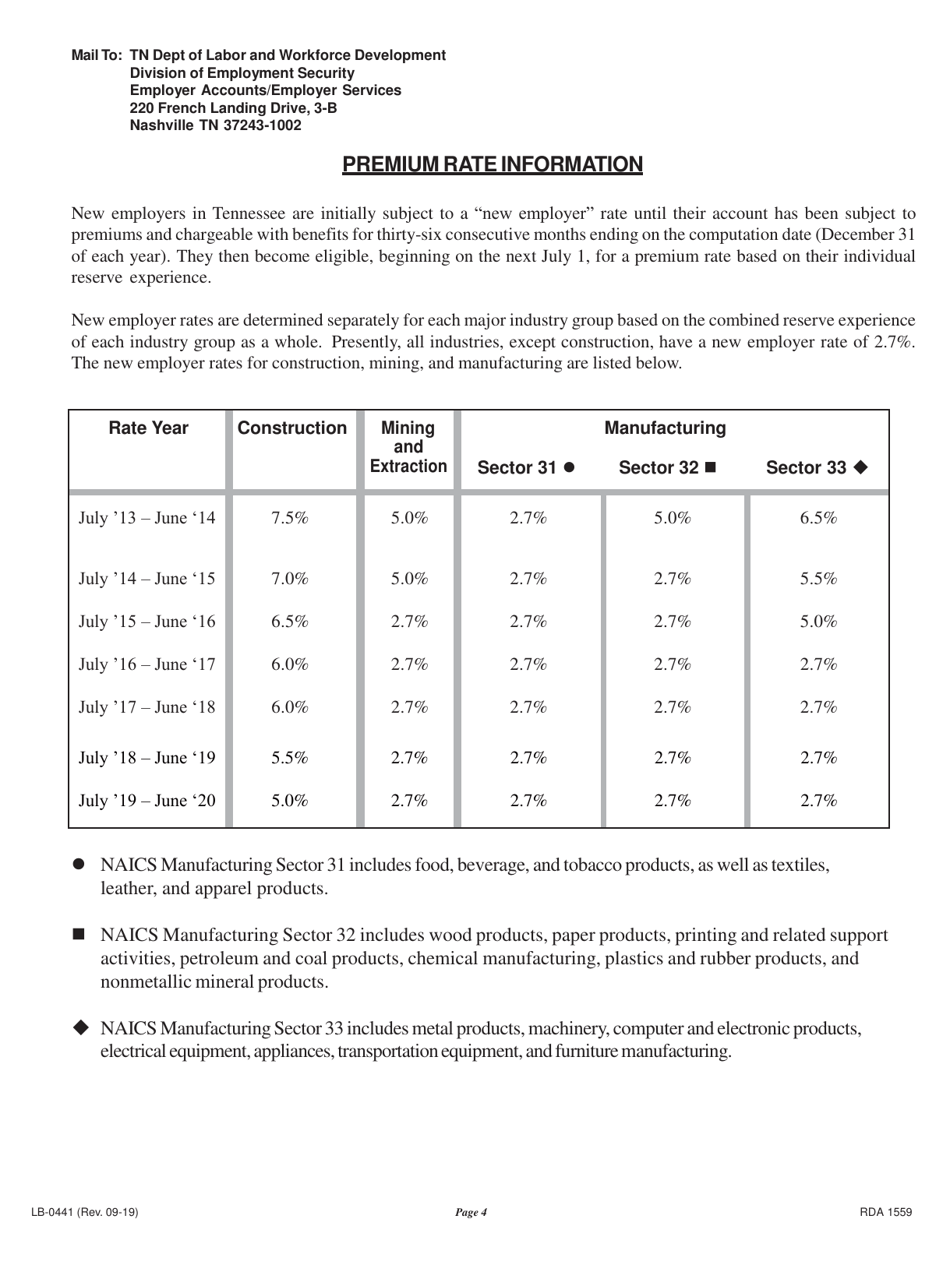

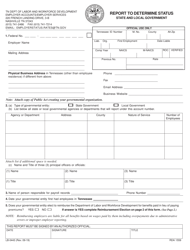

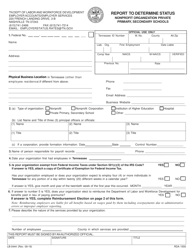

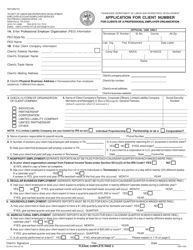

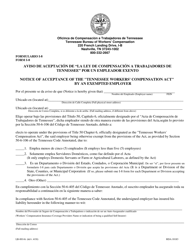

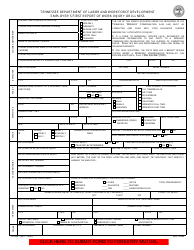

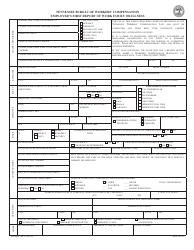

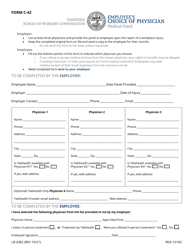

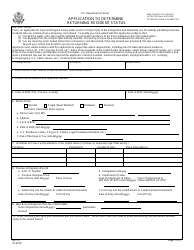

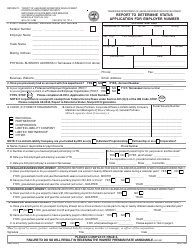

Form LB-0441 Report to Determine Status - Application for Employer Number - Tennessee

What Is Form LB-0441?

This is a legal form that was released by the Tennessee Department of Labor and Workforce Development - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LB-0441?

A: Form LB-0441 is a report used to determine the status of an application for an employer number in Tennessee.

Q: Why do I need a Tennessee employer number?

A: You need a Tennessee employer number to report and pay state unemployment taxes.

Q: How do I obtain Form LB-0441?

A: You can obtain Form LB-0441 by contacting the Tennessee Department of Labor and Workforce Development.

Q: What information is required on Form LB-0441?

A: Form LB-0441 requires information such as the employer's name, address, Social Security Number or Federal ID Number, and business start date.

Q: When is Form LB-0441 due?

A: Form LB-0441 is due within 20 days of receiving notice from the Tennessee Department of Labor and Workforce Development.

Q: What happens if I fail to submit Form LB-0441?

A: Failure to submit Form LB-0441 may result in penalties and delays in obtaining an employer number.

Q: Can I use Form LB-0441 for other purposes?

A: No, Form LB-0441 is specifically for determining the status of an application for an employer number in Tennessee.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Tennessee Department of Labor and Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LB-0441 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Labor and Workforce Development.