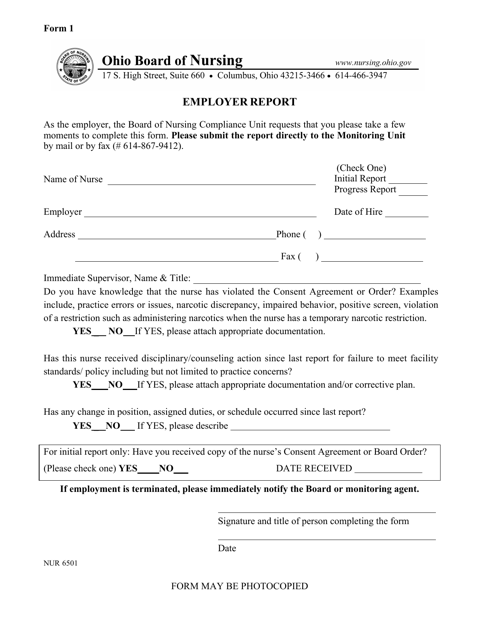

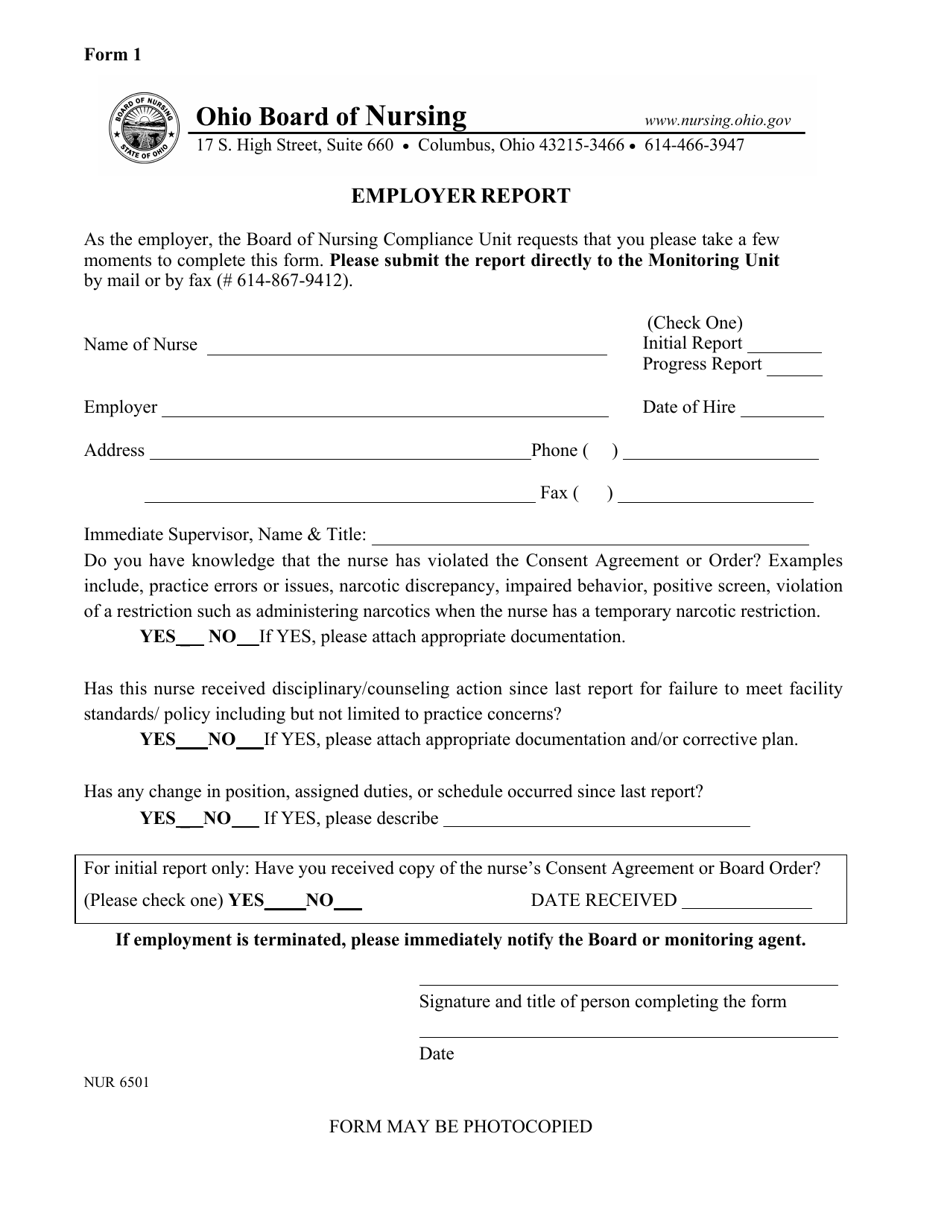

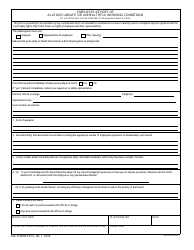

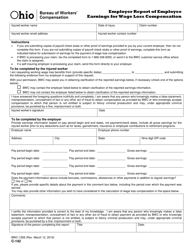

Form 1 Employer Report - Ohio

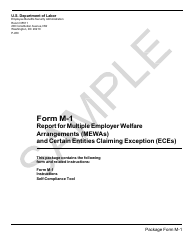

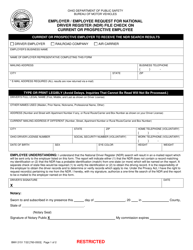

What Is Form 1?

This is a legal form that was released by the Ohio Board of Nursing - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

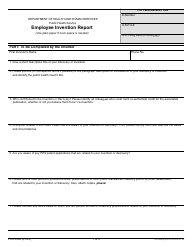

Q: What is Form 1 Employer Report?

A: Form 1 Employer Report is a document used by employers in Ohio to report their employees' wages and tax withholdings.

Q: Who needs to file Form 1 Employer Report?

A: All employers in Ohio need to file Form 1 Employer Report.

Q: What information is required on Form 1 Employer Report?

A: Form 1 Employer Report requires information about the employer, employee wages, and tax withholdings.

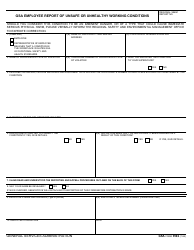

Q: When is the deadline to file Form 1 Employer Report?

A: The deadline to file Form 1 Employer Report is the last day of February.

Q: How can Form 1 Employer Report be filed?

A: Form 1 Employer Report can be filed electronically or by mail.

Q: Are there any penalties for not filing Form 1 Employer Report?

A: Yes, there are penalties for not filing Form 1 Employer Report, including monetary fines.

Q: Are there any exceptions to filing Form 1 Employer Report?

A: There may be exceptions to filing Form 1 Employer Report for certain types of employers, but it is best to consult with the Ohio Department of Taxation for specific information.

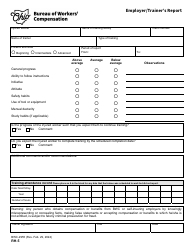

Q: What should I do if I made a mistake on my Form 1 Employer Report?

A: If you made a mistake on your Form 1 Employer Report, you should contact the Ohio Department of Taxation for guidance on how to correct the error.

Q: Can I request an extension to file Form 1 Employer Report?

A: Yes, you can request an extension to file Form 1 Employer Report, but it must be done in writing and approved by the Ohio Department of Taxation.

Q: Do I need to provide copies of Form 1 Employer Report to my employees?

A: No, you do not need to provide copies of Form 1 Employer Report to your employees.

Form Details:

- The latest edition provided by the Ohio Board of Nursing;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 1 by clicking the link below or browse more documents and templates provided by the Ohio Board of Nursing.