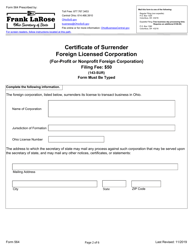

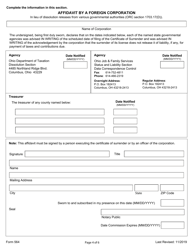

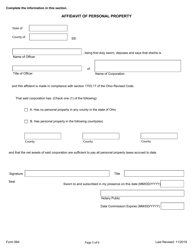

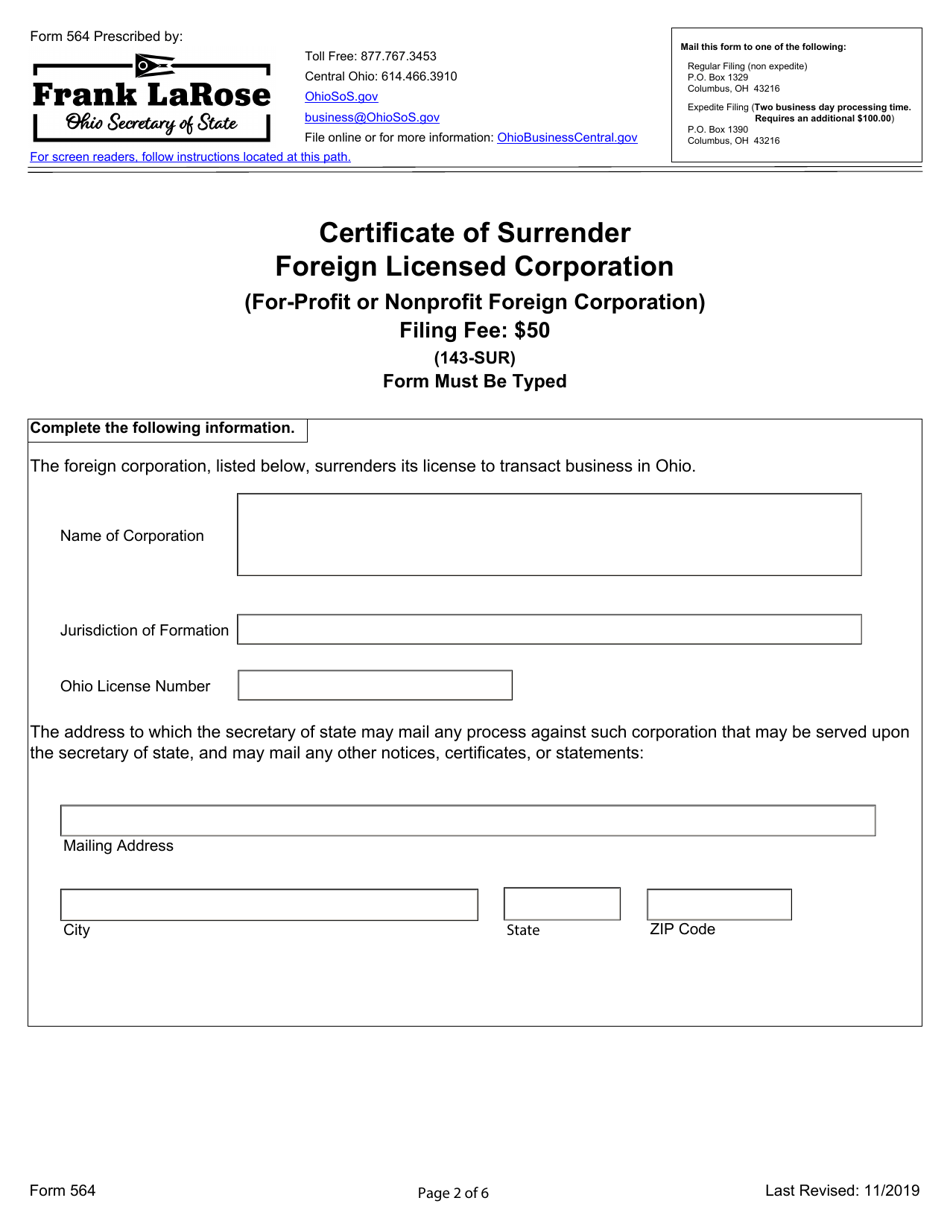

