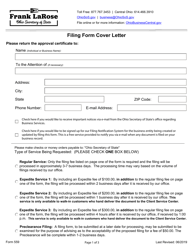

Form 559 Withdrawal of Business Trust - Ohio

What Is Form 559?

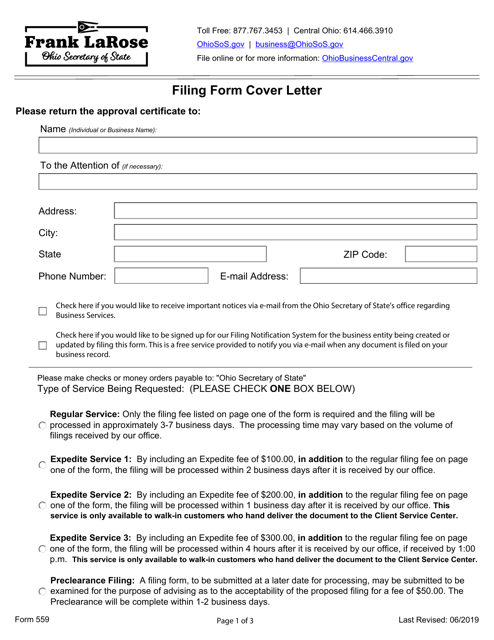

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

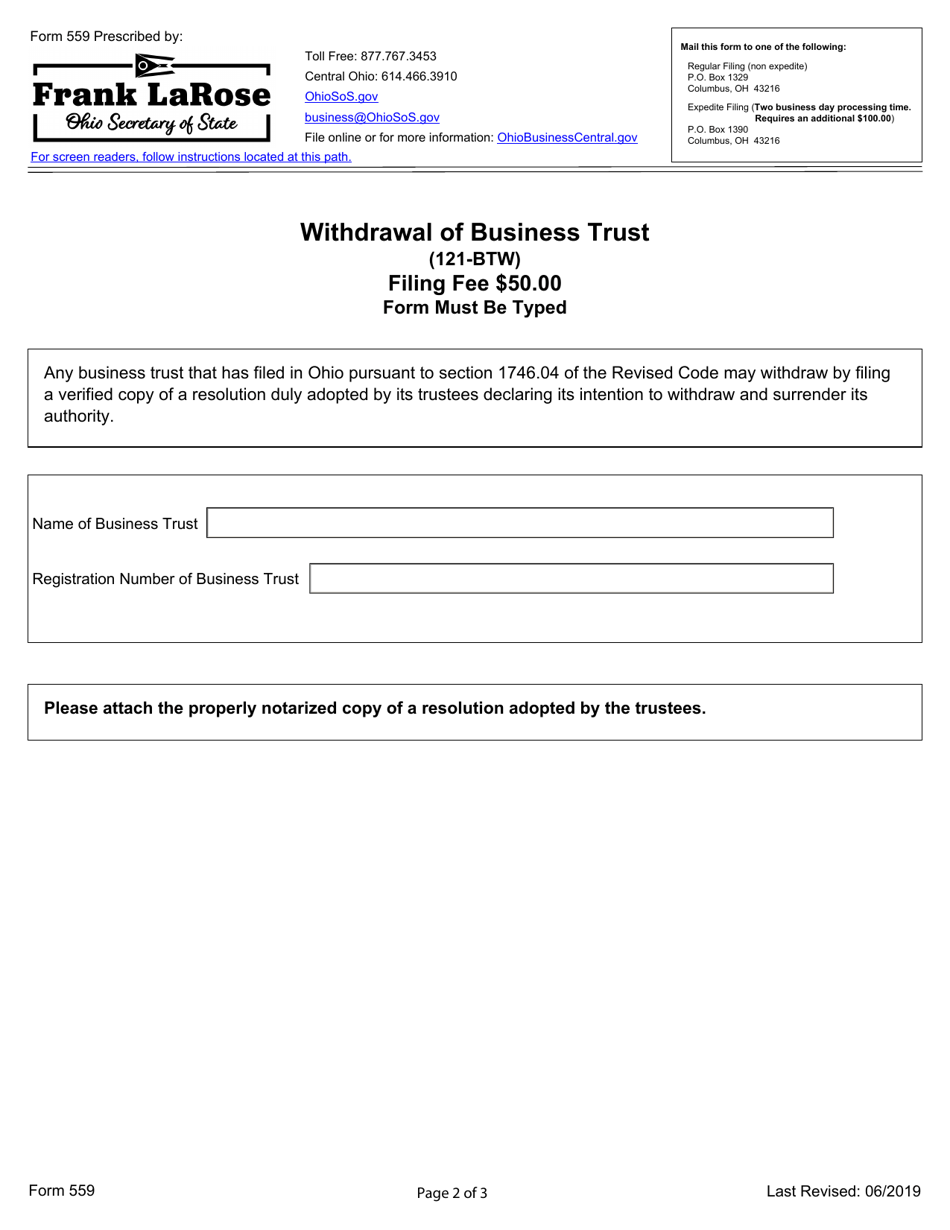

Q: What is Form 559?

A: Form 559 is a document used to withdraw a business trust in Ohio.

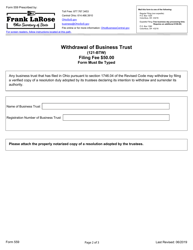

Q: How do I file Form 559?

A: You can file Form 559 by mail or in person with the Ohio Secretary of State.

Q: What information is required on Form 559?

A: Form 559 requires information such as the name of the business trust, the date of withdrawal, and the signature of an authorized person.

Q: What happens after I file Form 559?

A: After filing Form 559, the business trust will be officially withdrawn from the records of the Ohio Secretary of State.

Q: Are there any consequences for not filing Form 559?

A: Failure to file Form 559 may result in penalties or the business trust continuing to be subject to certain legal requirements.

Q: Can I get a copy of Form 559?

A: Yes, you can request a copy of Form 559 from the Ohio Secretary of State's office.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 559 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.