This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

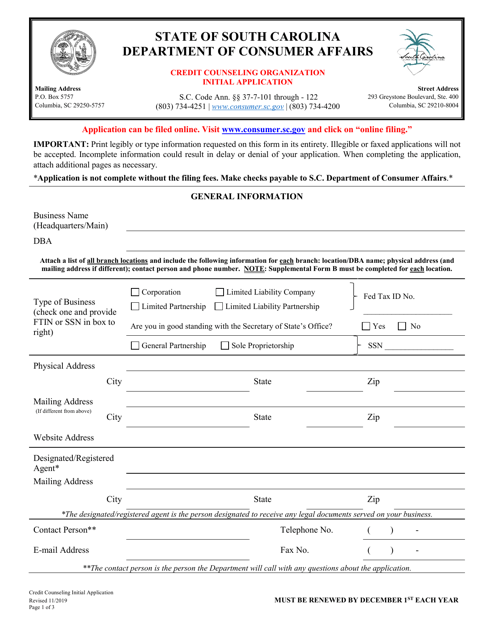

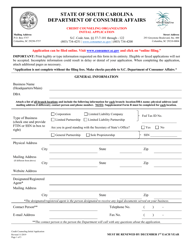

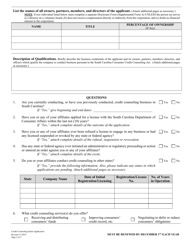

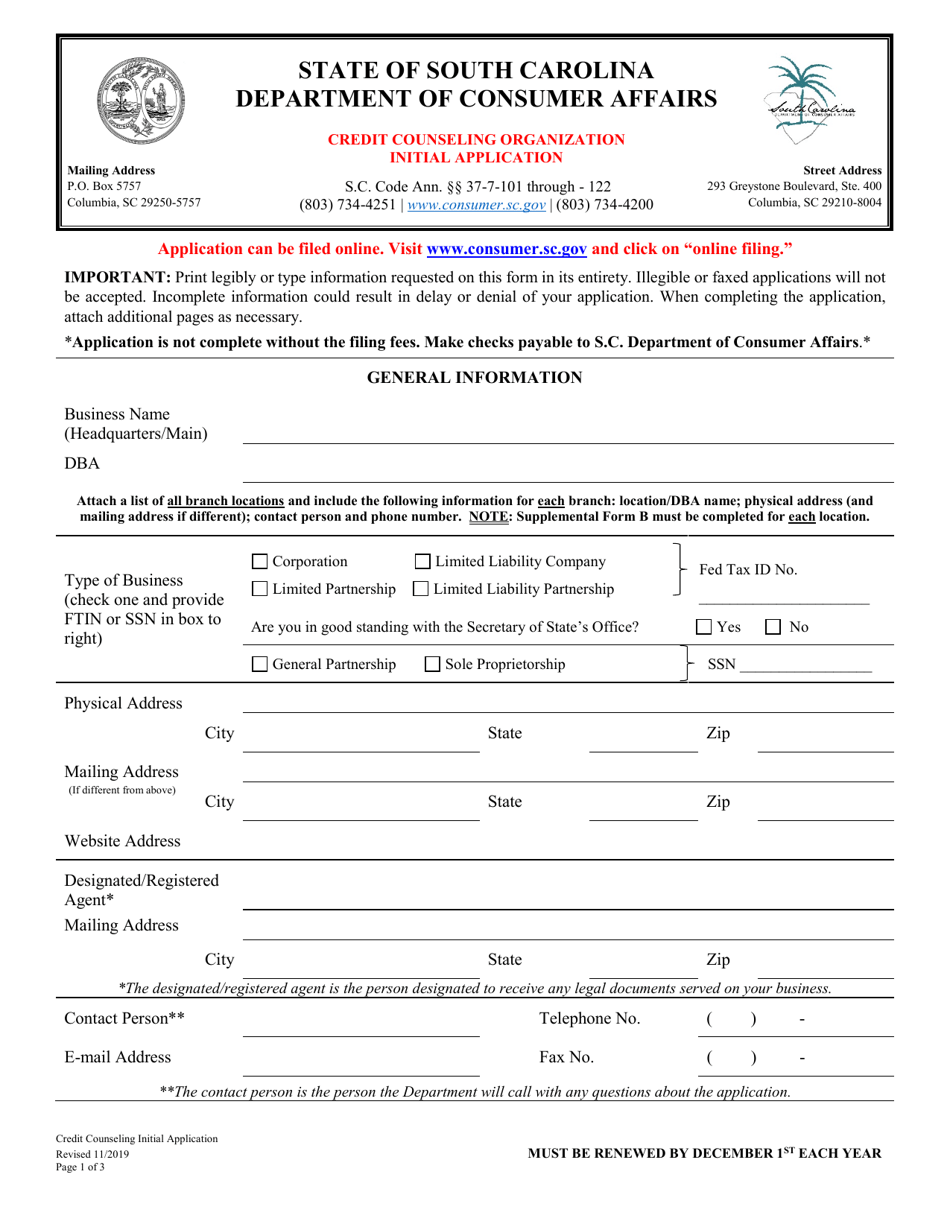

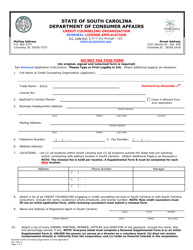

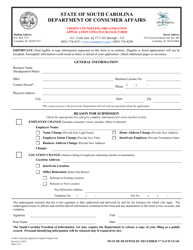

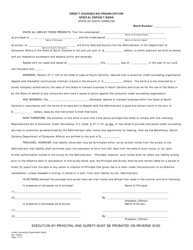

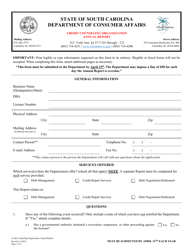

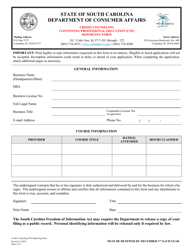

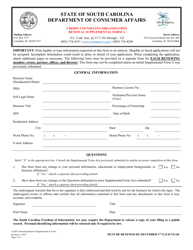

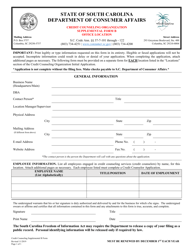

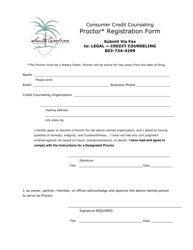

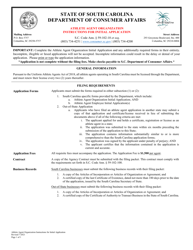

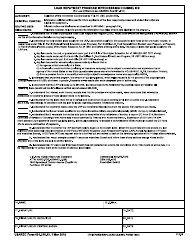

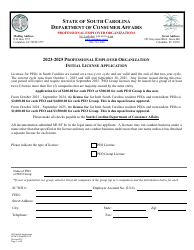

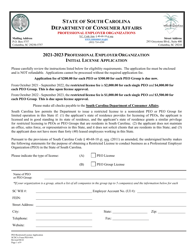

Credit Counseling Organization Initial Application - South Carolina

Credit Counseling Organization Initial Application is a legal document that was released by the South Carolina Department of Consumer Affairs - a government authority operating within South Carolina.

FAQ

Q: What is a credit counseling organization?

A: A credit counseling organization is a non-profit agency that helps individuals manage their debt and improve their financial situation.

Q: Why would someone need to apply to a credit counseling organization?

A: Someone may need to apply to a credit counseling organization if they are struggling with their debt and need assistance in developing a plan to repay it.

Q: What is the purpose of the initial application for a credit counseling organization?

A: The purpose of the initial application is for the credit counseling organization to gather information about the individual's financial situation and determine the appropriate course of action.

