This version of the form is not currently in use and is provided for reference only. Download this version of

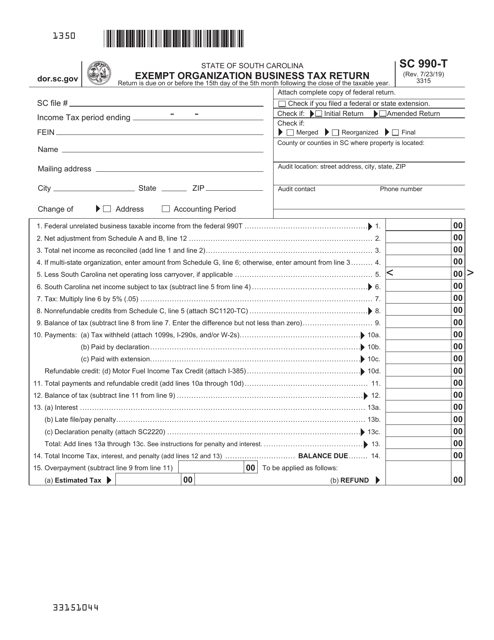

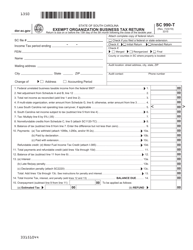

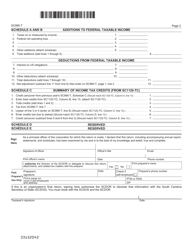

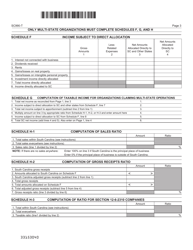

Form SC990-T

for the current year.

