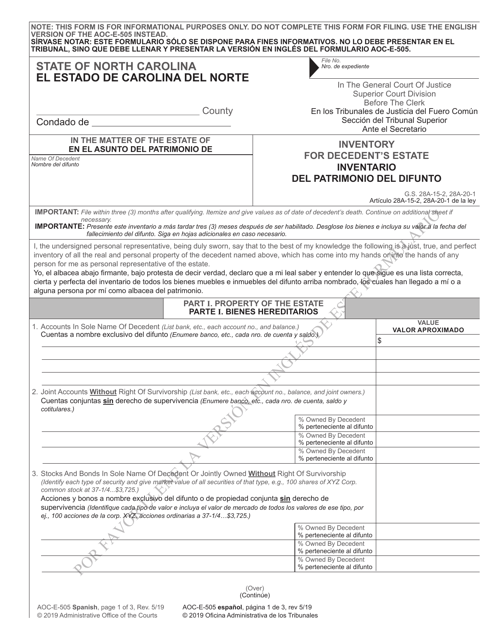

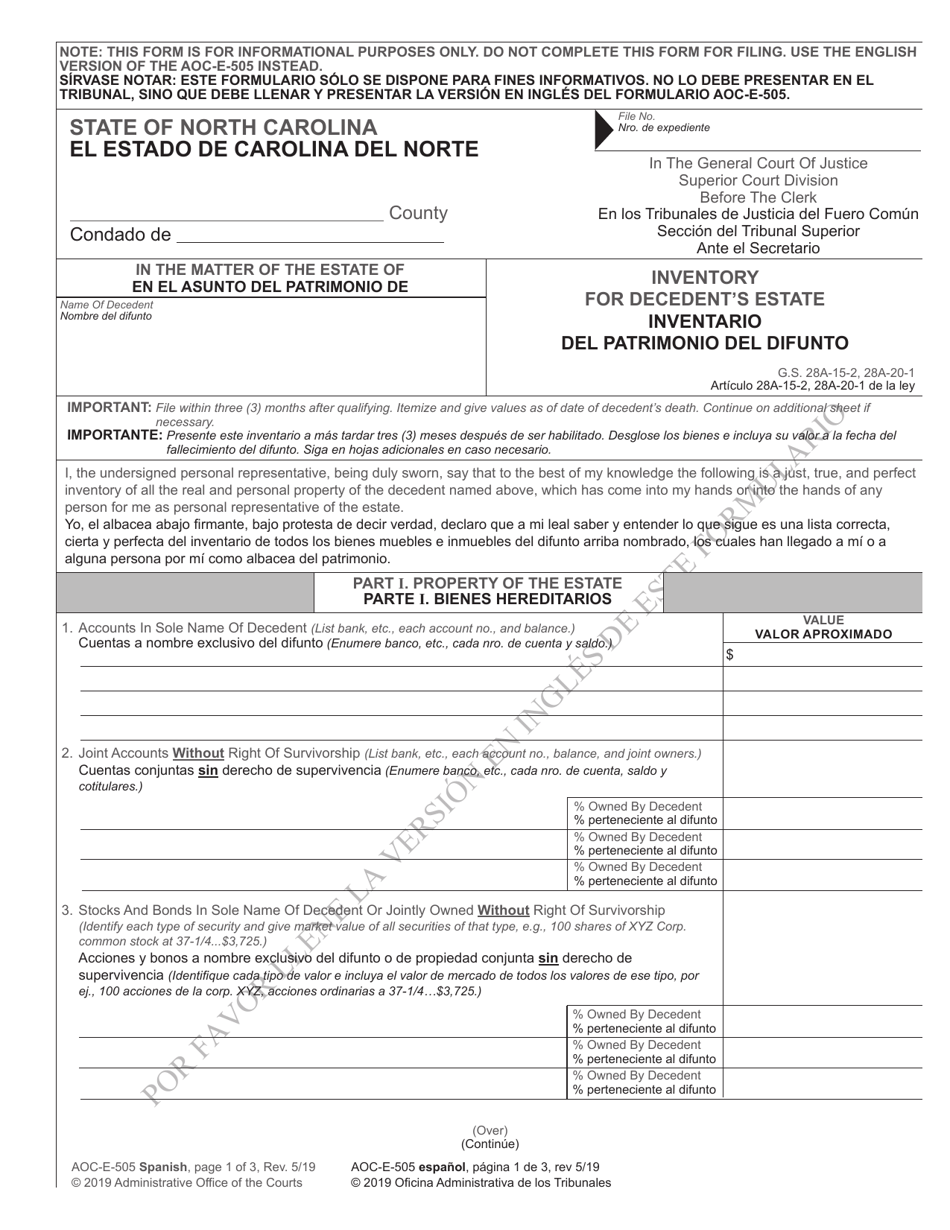

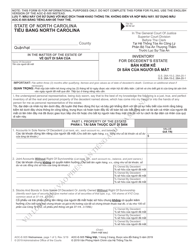

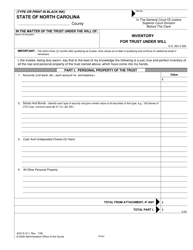

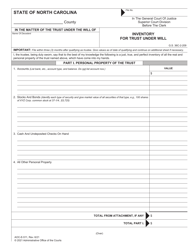

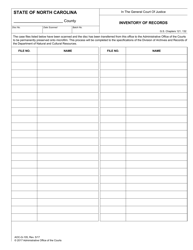

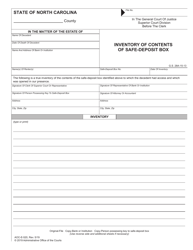

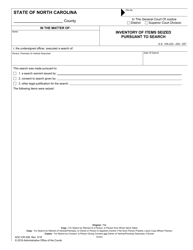

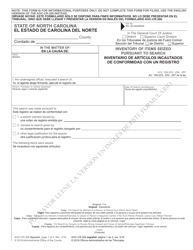

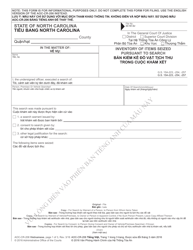

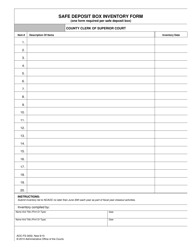

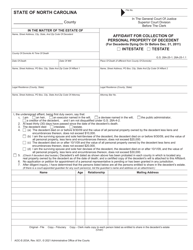

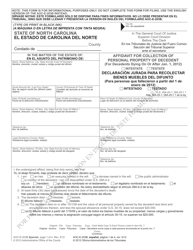

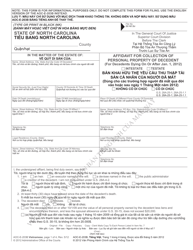

Form AOC-E-505 Inventory for Decedent's Estate - North Carolina (English / Spanish)

What Is Form AOC-E-505?

This is a legal form that was released by the North Carolina Superior Court - a government authority operating within North Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