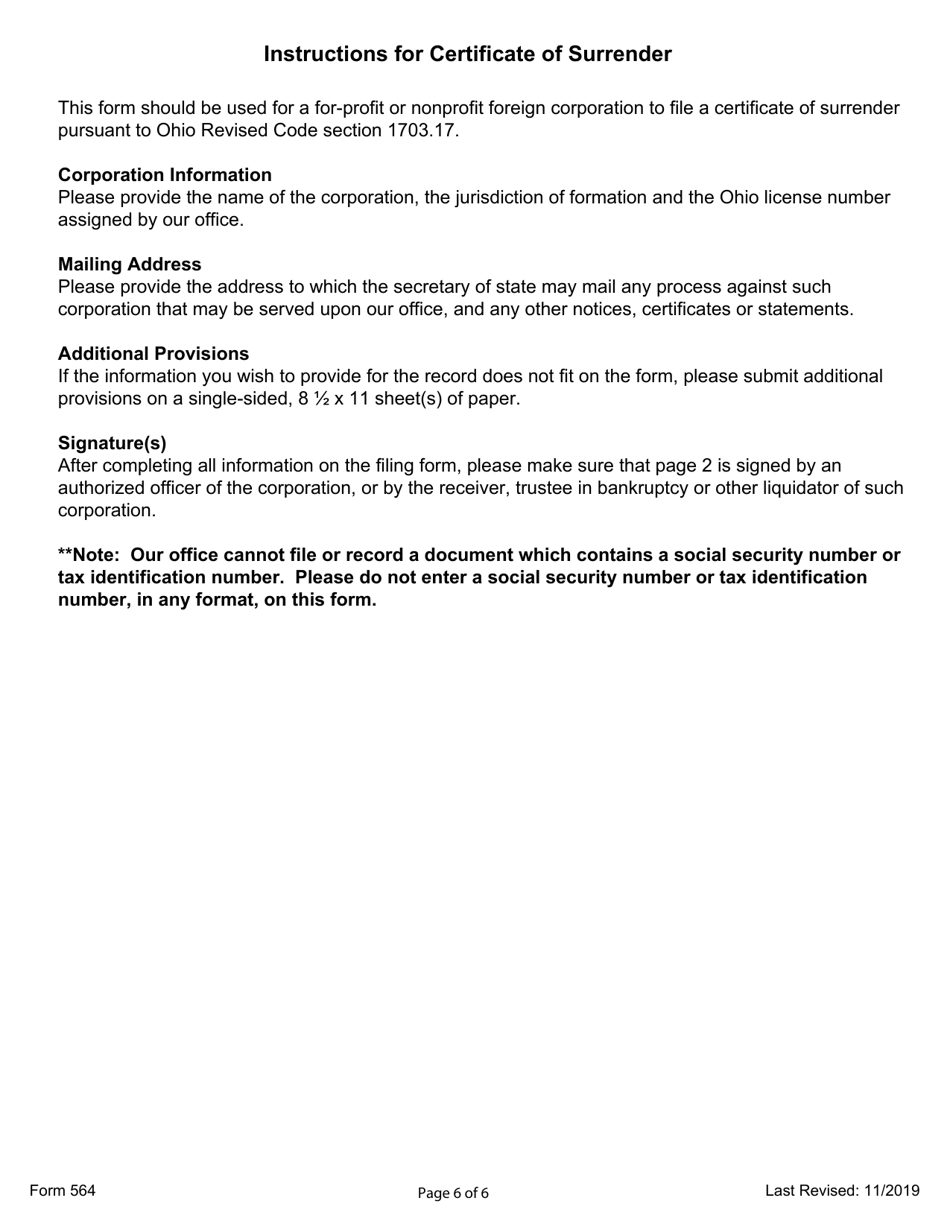

Form 564 Certificate of Surrender Foreign Licensed Corporation (For-Profit or Nonprofit Foreign Corporation) - Ohio

What Is Form 564?

