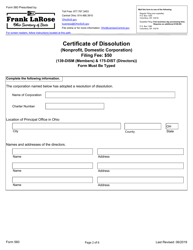

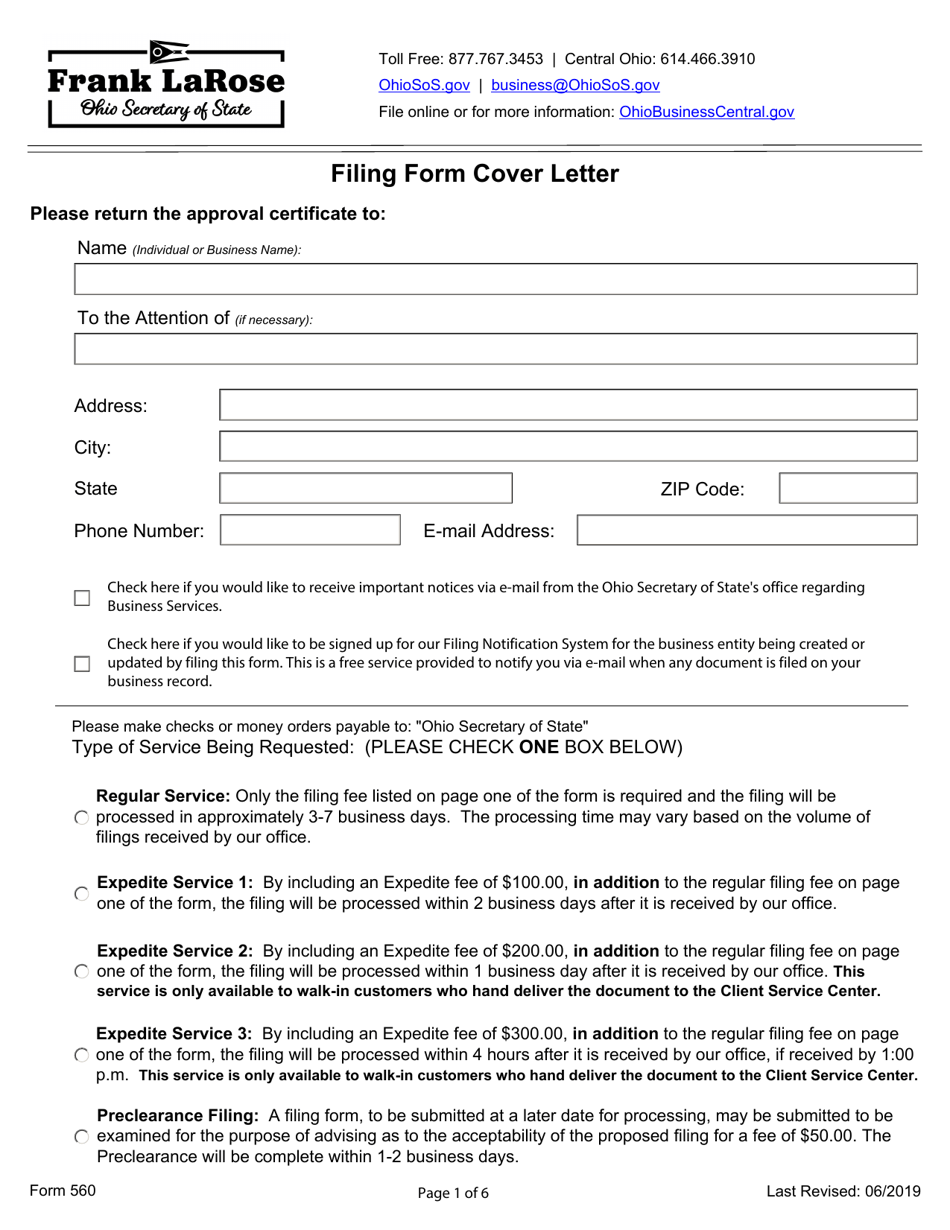

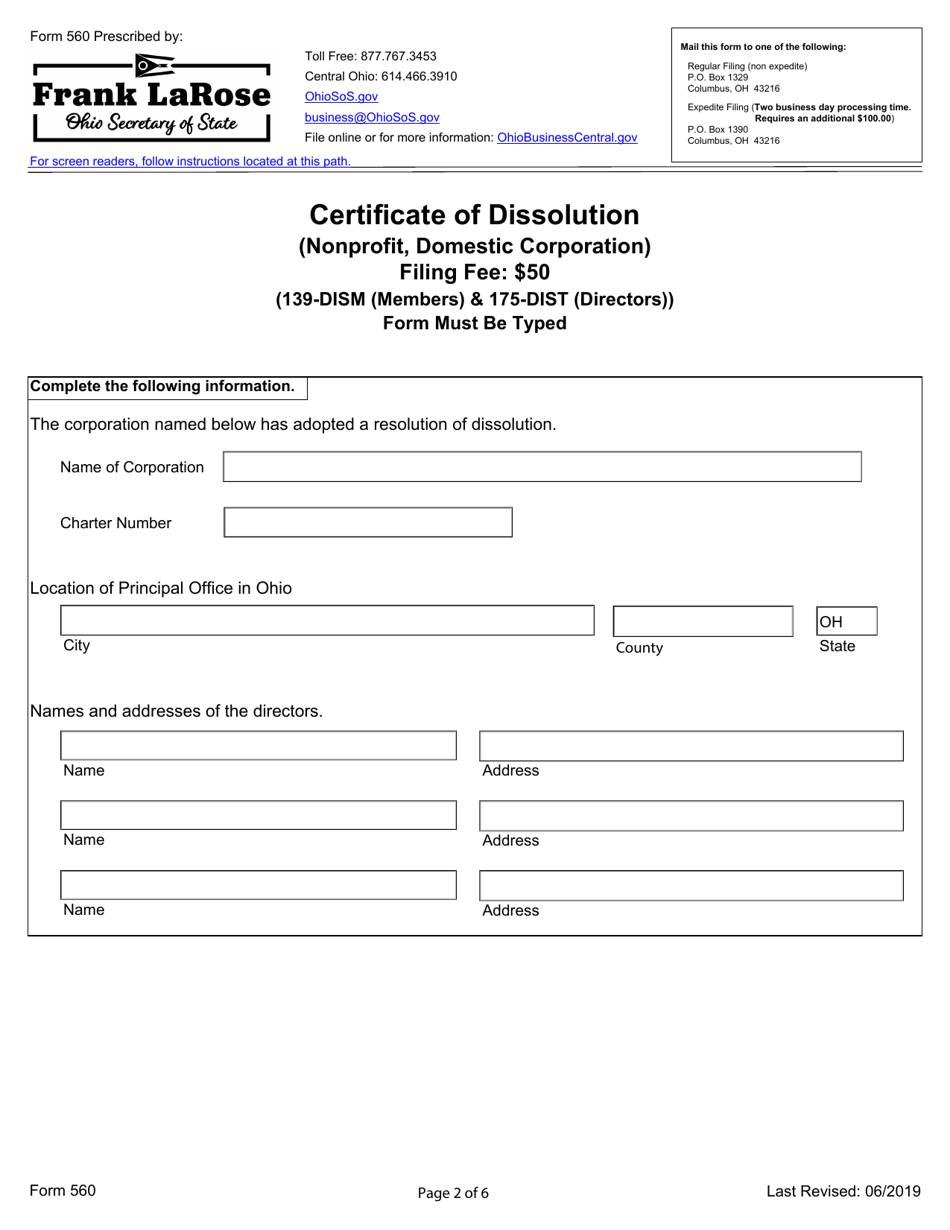

Form 560 Certificate of Dissolution (Nonprofit, Domestic Corporation) - Ohio

What Is Form 560?

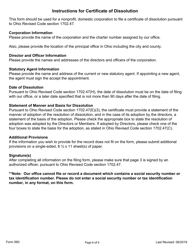

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 560?

A: Form 560 is a Certificate of Dissolution for Nonprofit Domestic Corporation in Ohio.

Q: What is a nonprofit domestic corporation?

A: A nonprofit domestic corporation is an organization formed for charitable, educational, religious, or other public purposes.

Q: When should Form 560 be filed?

A: Form 560 should be filed when a nonprofit domestic corporation in Ohio is ceasing its operations and wishes to dissolve.

