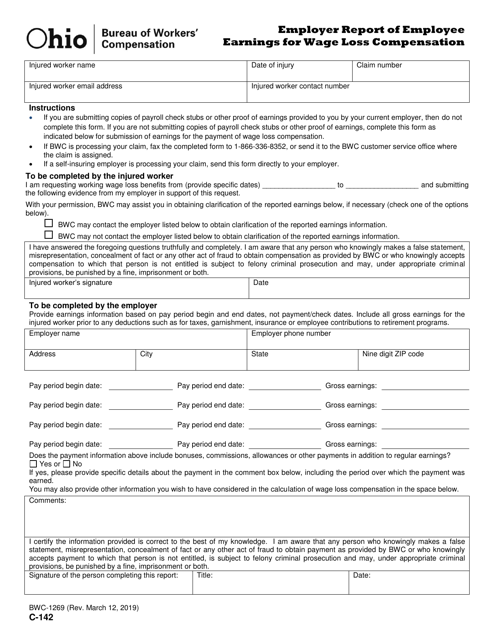

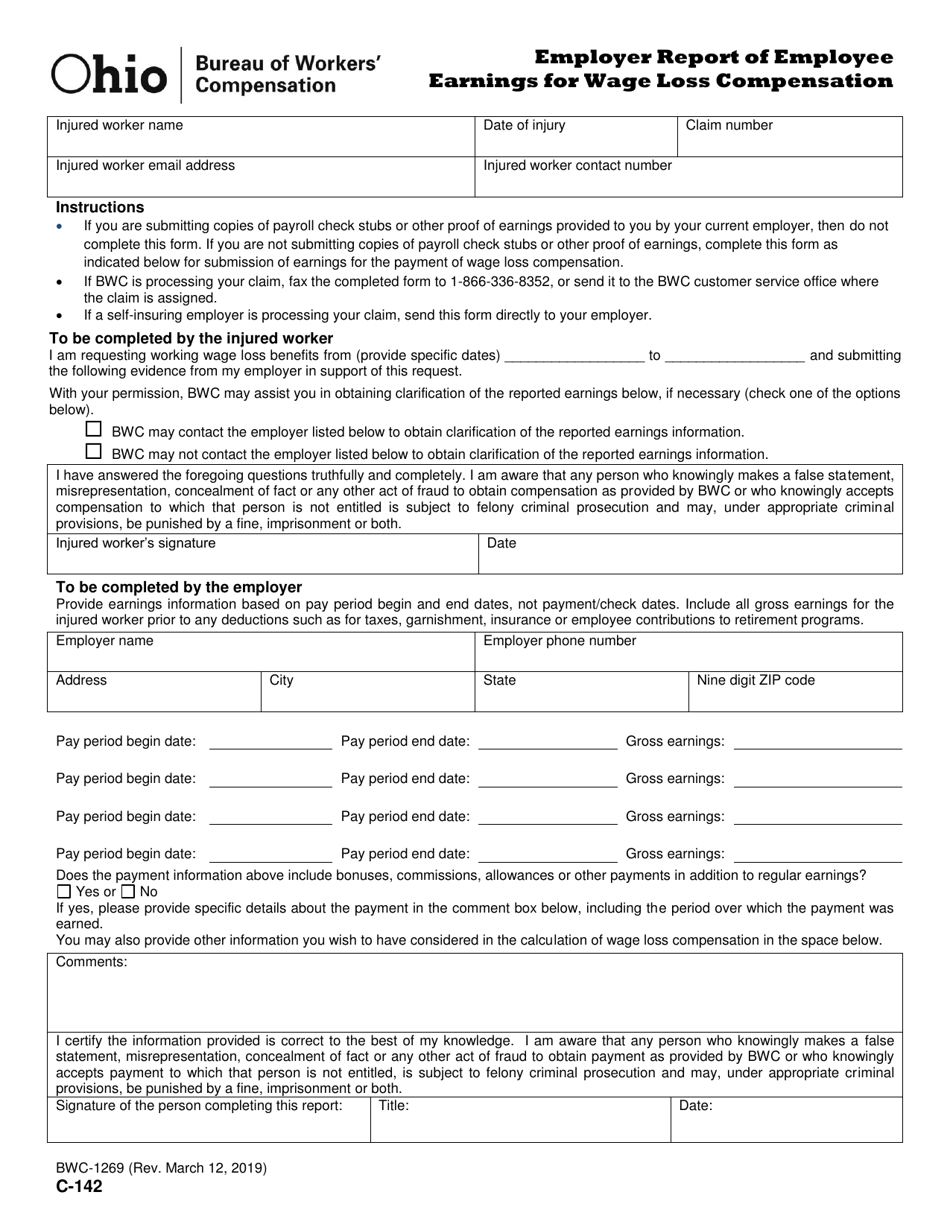

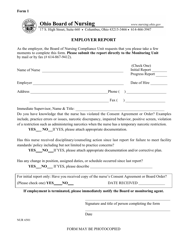

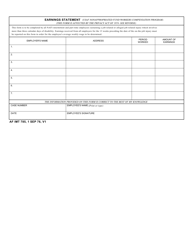

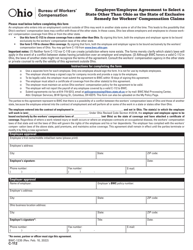

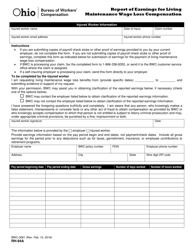

Form C-142 (BWC-1269) Employer Report of Employee Earnings for Wage Loss Compensation - Ohio

What Is Form C-142 (BWC-1269)?

This is a legal form that was released by the Ohio Bureau of Workers' Compensation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-142 (BWC-1269)?

A: Form C-142 (BWC-1269) is the Employer Report of Employee Earnings for Wage Loss Compensation in Ohio.

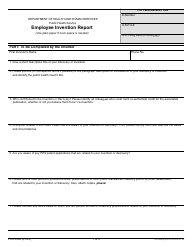

Q: Who needs to fill out Form C-142 (BWC-1269)?

A: Employers in Ohio need to fill out Form C-142 (BWC-1269).

Q: What is the purpose of Form C-142 (BWC-1269)?

A: The purpose of Form C-142 (BWC-1269) is to report employee earnings for wage loss compensation purposes in Ohio.

Q: How often do I need to submit Form C-142 (BWC-1269)?

A: Form C-142 (BWC-1269) should be submitted quarterly, within 30 days after the end of each calendar quarter.

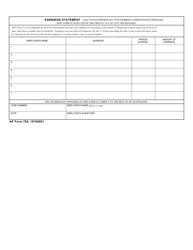

Q: What information do I need to provide on Form C-142 (BWC-1269)?

A: You need to provide details about your employees' earnings, including their name, social security number, earnings period, total gross wages, and any wage deductions.

Q: What happens if I don't submit Form C-142 (BWC-1269) on time?

A: Failure to submit Form C-142 (BWC-1269) on time may result in penalties or delays in processing wage loss compensation claims.

Q: Can I request an extension to submit Form C-142 (BWC-1269)?

A: Yes, you can request an extension to submit Form C-142 (BWC-1269) by contacting the Ohio BWC.

Q: Are there any fees associated with submitting Form C-142 (BWC-1269)?

A: No, there are no fees associated with submitting Form C-142 (BWC-1269).

Form Details:

- Released on March 12, 2019;

- The latest edition provided by the Ohio Bureau of Workers' Compensation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form C-142 (BWC-1269) by clicking the link below or browse more documents and templates provided by the Ohio Bureau of Workers' Compensation.