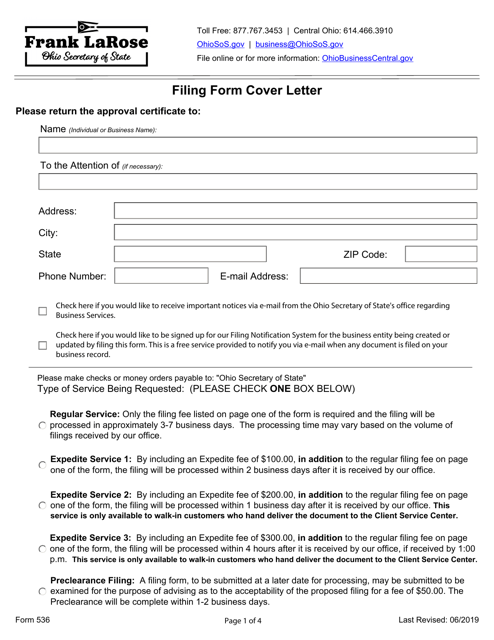

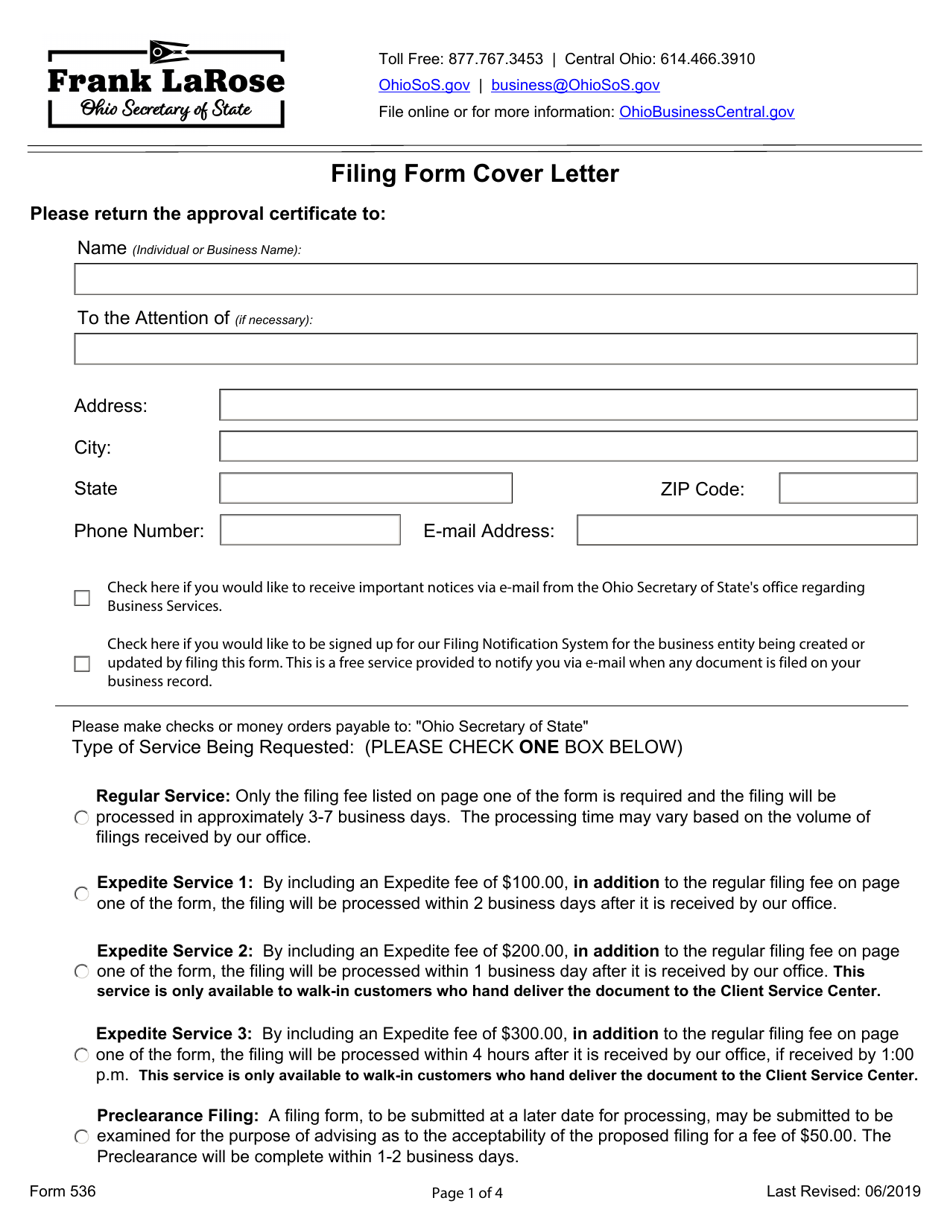

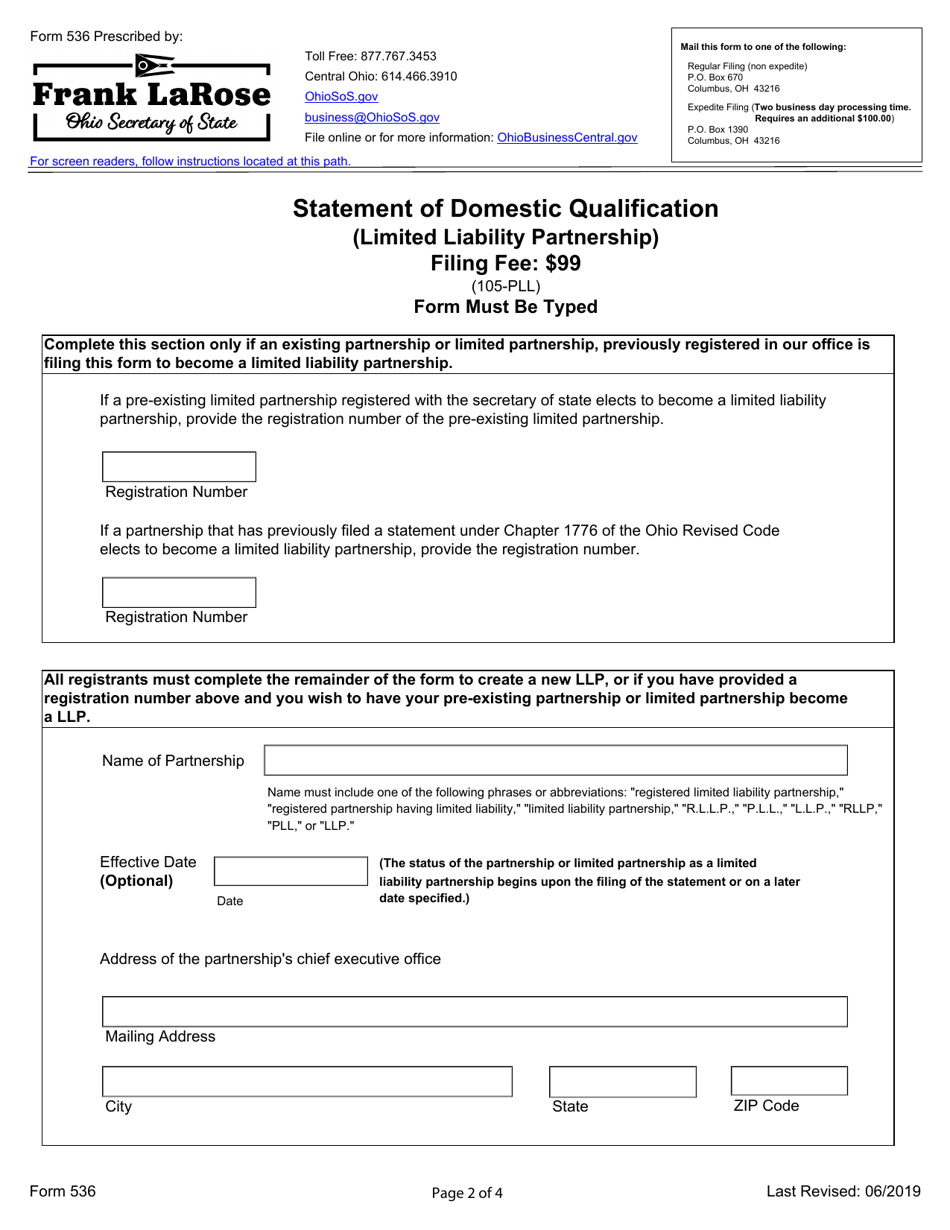

Form 536 Statement of Domestic Qualification (Limited Liability Partnership) - Ohio

What Is Form 536?

