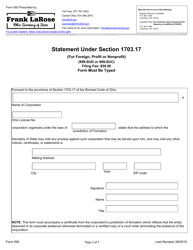

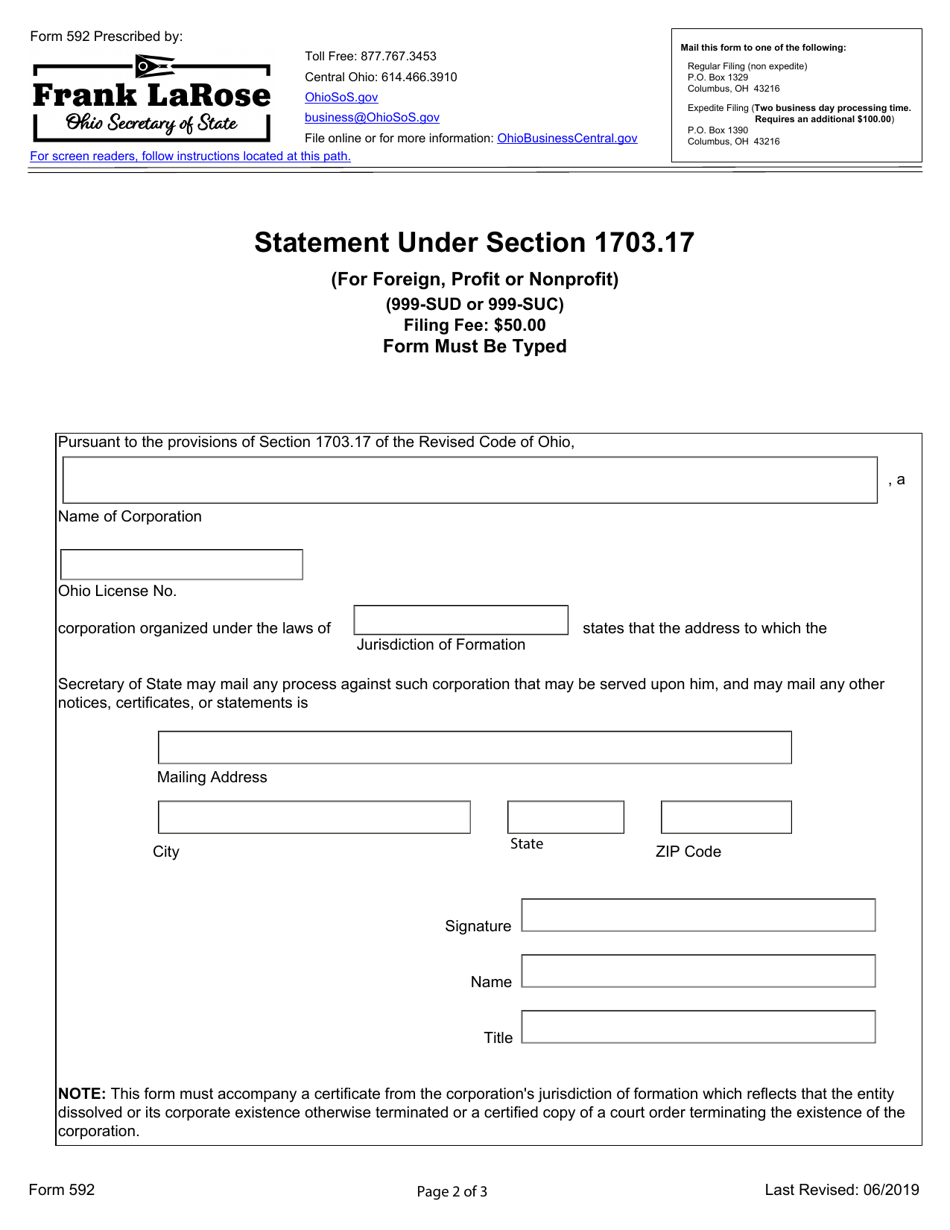

Form 592 Statement Under Section 1703.17 (For Foreign, Profit or Nonprofit) - Ohio

What Is Form 592?

