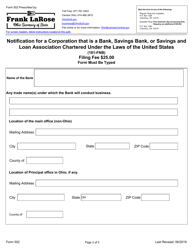

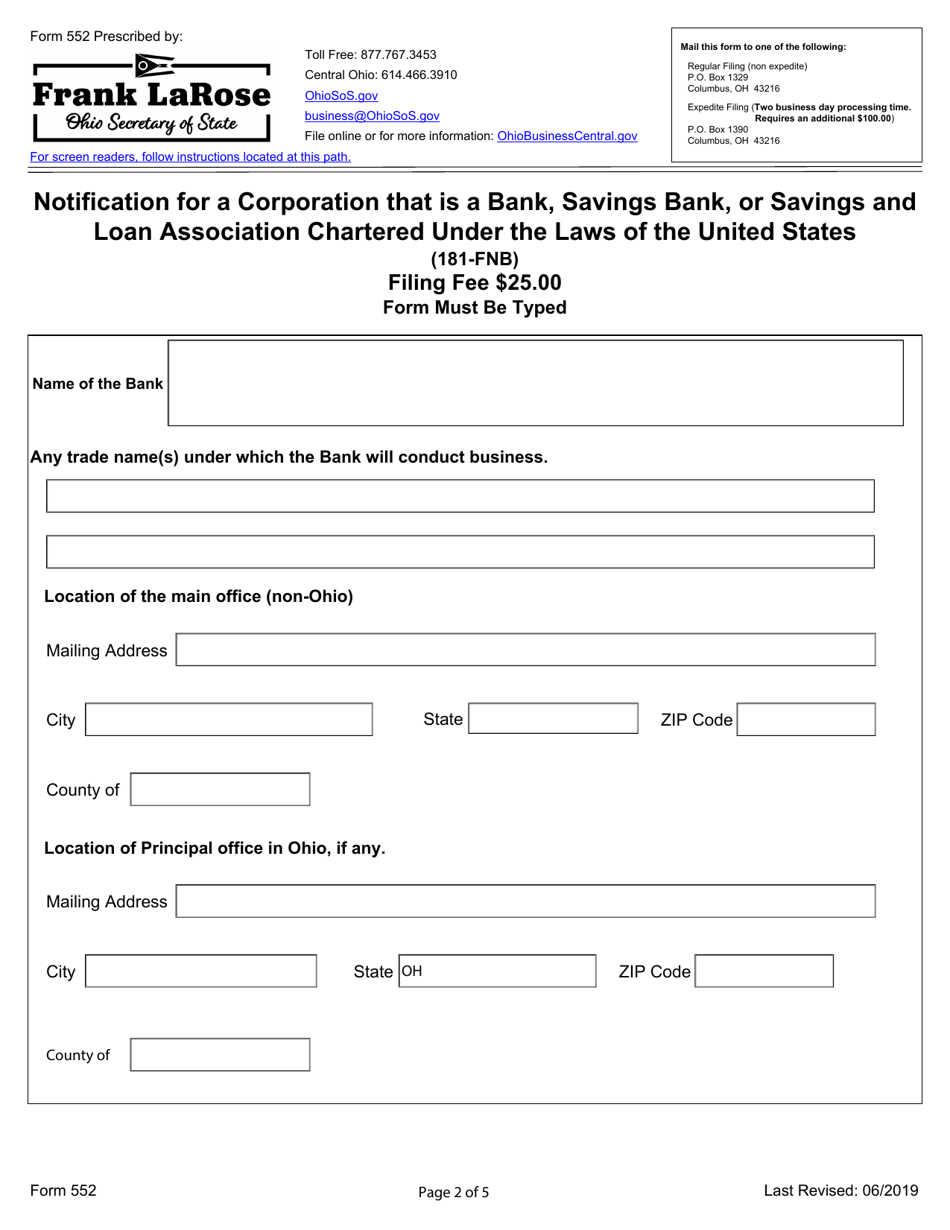

Form 552 Notification for a Corporation That Is a Bank, Savings Bank, or Savings and Loan Association Chartered Under the Laws of the United States - Ohio

What Is Form 552?

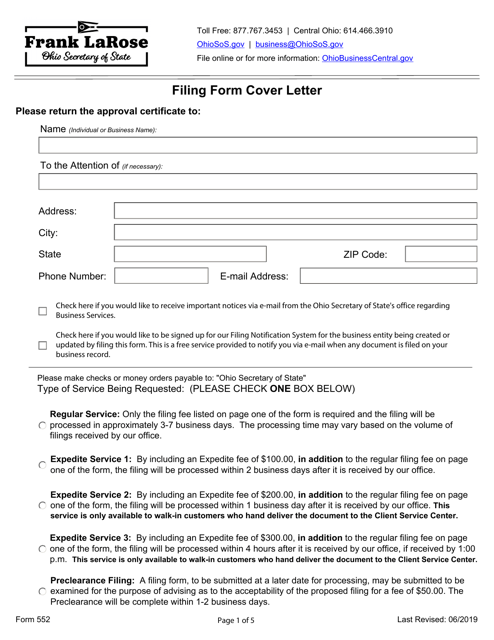

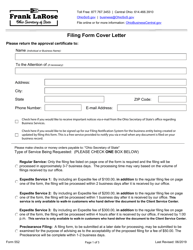

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 552?

