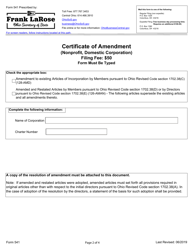

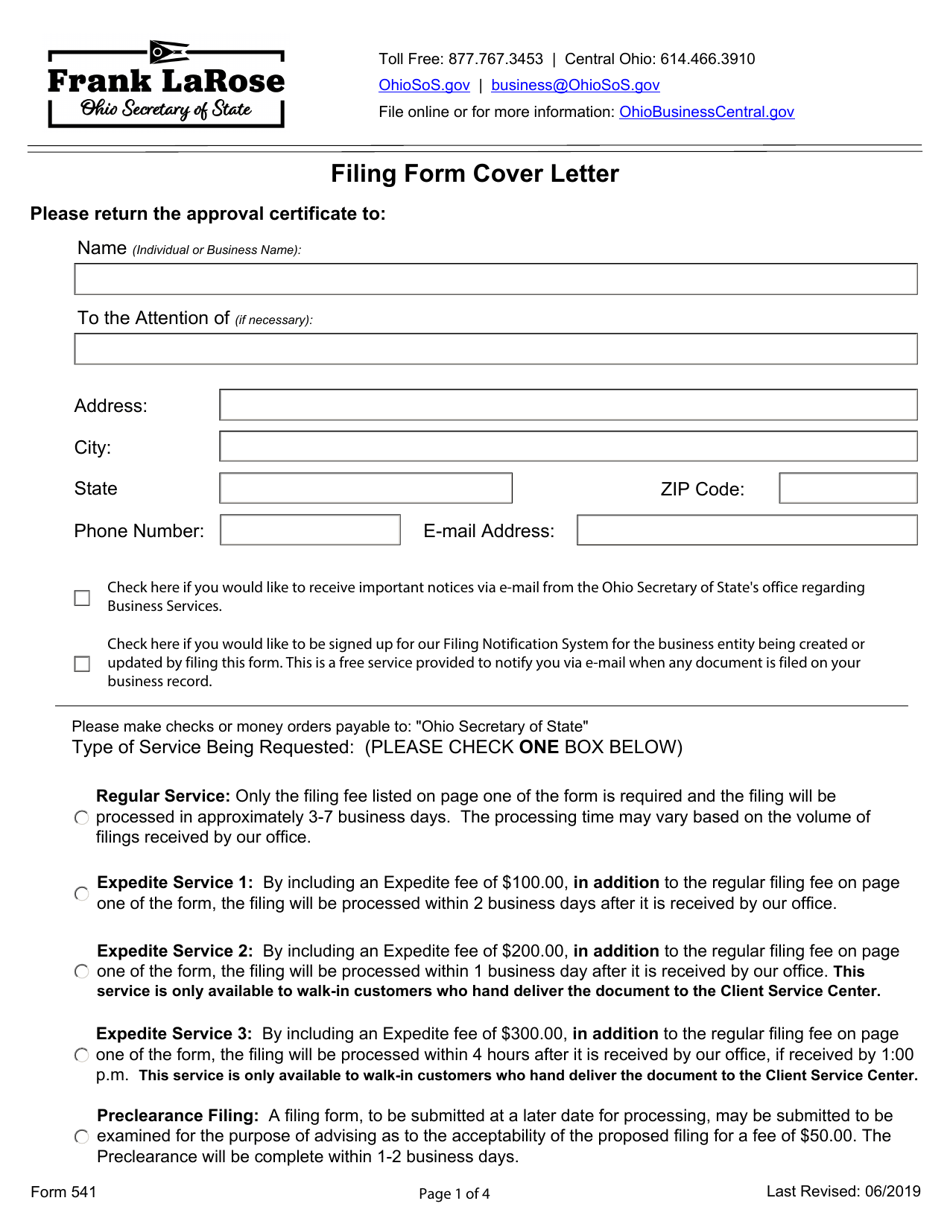

Form 541 Certificate of Amendment (Nonprofit, Domestic Corporation) - Ohio

What Is Form 541?