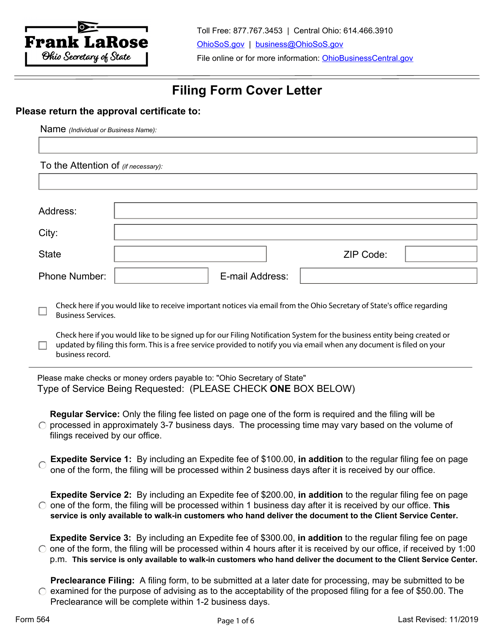

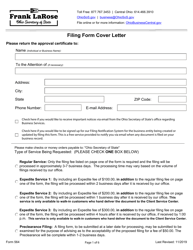

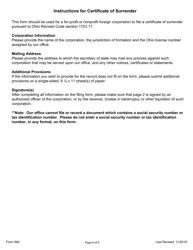

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 564 Certificate of Surrender Foreign Licensed Corporation?

A: Form 564 is a document used by foreign licensed corporations in Ohio to officially surrender their corporate status.

Q: Who should use Form 564?

A: Form 564 should be used by for-profit or nonprofit foreign corporations registered in Ohio that wish to surrender their corporate status.

Q: When should Form 564 be filed?

A: Form 564 should be filed when a foreign licensed corporation in Ohio wants to surrender its corporate status.

Q: What is the purpose of surrendering a foreign corporation's status?

A: Surrendering a foreign corporation's status allows the corporation to cease its business operations in Ohio and terminates its legal existence in the state.

Q: Are there any fees associated with filing Form 564?