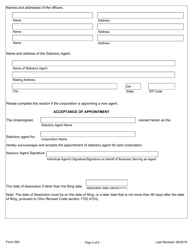

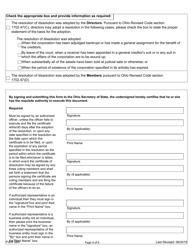

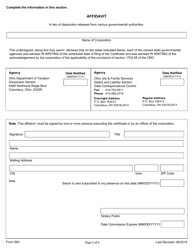

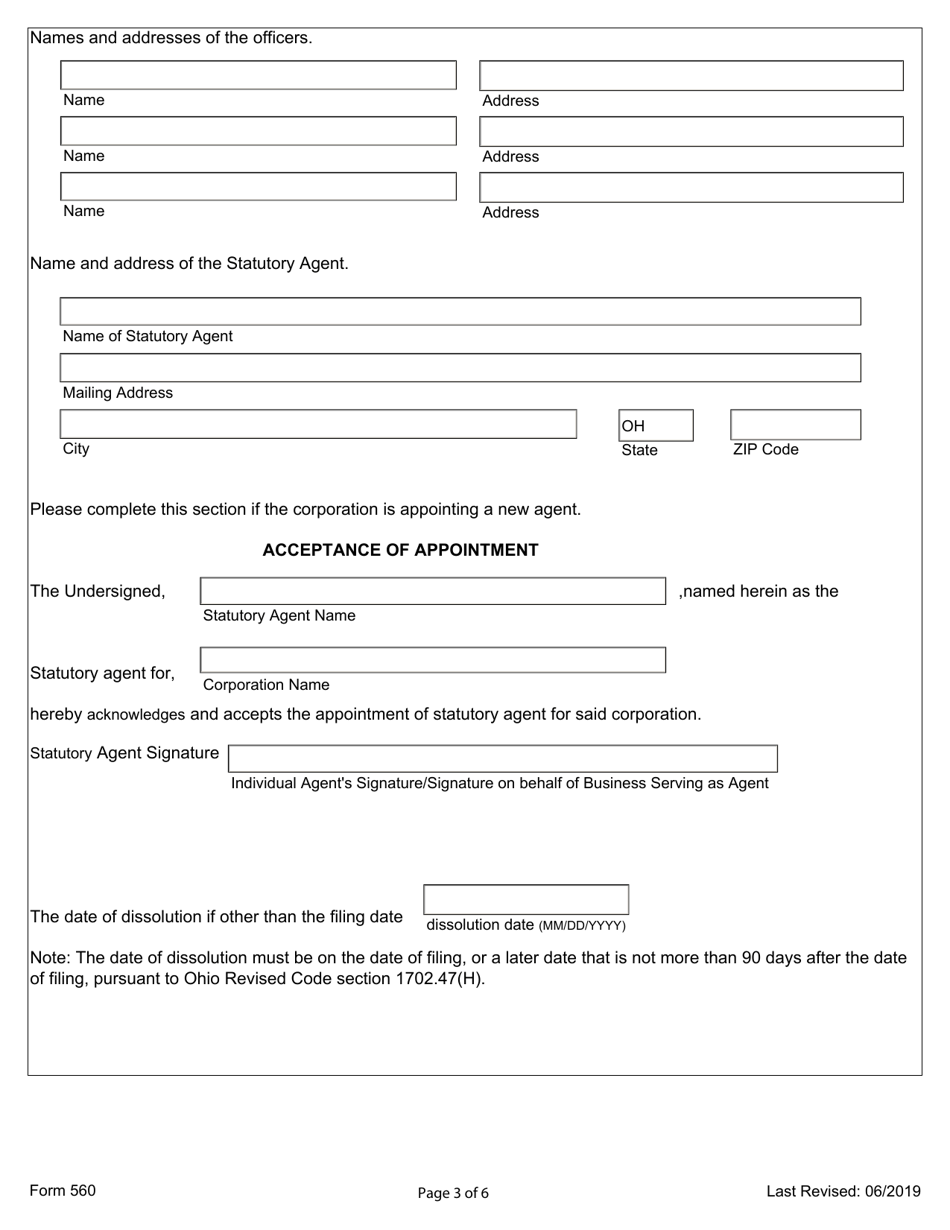

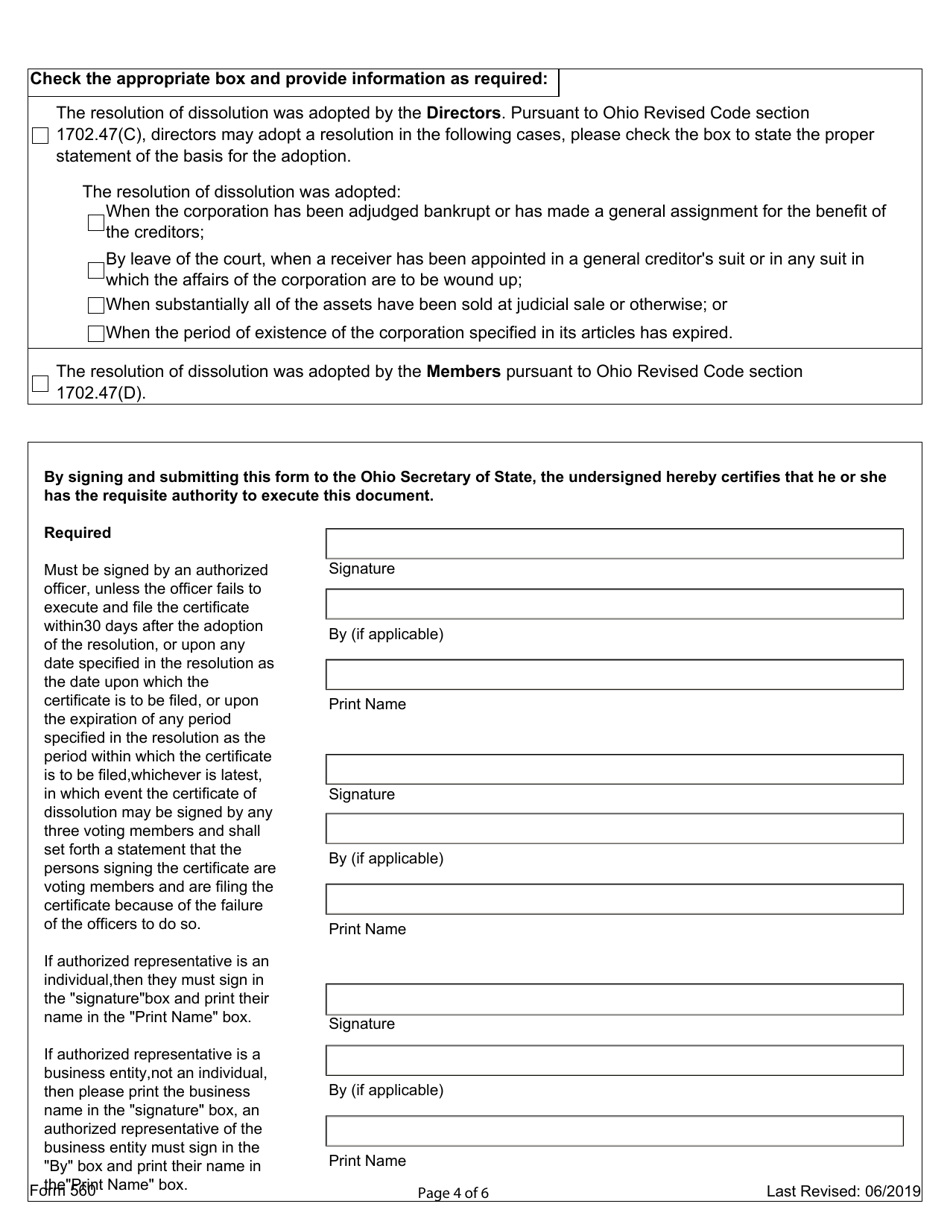

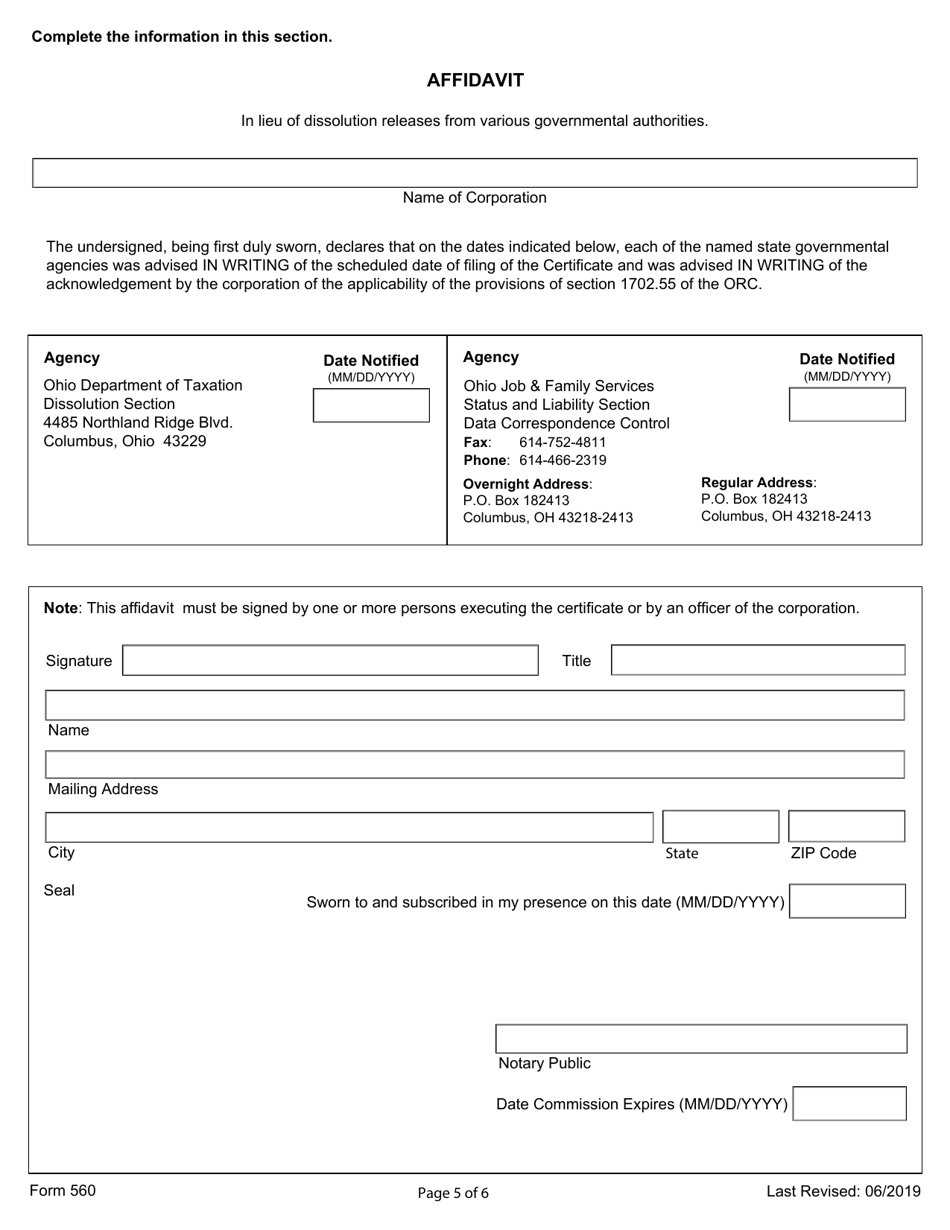

Q: What information is required on Form 560?

A: Form 560 requires information about the corporation's name, registered agent, dissolution date, and more.

