This version of the form is not currently in use and is provided for reference only. Download this version of

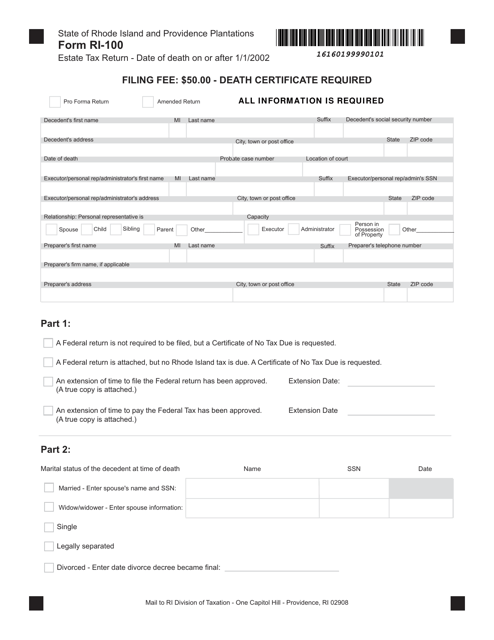

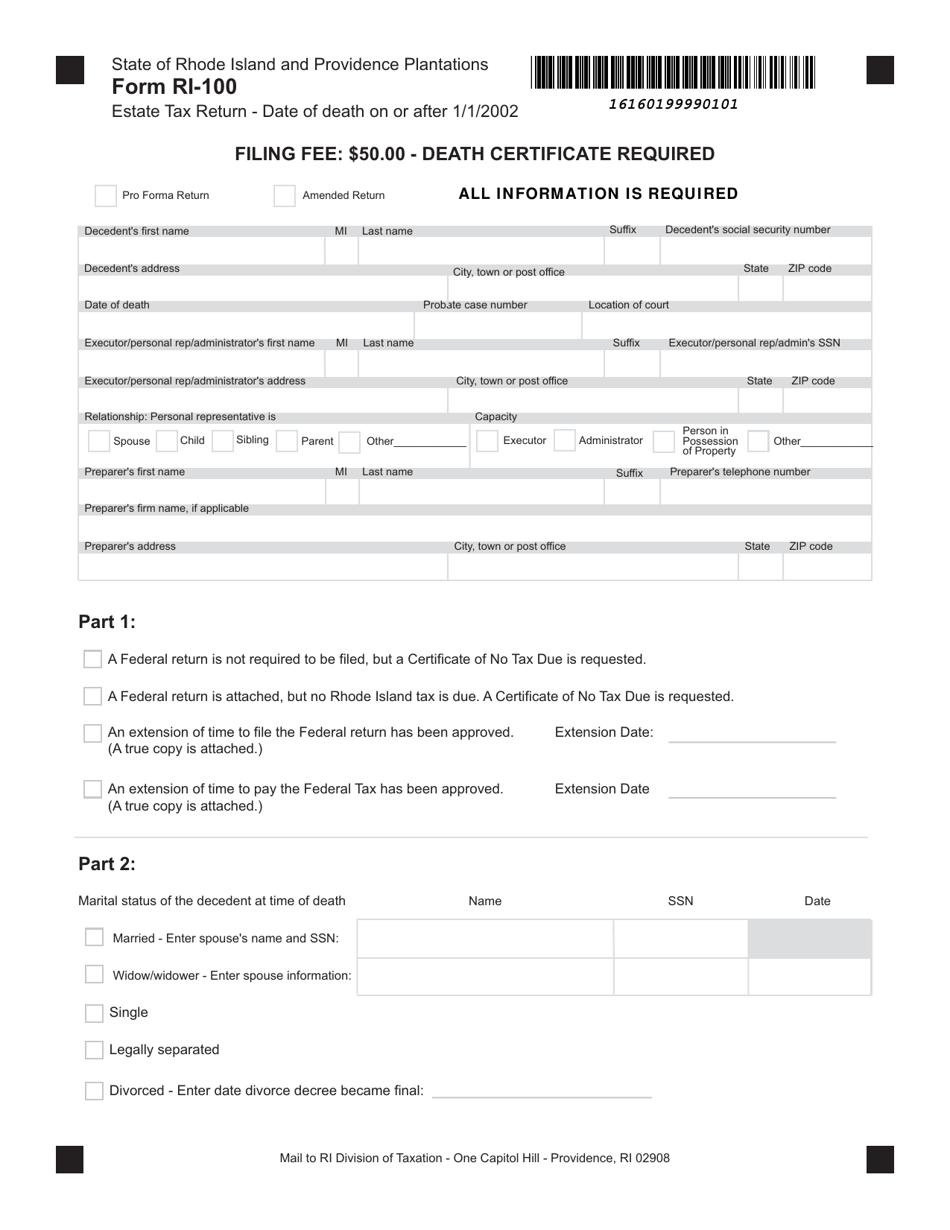

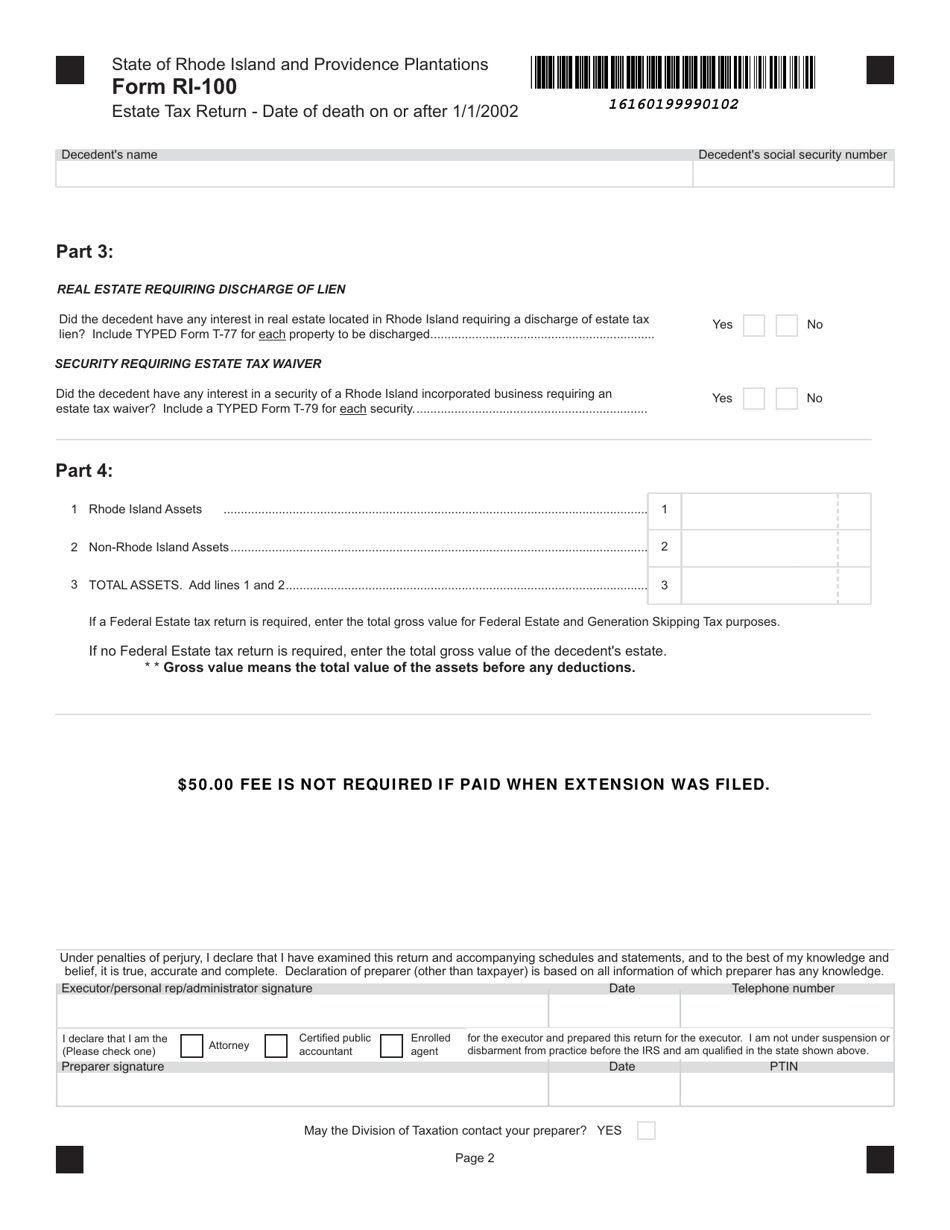

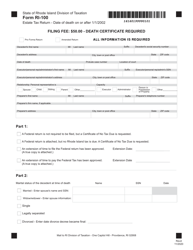

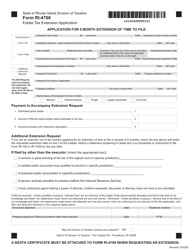

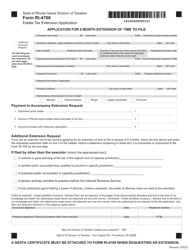

Form RI-100

for the current year.

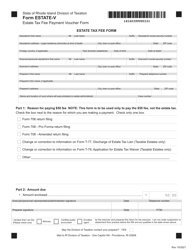

Form RI-100 Estate Tax Return - Date of Death on or After 1 / 1 / 2002 - Rhode Island

What Is Form RI-100?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-100?

A: Form RI-100 is the Estate Tax Return used in Rhode Island.

Q: Who should file Form RI-100?

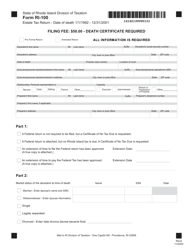

A: Form RI-100 should be filed by the Personal Representative of an estate of a decedent who passed away in Rhode Island.

Q: When should Form RI-100 be filed?

A: Form RI-100 should be filed if the date of death is on or after January 1, 2002.

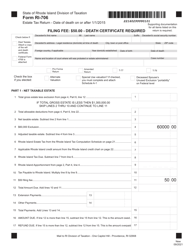

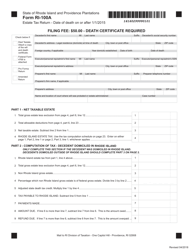

Q: What is the purpose of Form RI-100?

A: The purpose of Form RI-100 is to calculate and report the estate tax due to the state of Rhode Island for a decedent's estate.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-100 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.