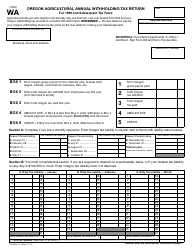

This version of the form is not currently in use and is provided for reference only. Download this version of

Form WA (150-206-013-1)

for the current year.

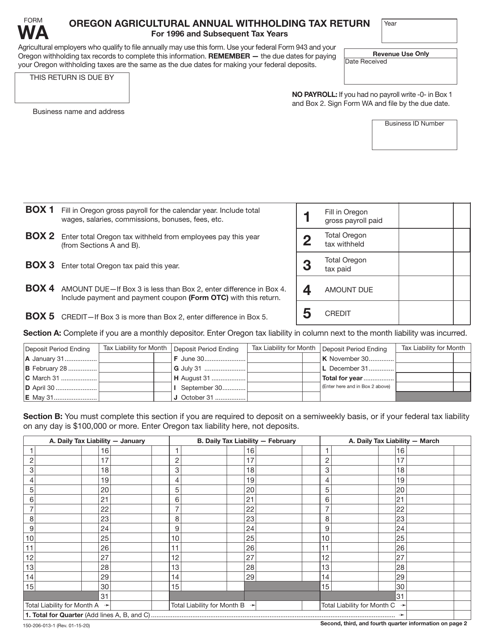

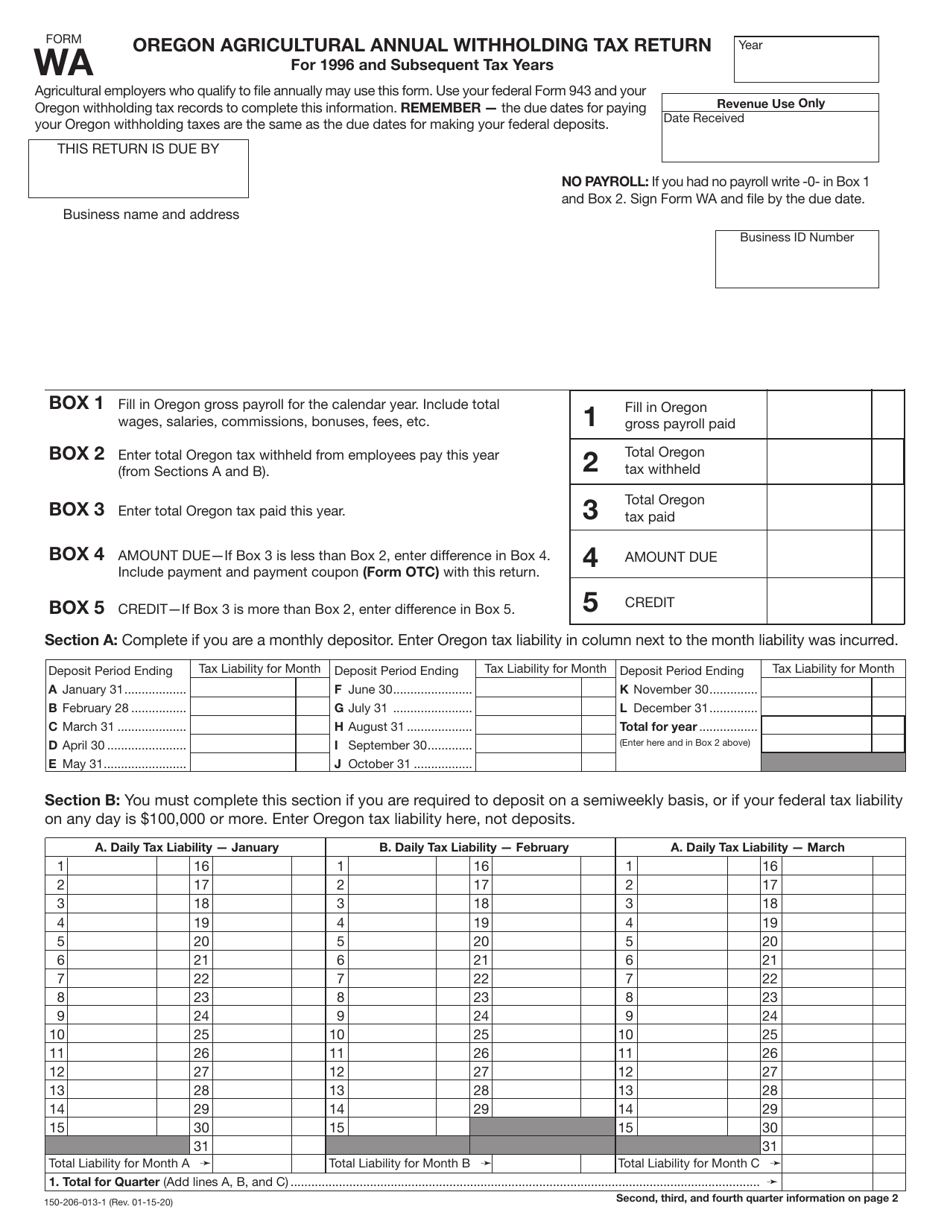

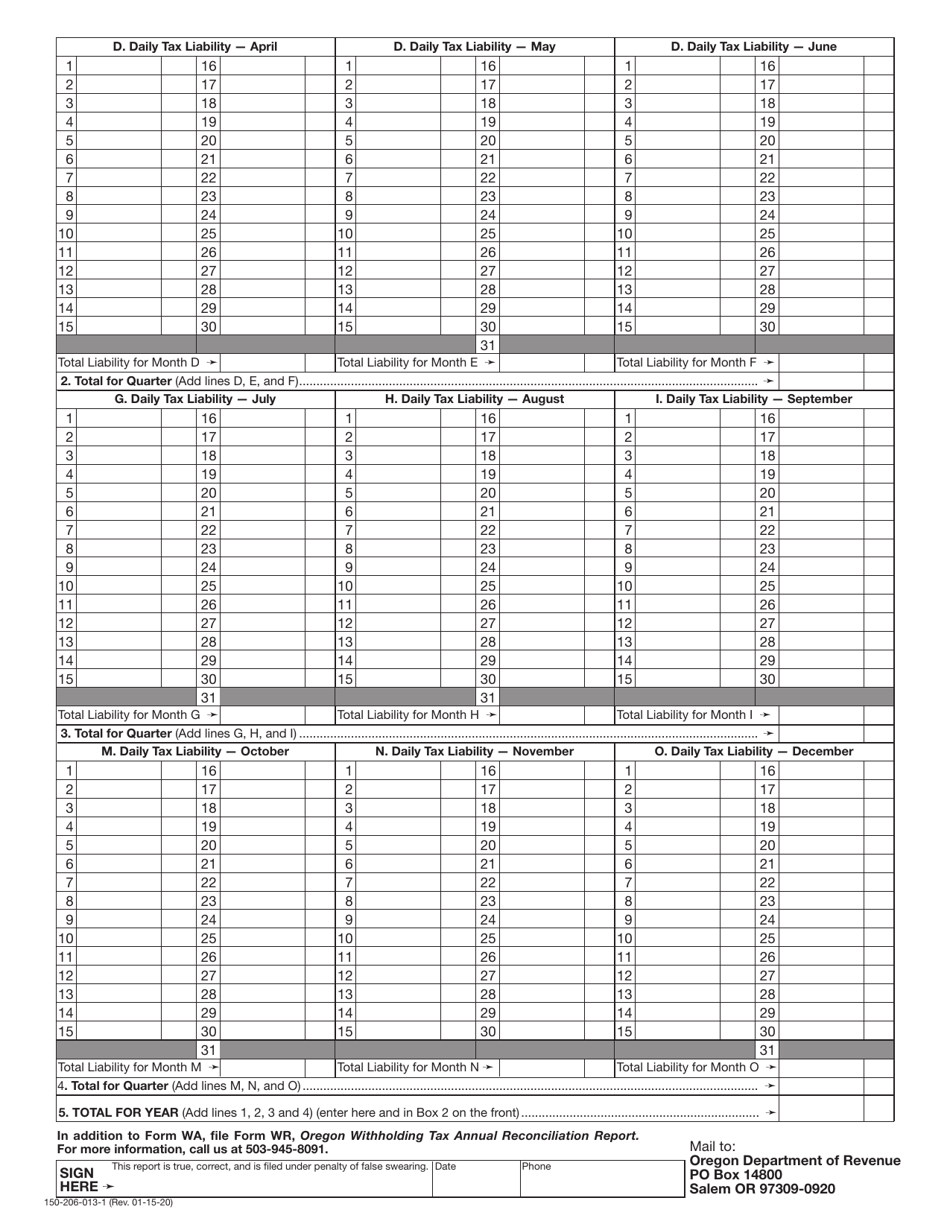

Form WA (150-206-013-1) Oregon Agricultural Annual Withholding Tax Return - Oregon

What Is Form WA (150-206-013-1)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WA (150-206-013-1)?

A: Form WA (150-206-013-1) is the Oregon Agricultural Annual Withholding Tax Return.

Q: Who needs to file Form WA (150-206-013-1)?

A: Farmers or agricultural employers in Oregon who have employees and need to withhold income taxes from their wages must file Form WA (150-206-013-1).

Q: What is the purpose of Form WA (150-206-013-1)?

A: The purpose of Form WA (150-206-013-1) is to report and remit the withheld income taxes from agricultural employee wages in Oregon.

Q: When is Form WA (150-206-013-1) due?

A: Form WA (150-206-013-1) is due annually on or before January 31st of the following year.

Form Details:

- Released on January 15, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WA (150-206-013-1) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.