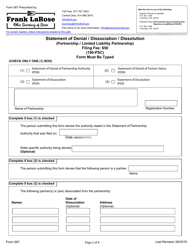

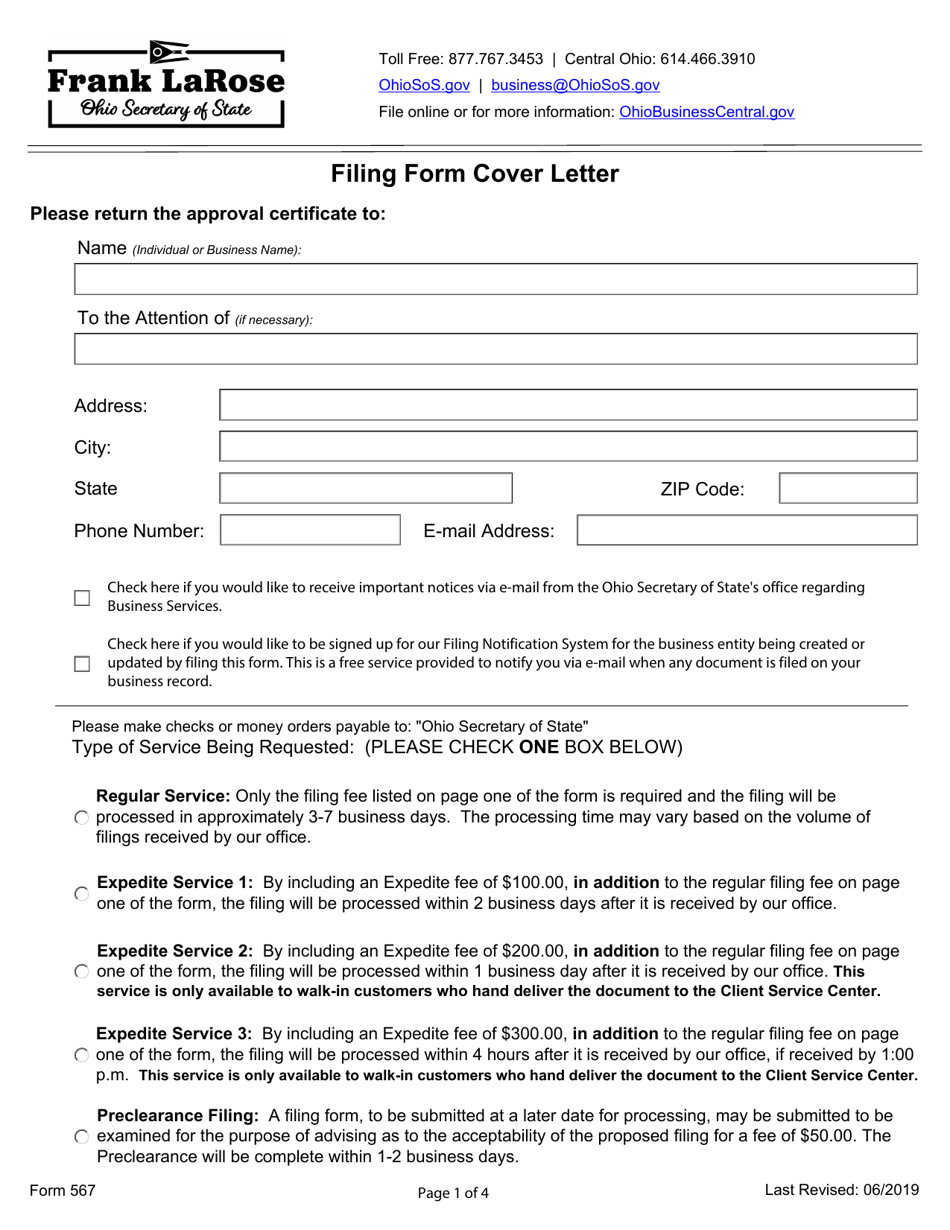

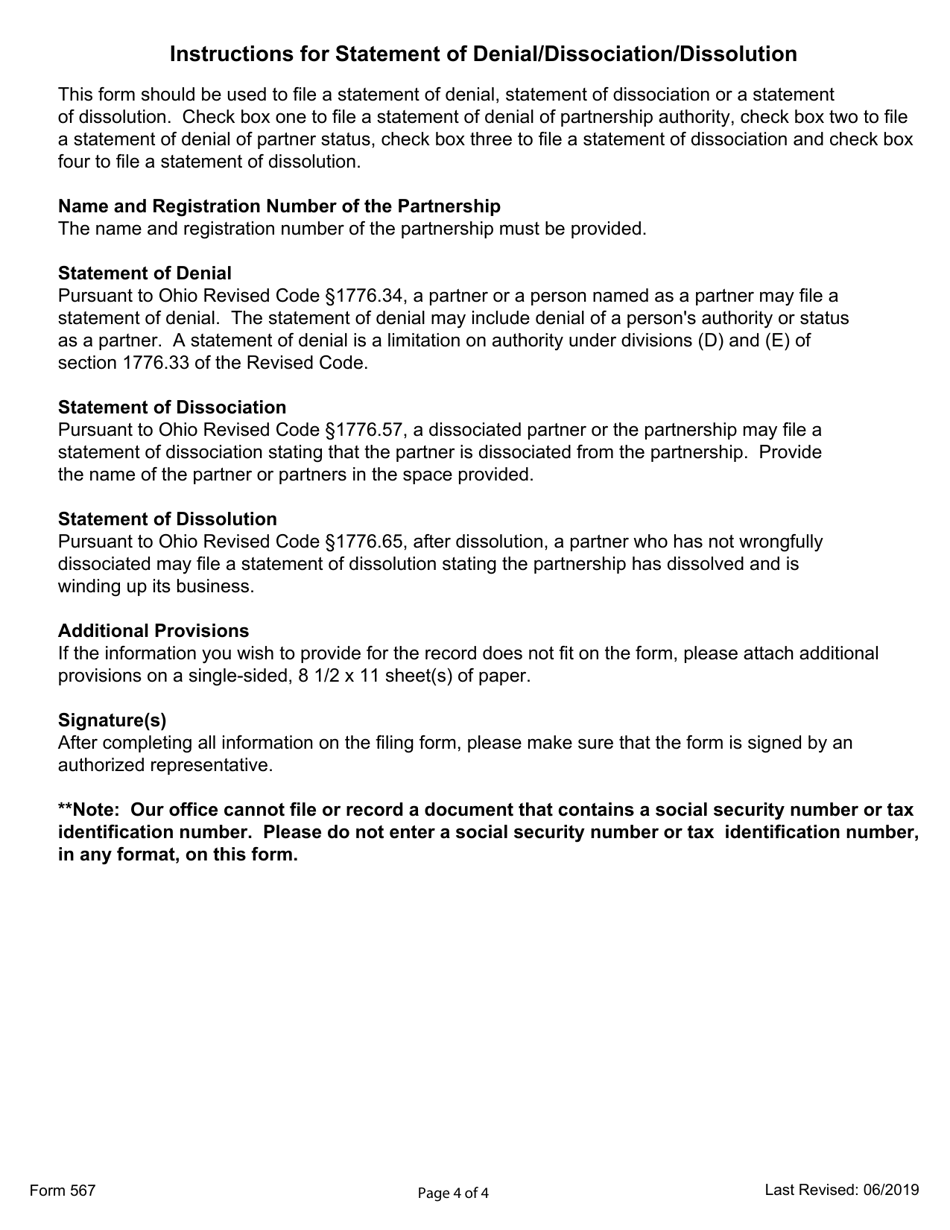

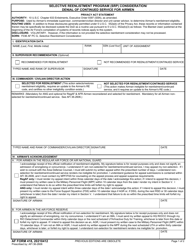

Form 567 Statement of Denial / Dissociation / Dissolution (Partnership / Limited Liability Partnership) - Ohio

What Is Form 567?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 567?

A: Form 567 is the Statement of Denial / Dissociation / Dissolution for Partnership or Limited Liability Partnership in Ohio.

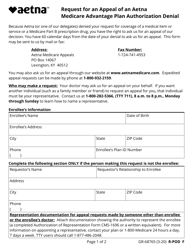

Q: Who needs to file Form 567?

A: Partnerships or Limited Liability Partnerships in Ohio that are denying, dissociating, or dissolving their partnership.

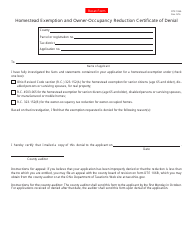

Q: What is the purpose of Form 567?

A: Form 567 is used to inform the Ohio Secretary of State about changes in partnership status such as denial of existence, dissociation of a partner, or dissolution of the partnership.

Q: When should I file Form 567?

A: Form 567 should be filed with the Ohio Secretary of State within 30 days of the denial, dissociation, or dissolution event.

Q: Is Form 567 the only form needed to dissolve a partnership in Ohio?

A: No, Form 567 is just one of the required forms. Additional forms may be necessary depending on the specific circumstances of the partnership.

Q: What information is required on Form 567?

