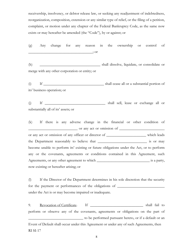

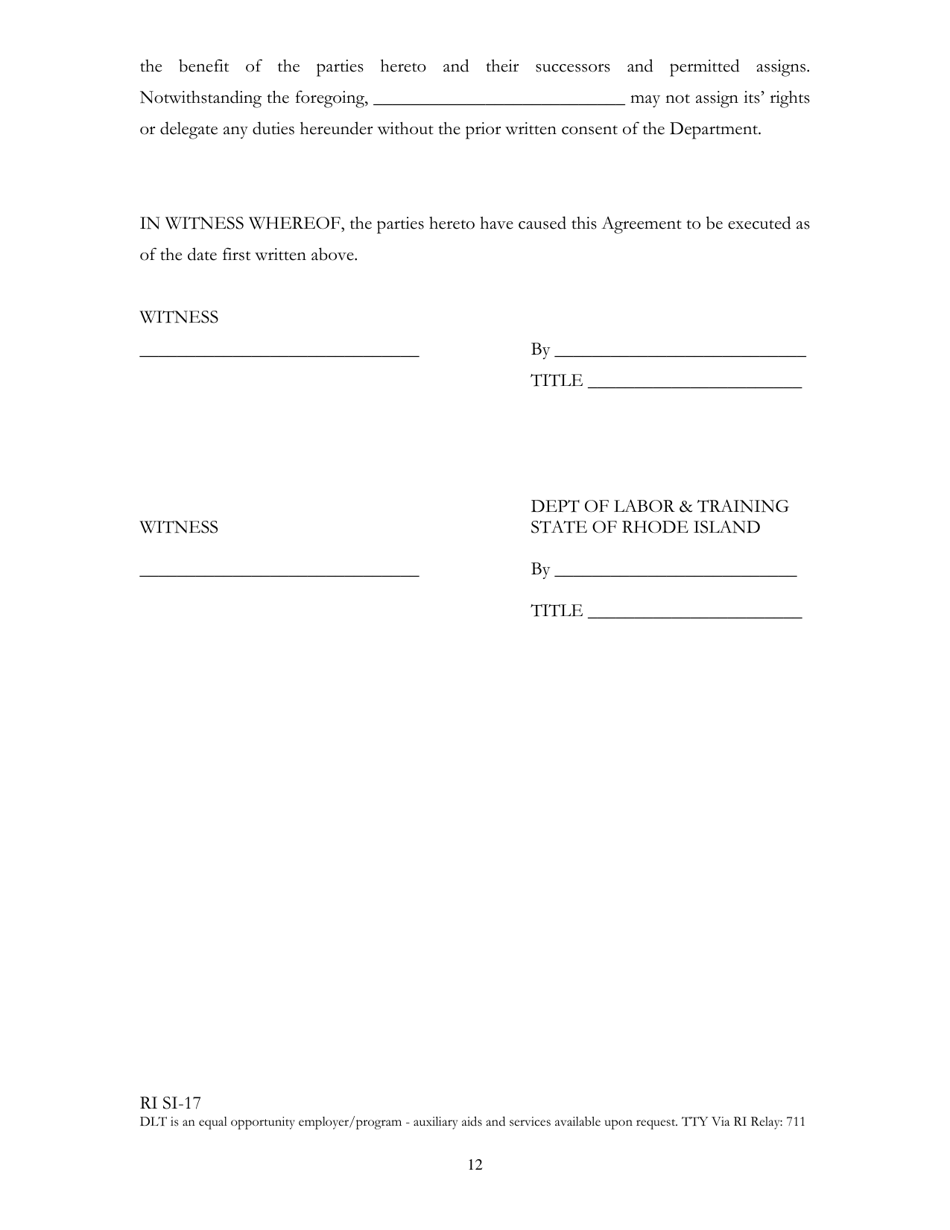

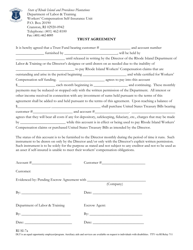

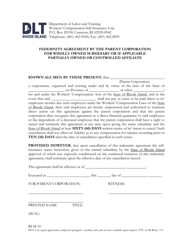

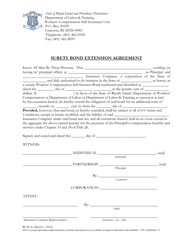

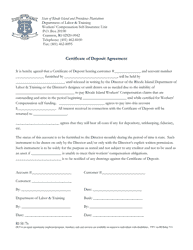

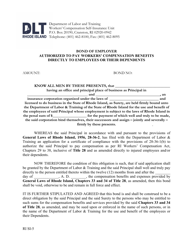

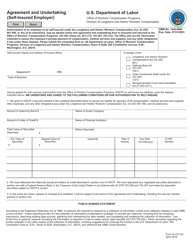

Form RI SI-17 Self-insurance Agreement - Rhode Island

What Is Form RI SI-17?

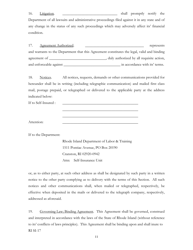

This is a legal form that was released by the Rhode Island Department of Labor and Training - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI SI-17?

A: Form RI SI-17 is a self-insurance agreement specifically for Rhode Island.

Q: What is self-insurance?

A: Self-insurance is a method of bearing the financial risk of insurance oneself, rather than taking out a traditional insurance policy.

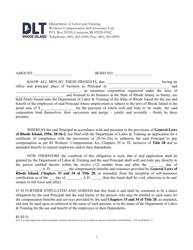

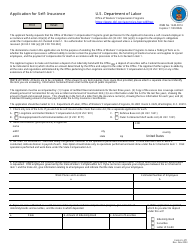

Q: Who needs to use Form RI SI-17?

A: Those who wish to self-insure in Rhode Island need to use Form RI SI-17.

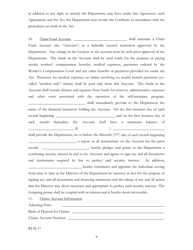

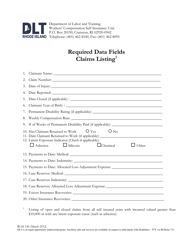

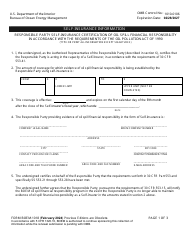

Q: What information is required on Form RI SI-17?

A: Form RI SI-17 requires information about the self-insured individual or company, including details about their finances and insurance coverage.

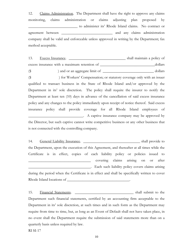

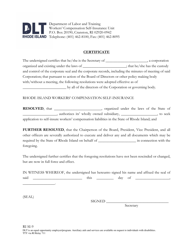

Q: What happens after submitting Form RI SI-17?

A: After submitting Form RI SI-17, it will be reviewed by the Rhode Island Department of Labor and Training. If approved, the self-insured individual or company will be granted permission to self-insure.

Q: What are the benefits of self-insurance?

A: Self-insurance allows individuals or companies to have more control over their insurance coverage and potentially save money on premiums.

Q: Are there any risks associated with self-insurance?

A: Yes, self-insurance carries the risk of bearing the full financial responsibility of any losses, which can be significant depending on the situation.

Q: Can I cancel my self-insurance agreement?

A: Yes, self-insurance agreements can be canceled, but a notice period and any required fees will apply.

Form Details:

- The latest edition provided by the Rhode Island Department of Labor and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI SI-17 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Labor and Training.