A: Form 552 is a notification form for corporations that are banks, savings banks, or savings and loan associations chartered under the laws of the United States - Ohio.

Q: Who is required to file Form 552?

A: Corporations that are banks, savings banks, or savings and loan associations chartered under the laws of the United States - Ohio are required to file Form 552.

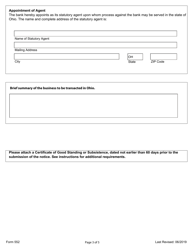

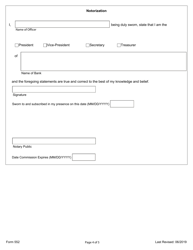

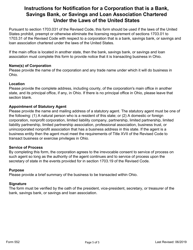

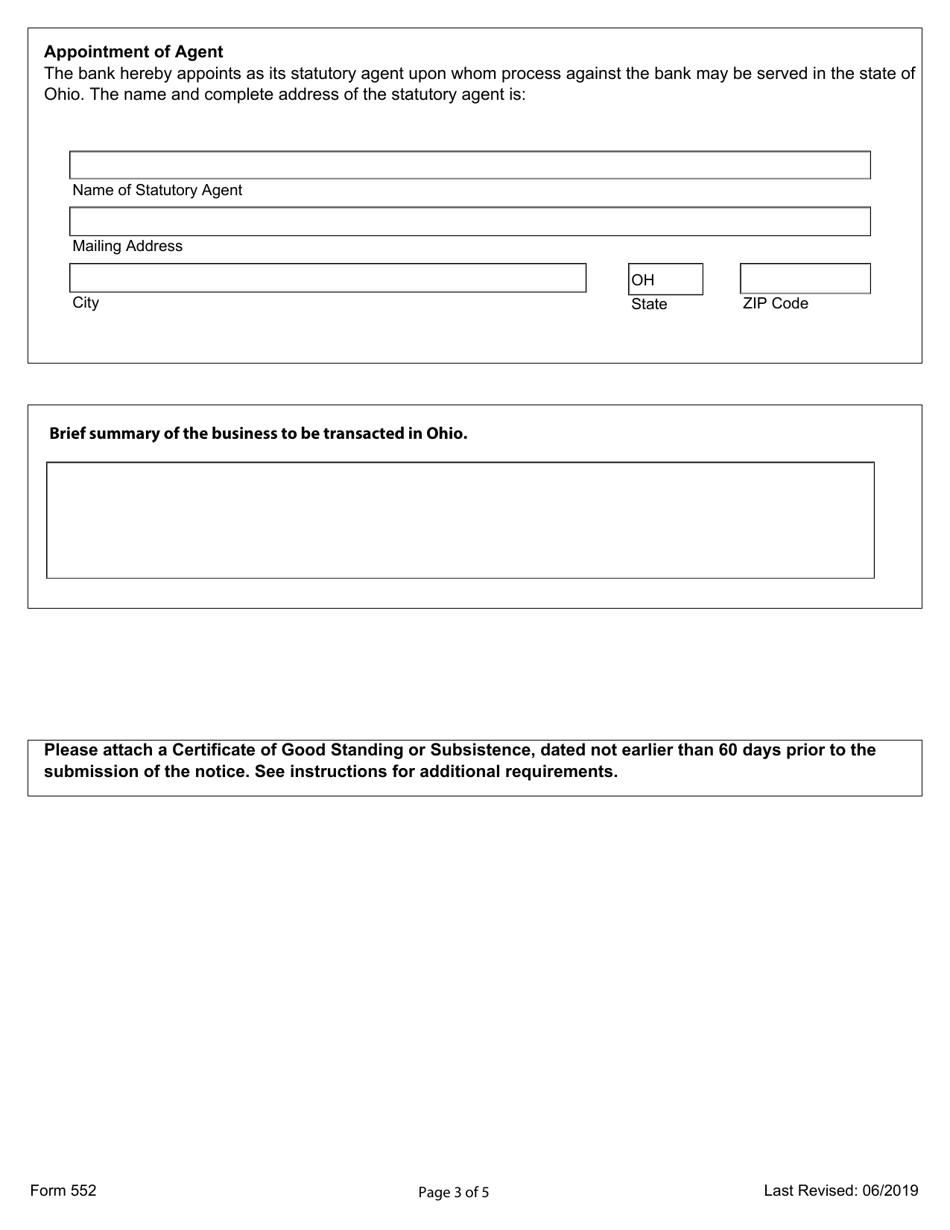

Q: What information is included in Form 552?