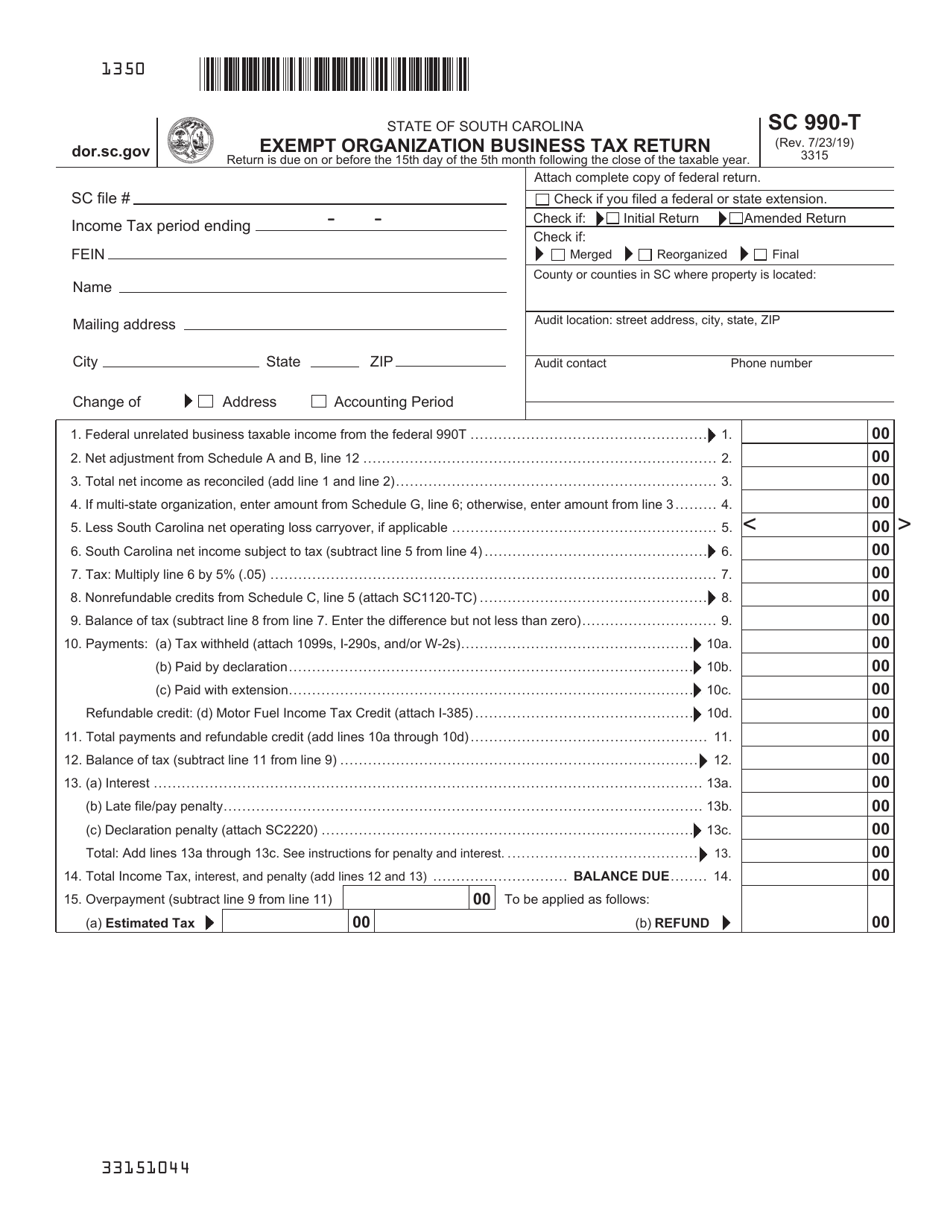

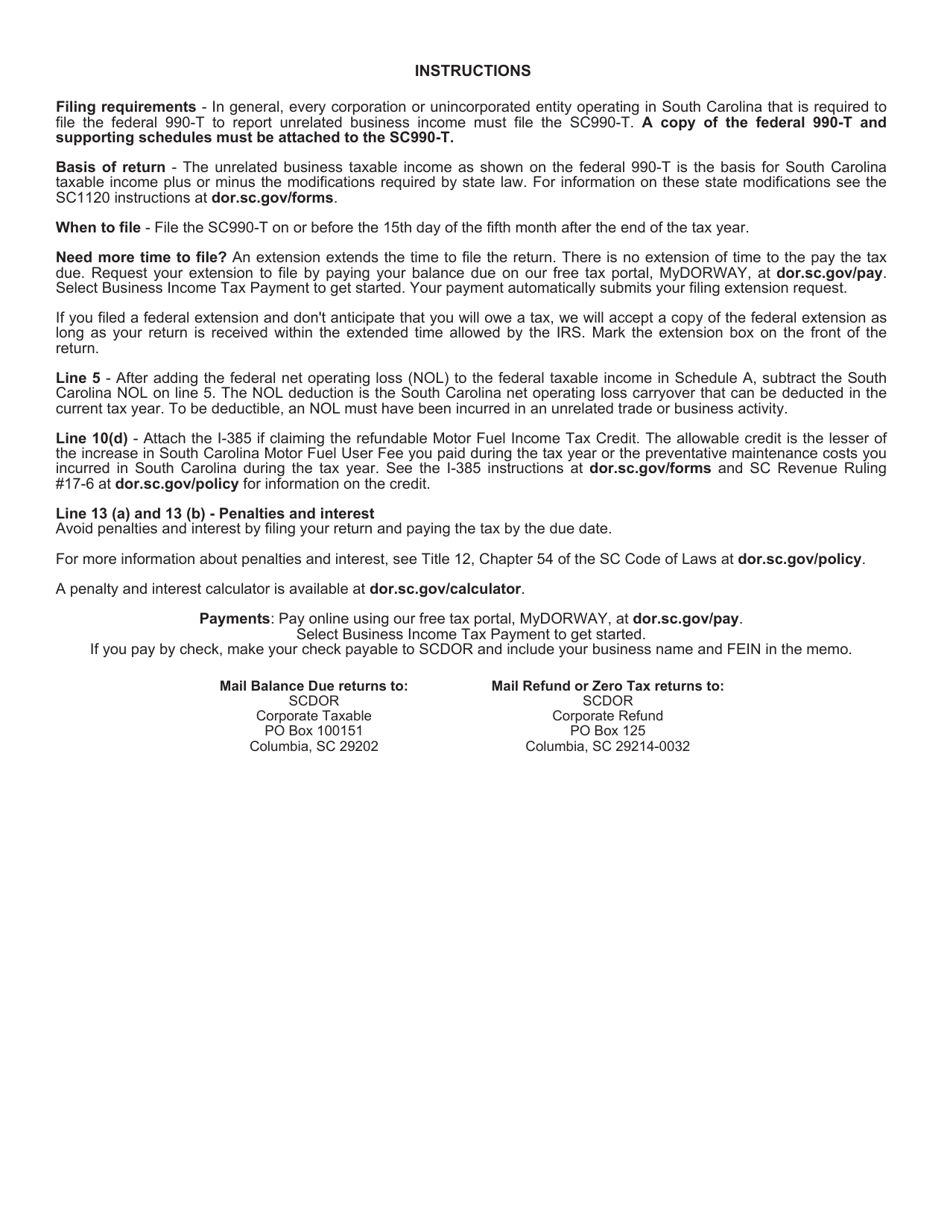

Form SC990-T Exempt Organization Business Tax Return - South Carolina

What Is Form SC990-T?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC990-T?

