This version of the form is not currently in use and is provided for reference only. Download this version of

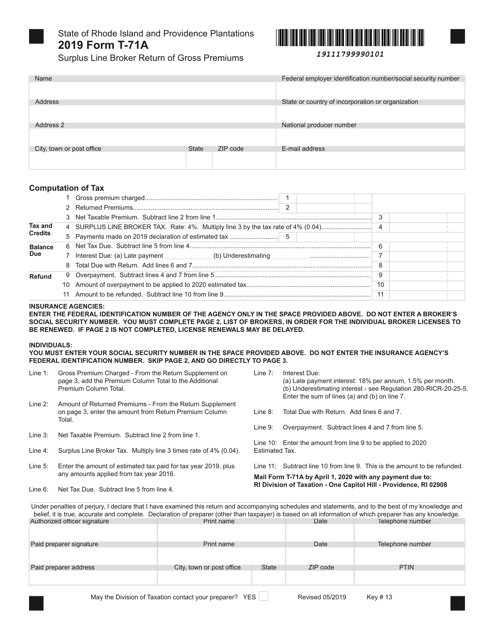

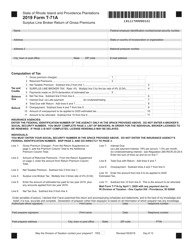

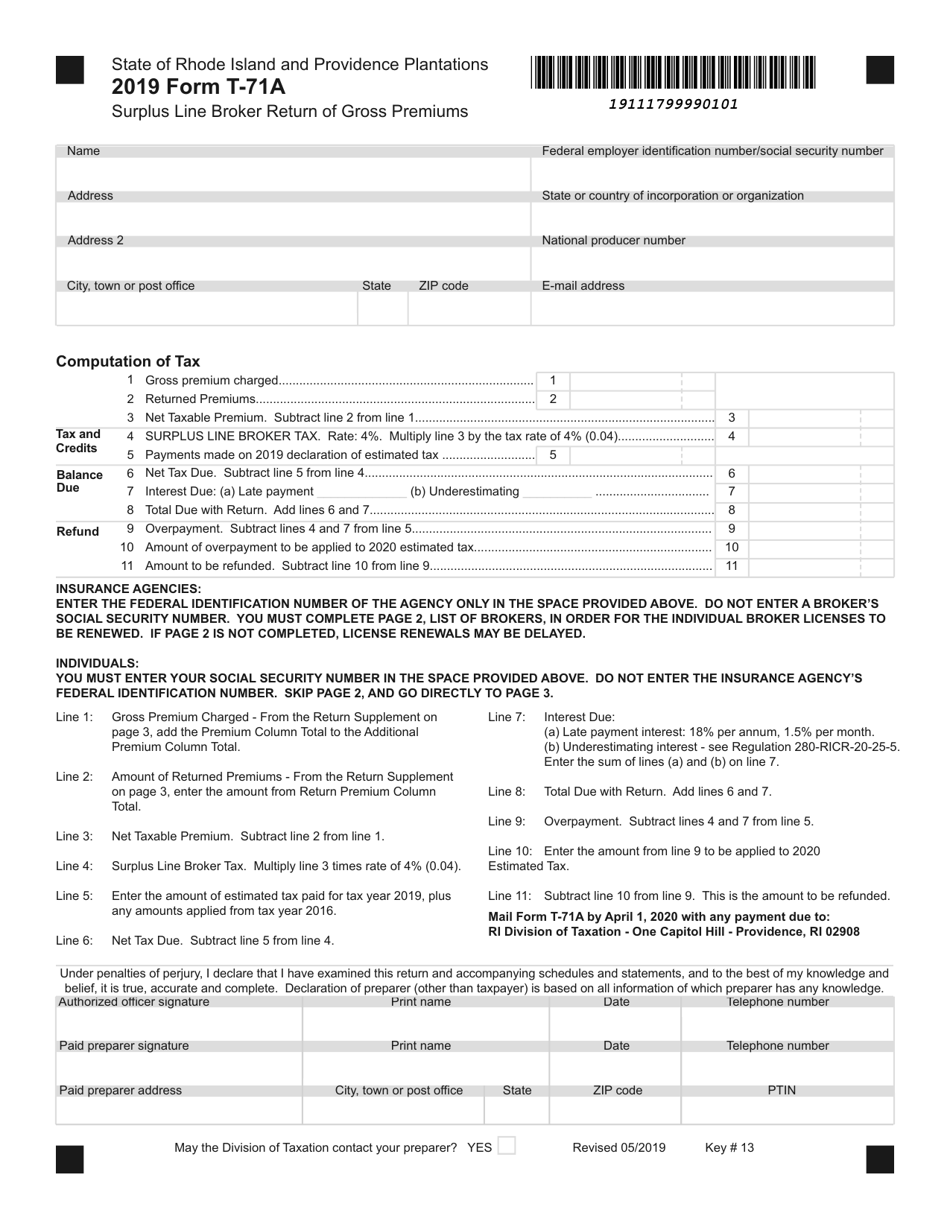

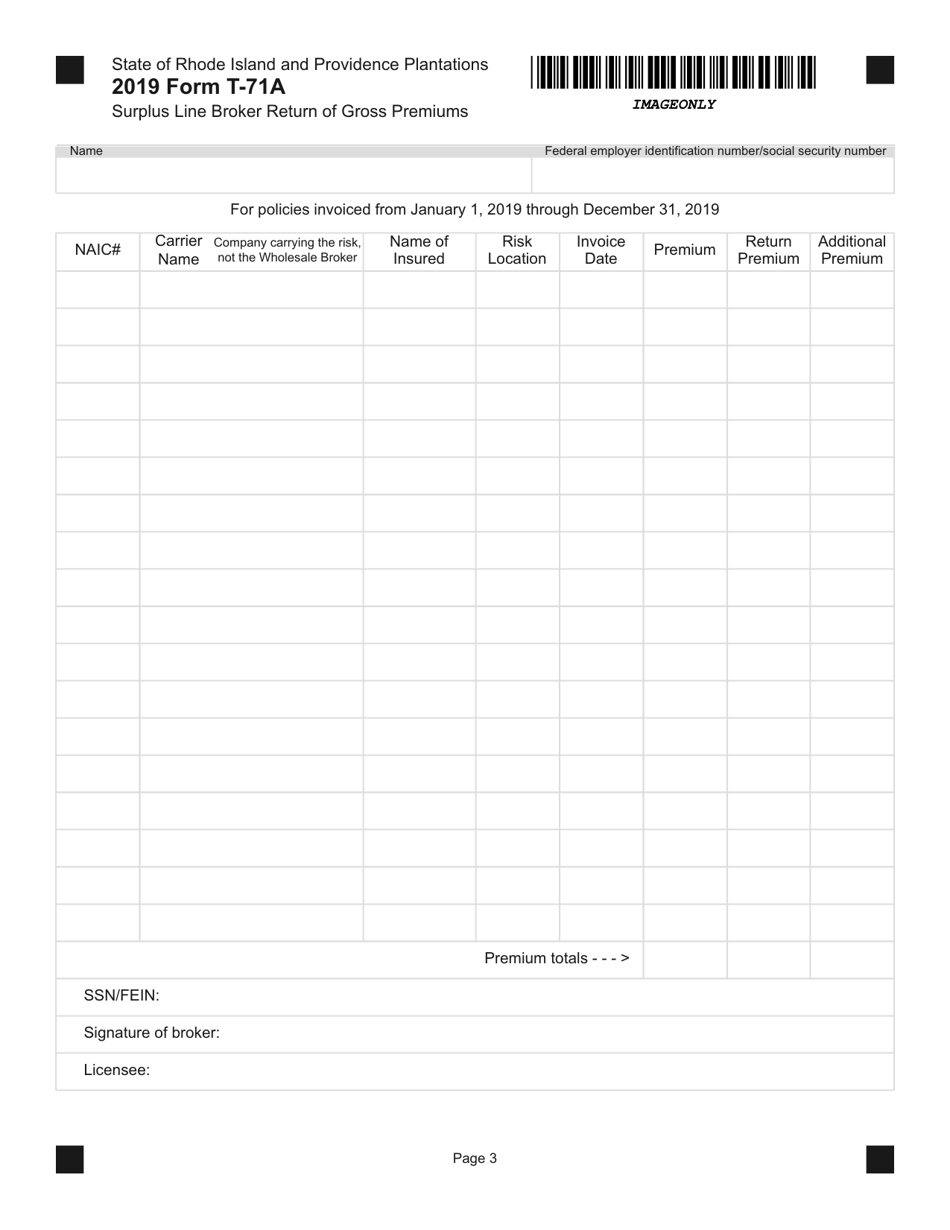

Form T-71A

for the current year.

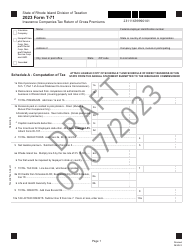

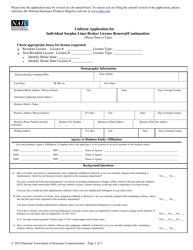

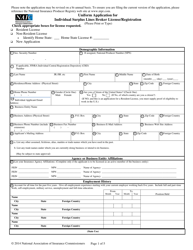

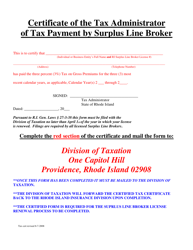

Form T-71A Surplus Line Broker Return of Gross Premiums - Rhode Island

What Is Form T-71A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-71A?

A: Form T-71A is the Surplus Line Broker Return of Gross Premiums form in Rhode Island.

Q: Who needs to file Form T-71A?

A: Surplus line brokers in Rhode Island need to file Form T-71A to report their gross premiums.

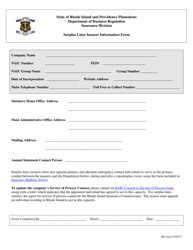

Q: What is a surplus line broker?

A: A surplus line broker is an insurance broker who can place coverage with non-admitted insurers for hard-to-place or unique insurance risks.

Q: What are gross premiums?

A: Gross premiums are the total premiums collected by a surplus line broker for insurance policies placed with non-admitted insurers.

Q: Why do surplus line brokers need to file Form T-71A?

A: Filing Form T-71A allows the Rhode Island Department of Business Regulation to track and regulate the activities of surplus line brokers and ensure compliance with applicable laws and regulations.

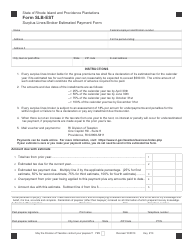

Q: When is Form T-71A due?

A: Form T-71A must be filed annually by March 1st for the previous calendar year.

Q: Are there any penalties for not filing Form T-71A?

A: Yes, failure to timely file Form T-71A may result in fines or other penalties as prescribed by Rhode Island law.

Q: Can I file Form T-71A electronically?

A: Yes, the Rhode Island Department of Business Regulation allows electronic filing of Form T-71A.

Q: Who can I contact for more information about filing Form T-71A?

A: For more information about filing Form T-71A, you can contact the Rhode Island Department of Business Regulation's Insurance Division.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-71A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.