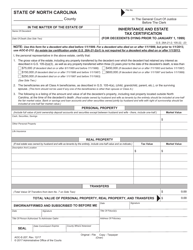

Q: What is the AOC-E-505 Inventory for Decedent's Estate?

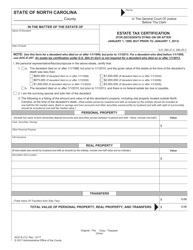

A: The AOC-E-505 is a form used in North Carolina to list the assets and debts of a deceased person's estate.

Q: Why is the AOC-E-505 Inventory for Decedent's Estate required?

A: The AOC-E-505 is required to provide an inventory of the deceased person's estate for probate purposes.

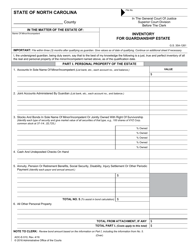

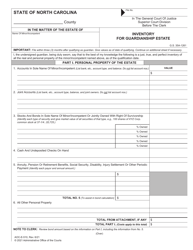

Q: Who needs to fill out the AOC-E-505 form?

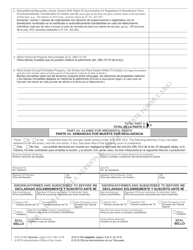

A: The personal representative of the deceased person's estate is responsible for filling out the AOC-E-505 form.