A: Form SC990-T is the Exempt Organization Business Tax Return for South Carolina.

Q: Who needs to file Form SC990-T?

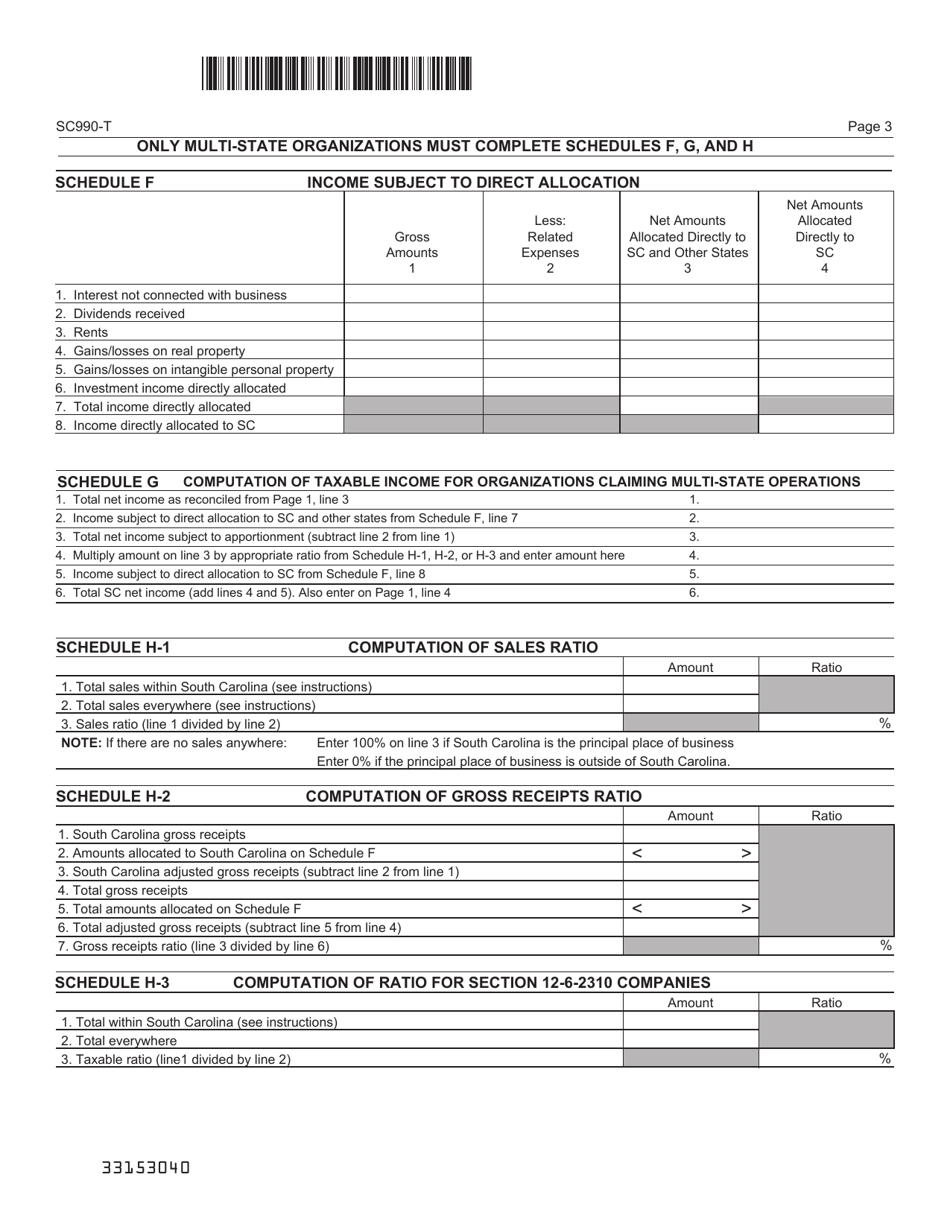

A: Exempt organizations operating a business in South Carolina need to file Form SC990-T.

Q: What is the purpose of Form SC990-T?

