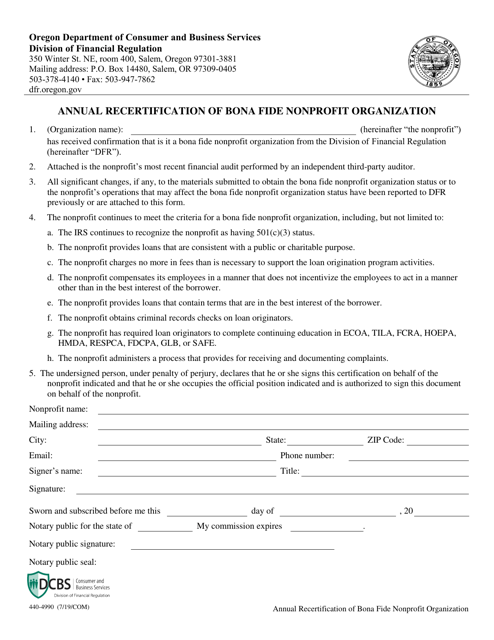

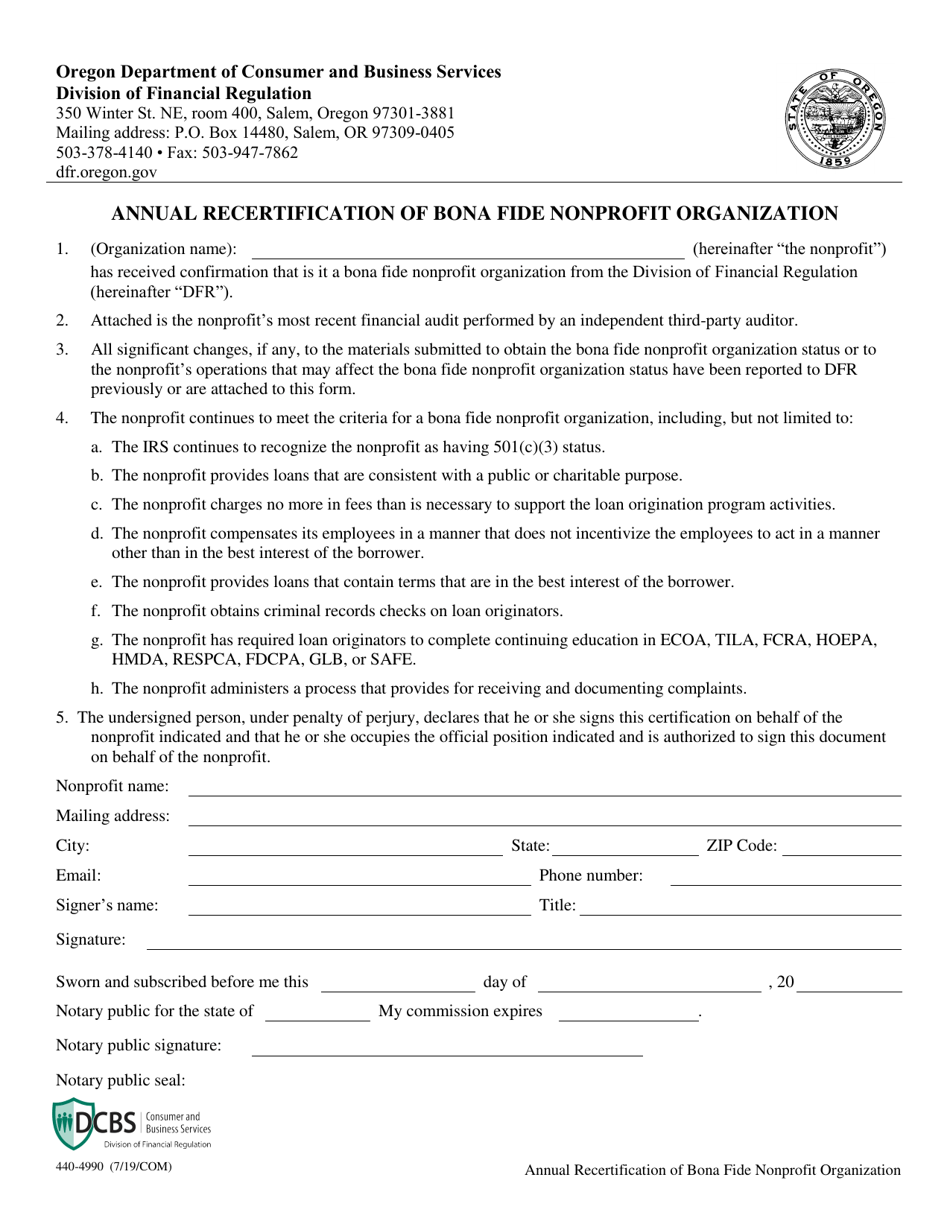

Form 440-4990 Annual Recertification of Bona Fide Nonprofit Organization - Oregon

What Is Form 440-4990?

This is a legal form that was released by the Oregon Department of Consumer and Business Services - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440-4990?

A: Form 440-4990 is the Annual Recertification of Bona Fide Nonprofit Organization in Oregon.

Q: Who needs to file Form 440-4990?

A: Bona fidenonprofit organizations in Oregon need to file Form 440-4990.

Q: What is the purpose of filing Form 440-4990?

A: The purpose of filing Form 440-4990 is to annually recertify the status of a nonprofit organization in Oregon.

Q: When is the deadline to file Form 440-4990?

A: The deadline to file Form 440-4990 is determined by the Oregon Department of Revenue and can vary each year.

Q: Are there any fees associated with filing Form 440-4990?

A: No, there are no fees associated with filing Form 440-4990.

Q: What information is required on Form 440-4990?

A: Form 440-4990 requires information such as the organization's name, address, federal tax identification number, and a declaration of its nonprofit status.

Q: What happens if I fail to file Form 440-4990?

A: Failure to file Form 440-4990 may result in the loss of the organization's nonprofit status in Oregon.

Q: Can I file Form 440-4990 if my organization is not based in Oregon?

A: No, Form 440-4990 is specifically for nonprofit organizations based in Oregon.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Oregon Department of Consumer and Business Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 440-4990 by clicking the link below or browse more documents and templates provided by the Oregon Department of Consumer and Business Services.