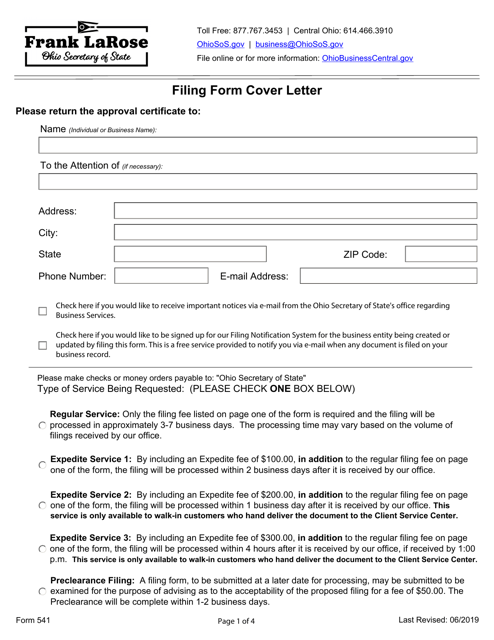

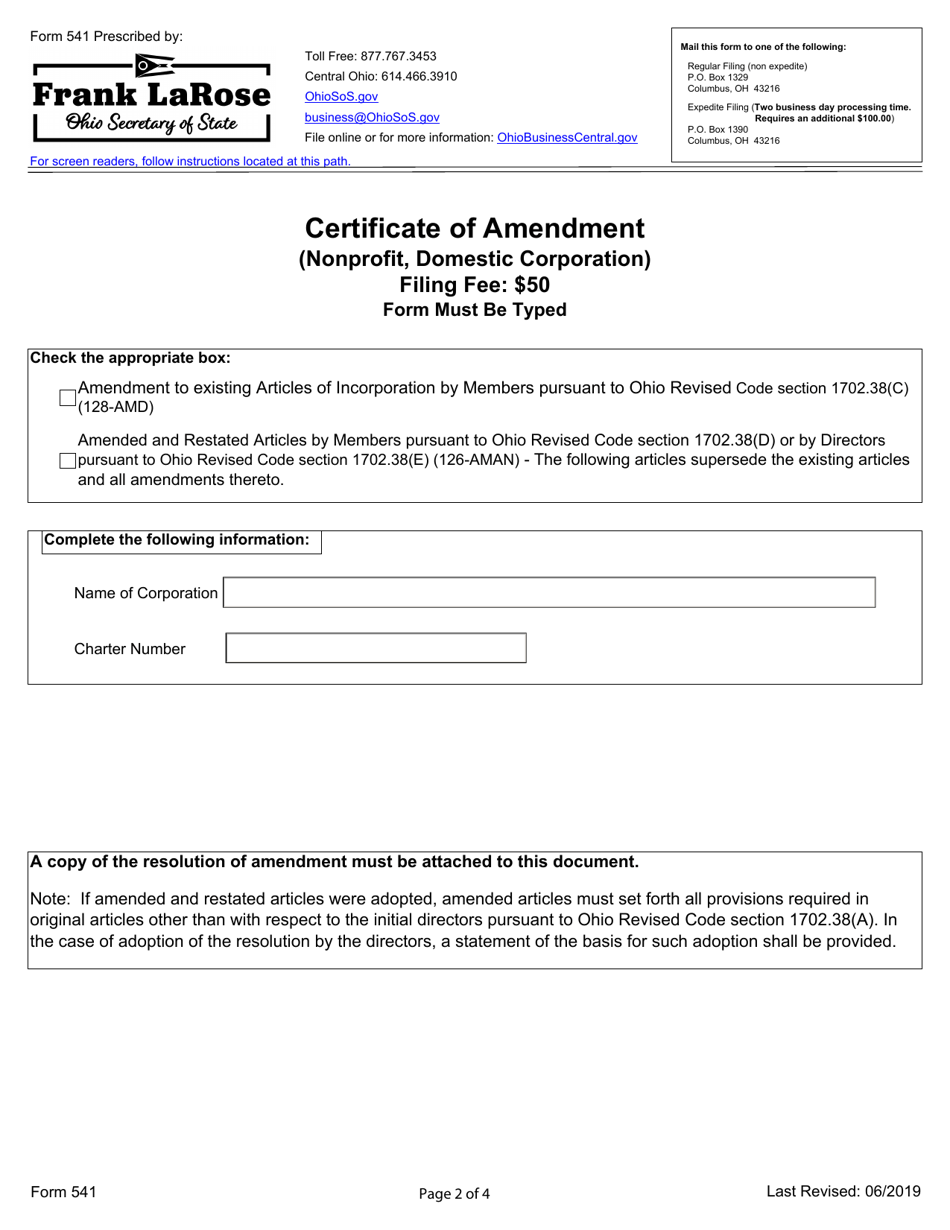

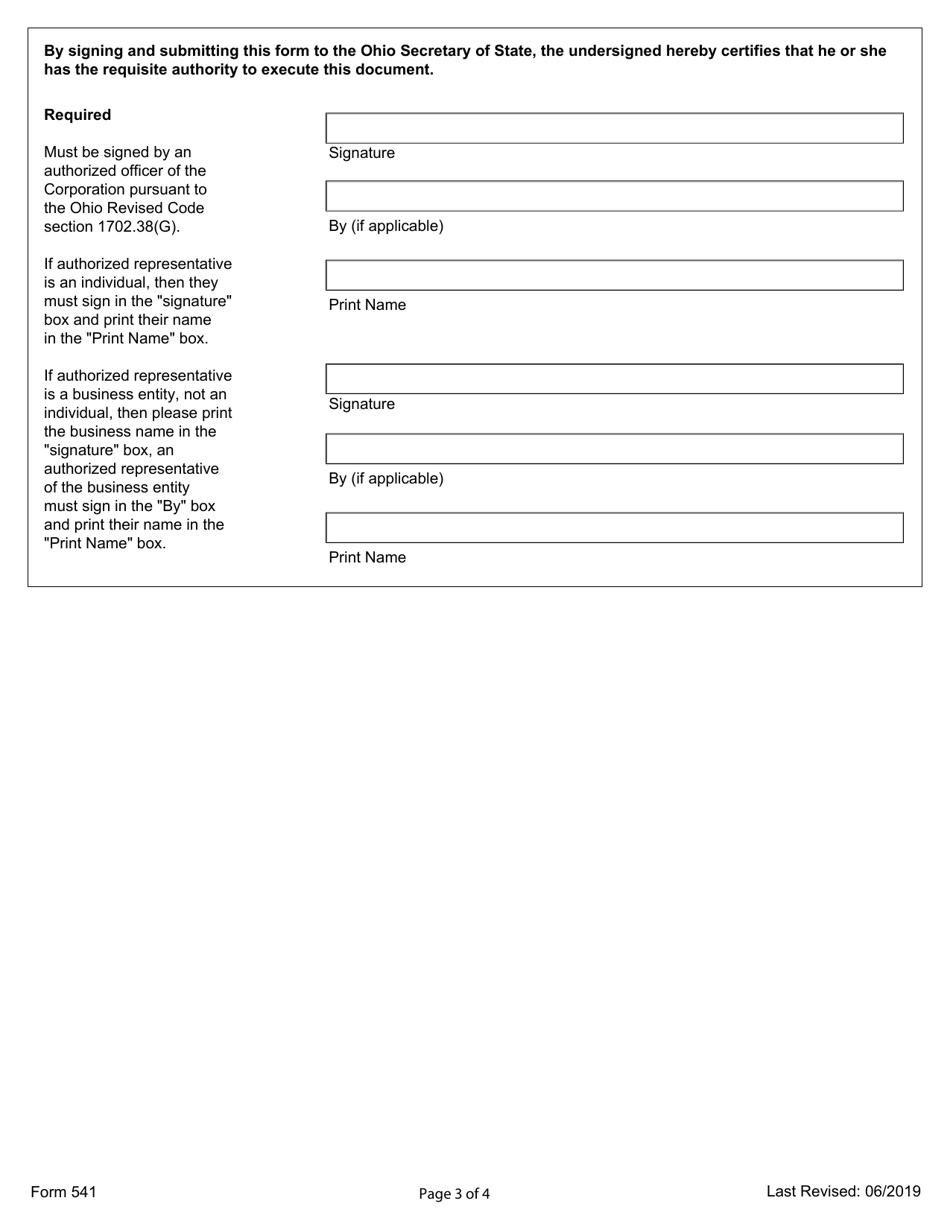

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 541?

A: Form 541 is the Certificate of Amendment for nonprofit domestic corporations in Ohio.

Q: What is a nonprofit domestic corporation?

A: A nonprofit domestic corporation is an organization that operates for charitable, educational, religious, or other similar purposes, and is incorporated in Ohio.

Q: What is the purpose of Form 541?

A: The purpose of Form 541 is to amend the articles of incorporation of a nonprofit domestic corporation in Ohio.

Q: When should a nonprofit domestic corporation file Form 541?

A: A nonprofit domestic corporation should file Form 541 when it needs to make changes or updates to its articles of incorporation.

Q: What information is required on Form 541?

A: Form 541 requires information such as the name of the corporation, the specific amendment being made, and the date of adoption of the amendment.

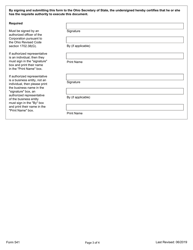

Q: Are there any other requirements or documents that need to be submitted with Form 541?

A: Additional requirements or documents may vary depending on the specific amendment being made. It is recommended to review the instructions provided with Form 541.

Q: What is the filing deadline for Form 541?

A: There is no specific filing deadline for Form 541. It should be filed as soon as possible after the adoption of the amendment.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 541 by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.