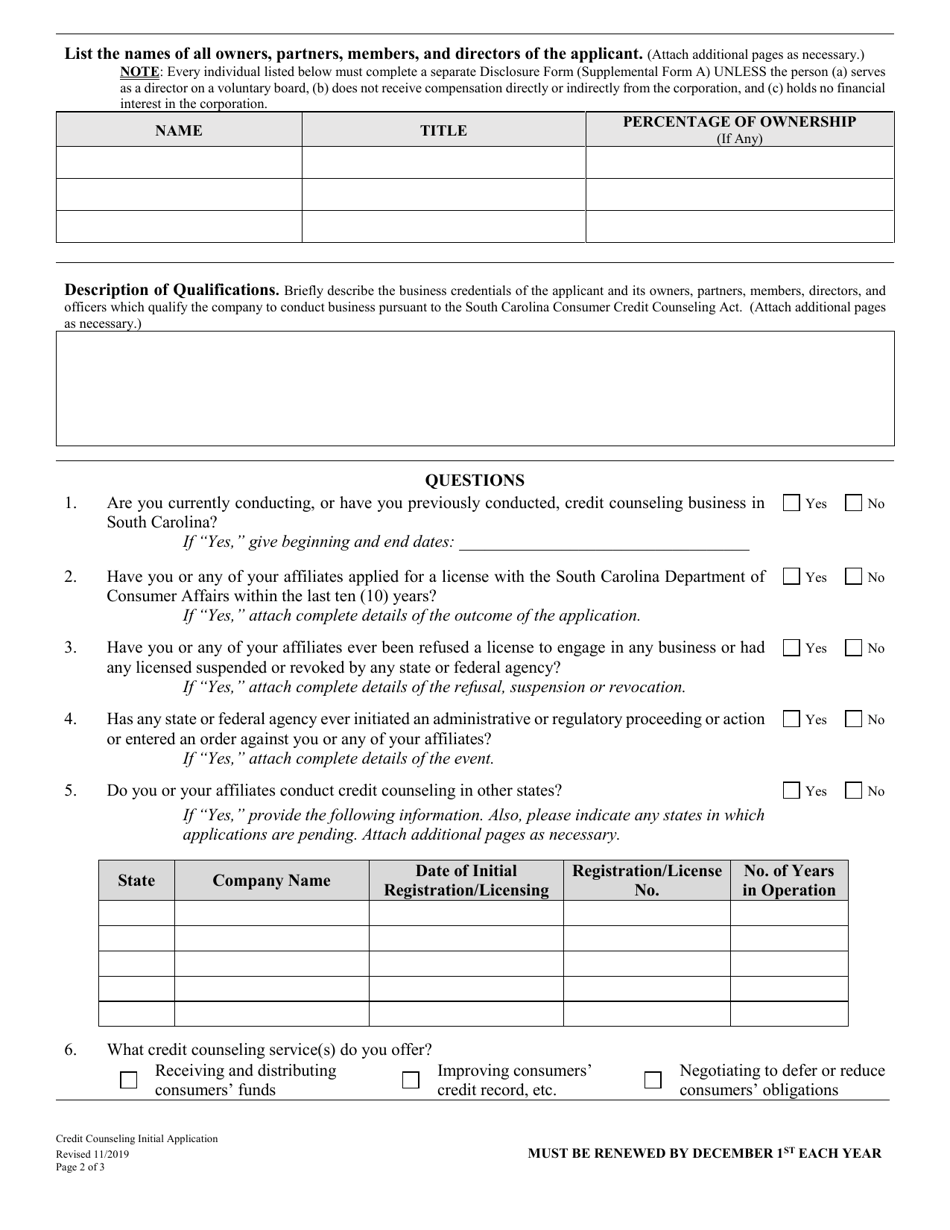

Q: What kind of information is typically required in the initial application?

A: The initial application may require information such as income, expenses, debts, and assets.

