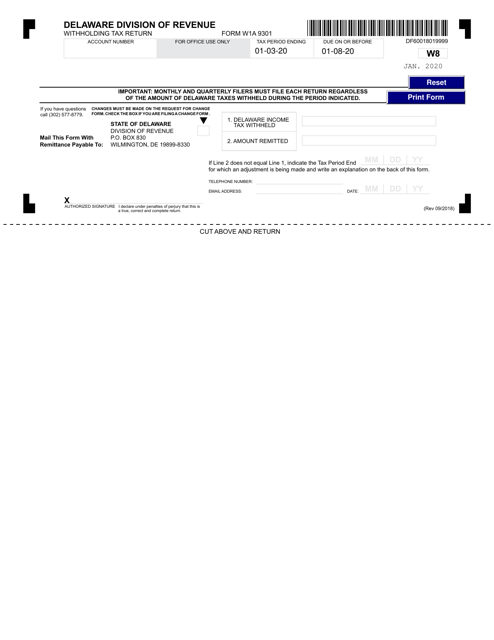

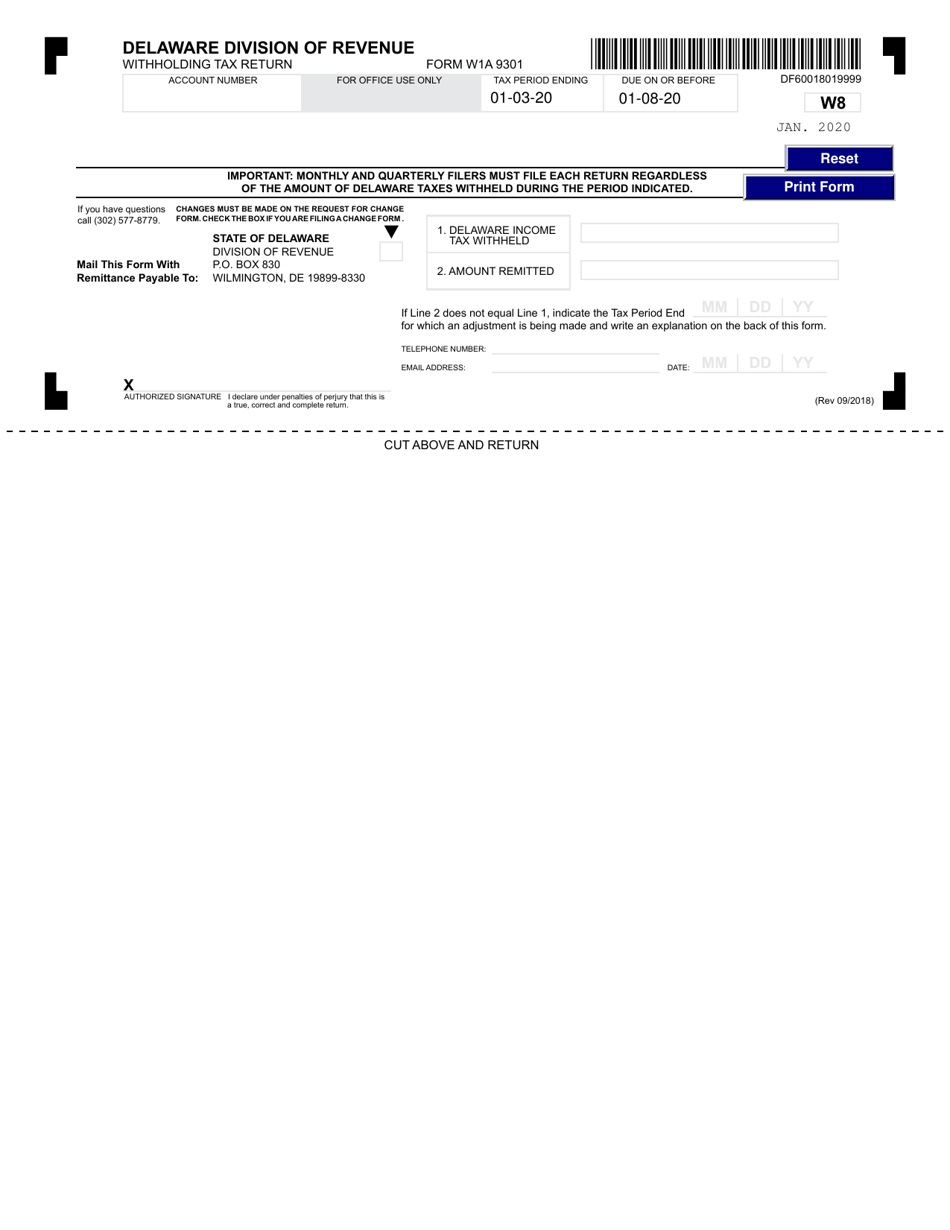

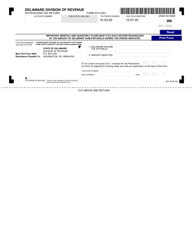

Form W1A 9301 Withholding Tax Return - January - Delaware

What Is Form W1A 9301?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W1A 9301?

A: Form W1A 9301 is the Withholding Tax Return for the state of Delaware.

Q: What is the purpose of Form W1A 9301?

A: The purpose of Form W1A 9301 is to report and remit withholding taxes withheld from employee wages to the state of Delaware.

Q: When is Form W1A 9301 due?

A: Form W1A 9301 is due on a monthly basis, with the due date being the 20th day of the following month.

Q: Who is required to file Form W1A 9301?

A: Employers who have withheld Delaware income tax from employee wages are required to file Form W1A 9301.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W1A 9301 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.