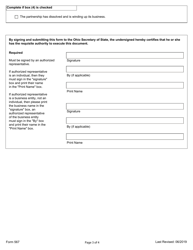

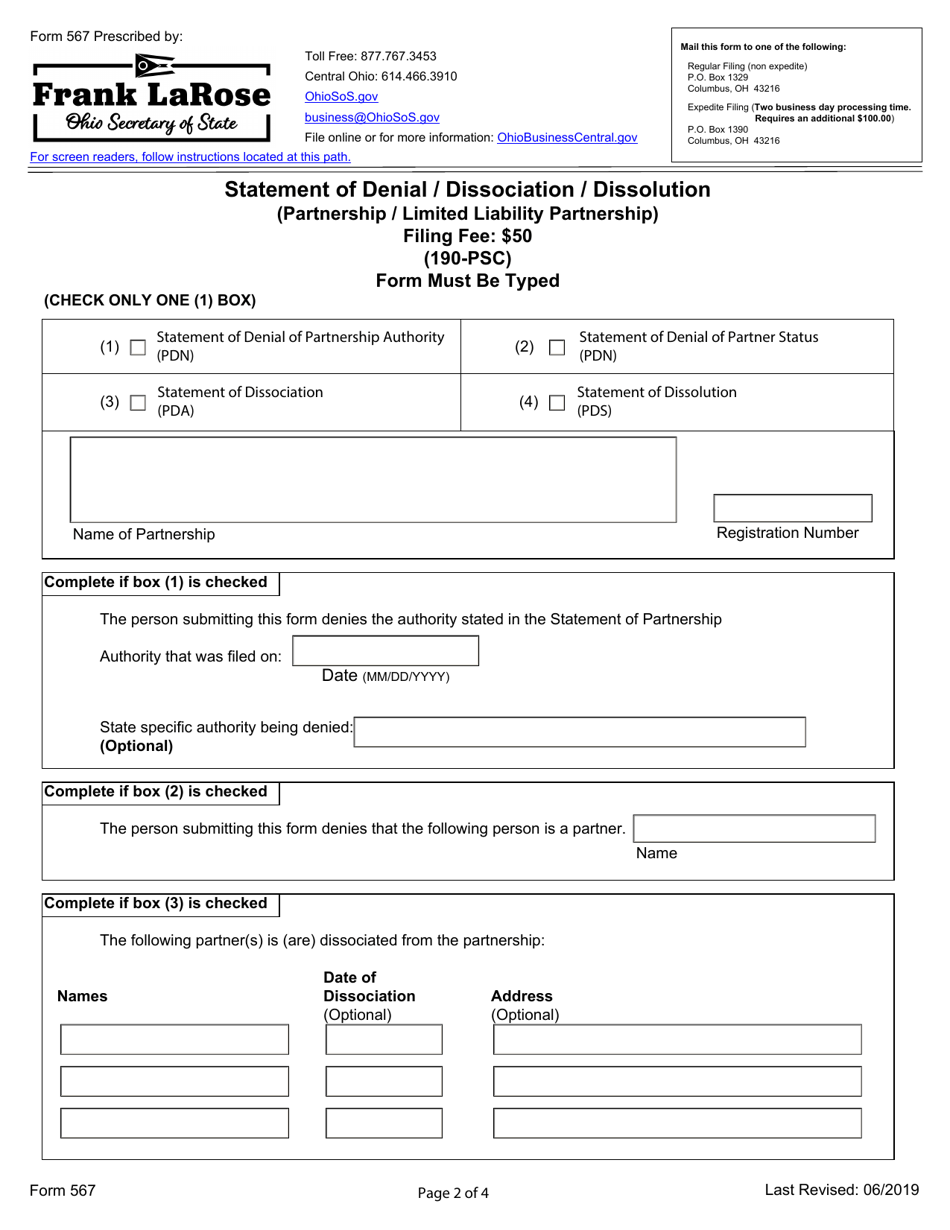

A: Form 567 requires information such as the partnership name, date of denial/dissociation/dissolution, reason for the event, and the signature of a partner.

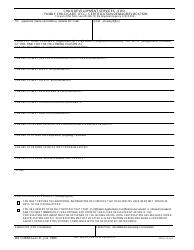

Q: What happens after I file Form 567?

A: After filing Form 567, the partnership's denial, dissociation, or dissolution will be recorded with the Ohio Secretary of State.

Q: Can I get a copy of the filed Form 567?

A: Yes, you can request a copy of the filed Form 567 from the Ohio Secretary of State's office.

Q: Are there any penalties for not filing Form 567?

A: Failure to file Form 567 within the required timeframe may result in penalties and other legal consequences. It's important to comply with the filing requirements to avoid any issues.

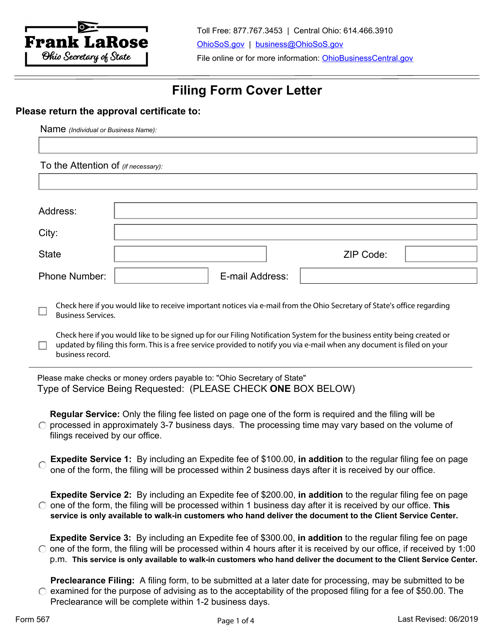

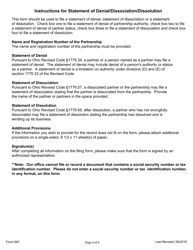

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 567 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.