Q: What happens after Form 560 is filed?

A: After Form 560 is filed and approved by the Ohio Secretary of State, the nonprofit domestic corporation will be officially dissolved and its legal existence will come to an end.

Q: Do I need to notify the IRS when filing Form 560?

A: Yes, the nonprofit domestic corporation should also notify the IRS of its dissolution.

Q: What other requirements may be necessary when dissolving a nonprofit domestic corporation?

A: Additional requirements may include settling debts, distributing assets, and complying with any other legal obligations or regulations.

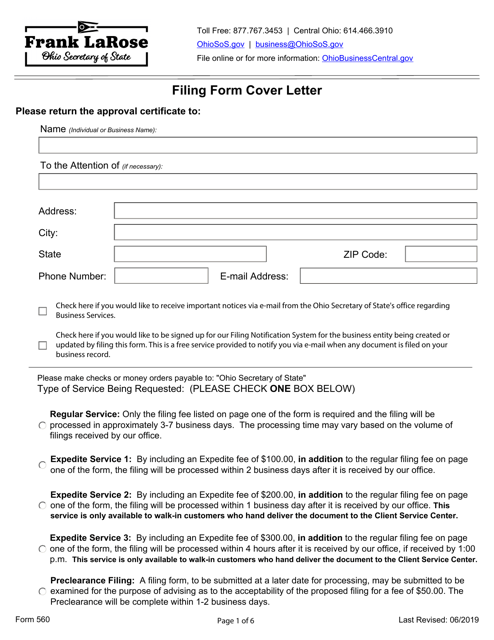

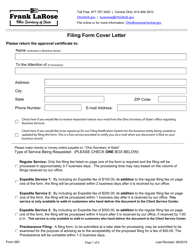

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 560 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.