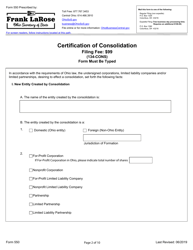

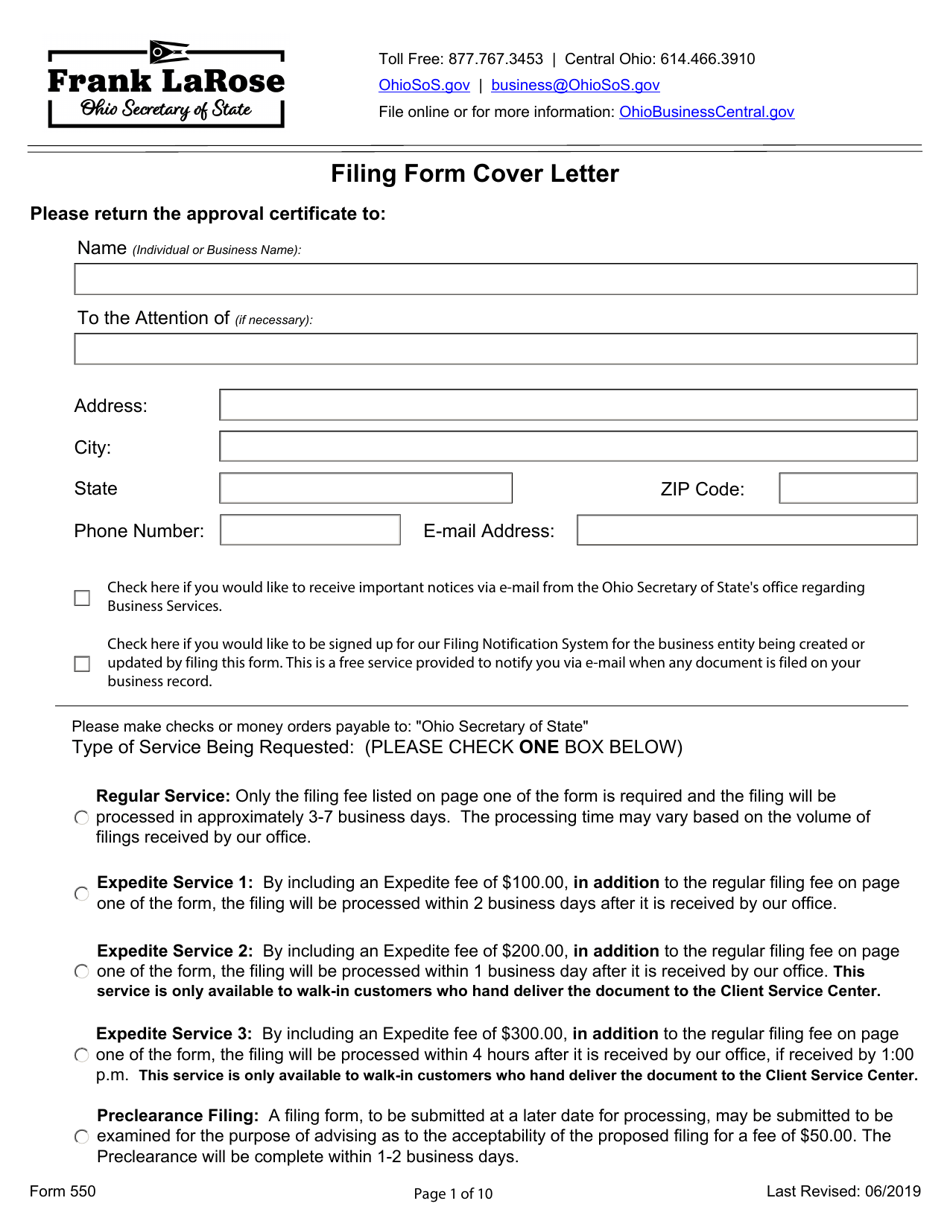

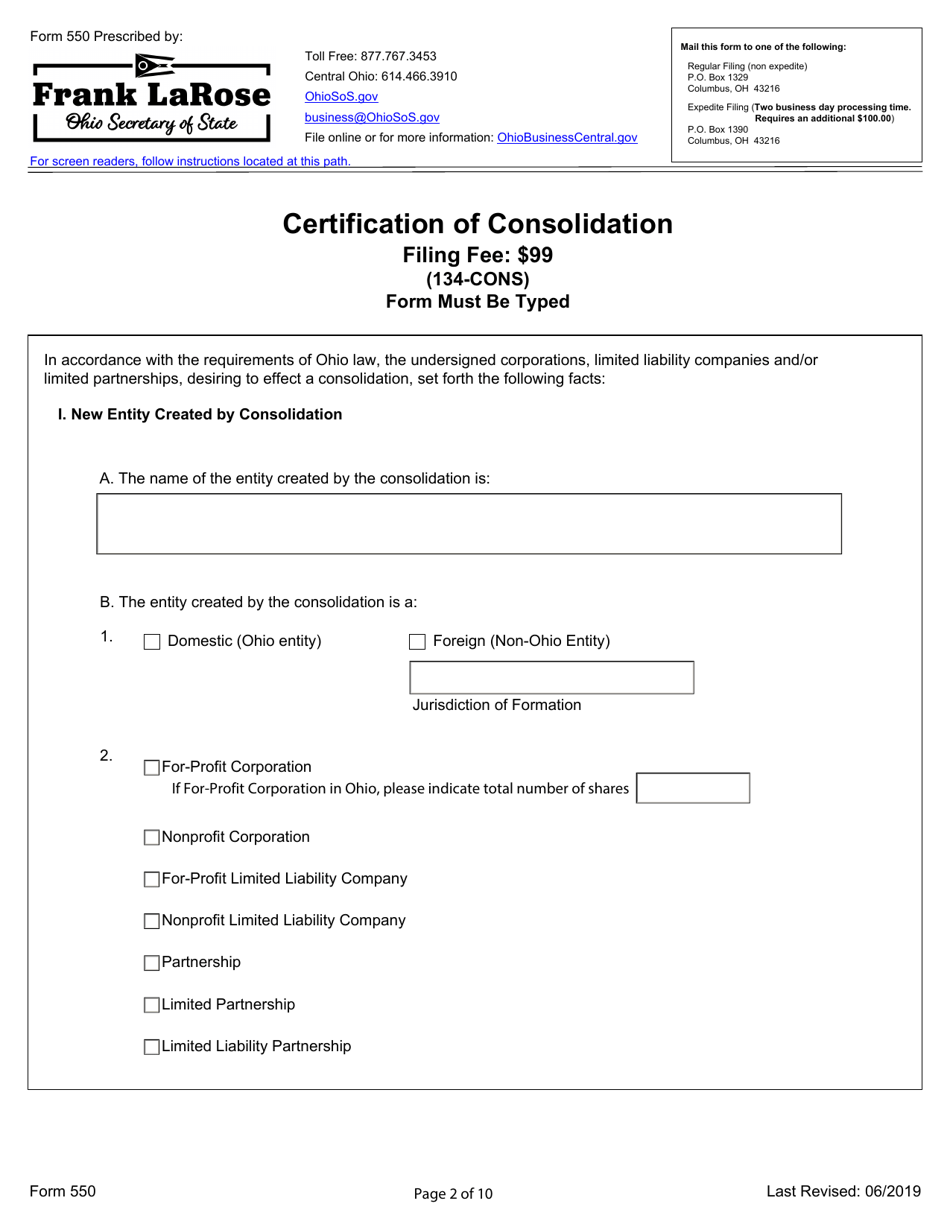

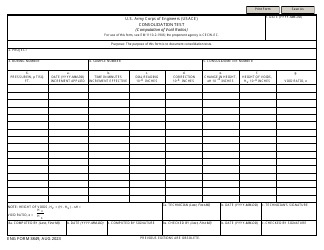

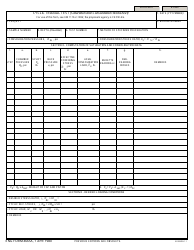

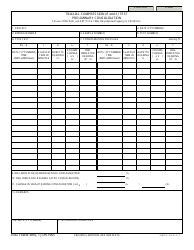

Form 550 Certification of Consolidation - Ohio

What Is Form 550?

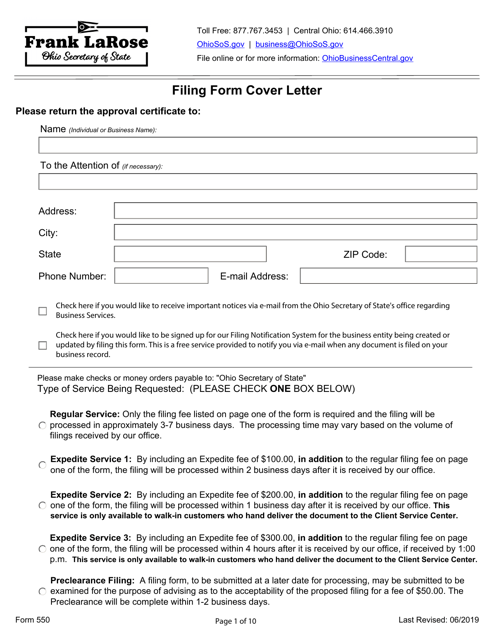

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 550?

A: Form 550 is a Certification of Consolidation form used in Ohio.

Q: What is the purpose of Form 550?