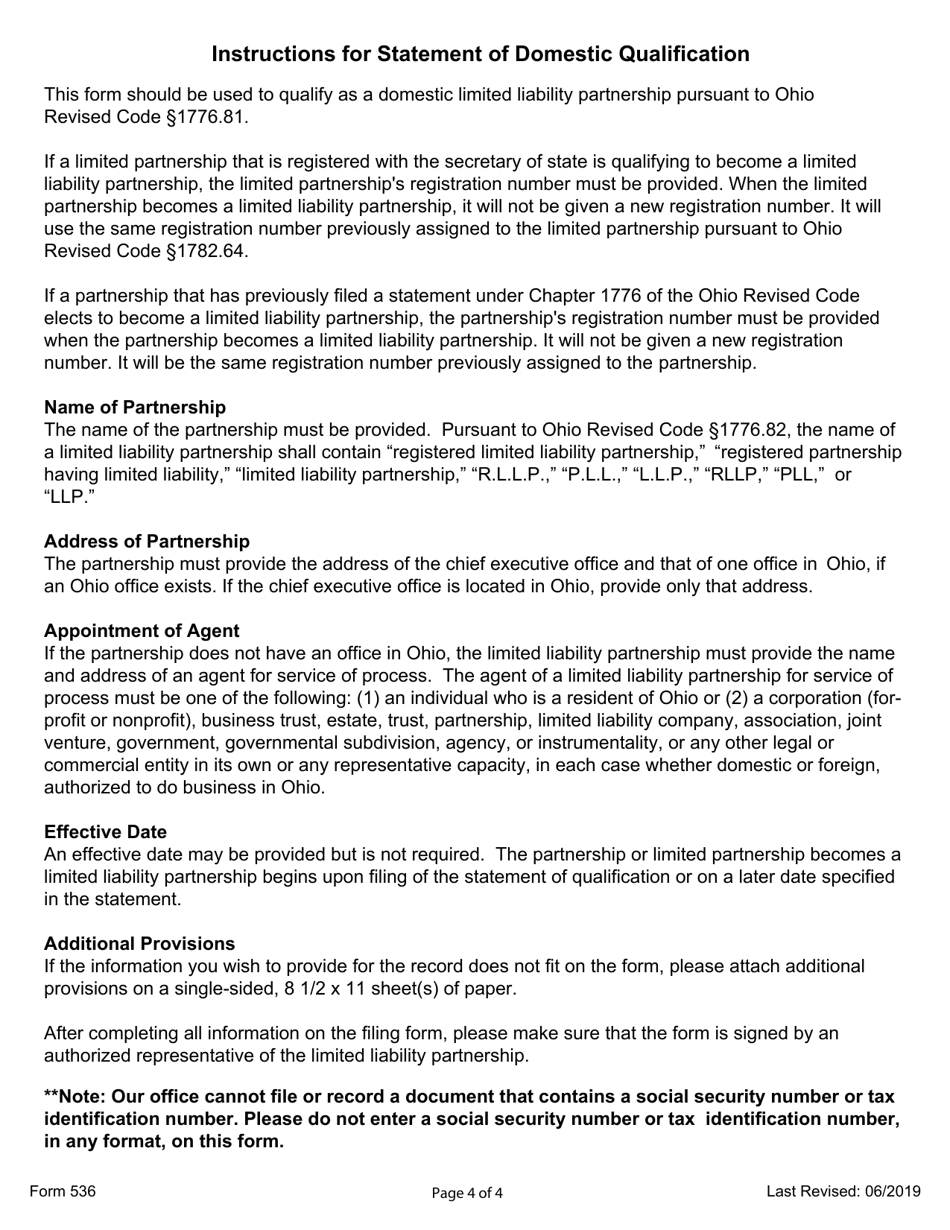

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

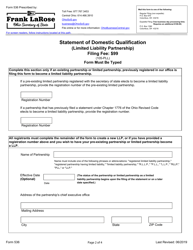

Q: What is Form 536?

A: Form 536 is the Statement of Domestic Qualification for Limited Liability Partnership in Ohio.

Q: What is a Limited Liability Partnership?

A: A Limited Liability Partnership (LLP) is a type of business structure that combines the benefits of a partnership with limited liability for the partners.

Q: Who needs to file Form 536?

A: LLPs that want to operate in Ohio must file Form 536 with the Ohio Secretary of State.