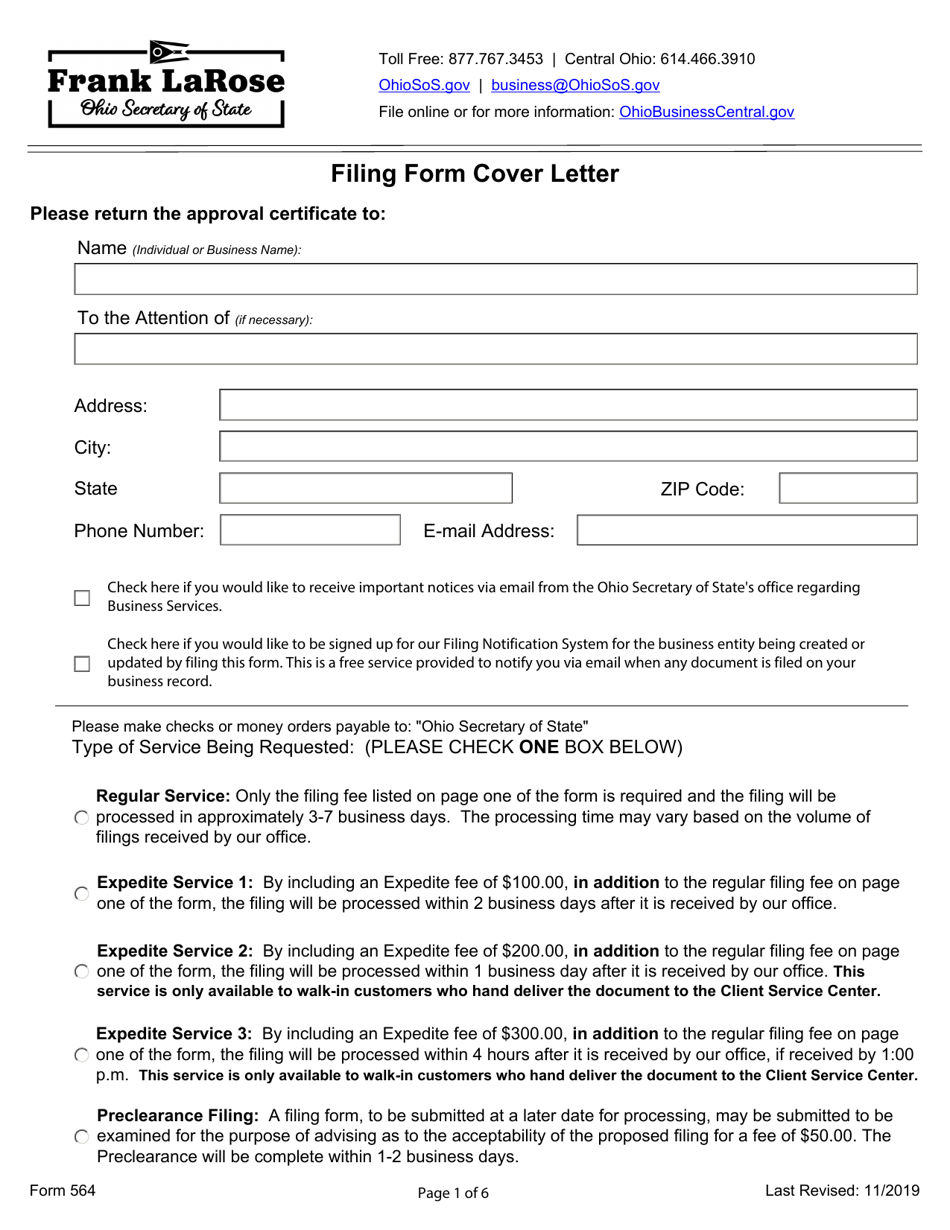

A: Yes, there is a $100 fee required for filing Form 564.

Q: What documents need to be submitted along with Form 564?