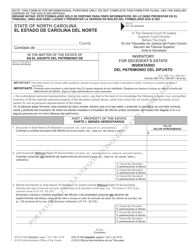

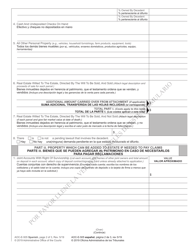

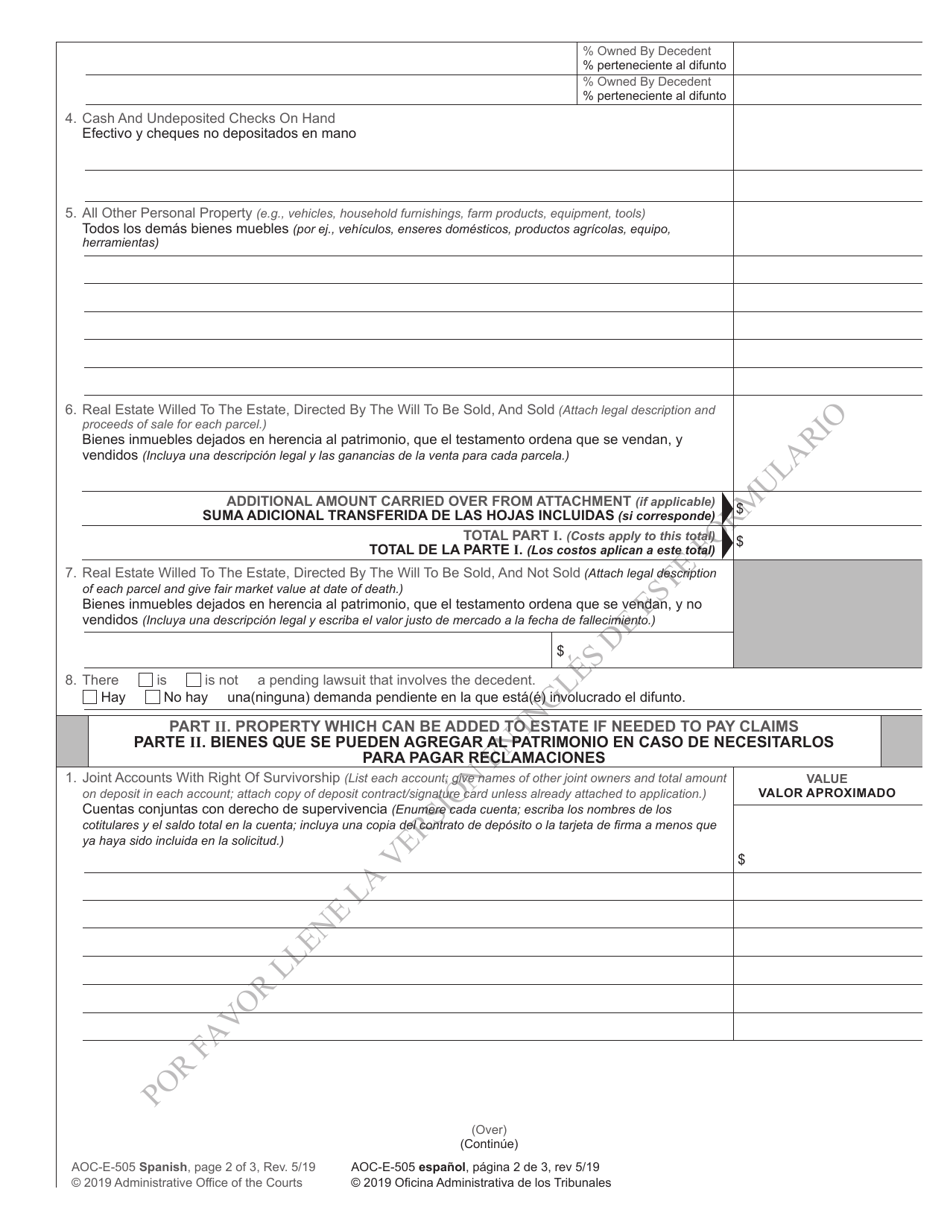

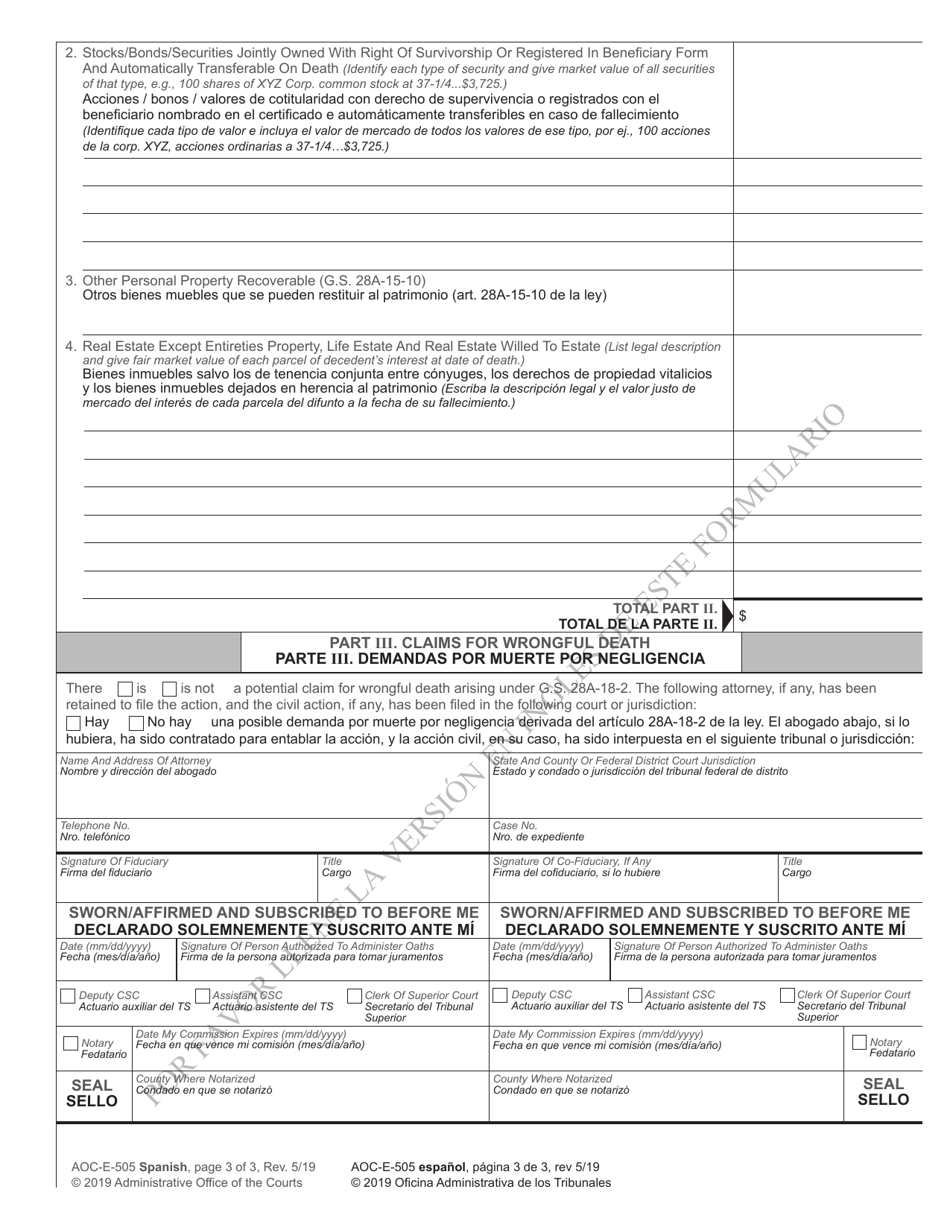

Q: What information is required on the AOC-E-505 form?

A: The AOC-E-505 form requires information about the deceased person's assets, such as bank accounts, real estate, and personal property, as well as their debts.

Q: Is the AOC-E-505 form available in Spanish?

A: Yes, the AOC-E-505 form is available in both English and Spanish.

Q: When should the AOC-E-505 form be filed?

A: The AOC-E-505 form should be filed within 3 months from the date of the personal representative's appointment.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the North Carolina Superior Court;

- Easy to use and ready to print;

- Available in Vietnamese;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AOC-E-505 by clicking the link below or browse more documents and templates provided by the North Carolina Superior Court.