A: The purpose of Form 550 is to certify the consolidation of entities in Ohio.

Q: Who needs to file Form 550?

A: Entities in Ohio that have consolidated need to file Form 550.

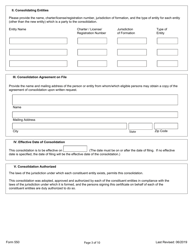

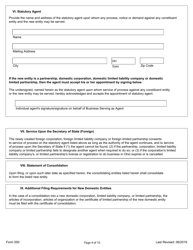

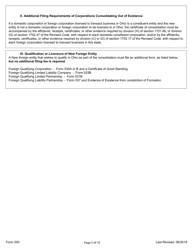

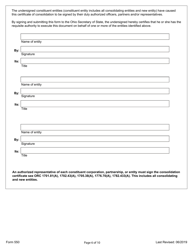

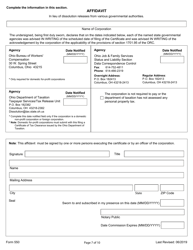

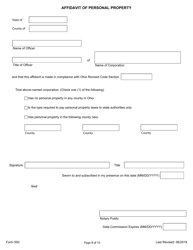

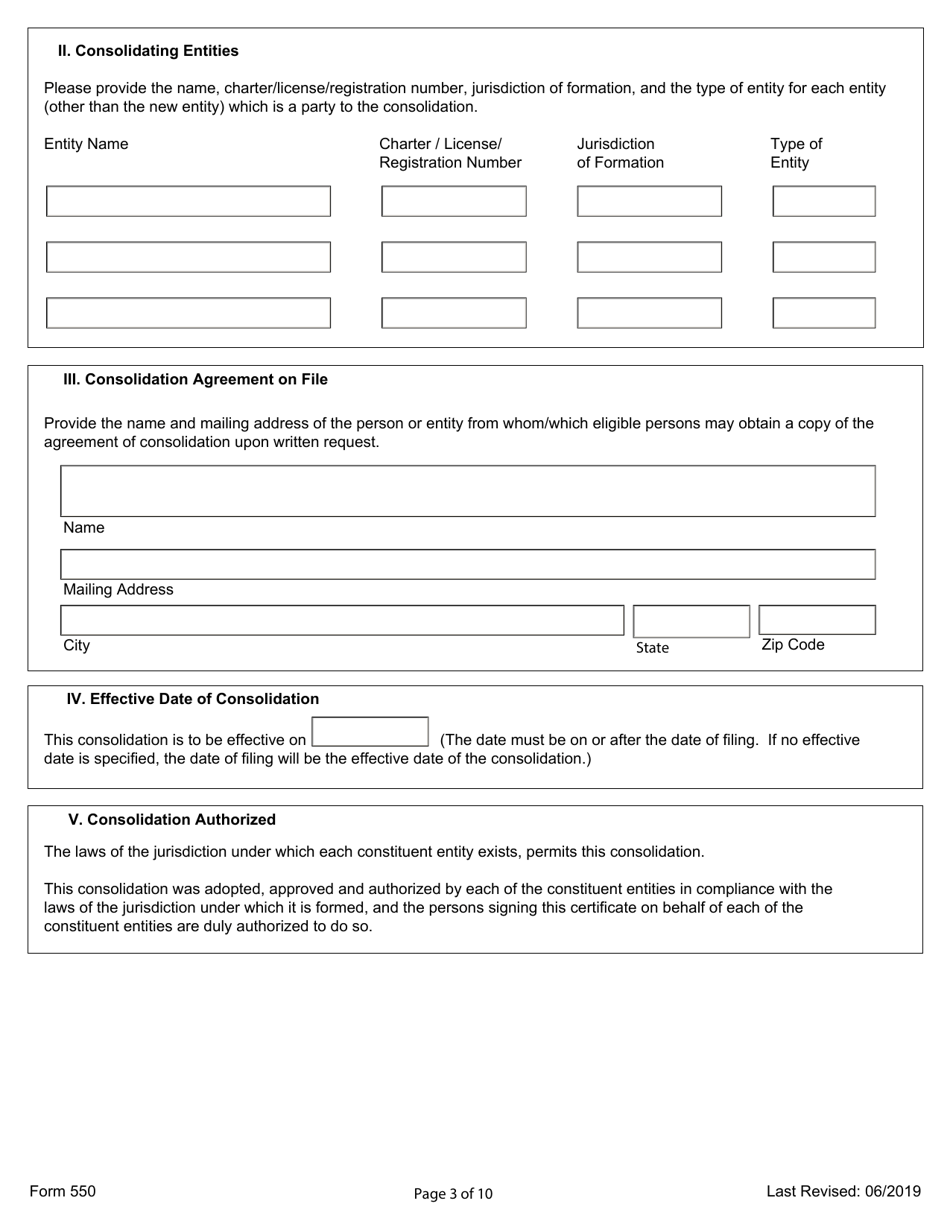

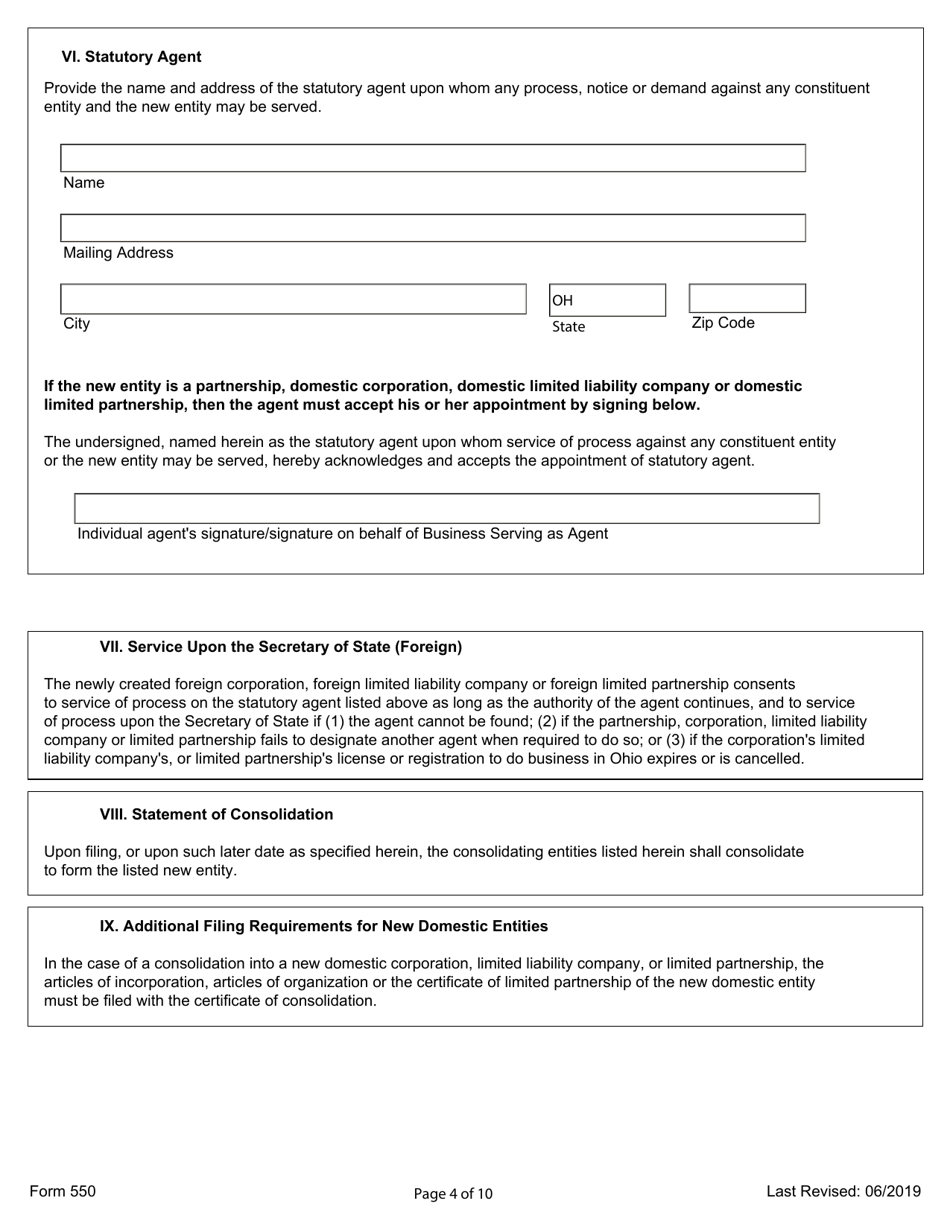

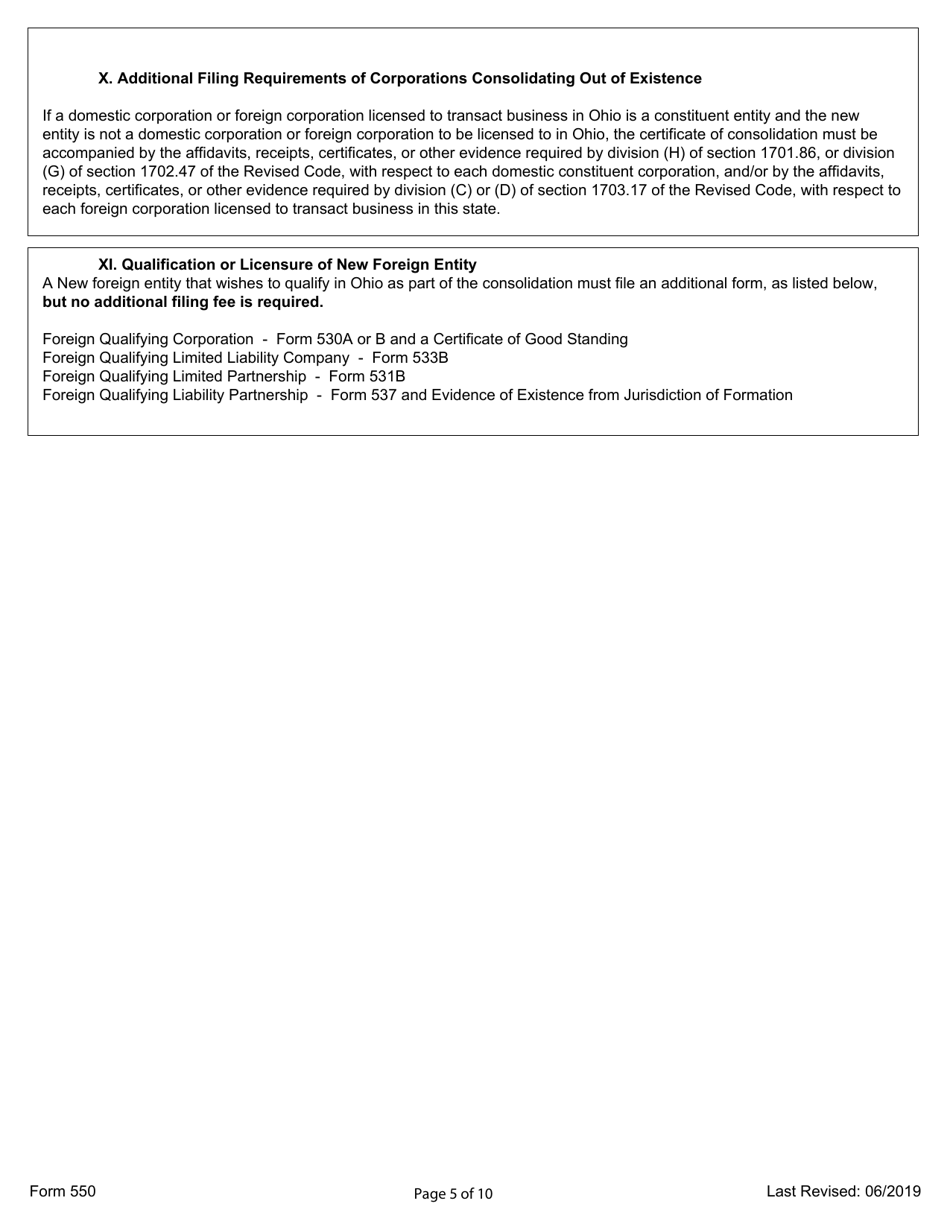