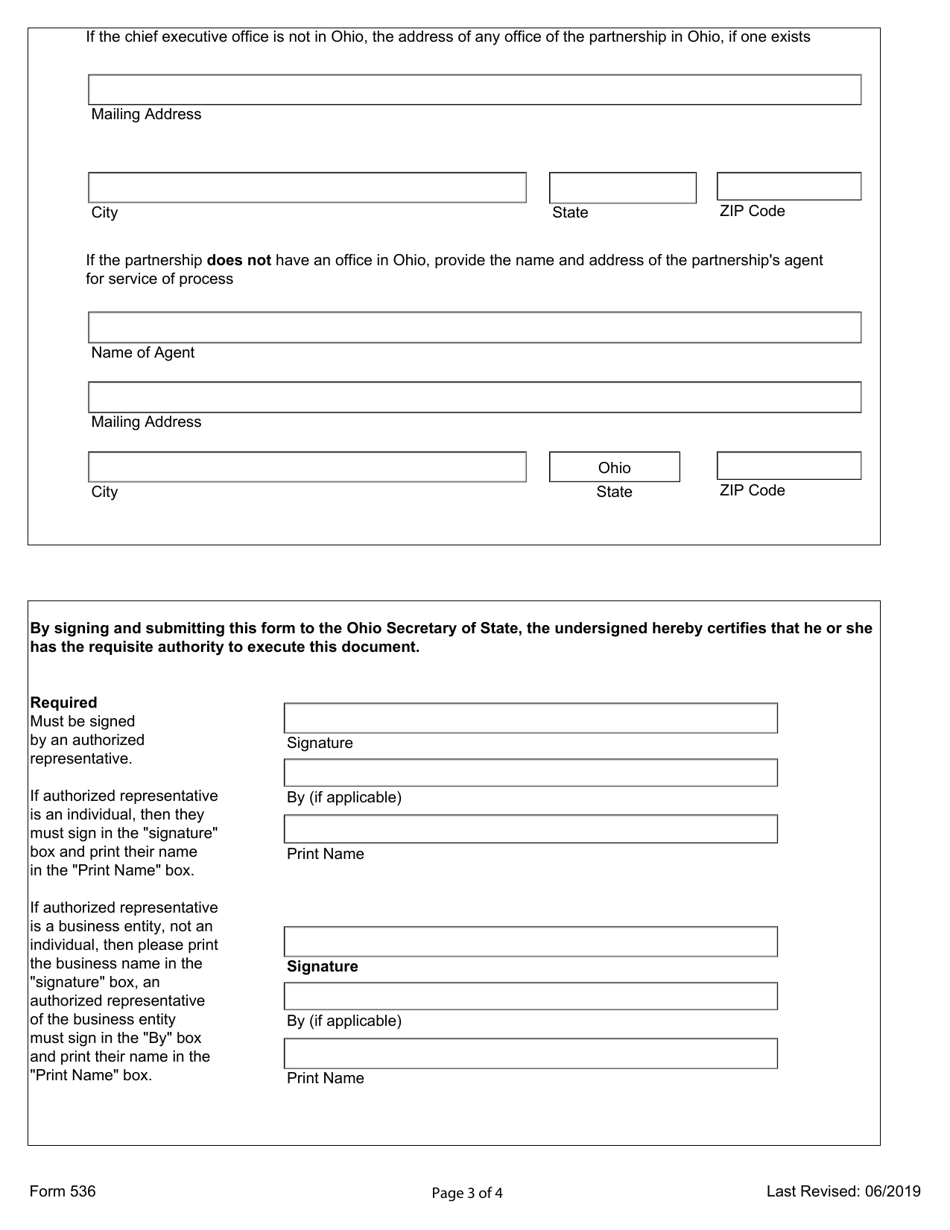

Q: What information is required on Form 536?

A: Form 536 requires information such as the LLP's name, principal office address, and the names and addresses of the partners.

Q: When should Form 536 be filed?

A: Form 536 should be filed before an LLP begins operating in Ohio.

Q: What happens after filing Form 536?

A: Once Form 536 is filed and approved, the LLP is authorized to conduct business in Ohio as a domestic LLP.

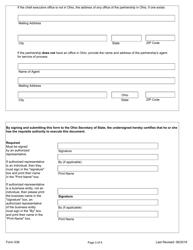

Q: Is a registered agent required for an LLP in Ohio?

A: Yes, an LLP in Ohio is required to have a registered agent who can accept legal documents on behalf of the LLP.

Q: Can the information on Form 536 be updated or amended?

A: Yes, changes to the LLP's information can be made by filing an amendment to Form 536.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 536 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.