This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

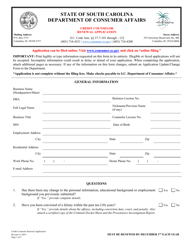

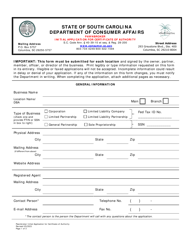

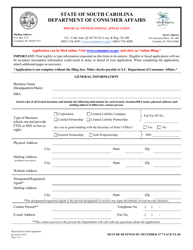

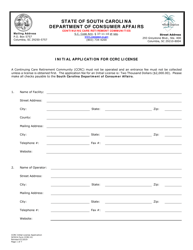

Credit Counselor Initial Application - South Carolina

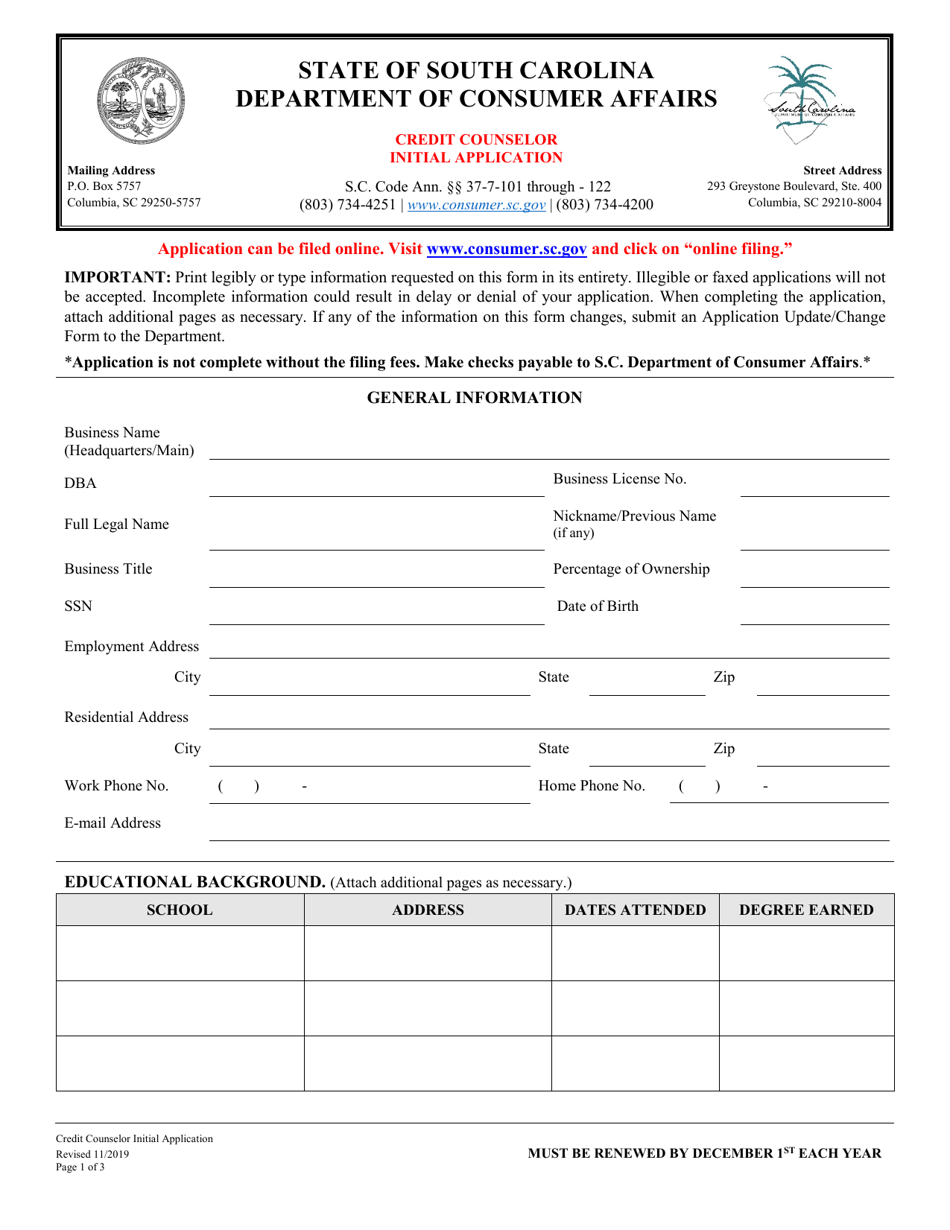

Credit Counselor Initial Application is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a Credit Counselor Initial Application?

A: The Credit Counselor Initial Application is a document required by the state of South Carolina for individuals or organizations seeking to become credit counselors.

Q: Who needs to complete the Credit Counselor Initial Application?

A: Anyone or any organization that wants to provide credit counseling services in South Carolina needs to complete the Credit Counselor Initial Application.

