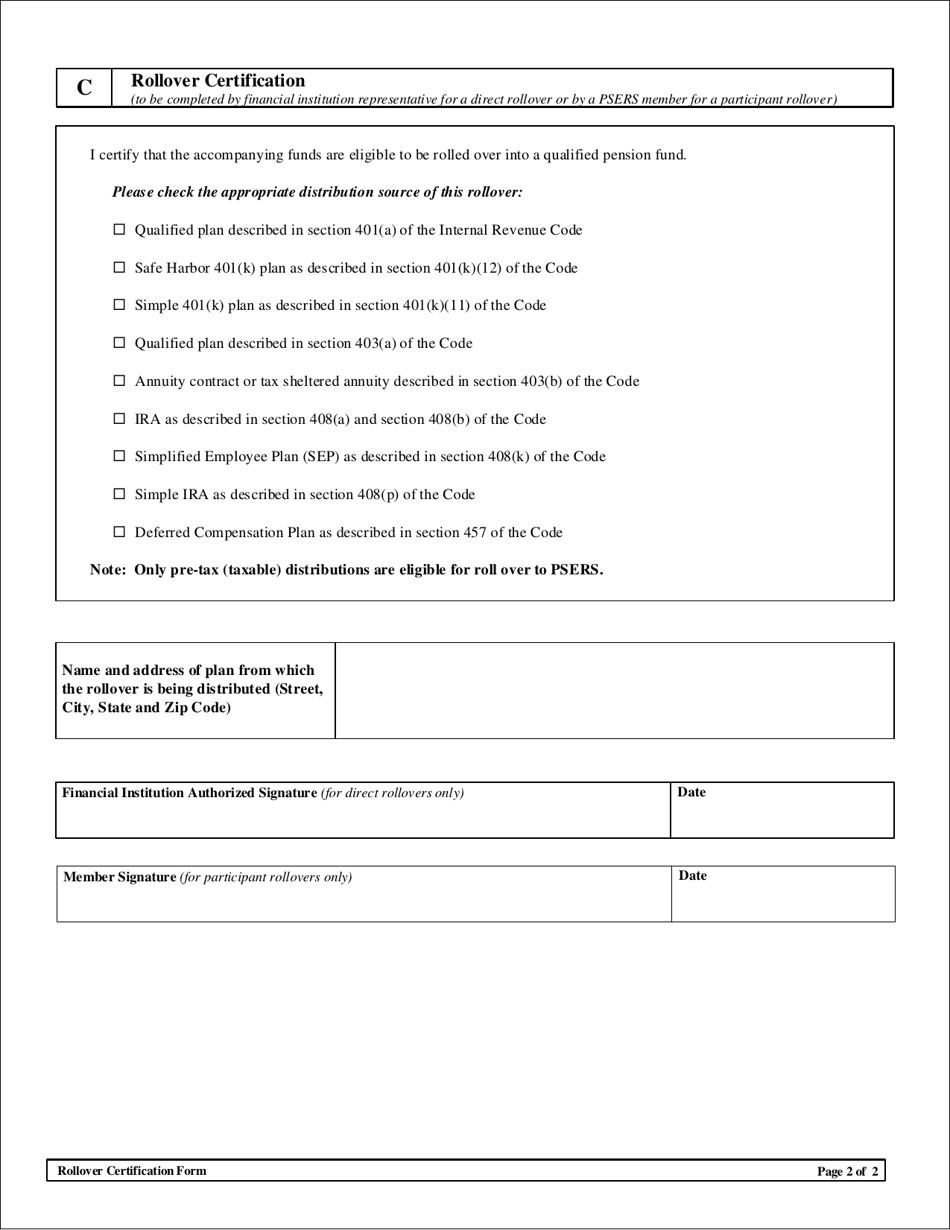

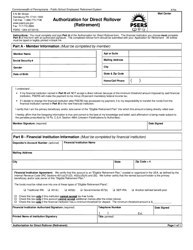

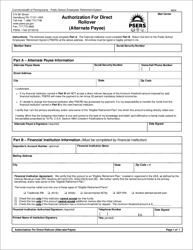

Form PSRS-928 Rollover Certification Form - Pennsylvania

What Is Form PSRS-928?

This is a legal form that was released by the Pennsylvania Public School Employees' Retirement System - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PSRS-928?

A: Form PSRS-928 is the Rollover Certification Form in Pennsylvania.

