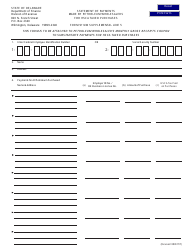

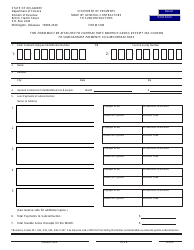

Instructions for Form 9114W Statement of Payments Made by Petroleum Wholesalers for Hsca Taxed Purchases - Delaware

This document contains official instructions for Form 9114W , Statement of Payments Made by Petroleum Wholesalers for Hsca Taxed Purchases - a form released and collected by the Delaware Department of Finance - Division of Revenue. An up-to-date fillable Form 9114W is available for download through this link.

FAQ

Q: What is Form 9114W?

A: Form 9114W is a statement used by petroleum wholesalers in Delaware to report payments made for purchases subject to the Hazardous Substance Cleanup Act (HSCA) tax.

Q: Who needs to file Form 9114W?

A: Petroleum wholesalers in Delaware who have made payments for purchases subject to the HSCA tax need to file Form 9114W.

Q: What is the purpose of Form 9114W?

A: The purpose of Form 9114W is to report the payments made by petroleum wholesalers for purchases subject to the HSCA tax to the state of Delaware.

Q: When is Form 9114W due?

A: Form 9114W is generally due on a quarterly basis, with the due dates falling on the last day of the month following the end of each calendar quarter.

Q: Are there any penalties for not filing Form 9114W?

A: Yes, failure to file Form 9114W or filing it late can result in penalties and interest charges imposed by the state of Delaware.

Q: Is there any specific format for completing Form 9114W?

A: Yes, Form 9114W must be completed according to the instructions provided by the Delaware Division of Revenue, ensuring accurate reporting of payments made for HSCA taxed purchases.

Q: Can Form 9114W be filed electronically?

A: As of now, Form 9114W cannot be filed electronically and must be submitted in paper format to the Delaware Division of Revenue.

Q: Is Form 9114W applicable only to petroleum wholesalers?

A: Yes, Form 9114W is specifically designed for petroleum wholesalers in Delaware who make payments for purchases subject to the HSCA tax.

Q: What other documents might be required along with Form 9114W?

A: Petroleum wholesalers may be required to provide supporting documentation such as invoices and receipts when submitting Form 9114W to the Delaware Division of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.