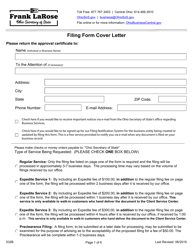

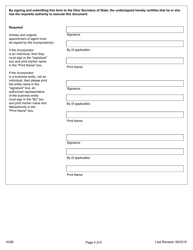

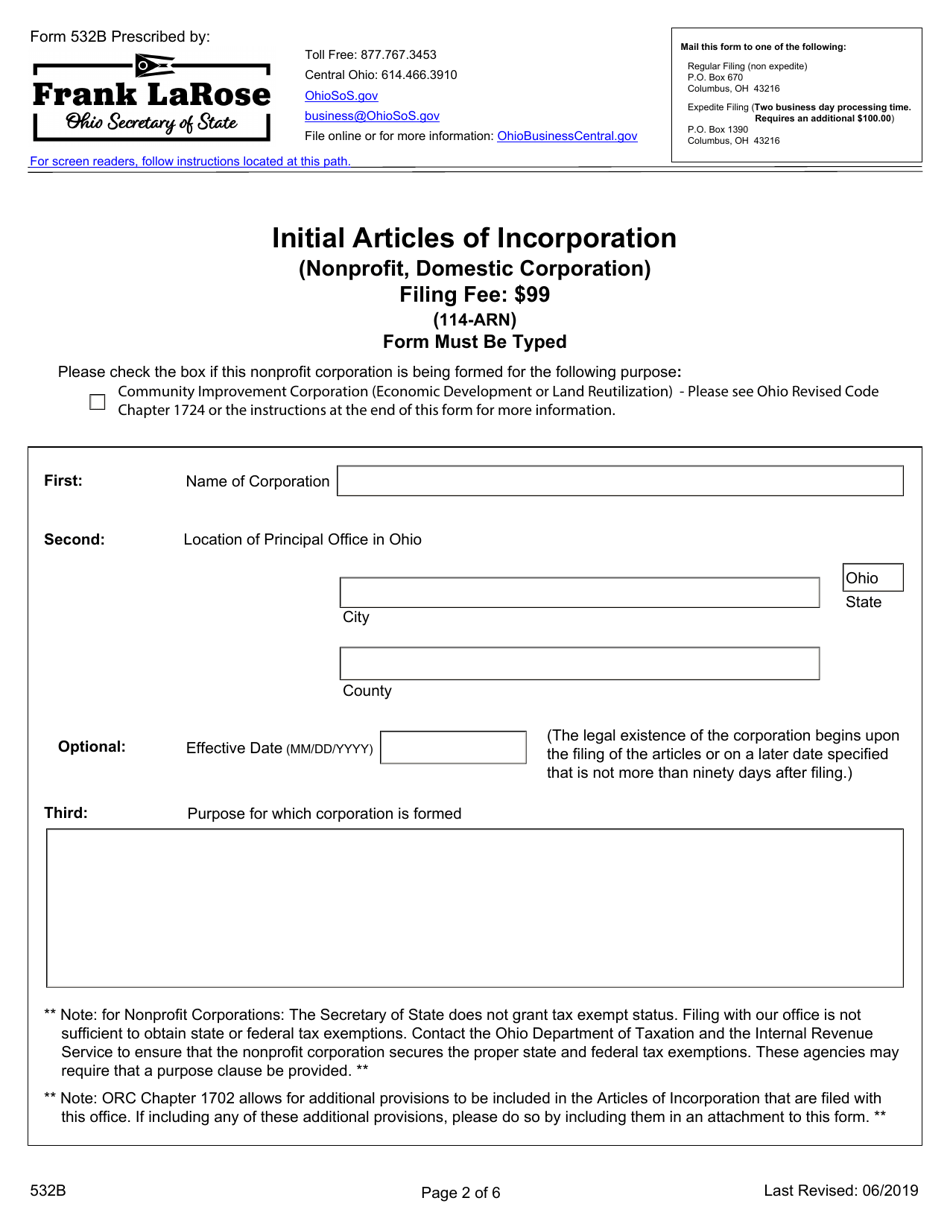

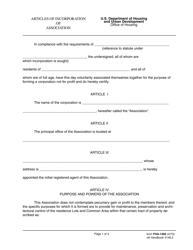

Form 532B Initial Articles of Incorporation (Nonprofit, Domestic Corporation) - Ohio

What Is Form 532B?