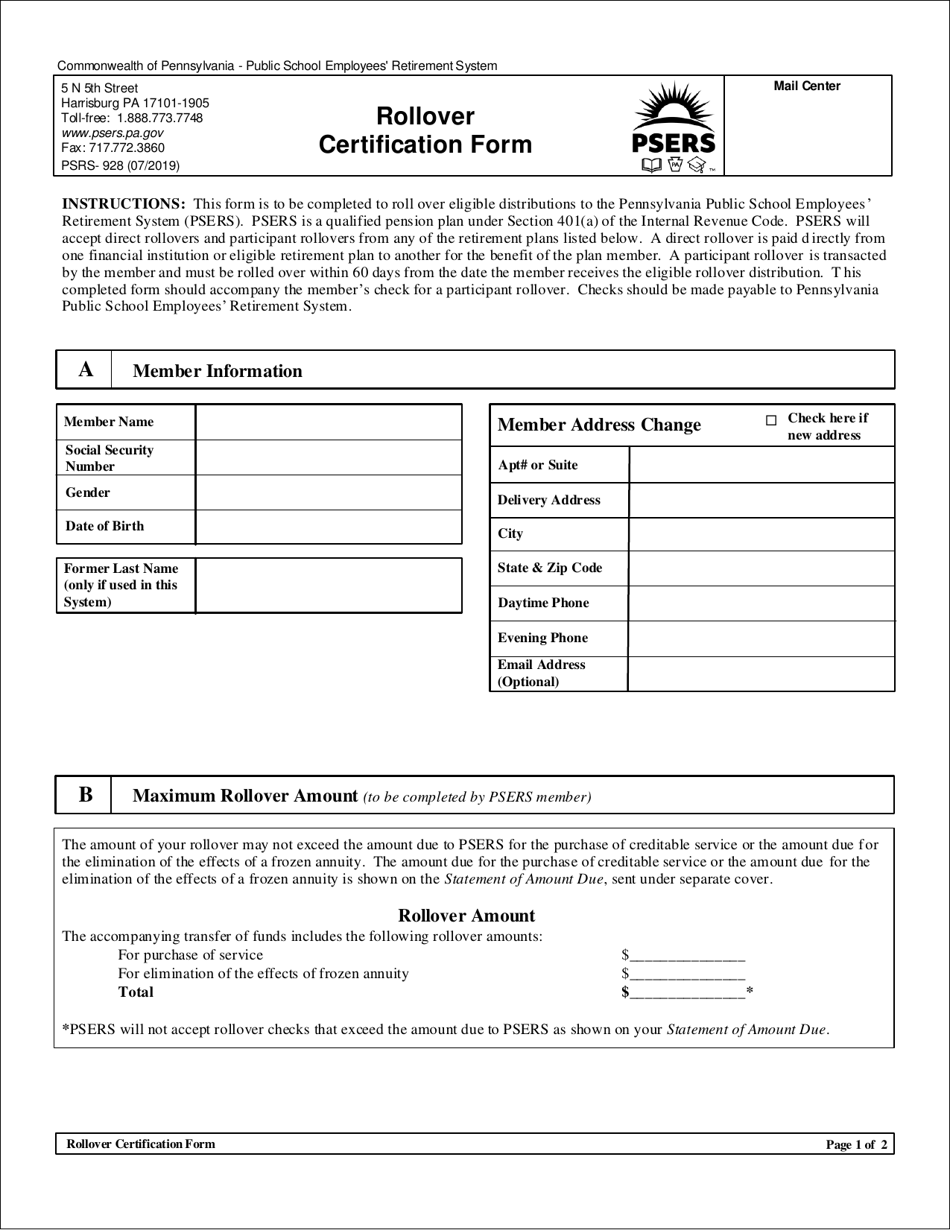

Q: What is the purpose of Form PSRS-928?

A: The purpose of Form PSRS-928 is to certify rollovers in Pennsylvania.

Q: Who needs to file Form PSRS-928?

A: Anyone who wants to rollover retirement funds in Pennsylvania needs to file Form PSRS-928.

Q: Is there a fee to file Form PSRS-928?

A: No, there is no fee to file Form PSRS-928.

Q: What information is required on Form PSRS-928?

A: Form PSRS-928 requires information about the type and amount of retirement funds being rolled over.

Q: How do I submit Form PSRS-928?

A: Form PSRS-928 can be submitted by mail or fax to the Pennsylvania State Employees' Retirement System.

Q: Can I make changes to a submitted Form PSRS-928?

A: Yes, changes can be made to a submitted Form PSRS-928 by filing an amended form.

Q: What is the deadline for filing Form PSRS-928?

A: The deadline for filing Form PSRS-928 is generally within 60 days of the rollover transaction.

Q: Is Form PSRS-928 only for Pennsylvania residents?

A: No, Form PSRS-928 can be filed by both Pennsylvania residents and non-residents.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Pennsylvania Public School Employees' Retirement System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PSRS-928 by clicking the link below or browse more documents and templates provided by the Pennsylvania Public School Employees' Retirement System.