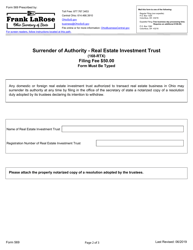

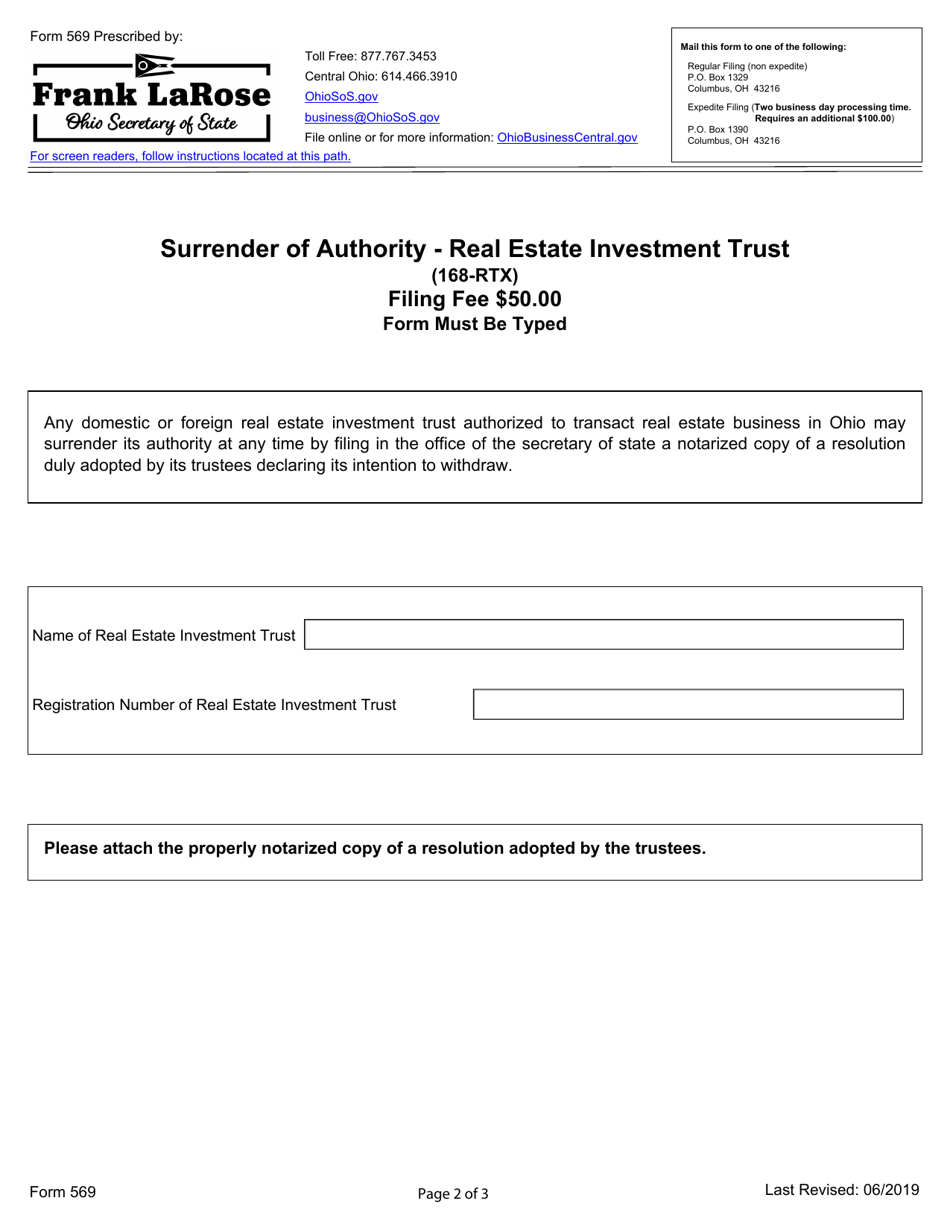

Form 569 Surrender of Authority - Real Estate Investment Trust - Ohio

What Is Form 569?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 569?

A: Form 569 is a document used to surrender authority as a Real Estate Investment Trust (REIT) in Ohio.

Q: What is a Real Estate Investment Trust (REIT)?

A: A Real Estate Investment Trust (REIT) is a company that owns, operates, or finances income-generating real estate and is required to distribute a substantial portion of its income to its shareholders.

Q: Why would someone need to surrender authority as a REIT?

A: There may be various reasons why someone would need to surrender authority as a REIT, such as a change in business strategy or dissolution of the company.

Q: Who needs to file Form 569?

A: Any REIT in Ohio that wants to surrender its authority to operate as a REIT needs to file Form 569.

Q: Are there any fees associated with filing Form 569?

A: Yes, there is a fee of $50 for filing Form 569.

Q: What information is required on Form 569?

A: Form 569 requires information such as the name and address of the REIT, the effective date of surrender, and the signature of an authorized officer.

Q: When is the deadline for filing Form 569?

A: Form 569 must be filed within 60 days after the date of surrender or dissolution of the REIT's authority.