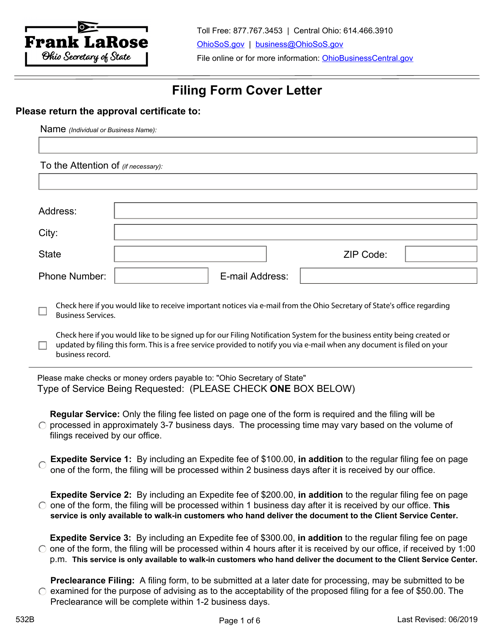

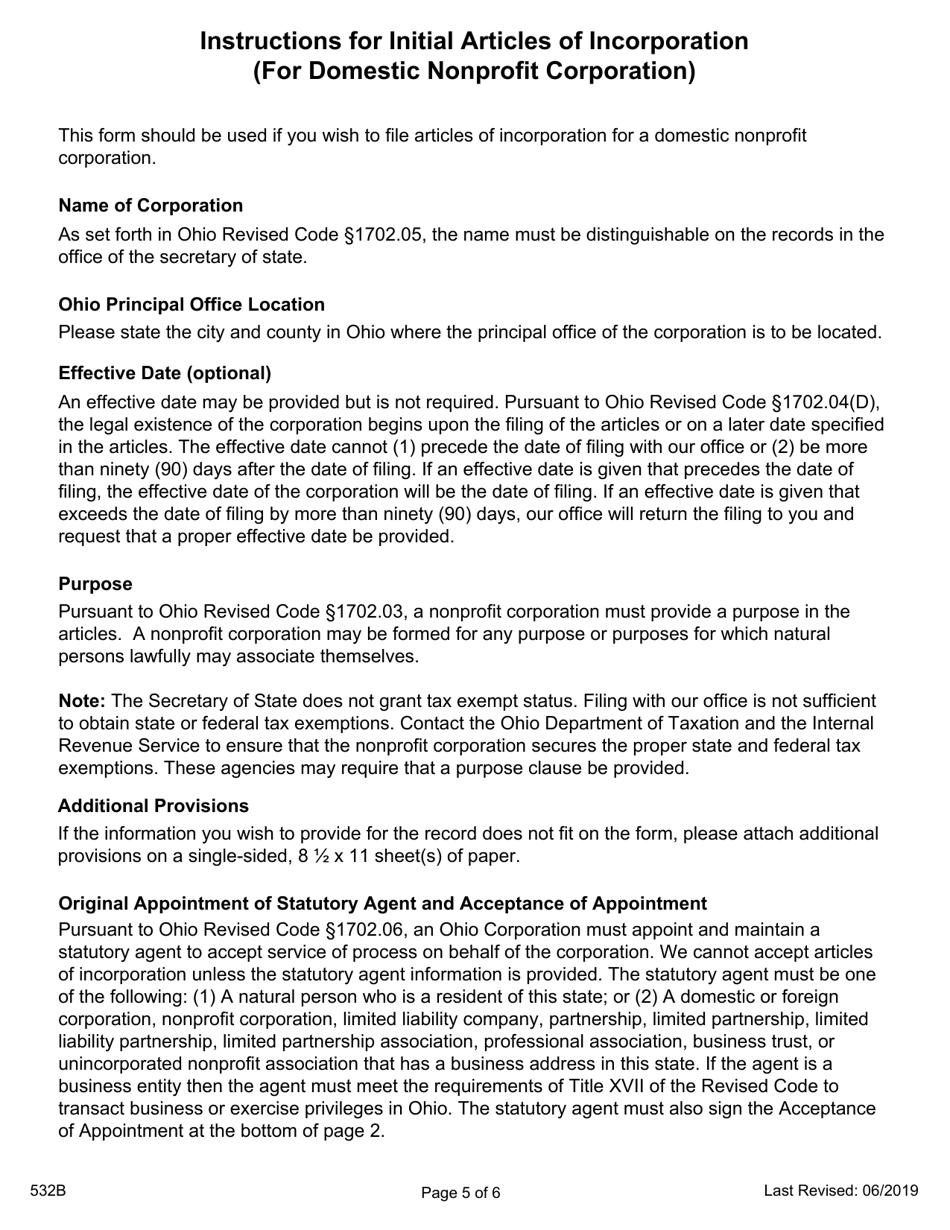

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 532B?