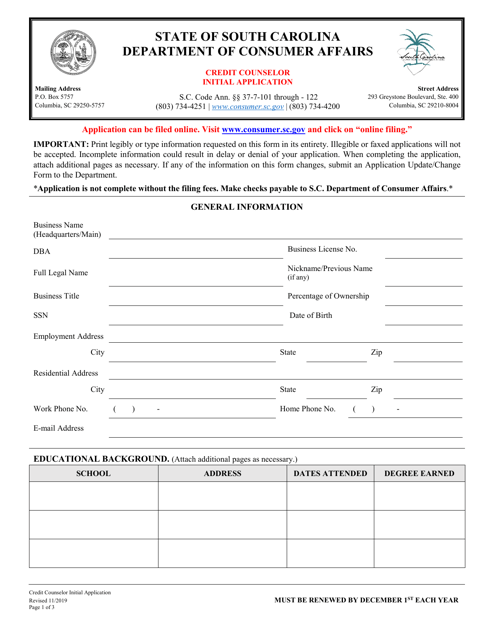

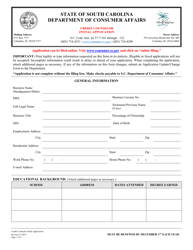

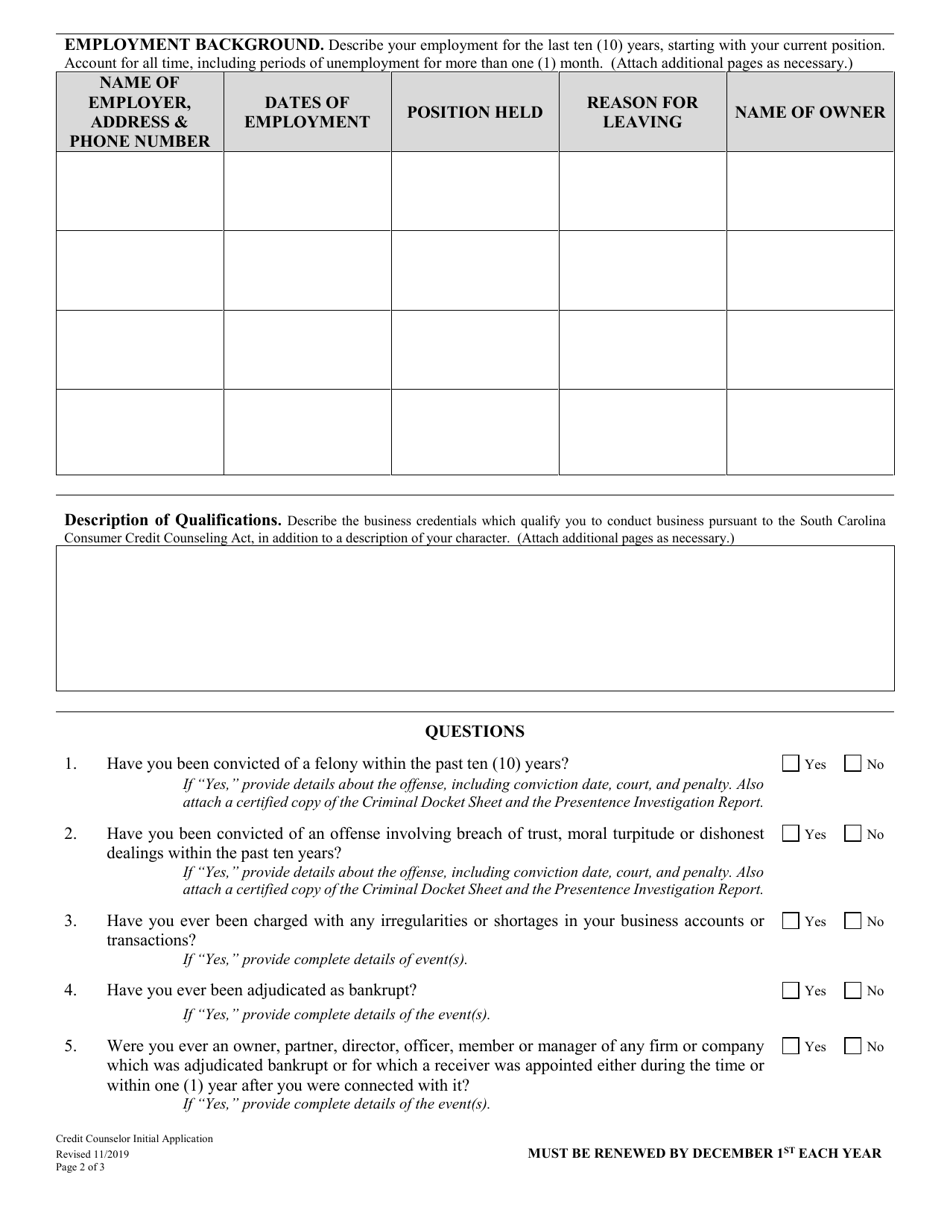

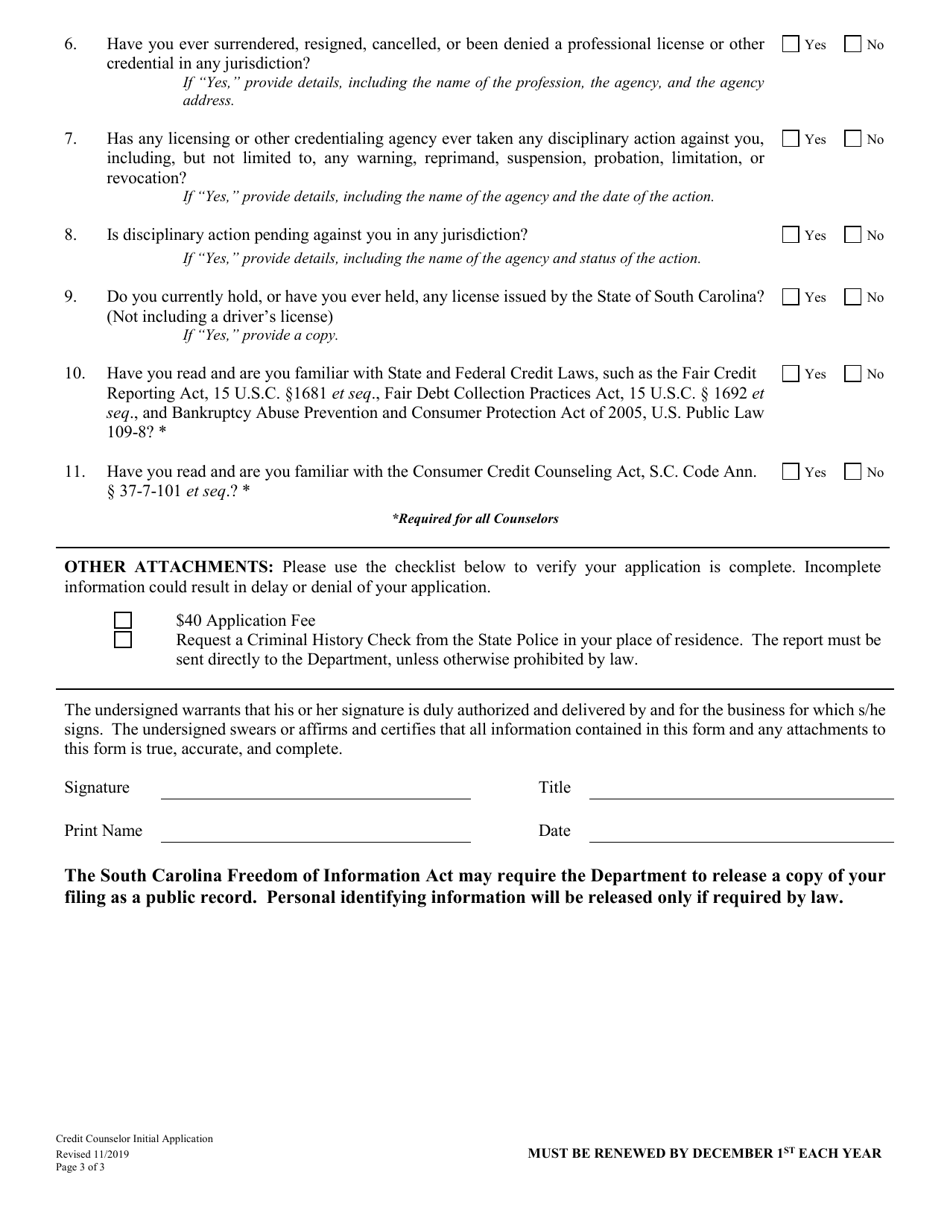

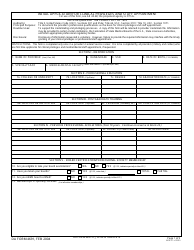

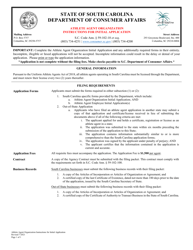

Q: What information is required in the Credit Counselor Initial Application?

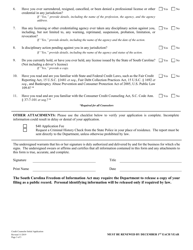

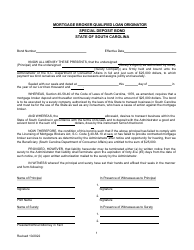

A: The application will typically require information about the applicant's personal and business details, educational background, experience in credit counseling, and any relevant certifications or licenses.

Q: What happens after I submit the Credit Counselor Initial Application?

A: After submitting the application, it will be reviewed by the South Carolina Department of Consumer Affairs. If approved, you may be required to complete additional steps before obtaining a credit counselor license.

Q: How long does it take to process the Credit Counselor Initial Application?

A: The processing time for the application can vary. It is best to contact the South Carolina Department of Consumer Affairs for the most up-to-date information on processing times.

Q: Can I start providing credit counseling services while my application is being processed?

A: No, you cannot provide credit counseling services until you have obtained a license from the South Carolina Department of Consumer Affairs.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.