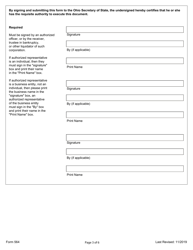

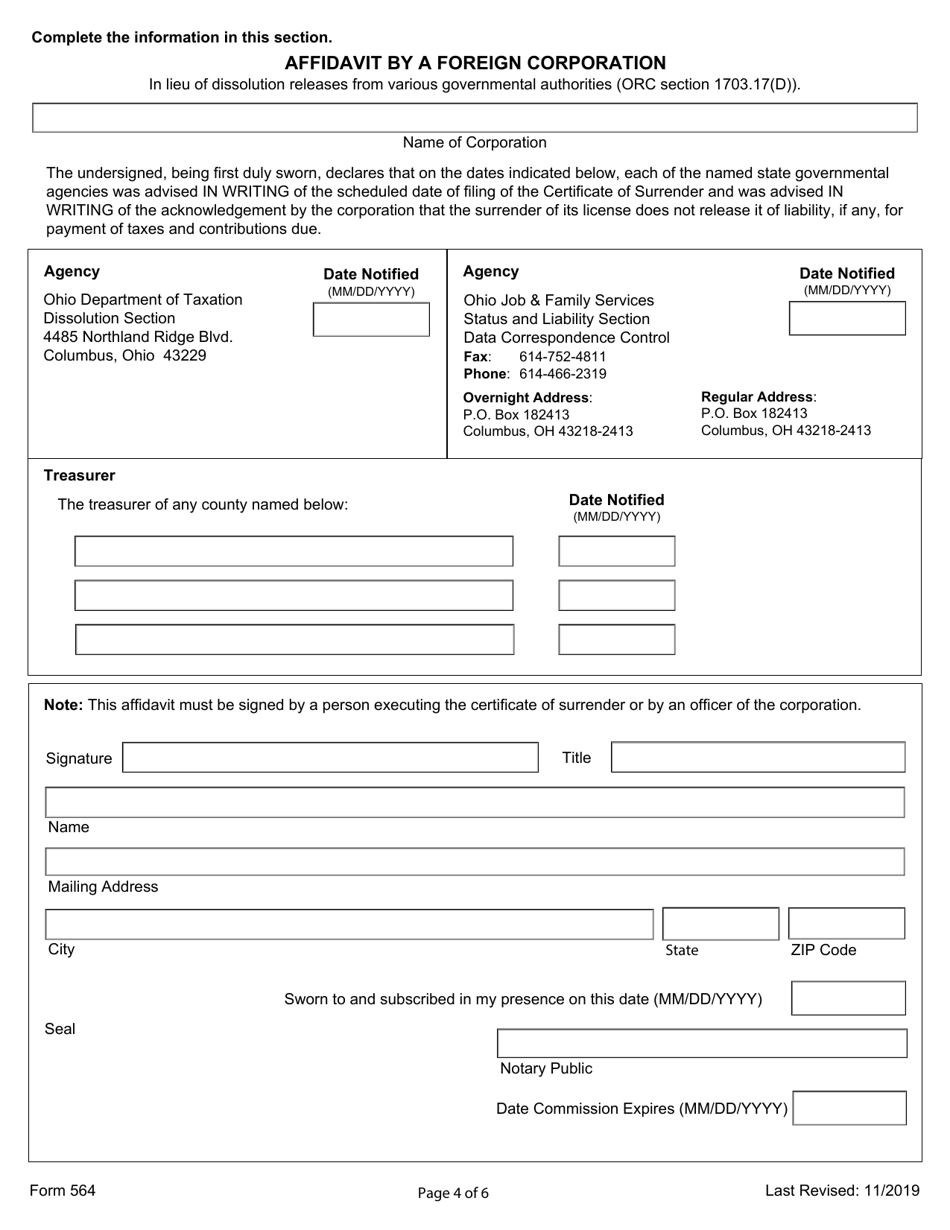

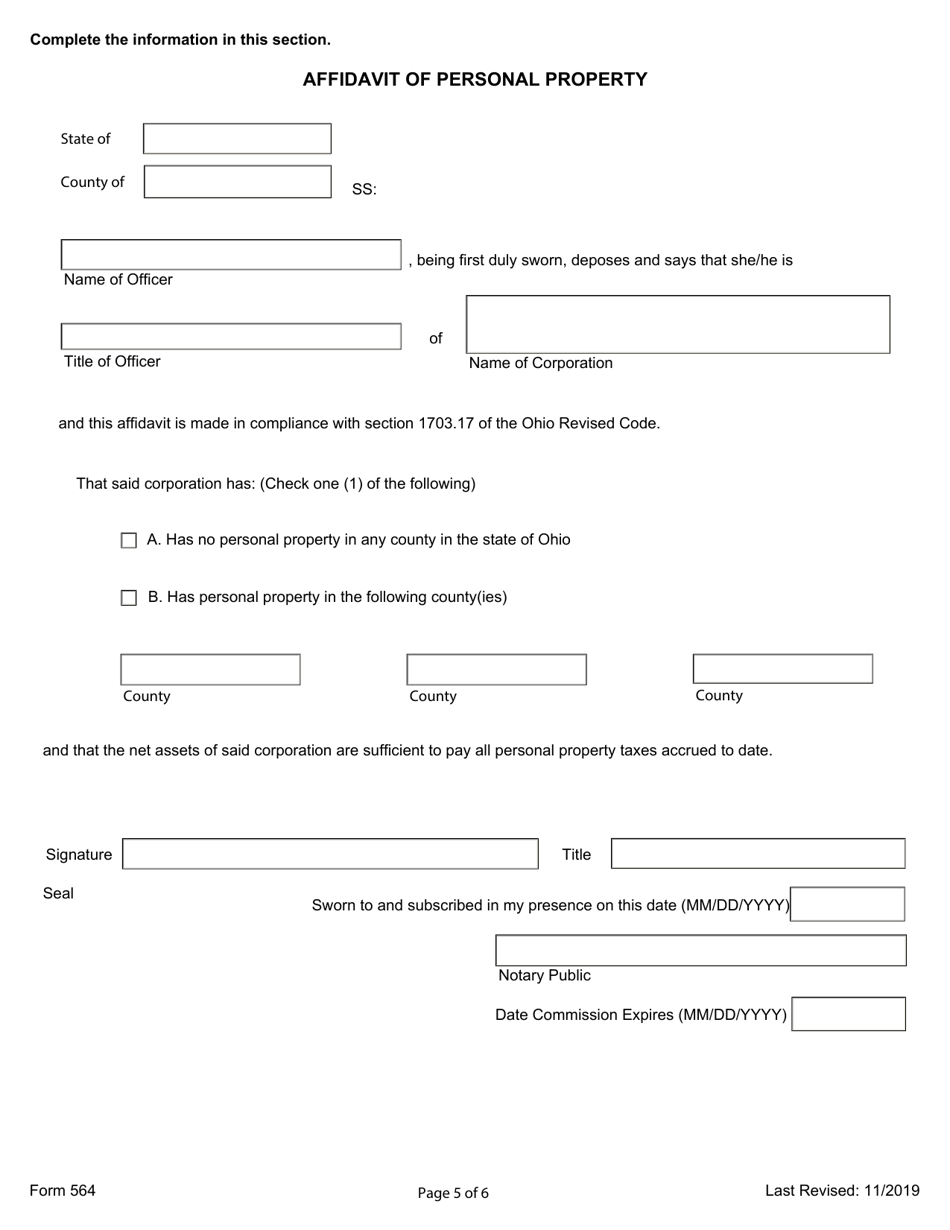

A: Along with Form 564, a foreign licensed corporation must submit a certified copy of its surrender or termination filing in its jurisdiction of incorporation.