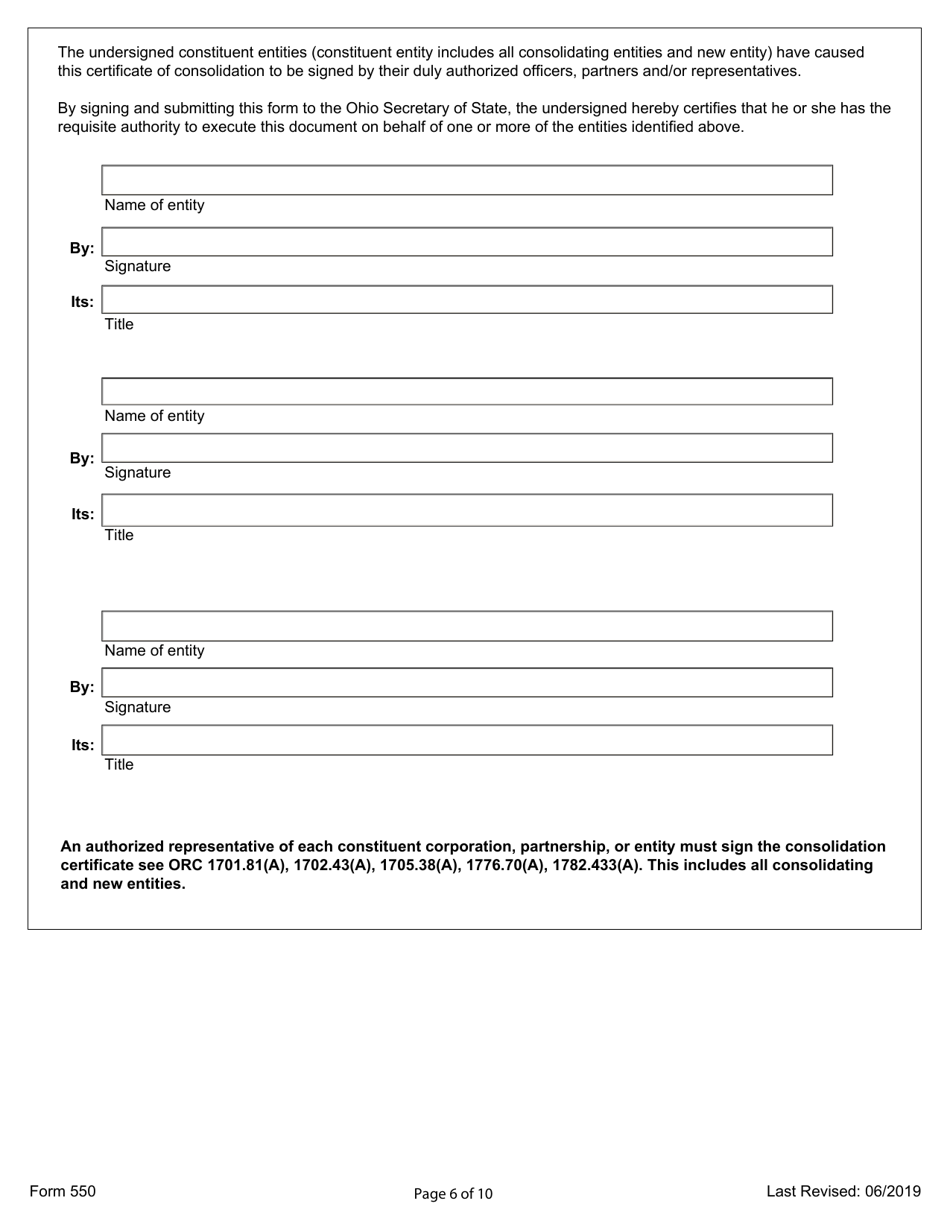

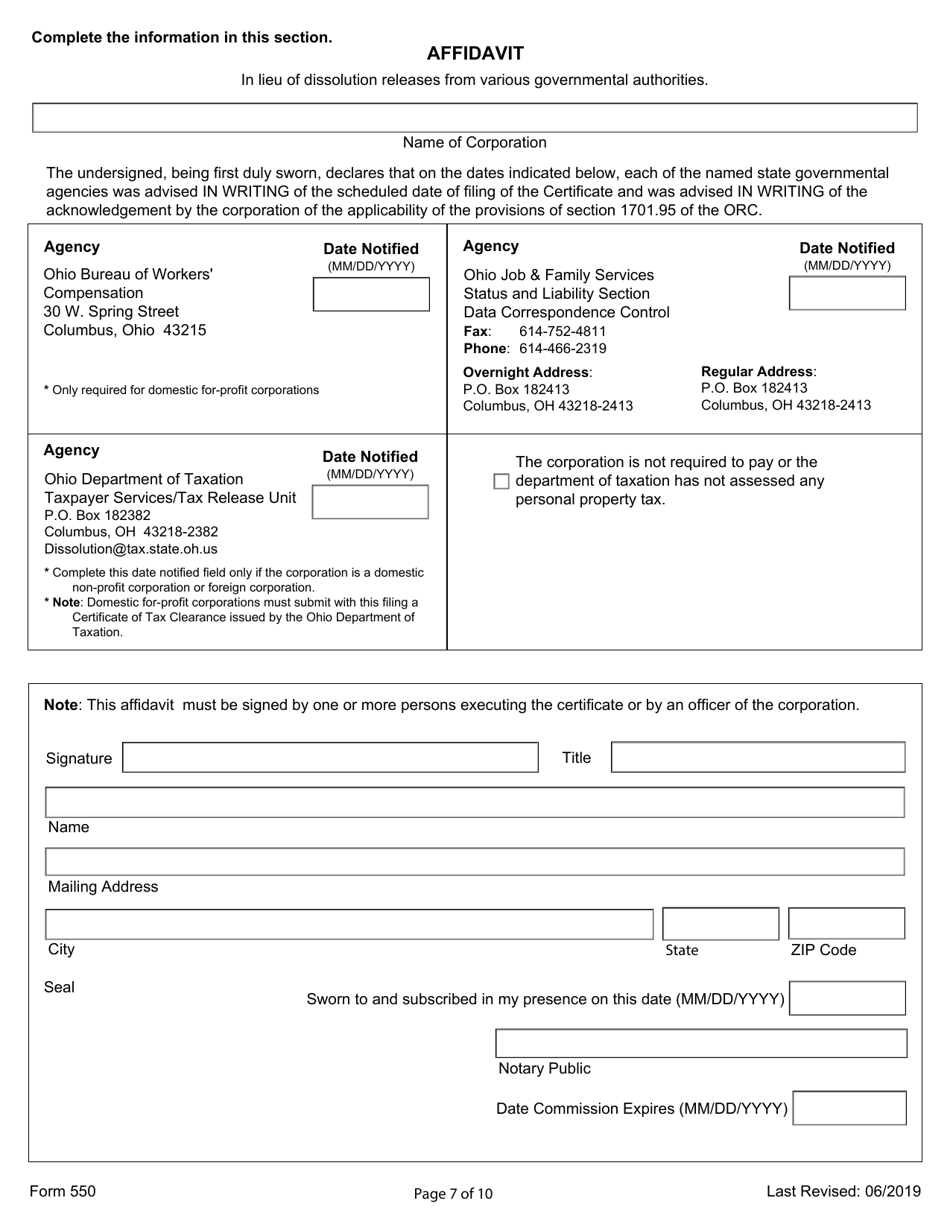

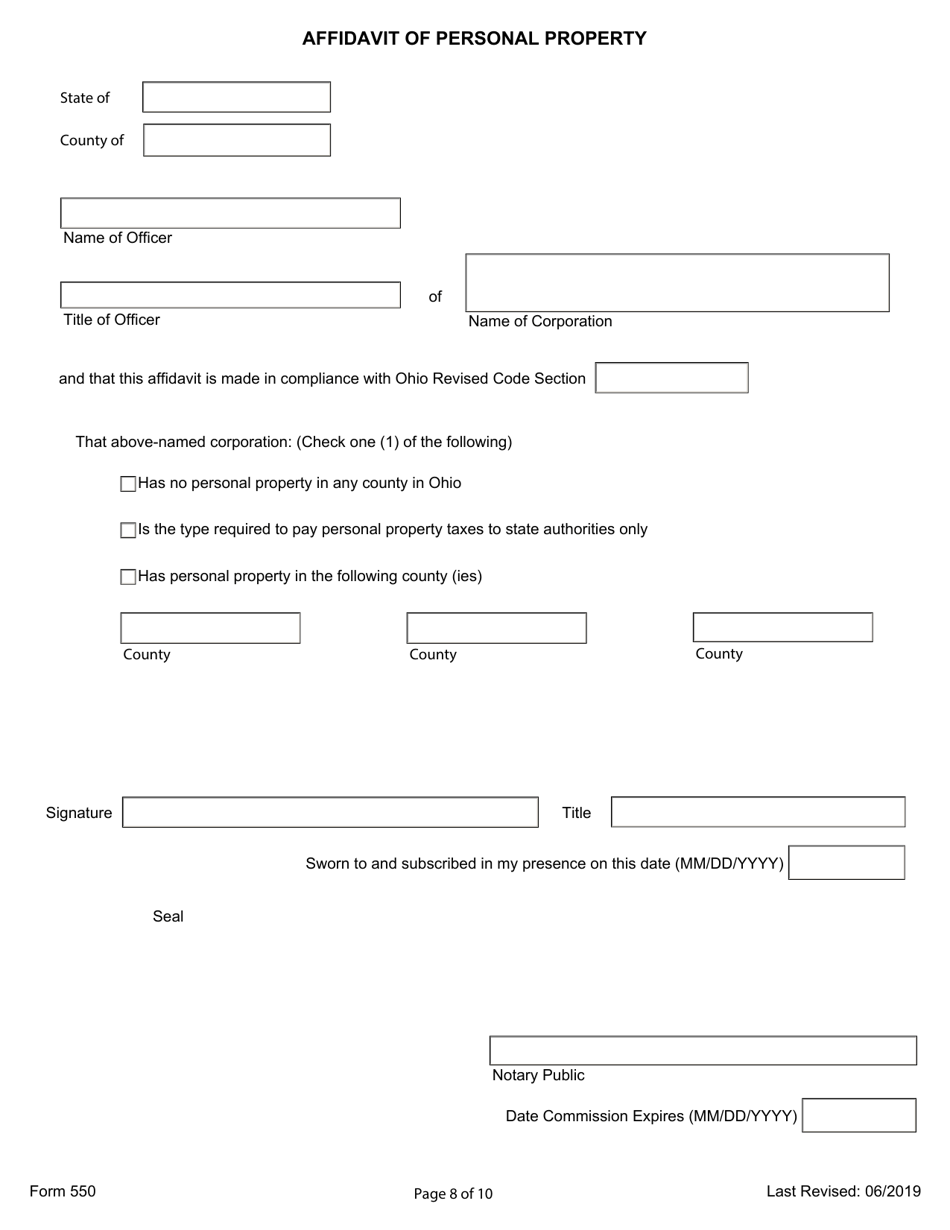

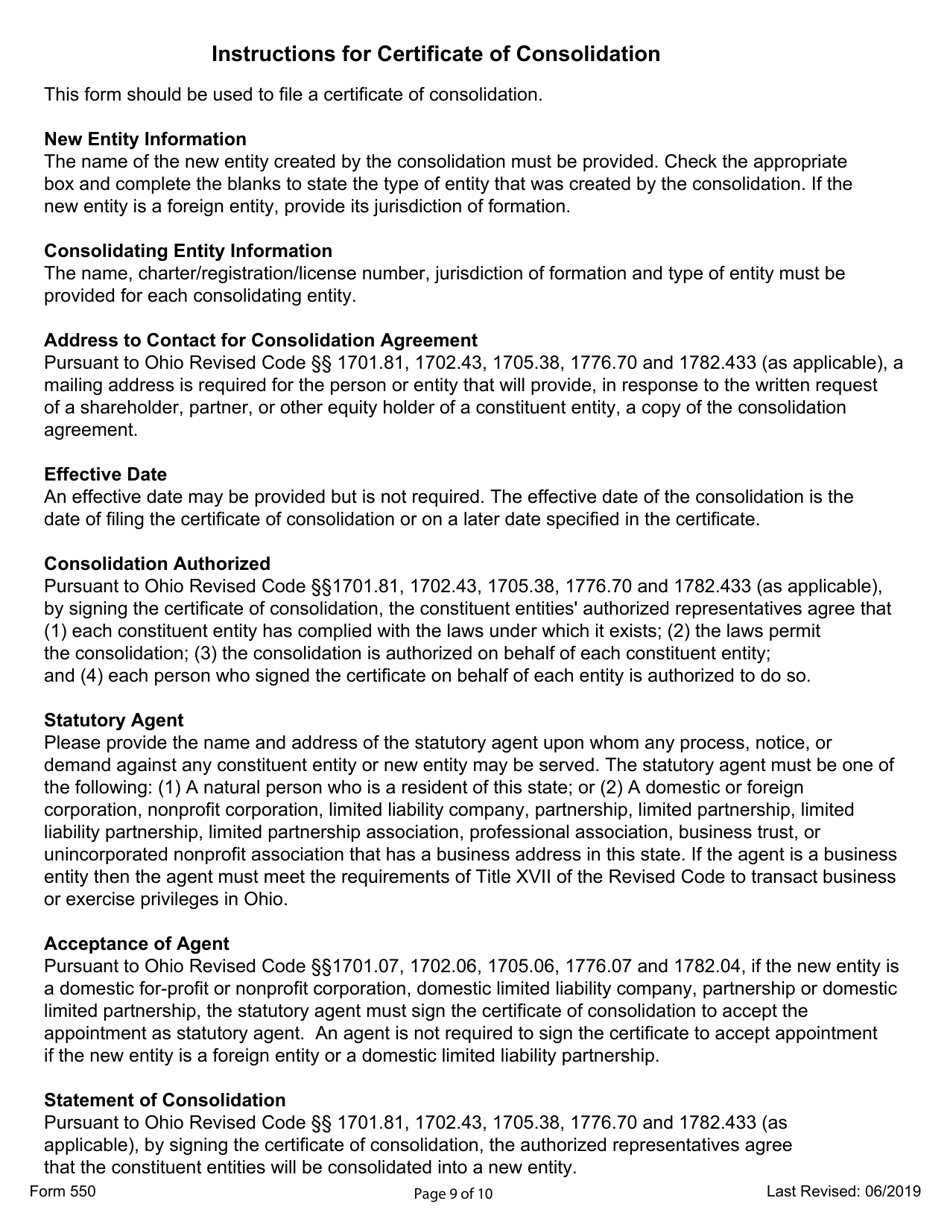

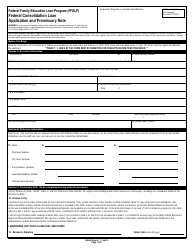

Q: What information is required on Form 550?

A: Form 550 requires information such as the name of the consolidating entities, effective date of consolidation, and signatures of authorized representatives.

Q: Is it mandatory to file Form 550?

A: Yes, it is mandatory to file Form 550 if there has been a consolidation of entities in Ohio.

Q: Are there any penalties for not filing Form 550?

A: Yes, there may be penalties for not filing Form 550. It is important to comply with Ohio state regulations.

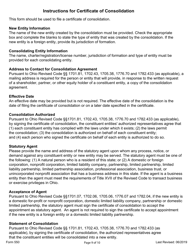

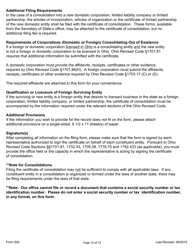

Q: Are there any specific instructions for completing Form 550?

A: Yes, there are specific instructions provided with Form 550. It is recommended to review these instructions carefully before filling out the form.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 550 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.