A: Form 532B is the Initial Articles of Incorporation (Nonprofit, Domestic Corporation) form.

Q: Who uses Form 532B?

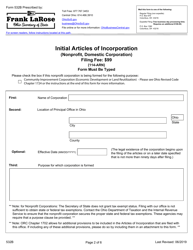

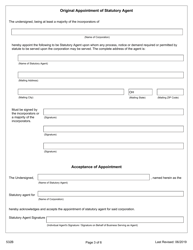

A: Form 532B is used by nonprofit organizations in Ohio to officially incorporate as a domestic corporation.

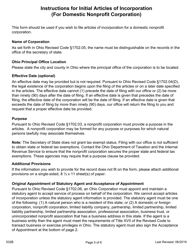

Q: What does it mean to incorporate as a domestic corporation?

A: Incorporating as a domestic corporation means establishing a legal entity separate from its members or founders.

Q: What is the purpose of Form 532B?

A: The purpose of Form 532B is to provide the necessary information for the formation of a nonprofit domestic corporation in Ohio.

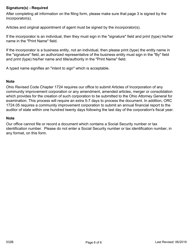

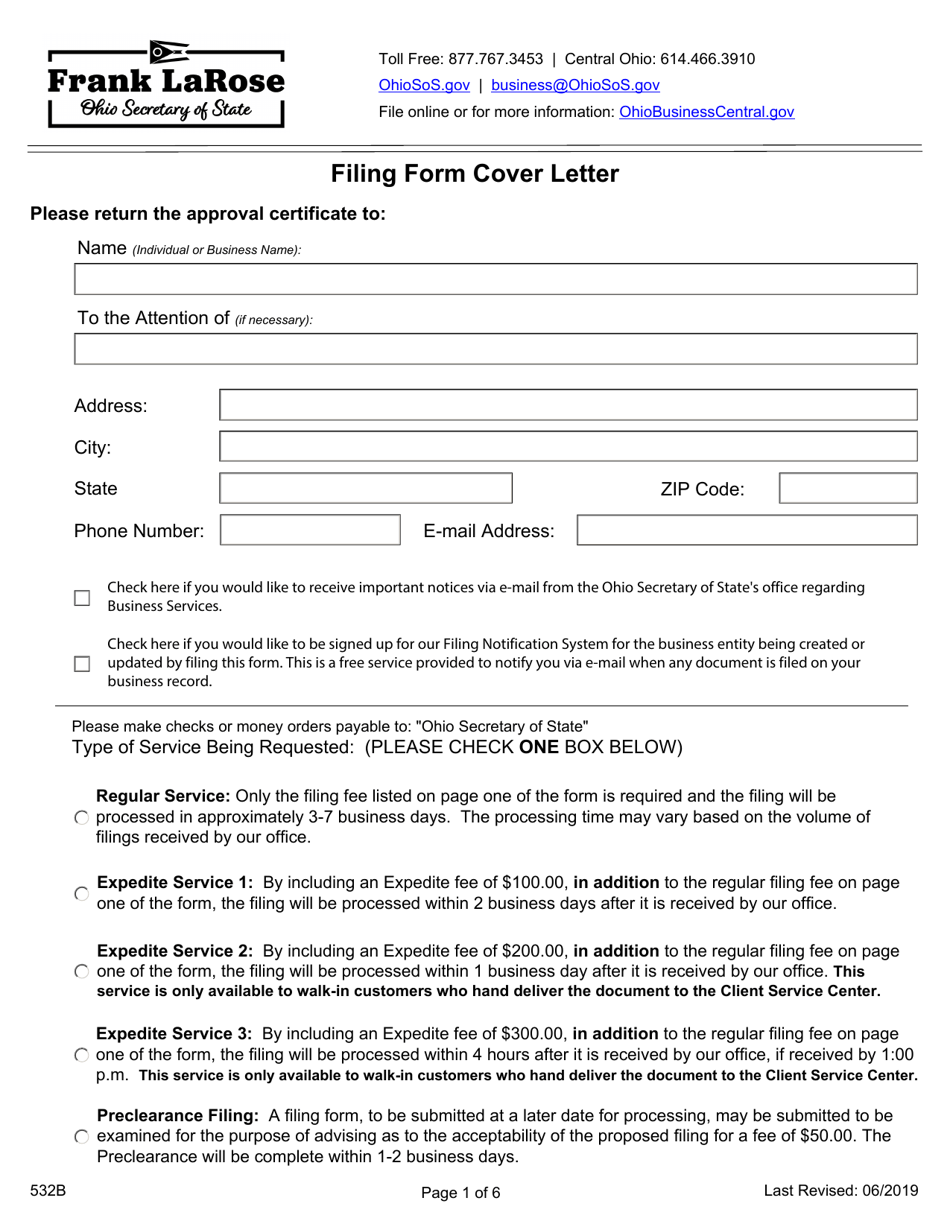

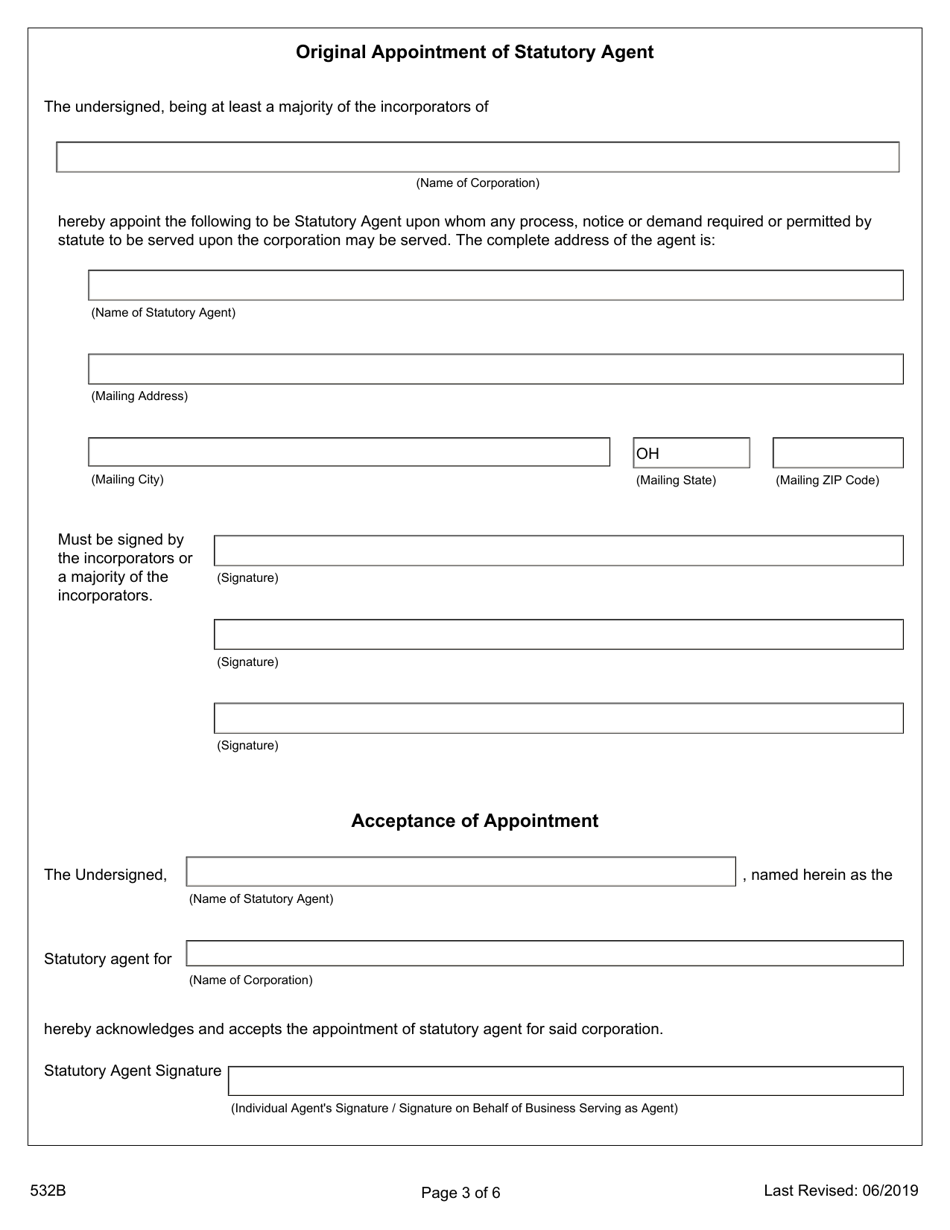

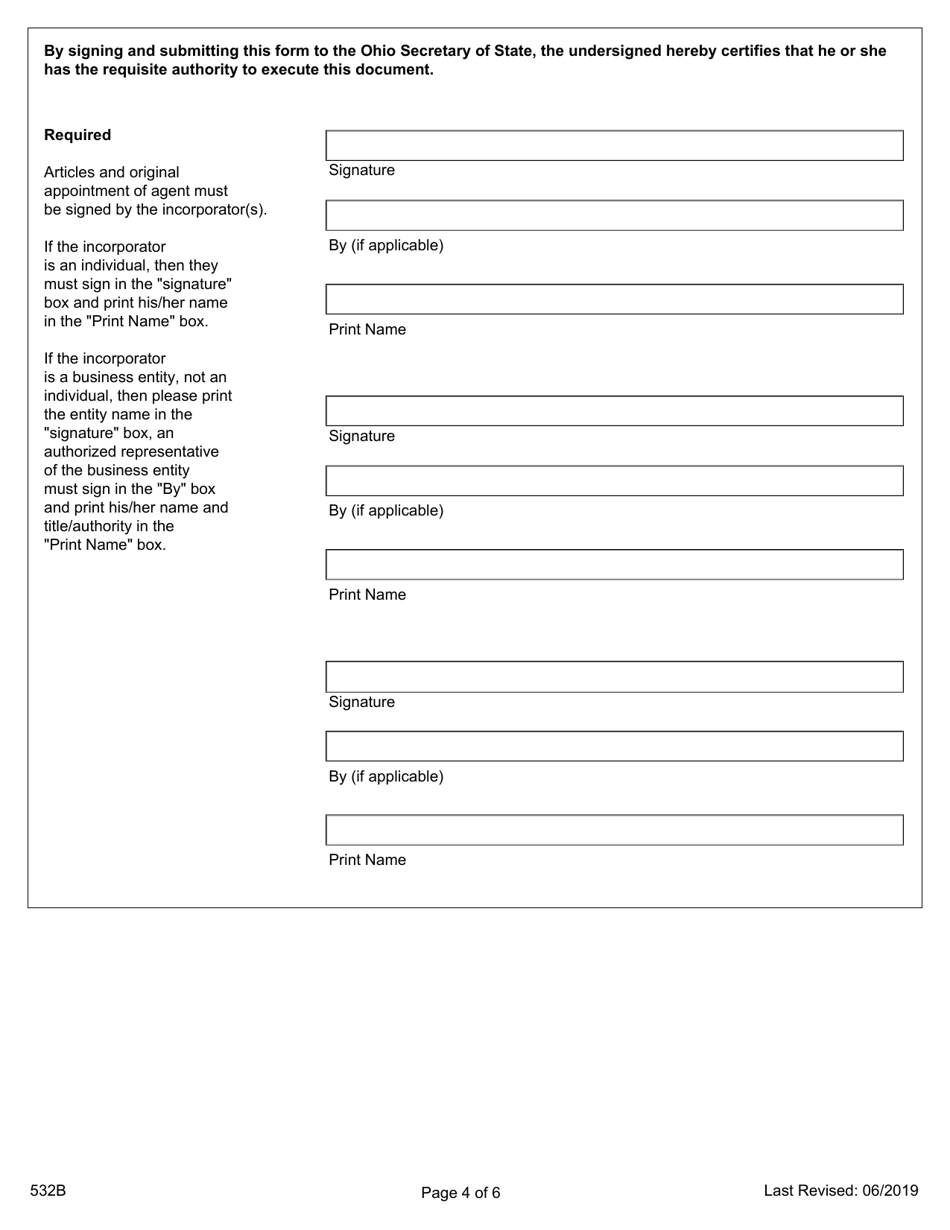

Q: What information is required on Form 532B?

A: Form 532B requires information such as the name, purpose, and initial directors of the nonprofit corporation.

Q: Are there any additional requirements for incorporating as a nonprofit in Ohio?

A: Yes, there may be additional requirements such as obtaining a federal tax exemption from the IRS.

Q: What is the timeline for processing Form 532B?

A: The processing time for Form 532B can vary, but generally, it takes a few business days for the Secretary of State's office to review and approve the filing.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 532B by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.