Q: Are there any penalties for not filing Form 564?

A: Failure to file Form 564 and surrender the corporate status may result in the corporation continuing to be subject to ongoing filing and tax obligations in Ohio.

Q: What happens after submitting Form 564?

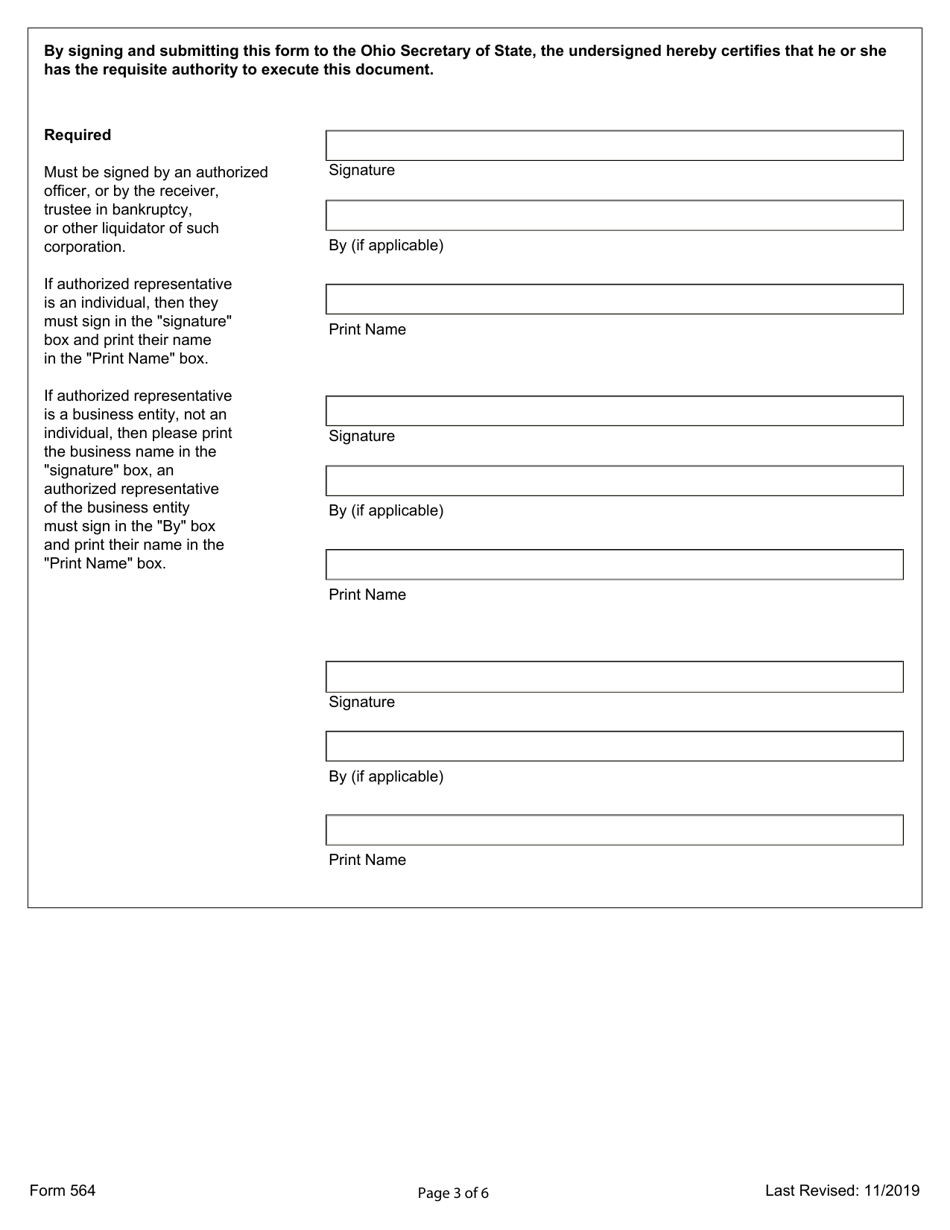

A: After submitting Form 564 and the required documents, the Ohio Secretary of State will process the surrender request and issue a Certificate of Surrender to the foreign corporation.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 564 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.