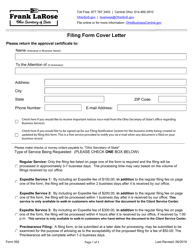

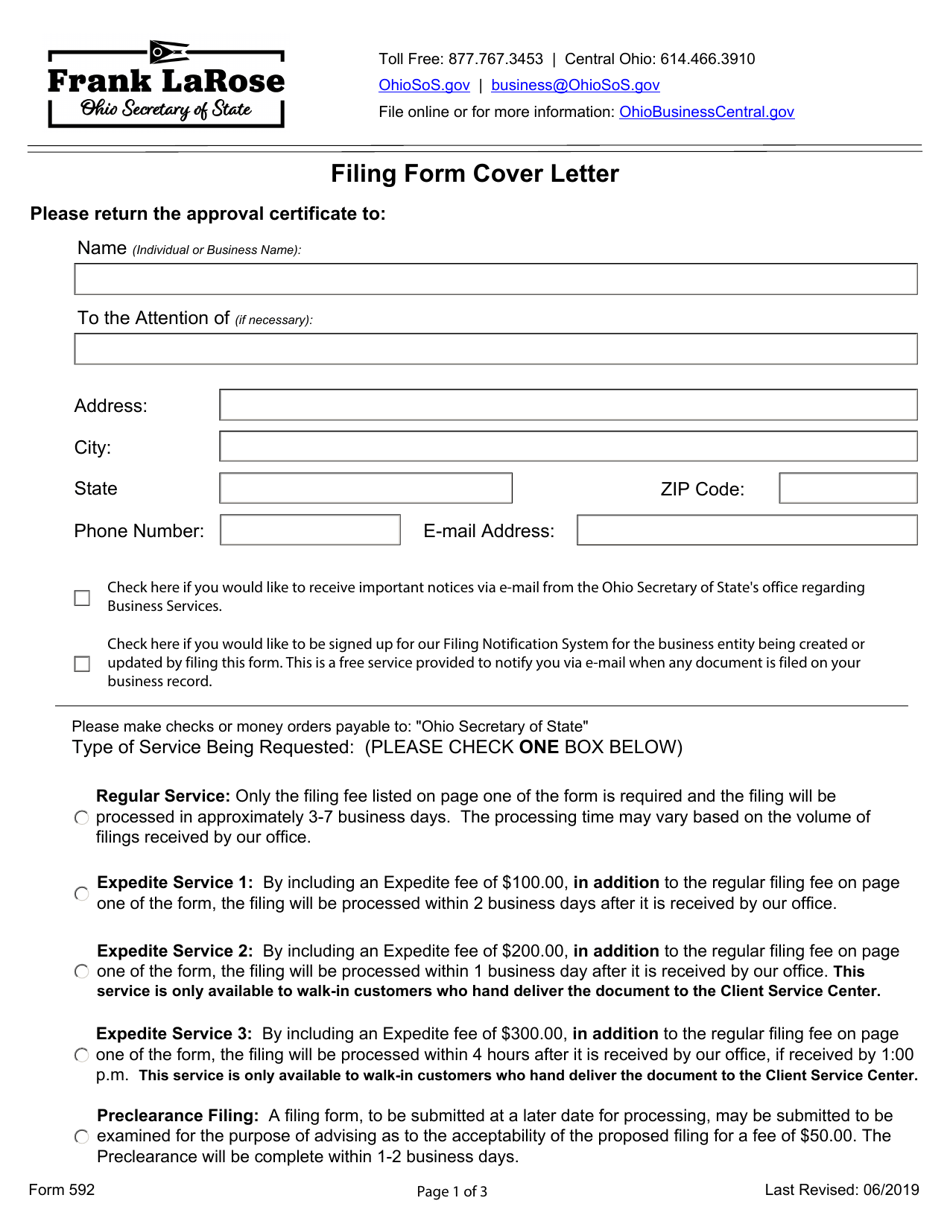

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form 592 Statement under Section 1703.17?

A: Form 592 Statement under Section 1703.17 is a form required by the state of Ohio for foreign, profit, or nonprofit corporations.

Q: Who needs to file a Form 592 Statement under Section 1703.17?

A: Foreign, profit, or nonprofit corporationsdoing business in Ohio need to file a Form 592 Statement under Section 1703.17.

Q: What is the purpose of filing a Form 592 Statement under Section 1703.17?

A: The purpose of filing a Form 592 Statement under Section 1703.17 is to provide information about the corporation's business activities in Ohio.

Q: What information is required to be reported on a Form 592 Statement under Section 1703.17?

A: A Form 592 Statement under Section 1703.17 requires detailed information about the corporation's business activities, including its name, address, and business purpose.

Q: When is the deadline for filing a Form 592 Statement under Section 1703.17?

A: The deadline for filing a Form 592 Statement under Section 1703.17 is typically on or before the 15th day of the third month after the end of the corporation's fiscal year.

Q: Are there any penalties for not filing a Form 592 Statement under Section 1703.17?

A: Yes, there may be penalties for not filing a Form 592 Statement under Section 1703.17, including late fees and potential loss of good standing status in Ohio.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 592 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.