A: Form 552 includes information about the corporation, its officers, and its principal place of business.

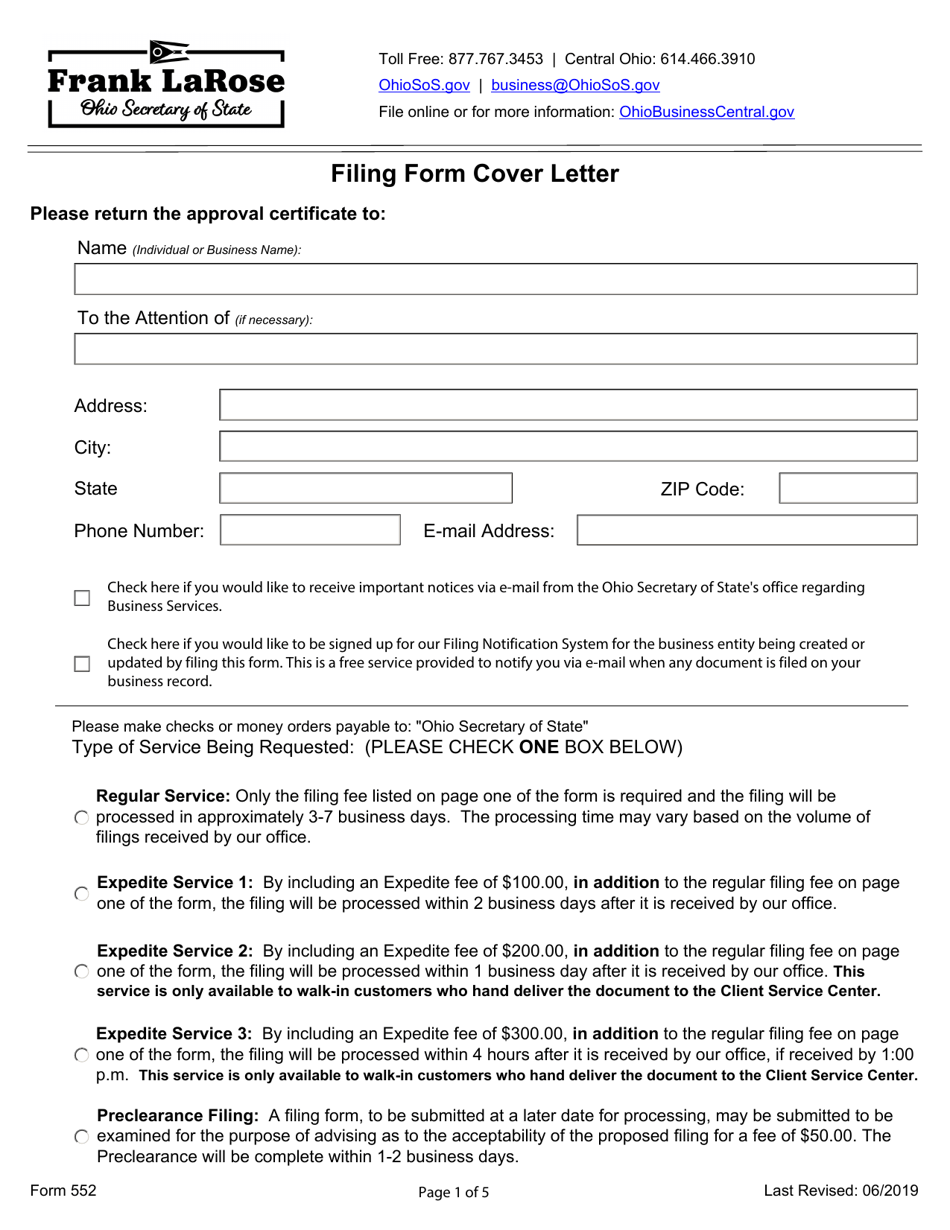

Q: Is there a fee for filing Form 552?

A: Yes, there is a fee for filing Form 552. The fee amount may vary, so it's best to check with the Ohio Secretary of State for the current fee schedule.

Q: When is Form 552 due?

A: Form 552 is due on or before the 15th day of the fourth month following the close of the corporation's taxable year.

Q: What happens if Form 552 is not filed on time?

A: If Form 552 is not filed on time, the corporation may be subject to penalties and interest.

Q: Are there any exemptions from filing Form 552?

A: There are no exemptions listed specifically for Form 552. However, it's best to consult with the Ohio Secretary of State or a qualified professional for specific exemption information.

Q: Is Form 552 specific to Ohio only?

A: Yes, Form 552 is specific to corporations that are banks, savings banks, or savings and loan associations chartered under the laws of the United States - Ohio.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 552 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.