Q: What happens after filing Form 569?

A: After filing Form 569, the Ohio Department of Taxation will process the form and update the status of the REIT.

Q: Can the surrender of authority as a REIT be revoked?

A: No, once the surrender of authority as a REIT is filed, it cannot be revoked.

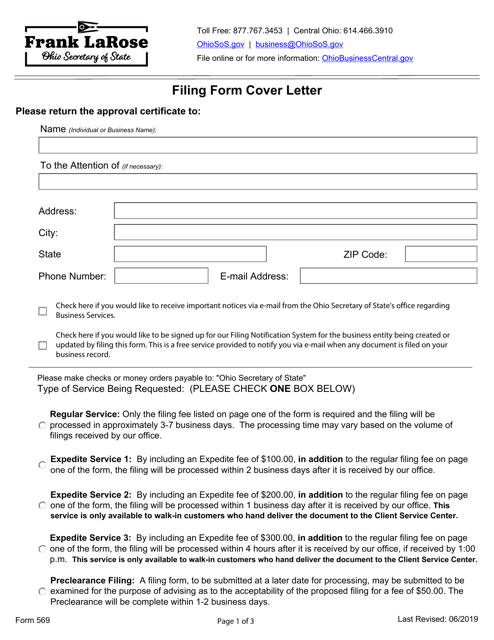

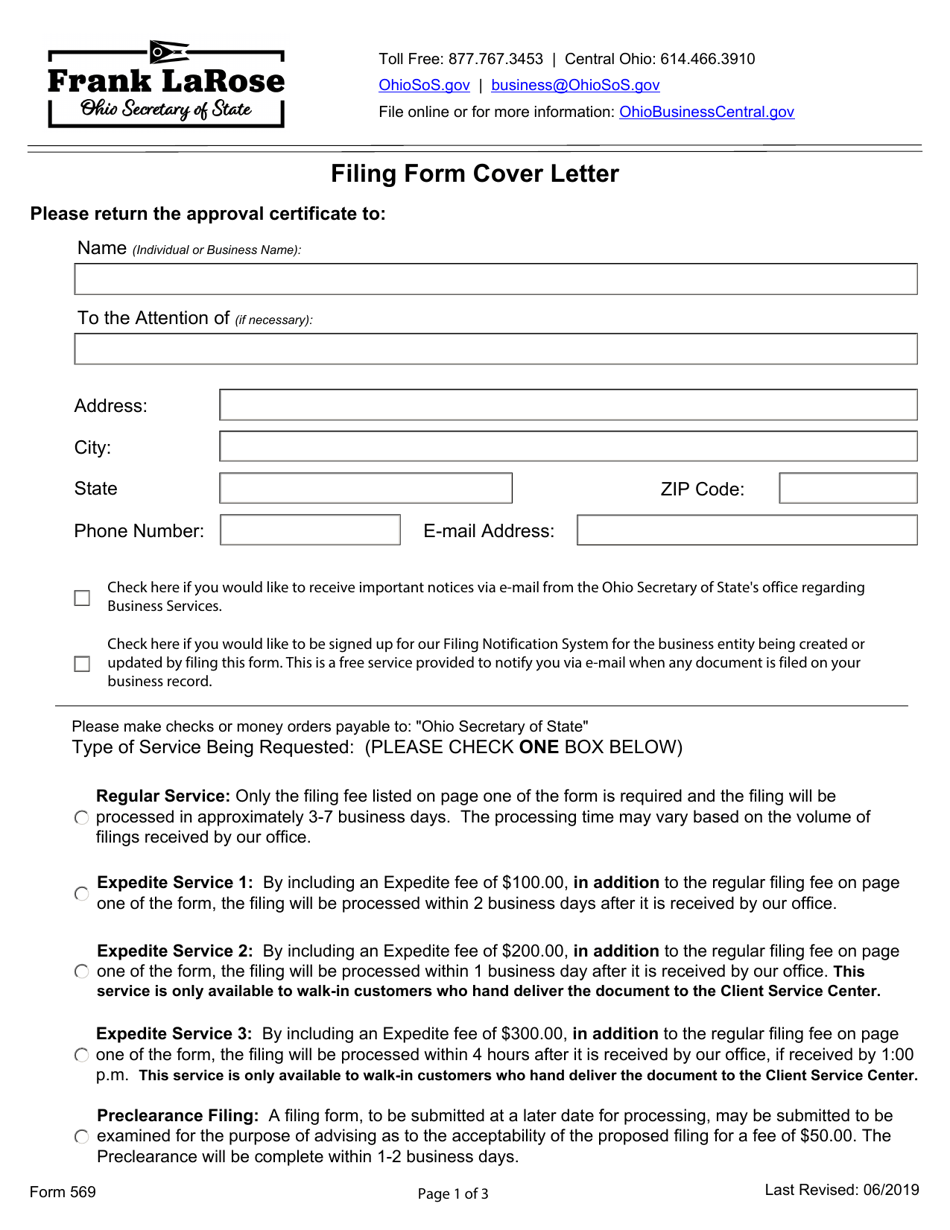

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 569 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.