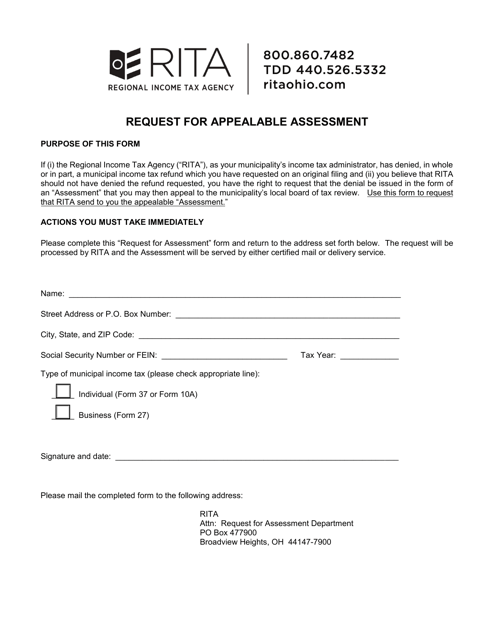

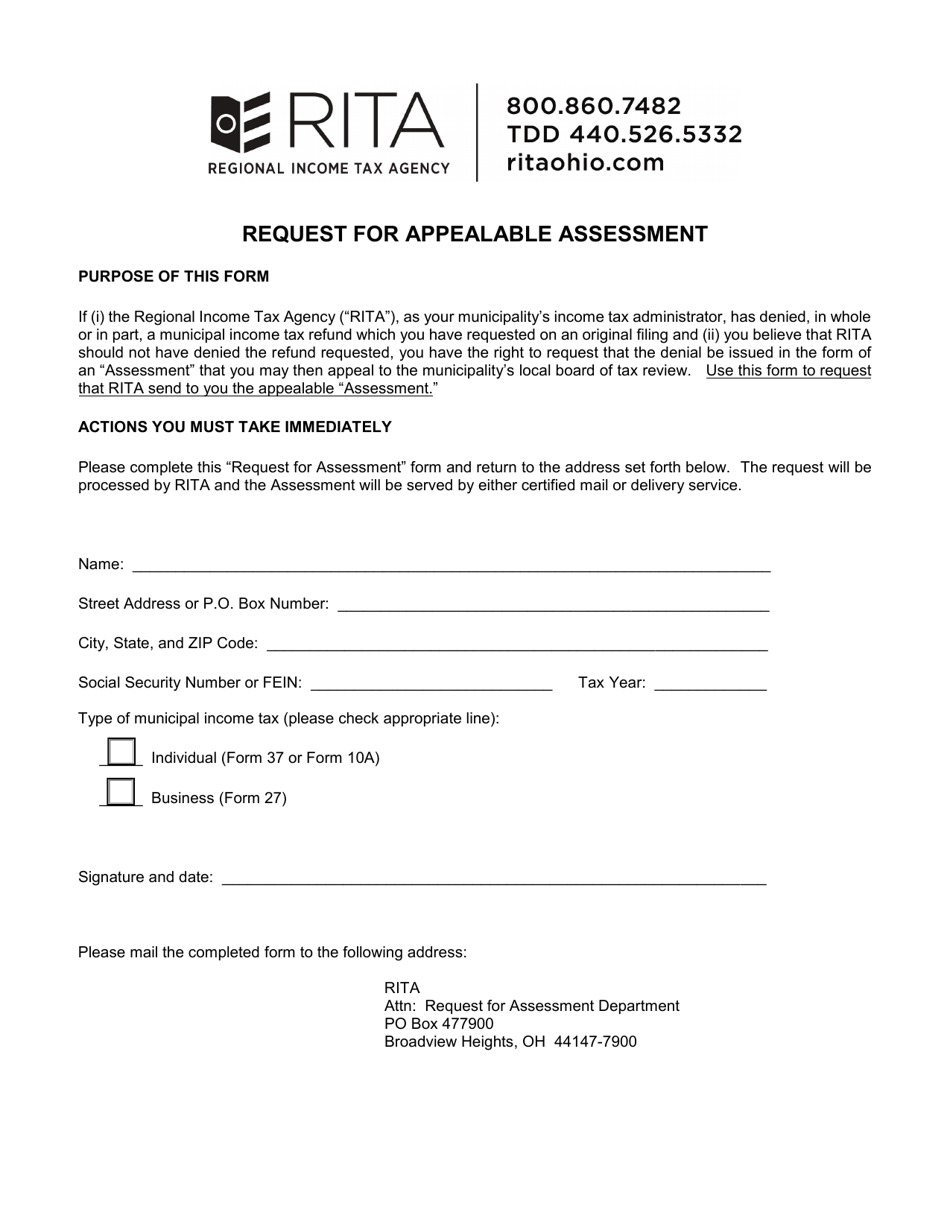

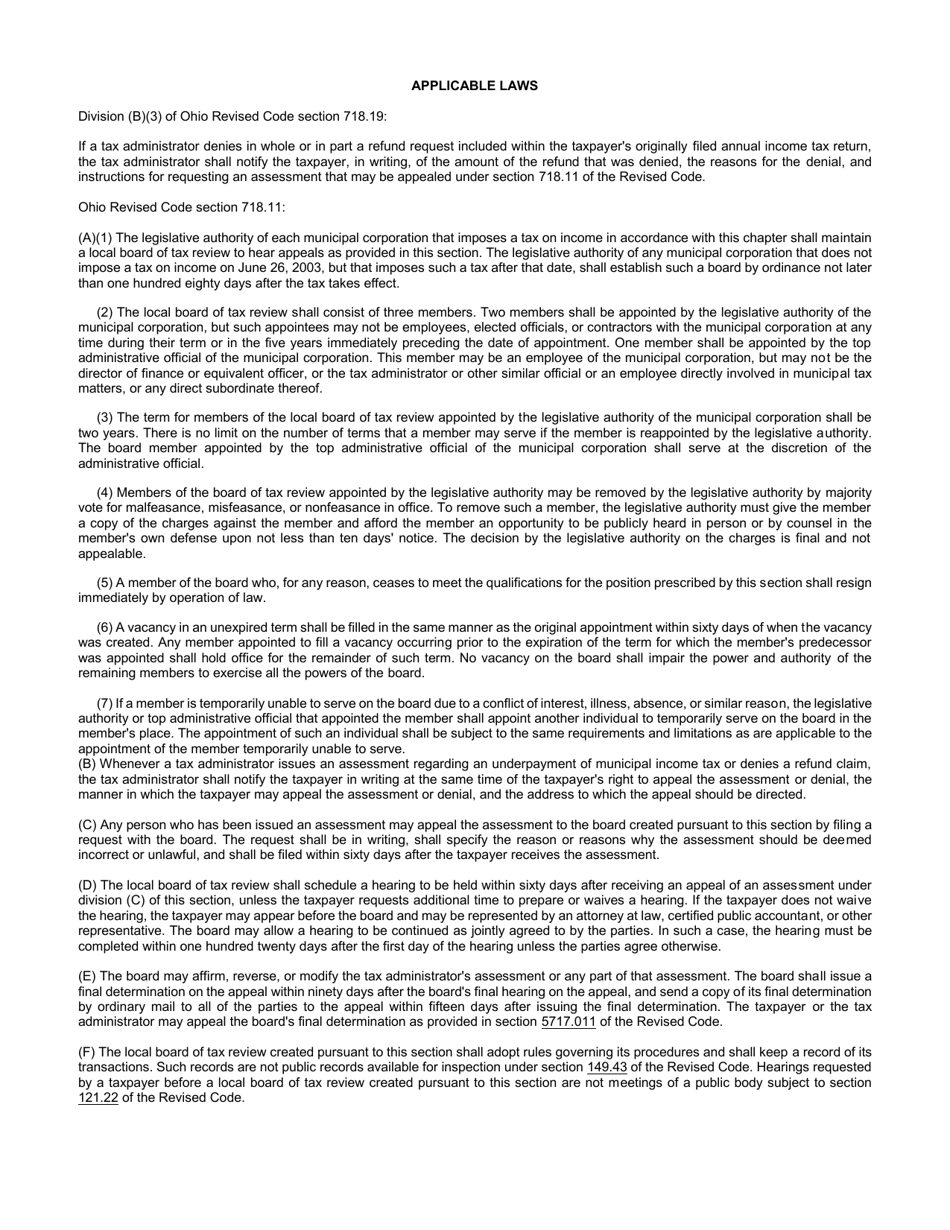

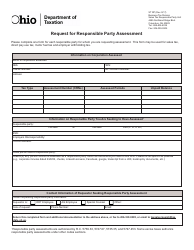

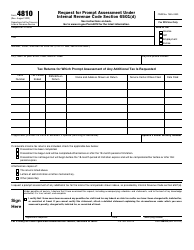

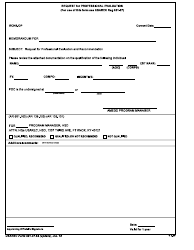

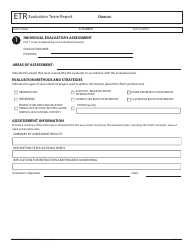

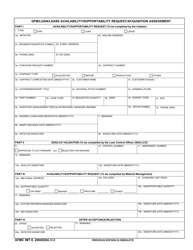

Request for Appealable Assessment - Ohio

Request for Appealable Assessment is a legal document that was released by the Ohio Regional Income Tax Agency (RITA) - a government authority operating within Ohio.

FAQ

Q: What is an Appealable Assessment?

A: An Appealable Assessment is a formal notice from the State of Ohio indicating that you owe taxes, and you have the right to appeal the assessment.

Q: How do I know if I received an Appealable Assessment in Ohio?

A: You will receive a formal notice from the State of Ohio indicating the amount of taxes owed and providing information on how to appeal the assessment.

Q: Can I appeal an Appealable Assessment in Ohio?

A: Yes, you have the right to appeal an Appealable Assessment in Ohio.

Q: How do I appeal an Appealable Assessment in Ohio?

A: To appeal an Appealable Assessment in Ohio, you need to follow the instructions provided in the notice you received and file a formal appeal with the appropriate Ohio tax authority.

Q: Is there a deadline for appealing an Appealable Assessment in Ohio?

A: Yes, there is a deadline for appealing an Appealable Assessment in Ohio. The deadline is typically stated in the notice you received, and it is important to adhere to it.

Q: What happens if I successfully appeal an Appealable Assessment in Ohio?

A: If you successfully appeal an Appealable Assessment in Ohio, the assessment may be reduced or eliminated, resulting in a lower or no tax obligation.

Q: What happens if I do not appeal an Appealable Assessment in Ohio?

A: If you do not appeal an Appealable Assessment in Ohio, the assessment will stand and you will be required to pay the taxes owed.

Q: Can I get help with appealing an Appealable Assessment in Ohio?

A: Yes, there are resources available to help you with appealing an Appealable Assessment in Ohio, such as contacting the Ohio Department of Taxation or consulting with a tax professional.

Form Details:

- The latest edition currently provided by the Ohio Regional Income Tax Agency (RITA);

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Regional Income Tax Agency (RITA).