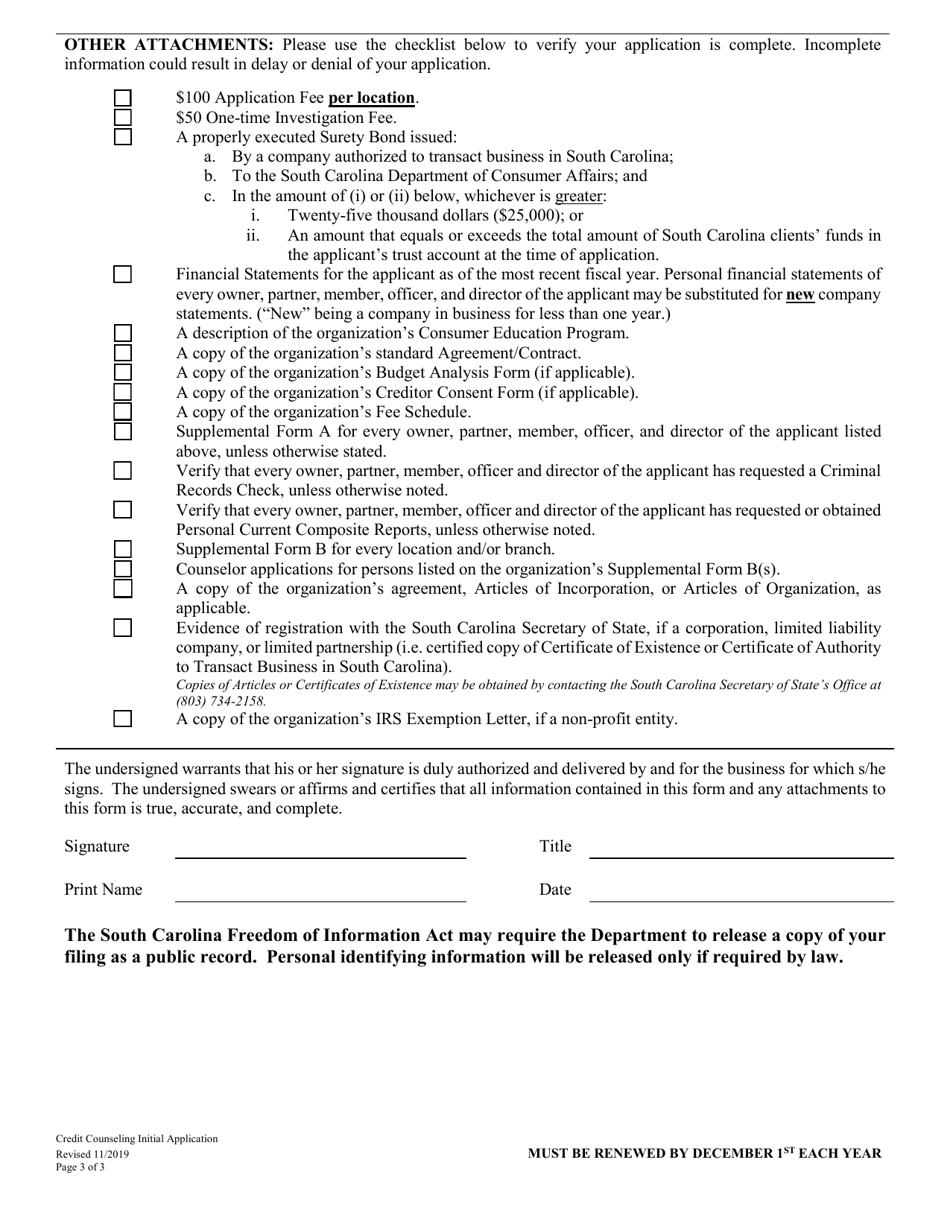

Q: Is there a fee for submitting the initial application?

A: It depends on the credit counseling organization. Some organizations may charge a nominal fee for the application process.

Q: What happens after the initial application is submitted?

A: Once the initial application is submitted, the credit counseling organization will review the information provided and contact the individual to discuss their options for debt management.

Q: Can anyone apply to a credit counseling organization?

A: Yes, anyone who is experiencing financial difficulties and is seeking help with debt management can apply to a credit counseling organization.

Q: Are credit counseling organizations regulated in South Carolina?

A: Yes, credit counseling organizations in South Carolina are regulated by the Department of Consumer Affairs.

Q: How can I find a reputable credit counseling organization in South Carolina?

A: You can find a reputable credit counseling organization in South Carolina by checking with the Department of Consumer Affairs for a list of approved agencies.

Q: Is credit counseling confidential?

A: Yes, credit counseling is confidential. The information provided by individuals applying to credit counseling organizations is protected by privacy laws.

Form Details:

- Released on November 1, 2019;

- The latest edition currently provided by the South Carolina Department of Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the South Carolina Department of Consumer Affairs.