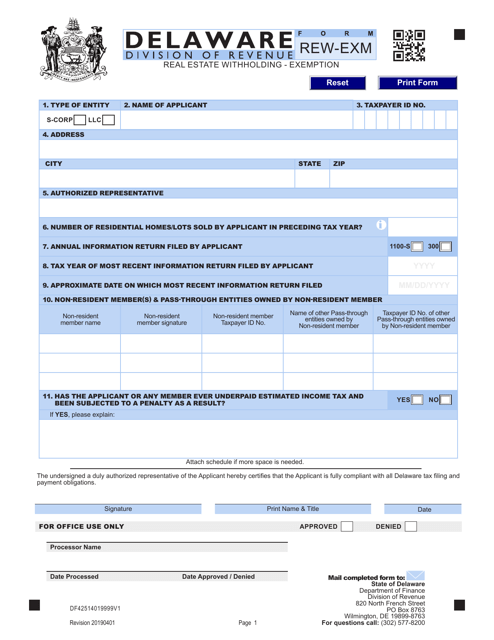

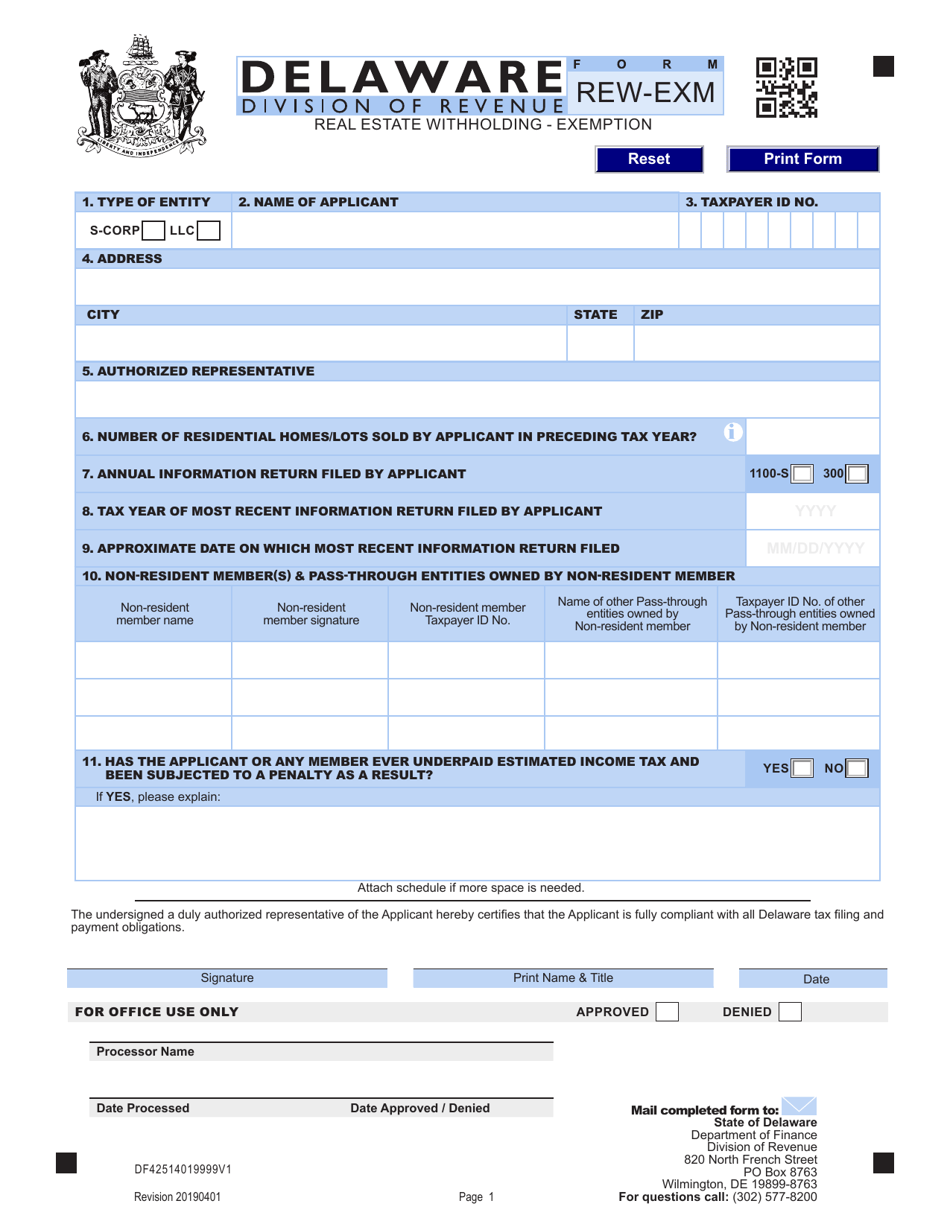

Form REW-EXM Real Estate Withholding - Exemption - Delaware

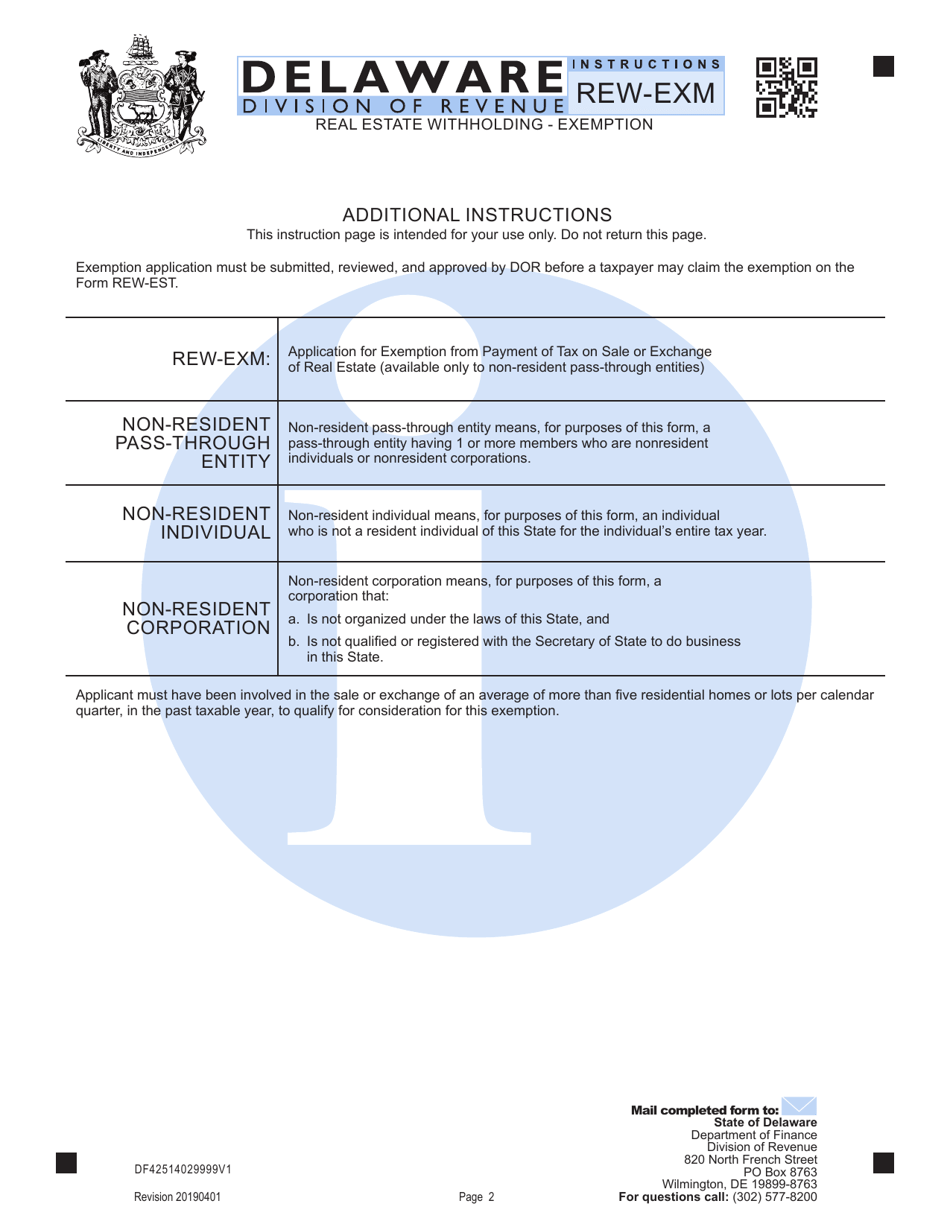

What Is Form REW-EXM?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REW-EXM?

A: The Form REW-EXM is a form used for real estate withholding exemption in Delaware.

Q: What is real estate withholding?

A: Real estate withholding is when a portion of the seller's proceeds from the sale of real property is withheld and remitted to the state.

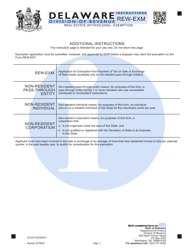

Q: Who needs to file Form REW-EXM?

A: The seller of real property in Delaware may need to file Form REW-EXM to claim an exemption from real estate withholding.

Q: How do I determine if I qualify for an exemption?

A: You need to review the instructions on the Form REW-EXM to determine if you meet the qualifications for an exemption.

Q: When should I file Form REW-EXM?

A: Form REW-EXM should be filed with the settlement agent prior to the closing of the real estate transaction.

Q: What happens if I don't file Form REW-EXM?

A: If you don't file Form REW-EXM or qualify for an exemption, the settlement agent may be required to withhold a portion of your proceeds and remit it to the state.

Q: Can I file Form REW-EXM after the closing of the transaction?

A: It is recommended to file Form REW-EXM prior to the closing of the real estate transaction, but you may still be able to file it after the closing.

Q: Do I need to file Form REW-EXM for every real estate transaction?

A: Yes, you need to file Form REW-EXM for each individual real estate transaction in Delaware.

Form Details:

- Released on April 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-EXM by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.