A: Form SC990-T is used to report business income and calculate the unrelated business income tax (UBIT) for exempt organizations in South Carolina.

Q: What information do I need to complete Form SC990-T?

A: You will need to provide information about your exempt organization, its business activities, and income from unrelated business activities.

Q: When is the deadline to file Form SC990-T?

A: Form SC990-T is due on the 15th day of the 5th month following the close of your organization's tax year.

Q: Are there any penalties for late filing of Form SC990-T?

A: Yes, penalties may be assessed for late filing or underpayment of the tax due.

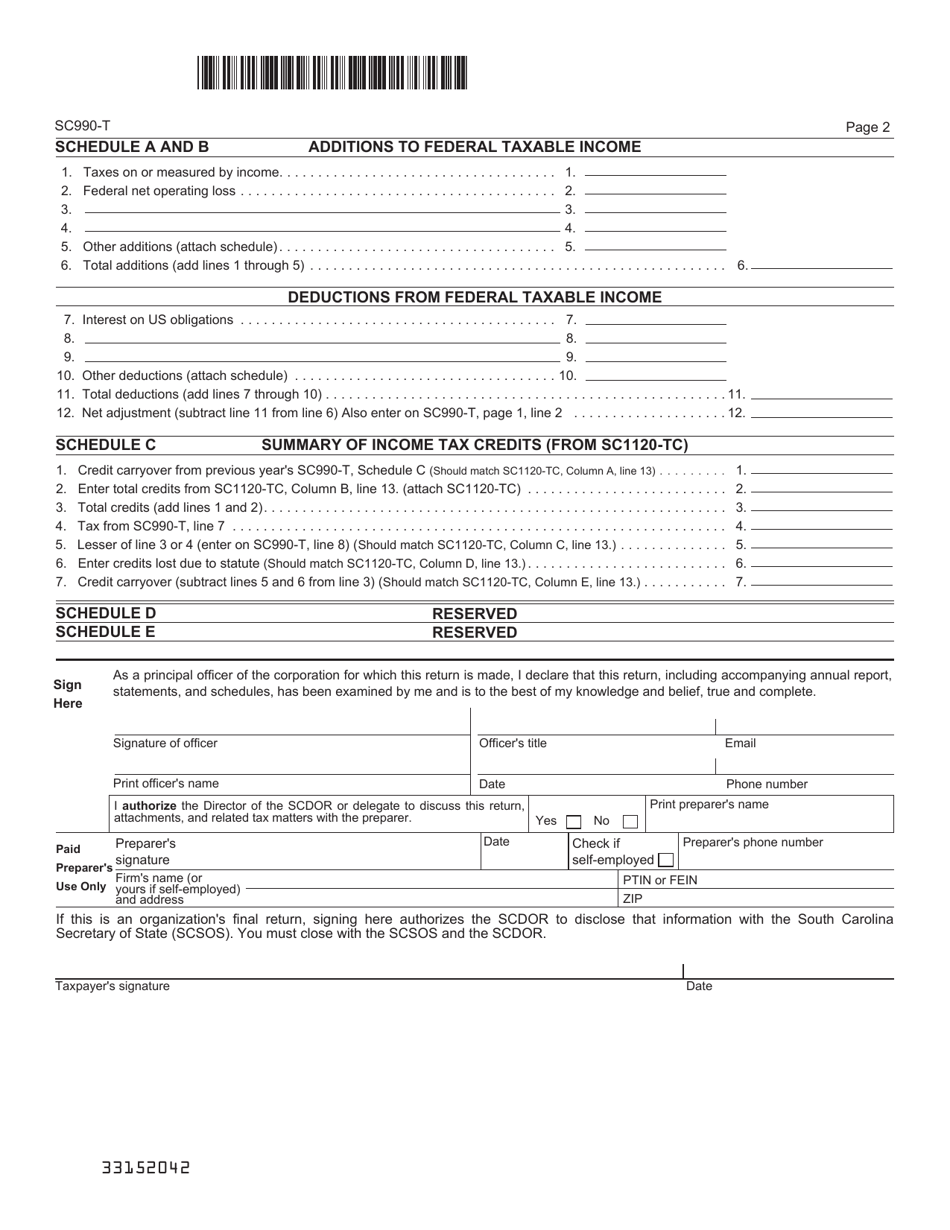

Q: Can I claim deductions on Form SC990-T?

A: Yes, you can claim deductions related to your organization's unrelated business activities on Form SC990-T.

Form Details:

- Released on July 23, 2019;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC990-T by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.