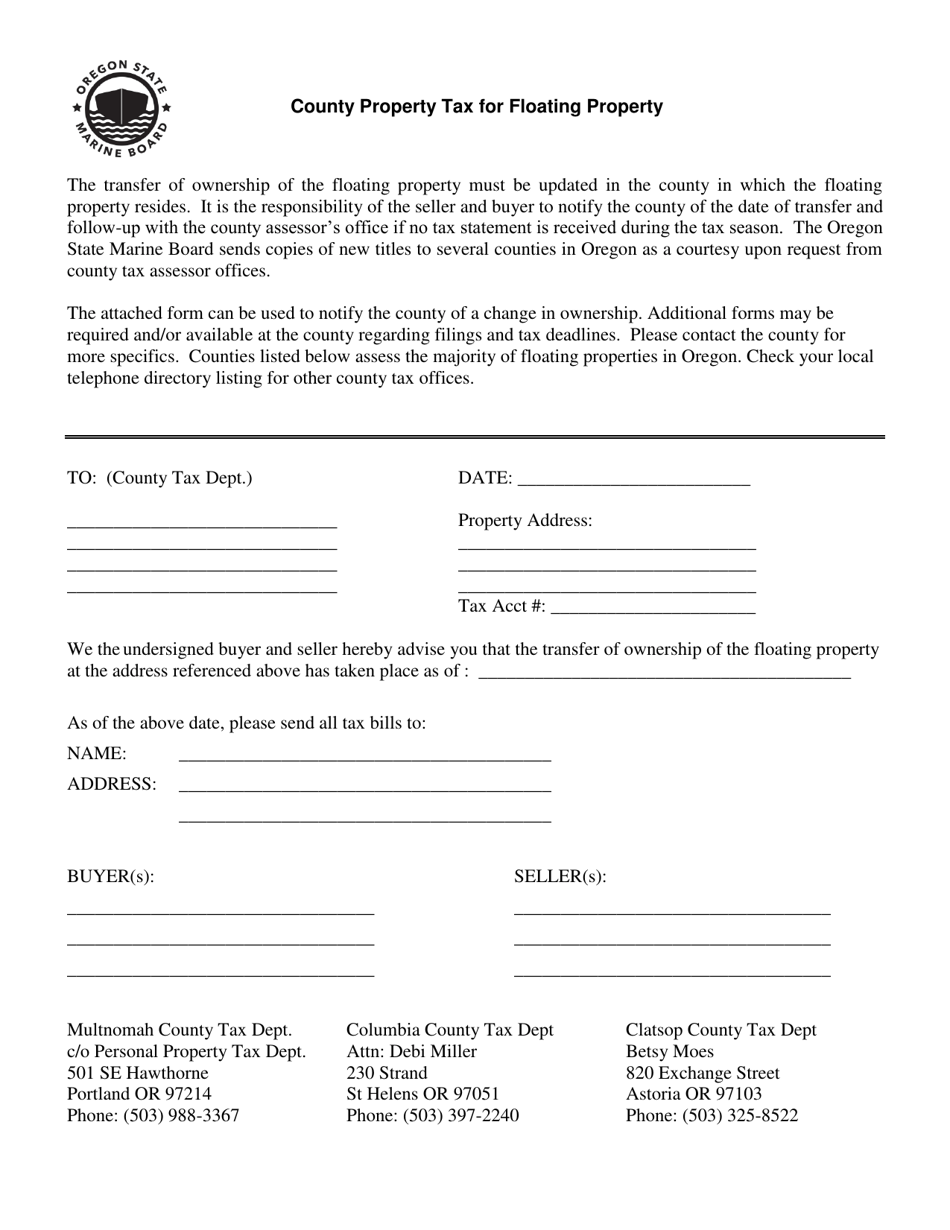

County Property Tax for Floating Property - Oregon

County Property Tax for Floating Property is a legal document that was released by the Oregon State Marine Board - a government authority operating within Oregon.

FAQ

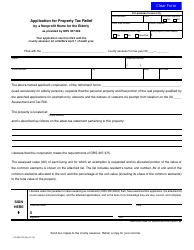

Q: What is county property tax?

A: County property tax is a tax imposed on real property by the county government in Oregon.

Q: What is considered floating property?

A: Floating property refers to any property that is not permanently affixed to land, such as houseboats, floating docks, or floating homes.

Q: How is county property tax calculated for floating property in Oregon?

A: County property tax for floating property in Oregon is calculated based on its assessed value, which is determined by the county assessor's office.

Q: How often is county property tax assessed for floating property in Oregon?

A: County property tax for floating property in Oregon is assessed annually.

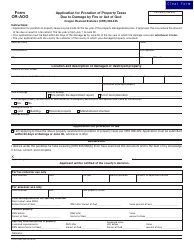

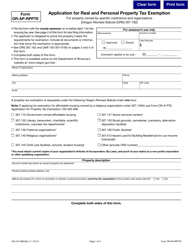

Q: Are there any exemptions or deductions available for floating property owners in Oregon?

A: In Oregon, there are no specific exemptions or deductions available exclusively for floating property owners. However, general property tax exemptions and deductions may apply depending on individual circumstances.

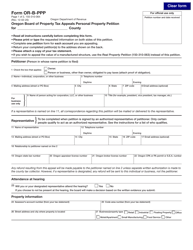

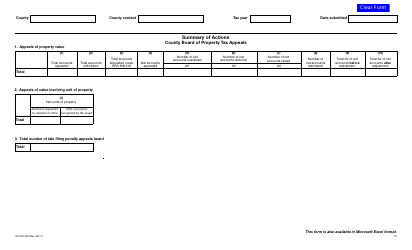

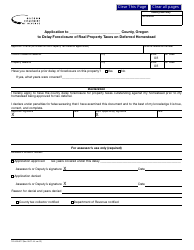

Q: Can I appeal my county property tax assessment for my floating property in Oregon?

A: Yes, you have the right to appeal your county property tax assessment for your floating property in Oregon. Contact your county assessor's office for more information on the appeals process.

Q: How are county property tax funds used in Oregon?

A: County property tax funds in Oregon are used to support various local government services, such as schools, public safety, infrastructure, and other community programs.

Q: Can county property tax rates for floating property vary across different counties in Oregon?

A: Yes, county property tax rates can vary across different counties in Oregon. Each county sets its own property tax rates based on local budget and funding needs.

Q: Are there any discounts or credits available for paying county property tax on floating property in Oregon?

A: There are no specific discounts or credits available for paying county property tax on floating property in Oregon. However, timely payment may help avoid penalties or interest charges.

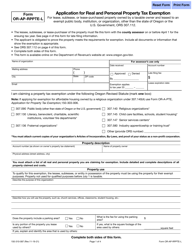

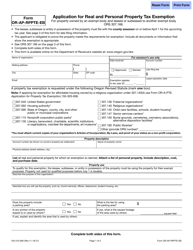

Form Details:

- The latest edition currently provided by the Oregon State Marine Board;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon State Marine Board.